INTRODUCTION

If you are really into trading and you want to earn more profits from your capitals then the below material will suit you very well. Today I am going to introduce you to an efficient way of detecting or recognizing false signals produced by some indicators that leads to maximum losses.

1. Explain Confluence trading. Explain how a trade setup can be enhanced using confluence trading.

WHAT IS CONFLUENCE TRADING

Confluence trading is a concept that allows traders to line up several technical analysis indicators to judge whether any particular trading signal from either the support or resistance levels on a cryptographic chart has better or poor odds of success. In other terms, it is defined as a circumstance whereby two (2) or more trading tools meet or agree on the same market signals to provide a more comprehensive investment strategy for traders.

For instance, if a 50-period Exponential moving average (EMA), a 50% Fibonacci retracement, a -61.8% Fibonacci target, and a cryptocurrency trend line all align themselves on the same spot on the chart, then this can be referred to as confluence trading because of the combination of the usage of different analysis tools to confirm a given signal which in turn gives traders a higher advantage to hop into the market to make some money.

A reminder, all the tools used do not necessarily have to meet at the same spot on the chart before making a trade decision since they all have different accuracy levels. It's also very important to analyze different forms of indicators to avoid using the ones with the same functionality.

For instance, using a stochastic to confirm a signal spotted by an RSI. Both indicators are of the same type and often show the same results of overbought and oversold signals and generally move in the same direction. So as a trader you are required to know how and when to use indicators appropriately to avoid falling for false detected signals.

Frankly speaking, understanding what confluence trading actually is and how to effectively use it is sometimes very difficult or challenging even for experienced traders because of the myriad of different shapes formed by the confluence zone on the chart.

The chart below provides a clear visual example of how traders can use technical analysis tools to enhance a trade setup using confluence trading methodology.

From the above image of CAKEUSDT pair taken from trading view, it can be seen that more than one analysis tool was used to confirm the strong bearish signal produced by the price market. Thus, I used a relative strength index (RSI) alongside an exponential moving average (EMA) indicator to validate the signal. Notice that the RSI is in the price overbought region which indicates a bearish trend. Now, let's take a look at the EMA indicator for a second (the blue line passing through the price candles). It can be seen that after the occurrence of a breakout, all the price candlesticks started to move below the blue line indicating a bearish trend. This confirms that the signal detected by the RSI indicator is very legit and reliable.

2. Explain the importance of confluence trading in the crypto market?

Confluence trading strategy really has a lot of great importance in the cryptocurrency world. Some are as listed below.

Recognition of false signals: False signals are the main mischiefs in the cryptocurrency market that leads to tons of assets loss because of the use of only one technical analysis tool by most traders (newbies) to spot them. But since the adoption of confluence trading thus the use of more than one technical indicator to detect price signals and fake breakouts, traders have been able to earn multiple incomes from their invested capitals.

It increases the confidence level of traders: Most trade orders are placed by traders with uncertainty as to whether their assets are going to yield a better output or not. With confluence trading, the trader's confidence is increased by a great percentage, say 80% because of the use of multiple types of indicators to confirm the validity of a spotted signal in the market charts.

It provides traders with maximum winning opportunities: By merging tools and indicators, the trader is eliminating the vulnerabilities of each tool or indicator when used separately. In other words, the trader effectively reduces the risk of relying on only one particular technique and thereby receives more confirmation for a setup which in turn increases the trader's chance of winning profits.

3.Explain 2-level and 3-level confirmation confluence trading using any crypto chart.

2-LEVEL CONFIRMATION CONFLUENCE

A 2-level confirmation confluence trading is the use of only two (2) technical analysis indicators by traders to confirm whether the signals produced on a cryptographic chart due to price volatility are valid or not before taking a chance to risk their capitals.

The chart above clearly defines exactly what a 2-level confirmation confluence is from Stochastic and Moving Average indicators.

Now let's take a good look at the stochastic tool located just above the price market. It managed to enter the price oversold region (below 20) as indicated by the pink circle and started to signal a bullish trend. Since indicators are not 100% reliable, I added a Moving average indicator to verify the signal.

From the screenshot, you can notice that after the occurrence of a breakout from the previous trend pattern, all the candlesticks switched positions from below the MA indicator to above it. The movement of candlesticks from below to above the MA clearly indicates a change in trend thus, from a bearish trend to bullish, hence confirming the signal spotted earlier by the Stochastic indicator.

3-LEVEL CONFIRMATION CONFLUENCE

A 3-level confirmation confluence trading is the use of only three (3) technical analysis indicators by traders to confirm whether the signals produced on a cryptographic chart due to price volatility are valid before taking a chance to risk their capitals.

The screenshot is above taken from tradingview clearly defines exactly what a 3-level confirmation confluence is. I made use of three technical indicators to validate the signals produced by the price market thus, the Stochastic, Moving Average (MA), and MACD indicators.

As a first confirmation, I used the Stochastic indicator to spot the oversold region on the chart as indicated by the red circle. The oversold region signals a buy order (the asset price is in a bullish trend). The blue line passing through the candlesticks (MA) is the second technical analysis tool I used to confirm the price signals. It can be seen that after the breakout, the candlesticks moved from below the candlesticks and attached themselves to the upper side which indicates a change in trend from bearish to bullish.

The third tool used for confirmation is the MACD indicator. From the above chart, the MACD line has provided a more precise view of the price market with the aid of a support line. Both lines intersected multiple times before reaching the breakout point. During a bearish trend, the lines travel below the price assets and vise-versa when bullish (similar to a moving average) as shown in the screenshot.

4. Analyze and Open a demo trade on two crypto asset pairs using confluence trading. The following are expected in this question.

The asset pair that I am going to use to open my demo trade is XRP/ Tether. I will be using tradingview paper trading to showcase my trades. The paper trading option on tradingview can be accessed by clicking on Trading panel and selecting the paper-trading option. Don't forget to click on connect as well.

a) The image provided below is on a 1-day timeframe. When you take a close look at the chart, you will notice an extreme bearish trend with a series of lower highs and lower lows which commenced on 09 Nov 2021 before the occurrence of a breakout on 19 Dec 21.

b) A 3-level confirmation confluence is what I used to verify my spotted signals before executing the trades because of the uncertainties associated with indicators. Meaning I made use of only three technical trend indicators which include, the RSI indicator, the SMMA indicator, and the Stochastic oscillator to make a perfect trading decision. The SMMA indicator was used to detect the legibility of the signals produced by the price market alongside its trend direction. From the screenshot provided above, it can be seen that the asset prices has started to shoot upwards (the candlesticks are moving above the SMMA).

After using the SMMA indicator to grab the direction of the latest trend signal, I introduced a Stochastic oscillator to confirm it before risking my capital. To my surprise, stochastic was showing a completely different signal. Thus, it showed a price overbought which made me question whether the signal recognized by the SMMA was false or not because the candlesticks were still above the SMMA line trending upwards. Due to this, I included a different tool (RSI) to the chart just to verify everything. The RSI also came out with a signal equal to the signal detected by the SMMA indicator. From this, I came to the conclusion that the signal detected by the Stochastic oscillator was fake and hence not reliable.

c) From the different signals detected by the RSI, Stochastic Oscillator, and SMMA as I explained earlier, I finally confirmed my stand and placed my trade knowing that the market is still going to signal a bullish trend.

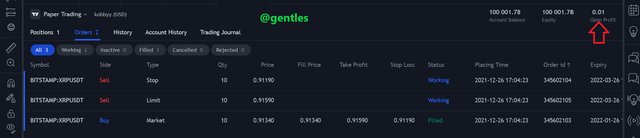

I took a risk and placed a buy entry position with a take profit of 0.91590 and a stop loss at 0.91190 as shown in the picture below.

After successfully placing my order I started to earn small amount which means that my risk was worth taking.

The asset pair that I am going to use to open my demo trade is Harmony/ TetherUS. I will be using tradingview paper trading to showcase my trades.

A 2-level confirmation confluence is what I used to verify my spotted signals before executing the trades because of the uncertainties associated with indicators. Meaning I made use of only two technical trend indicators which incudes,the HalfTrend indicator, and the Momentum indicator to make a perfect trading decision. The HalfTrend indicator was used to detect the legibility of the signals produced by the price market alongside its trend direction. From the screenshot provided below, it can be seen that the asset prices has started to shoot upwards (the candlesticks are moving above the HalfTrend). The blue and red lines as indicated in the image indicates bullish and bearish trends respectively. Meaning a price is in an uptrend movement when the price candles are moving above the blue arrow and a downtrend when moving below the red arrow.

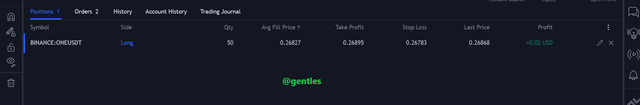

To surely confirm the signal detected, I added a Momentum indicator which also signaled a bullish continuous trend. So I concluded and placed a buy order with a take profit position of 0.26895 and a stop loss at 0.26783 as seen below.

CONCLUSION

There is no actual hard and fast rule about how you can harness the power of trading with a confluence strategy. You can combine multiple technical analysis indicators to find a confluence and take a trade when all these indicators line up at a certain spot.

Alternatively, you can simply identify the major resistance and support levels and wait for the price to create a common price action pattern around these levels, and take the trade in the direction of the price action momentum.

Also, remember that the resistance and support formed around key levels are always important because they are the pivot zones that many traders keep an eye on. You should always try your possible best to identify such areas of importance before placing a trade on the market.

Finally, regardless of which trading method of confluence you decide to use while developing your trading strategy, you should always diversify your tools and combine various fundamental and technical factors to increase your overalls winning odds.

Hello @gentles, I’m glad you participated in the 6th week Season 5 of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Observations:

That's correct.

Recommendation / Feedback:

Thank you for submitting your homework task.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

thank you very much prof

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit