Hi, Prof.@allbert thanks for your lecture. I really learned a lot.

Graphically, explain the difference between Weak and Strong Levels. (Screenshots required) Explain what happens in the market for these differences to occur.

A support and resistance levels are formed when the market price action of an asset turns back and changes direction. This action usually leaves a peak or a trough in the market chart. Technically, they are price levels that are horizontal and join price bar lows to other price bar lows and price bar high to price bar highs and forms a horizontal level on a price chart.

Support and resistance levels are easily discovered. They can be seen by finding the lowest or highest prices on the chart and connecting them with a horizontal line to indicate them. They are very important in trading and can aid a trader to trade easily and make a profit.

We have two forms of support and resistance, they are;

• Strong support and resistance levels

• Weak support and resistance levels

Their names suggest their strength. Strong and weak levels tell or indicate their reliability. They are identified by how often the price of the asset reaches the support or resistance levels and reverses or bounces back to the opposite direction.

Strong Support and Resistance

When the price reaches and reverses on the horizontal level multiple times then it is said to be a strong level. It shows various times the price has experienced price pullback and rejection. It tells the trader that those levels are reliable.

• Strong Resistance:

When the price of the asset rises and reaches a peak then reverses downwards and rises again to the same level several times, then that peak level is said to be a strong resistance level. This means the resistance level is reliable and have oftentimes repelled the price uptrend of the asset and holding it within a certain range.

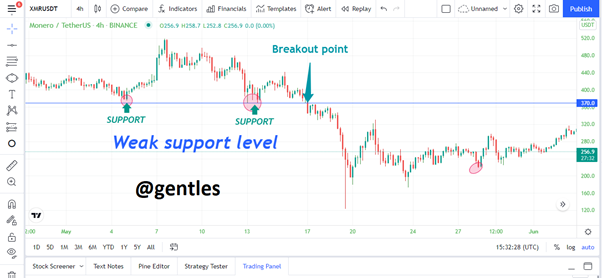

As seen from the XMRUSDT chart above, the price of XMRUSDT increased and reached a peak of about the same level 4 times to make 4 resistance levels. This indicates a strong resistance forming in the market. What causes a strong resistance is the high trading volume and sell orders placed at a certain time. Traders place pending sell orders at the resistance level and are triggered when the price reaches that point and makes the market liquid. This causes the price to fall again to create another resistance level these resistance levels come together to make a strong resistance.

• Strong Support

When the price of the asset falls and reaches a low level then reverses upwards and falls and rises again to the same level several times, then that low level is said to be a strong support level. This means the support level is reliable and has oftentimes repelled the price downtrend of the asset and holding it within a certain range.

As seen from the XMRUSDT chart above, the price of XMRUSDT fell and reached a low point of about the same level 4 times to make 4 support levels. This indicates a strong support forming in the market. What causes a strong support is the high trading volume and buy orders placed at certain times. Traders place pending buy orders at the support level and are triggered when the price reaches that point. This causes the price to rise again to create another support level.

Weak Support and Resistance

Weak level on the other hand indicates that the support and resistance levels are not reliable. It happens when the level gets penetrated.

• Weak Resistance

When the price of the asset rises and reaches a point and falls again and rises to create a resistance level but it gets penetrated or broken later and the price was only bounced back once or twice then it is a weak resistance.

It can be seen from the chart that the price was only bounced back by the resistance level, not more than twice, and got penetrated at the breakout point. This was caused by low trading volume and fewer sell orders. When traders place only a few pending sell orders at the resistance level but they are quickly executed and when the price reaches the resistance level again and there are no pending sell orders again, the resistance level is broken.

• Weak Support

When the price of the asset falls and reaches a point and reverses upwards and falls again to create a support level but it gets penetrated or broken later and the price was only bounced back once or twice then it is a weak support.

It can be seen from the chart that the price was only bounced back by the support level, not more than twice, and got penetrated at the breakout point. This was caused by low trading volume and fewer buy orders. When traders place only a few pending buy orders at the support level but they are quickly executed and when the price reaches the support level again and there are no pending orders again, the support level is broken.

Explain what a Gap is

A gap is when there is a skip in the price of an asset on a chart that shows the price has crossed a particular level to another level without the immediately past price level. This usually means that the asset has opened a new price right after the previous closing price and creates a gap between the two prices. So basically, when the price of the asset changes from one level to another and there is no trading between those price levels a gap is created. The gap can be formed from either direction of the market, it could be a fall or rise in the price of the asset.

On the chart it can be seen based on the new candlestick does not match the closing of the previous candlestick because it can be seen that there is an empty candlestick in between them. This happens due to a lot of reasons, it could be that there was good or bad news after the closing and a lot of traders change their minds on the asset, decide differently and place a high volume of buy or sell orders. It often happens after weekends where a lot of things can change. Oftentimes the gaps get filled over time and may serve as support and resistance levels.

Explanation for the types of Gap

• Runaway Gap

This type of gap is when there is a gap that happens in the middle of the market structure. It shows in a continuing trend. It happens because of a large trading volume at any time. It also shows a good resistance and support level.

In the VET/USDT chart above. a runaway gap was formed and later showed a continuation in the trend of the market.

• Breakaway Gap

This type of gap shows a breakout in the market structure and changes the direction of the market trend. Here, after the gap is formed the market reverses direction and starts a new trend. This gap also provides good resistance and support levels.

From the chart above, a breakaway gap was formed when a gap changed the downward trend of the market to an upwards trend.

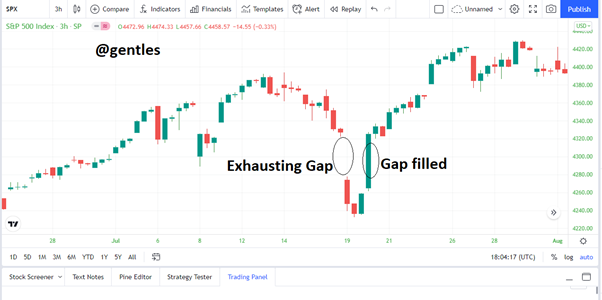

• Exhaustion Gap

Unlike the runaway gap, the exhaustion gap happens that the end of a trend. It is difficult to notice it as it resembles a runaway gap but often becomes clear after the price gap has been filled. It doesn’t really give any support or resistance levels.

An exhaustion gap can be seen from the chart above and it can also be seen that the gap gest filled by the price movement later. Here placing an order in the opposite direction of the gap as it is getting to the fill area could yield profits.

Through a Demo account, perform the (buy/sell) through Strong Supports and resistances

I will be using a demo account on TradingView to execute a trade using strong resistance and strong support. I will do a strong resistance level trade. Then we will set take profit rather than stop loss for our trade.

To buy the asset I will make use of the break retest break trading strategy.

• To begin I will find a strong resistance level to aid in the entry-level of the market.

• We then have patience for the price to penetrate the resistance level and retest it.

• We then wait for the price to rise above the swing high peak in the candlestick that follows, then we place a buy order with a take profit and stop loss using a risk-reward ratio of 1:1

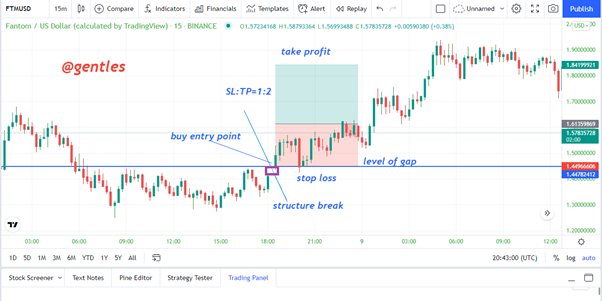

Through a Demo account, perform the (buy/sell) through Gaps levels. Explain the procedure (Required Screenshots).

In the chart above, I have placed a buy entry on the FTM/USD. I detected an uptrend when the gap was formed. I set a risk-reward ratio to 1:2 which is the stop loss and take profit. How to execute a buy entry through gap levels was shown on the chart.

Conclusion

In this post, I wrote about both strong resistance and support then weak resistance and support levels in the first part. The strong levels are a result of a price high hitting the resistance level or a price low hitting the support level more than twice making it very reliable. The weak levels are created when the price highs or lows fail to hit the resistance or support level more than twice and get broken or penetrated making it unreliable. The break retest break method can be used together with strong resistance levels to trade.

The second part of the post was about gaps in the chart. This usually means that the asset has opened a new price level right after the previous closing price and leaves a gap between the two prices. Gaps are of three types, breakaway gap, runaway gap, and exhaustion gap. We can use the breakaway gap that enables a trend reversal to trade.

Hello @ Thank you for participating in Steemit Crypto Academy season 4 week 1.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

thank you Prof for your review. i will be more careful on with my presentation next time

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit