Source

.png)

Question no. 1:

What is meant by order book and how does the crypto order book differ from our local market, explain with examples (answer must be written in your own words, copy paste or from another source will not be accepted).

Conventional order book:

It is a layered tool to keep track of buying and selling products usually usually usually written by hand or printed on paper is the amount of items sold in trade at the time prices and quantity of a product this will help determine if sales are good or bad, if the prices are liking the customer or here to adjust them more depending on the need of each customer and what this willing to pay per piece these assets can not work in pairs nor you can make a technical analysis as in cryptocurrencies as they lack volatility.

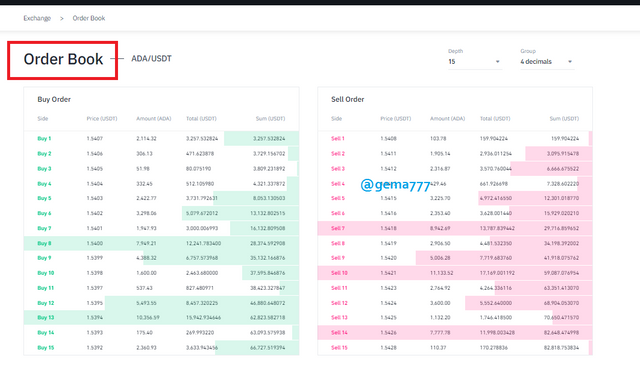

Digital order books:

In the open book of digital orders in cryptocurrency we can see a long record where the data is stored automatically in the blockchain system of purchase and sales quantities sold per day, this execution of values depends on 100% of users demand and supply the value is volatile there is a limit of token or coins if they are limited but there is the case of USDT which is unlimited and they print more coins depending on the need of the people.

Example of trading pairs in order books are ETH/USDT, BTC/USDT, BTC/ETH, this way they are traded in the digital markets.

.png)

Differences between the two:

In traditional business the books are filled out by hand or printed on physical invoices only filled out once and this lacks volatility. and the record is lost or wears out over time.

In Digital business everything is captured on the blokchain network and does not need to be filled out by hand, everything is automatic and digital, traded in pairs and keeps the record forever.

In conventional business prices do not have much difference between them since the customer negotiates with the owner reaching a mutual agreement there is not much room for negotiation.

In the digital ones they are highly volatile and the margin is subscribed by the users, the market, catastrophes, the fomo, and other factors that can influence as the wars, pandemics, everything influences the prices of the cryptocurrencies.

.png)

Question #2:

Explain how to find the order book in any exchange through a screenshot and also describe each step with text and also explain the words given below (answer should be written in your own words).

Practical guide for using the order book:

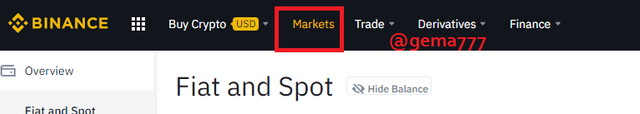

Binance

.png)

*Then select the Fiat Markets option

*Select the ADA currency

*Click on the pair ADA/USDT

Binance

.png)

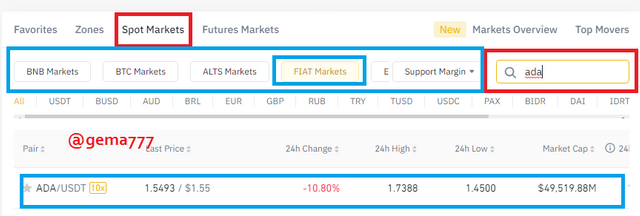

*Select Advanced Trade

*Submit ok

*continue...

Binance

*Then select the Fiat Markets option

*Select the ADA currency

*Click on the pair ADA/USDT

Binance

Binance

.png)

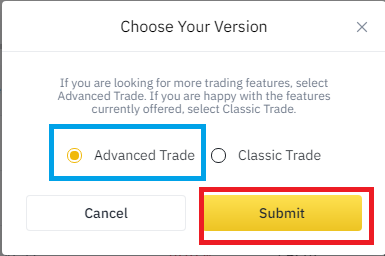

Pairs:

They are used to make combinations between different currencies in digital trading either by Fiat coins that one of my best options cryptocurrency or tokens, we know that cryptocurrencies are assets that rise and fall in value depending on their use, fomo, or interest at the time. for that then we use the exchanged for example I have USDT and I get the news that ADA will rise in price then I buy ADA cheap and sell it more expensive in some important resistance. all this is stored in the records of the workbooks.Support:

Are important points where large volumes of purchases are stored were old resistances but when they were exceeded at a previous time created new highs then the old resistances are now supports because at that time there was an important level of purchases at that point usually prices in downtrends usually rebound in the supports and through technical analysis show us if it will go down more or go up.Resistance:

Supposing that we touch a historical maximum but the machine users and novices lose interest in buying at that point then the price goes down to a support the maximum point of that graph where there were important volumes of purchases now is a resistance it is usually used to put orders of sales.

Binance

.png)

Question #3:

Explain the important future of the order book with the help of a screenshot. In the meantime, a screenshot of the verified profile of your Exchange account should be displayed (the answer should be written in your own words)

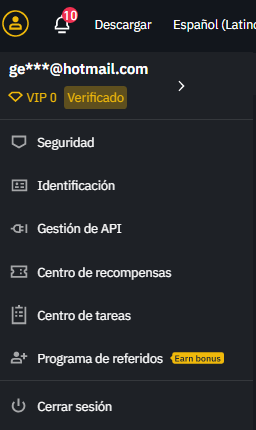

Let me show my verified user:

Screenshot with verified profile Binance

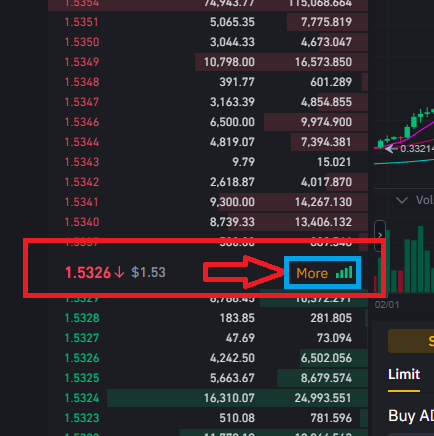

The order book has multiple functions is very interesting I will highlight some of them for everyone usually this is the brain of everything the order book is extremely important and a very powerful tool without it we could not trade the market, then we will talk about several factors that we would like to know.

We can make limit operations both to buy and sell assets in general in automatic or manual either with the edenes limit, OCO, and manual with the option "market" for this reason each operation described above are important for the ecositema and user interaction, it allows users to have more speed in relation to current operations. or future business we must know how each of these 4 elements work.

Limit order: we only have to place the value in the price box and the amount of coins we are going to buy in the green box.

In the case of selling to place a limit order we must only place the amount of coins or token to sell at the price that interests us most to win never below in losses unless it is very necessary for an emergency.

Binance

.png)

Question #4:

How to place buy and sell orders in stop limit and OCO trades? explain through screenshots with verified exchange account. you can use any verified exchange account (answer must be written in your own words).

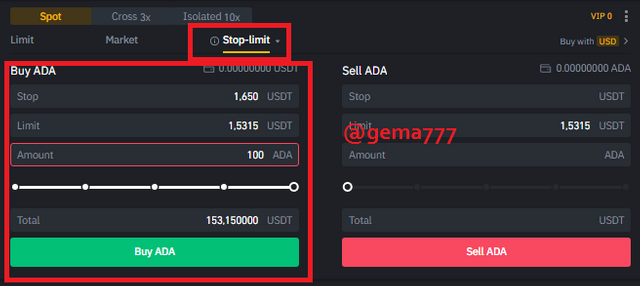

Buy and sell orders with stop limit

While we know that stop limit orders are operations that we will place automatically to buy at a price that suits us waiting for a long time or short time depending on the volatility of the current market in these orders we will place an estimated price to buy when the price touches the price we placed in the order is activated and executed automatically without the need for us to be glued to the computer.

Example:

In the stop we place 1.6$.

In the limit $1.5

amount of coins: 100

Total to be paid $153

$=USDT

Binance

.png)

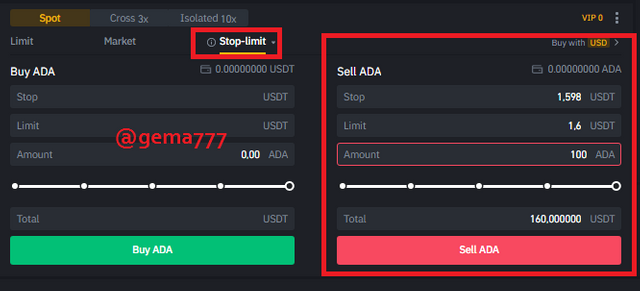

Stop-Limit Sell Order

Let's demonstrate how to use in the Sales Order is the same as the buy order only that here we will sell at a price that we like to get juicy profits, then we go to the Stop part and place a price that we would like to sell and in limit usually the limit price is a little higher than the stop.

Example:

In the stop we place 1.598$.

In the limit $1.6

amount of coins: 100

Total to be paid $160

$=USDT

Binance

.png)

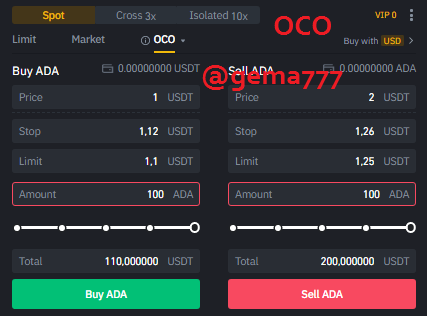

OCO" ORDER

Guide how to use OCO orders

Select "OCO".

Price: select the price we are going to sell or buy.

Stop: We will select a price at which we want to sell in case we are in operations and if the price breaks some important resistance then we sell to protect ourselves and buy lower.

Limit: Here the price is lower than the stop price because the volatility is so fast that jumps occur to prevent and have a good insurance we must place the price lower than the stop price.

Amount: amount of tokens or coins to sell.

Total: amount of money that once the operation is completed 1 "price" you will get in your token in USDT.

Binance

.png)

Question no 5:

How does order book in trading help to make profit and protect from losses? Share the technical point of view, which helps to explore the answer (the answer should be written in your own words that show your experience and understanding)

Order book helps us in providing important data to make trades in the market at our convenience and these help us to achieve greater results protect us from volatility with stop losses and maintain a strategy that helps us to make money by this we will have a plan to trade markets with the help of order book.

We can perform operations with stop limit orders, in this way we can buy or sell at a price determined by us buy at supports sell at resistances through our own technical analysis in cryptocurrencies of this will depend on the future of our finances thus playing a very important role in our lives.

The OCO orders not only help us to sell at prices that benefit us if not also to protect our assets from negative volatility as the market never knows when it will reach an unexpected level this can be in hours days months or seconds, through the OCO order we can determine the stop loss at prices that will help us to protect and sell at desired levels.

.png)

Conclusion:

In the research process we realized that order books are extremely important for the digital economy we also saw that the evolution of the order book of traditional trades and in this way were adopted and evolving so extremely important features for the entire digital ecosystem help us create graphs of market stories as it works in conventional life and in this way we can get those mathematical calculations, to be able to operate the digital market that is relatively new in the world. In comparison to the conventional markets of thousands of years it was a pleasure and a pleasure to do this work and guides for many students who come to this task can do and better understand the systems of the order book see you in a next task thank you teacher.

.png)

Cc:

@steemitblog

@steemcurator01

@steemcurator02

@yousafharoonkhan

.png)

Thank you for joining The Steemit Crypto Academy Courses and participated in the Homework Task season 2 week 7.

Thank you very much for participating in this class. I hope you have benefited from this class.

Grade : 6

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit