Assalam-o-Alaikum!

I hope that you will be well with the blessing of Allah Almighty. I am so glad to see this new homework task that is so amazing and this is really looking so good. I participated in this task because there is a great opportunity to learn about the orders on Binance.

So let's start it quickly.

Define the Order Book and explain its components with Screenshots from Binance.

Answer Question Number One

OrderBook

The order book is a list of particular asset pairs in trading which shows every open order of asset pairs. Orderbook is electronic and it is arranged by price. It shows the list of particular sell and buys orders for an asset and the order book has a bid side and an ask side. We can say that an order book is the list of orders which is used as a record for buyers and sellers as a particular instrument.

BID SIDE

The bid prices refer to the highest prices that traders are willing to pay for security and it represents the high demand side of the market for the given stock and these are the first two columns from the left side of the order book it consists of the prices and the quantity of the open bid sides on the crypto asset.

BID PRICE

This is actually the amount that traders or buyers pay for security and it is contrasted with the selling price or offer. In the Binance this price is found on the right side of the order book in green color and the bid price is actually the price of opened bids that are arranged in the order with the highest at the top.

BID QUANTITY

The bid quantity shows the both price of the potential buyer and the quantity to be purchased at the price. The bid means the price on which a market maker is willing to buy and unlike a retail buyer a market maker also shows an asking price and this is called bid quantity.

ASK SIDE

The ask side is the second column from the left side of the order book and this contains that list of the priced and the quantity of the open sell orders and asks on the crypto asset and this is the lowest proposed selling price, it represents the side supply of the market for the given stock.

ASK PRICE

These prices show a red color appearance at the left of the ask side of the order book and as I've already mentioned that it represents the minimum price that a seller is willing to take for the same security and it is also called the offer price.

ASK QUANTITY

The ask quantity is the quantity of the sell orders or asks opened and are then arranged according to the asking price. It means the price on which the seller is ready to sell any stock or commodity is called bid quantity.

Who are Market Makers and Market Takers?

Answer Question Number Two

Market Makers

Market makers are individual parts or members of exchange that are people who sell and buy securities for their account and they are the persons who placed the existing orders of buy and sell that were matched and these orders are usually placed above the market price or under the market price and they are placed by using limited orders.

Market Takers

And in the opposite market takers are the persons who buy and sell orders for trading that match the existing order for trade to happen and these orders are commonly placed at the market price either automatically or by setting limit orders at the market.

In simple words, we can say that every order on the order book was placed by a market maker, and if any market taker places an order it does not go to the order book since it will match an existing order and get closed. Order books have open orders that can only be a market maker.

What is a Market Order and a Limit order?

Answer Question Number Three

Market Orders

A market is the name of the buy or stock at the best price of the market's current value and the market order usually ensures an execution, but it does not guarantee a specified price. The market orders are the orders that are placed on the current price of the market and they are usually the orders of the market takers and they did not count in the order book because they filled quickly because they are placed on the current price of the market.

Limit Order

This order is placed above the market price or below the current price of the market. When once the market price increases or falls to the preset prices then they are to be filled and the limits sell orders are placed above the market price while limits buy orders are placed the market price and these terms are used in trading. These are so useful terms and many traders use them.

A limit order is an order type on most exchanges i.e Binance.

Explain how Market Makers and Market Takers relate to the two order types and liquidity in a market.

Answer Question Number Four

Market makers populate the order book with their limited orders which are placed above or below the market prices and when many orders are opened by the market makers then there is the liquidity and liquidity is preferred to ease with which an asset or secure to the price. Market makers come into the market with their orders that open with their open limit orders and are filled.

Market takers accept the prices of the market makers so they are provided liquidity by the market providers. Originally market makers provide liquidity and the market takers take to the liquidity in the market so this is such a simple process.

The market makes with open limit orders mean abundant liquidity which will make markets orders by market takers to be filled faster.

Place an order of at least 1 SBD for Steem on the Steemit Market place by

a) accepting the Lowest ask. Was it instant? Why?

b) changing the lowest ask. Explain what happens.

(Make sure you are logged in to your wallet).

Answer Question Number Five

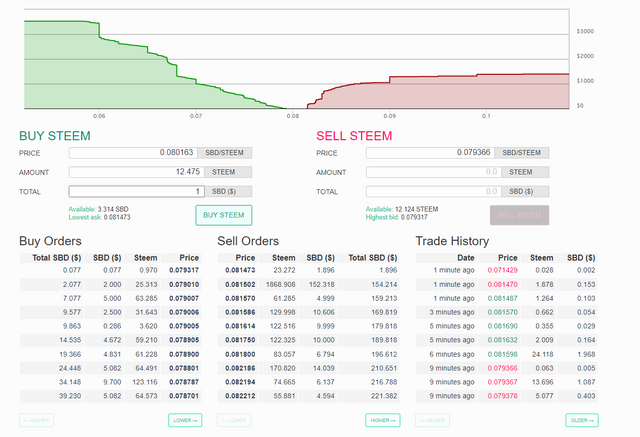

Now I come to the Steemit where I accepted the lowest order price for one SBD on the internal market.

The lowest ask price was 0.80163 so I placed my order of 1 SBD. I put 1 SBD and change them into 12.475 STEEM.

I clicked on the BUY STEEM button and after I will conform to my limit order but sorrow I could not take a screenshot of my confirm order box. After click on Ok to confirm a new box will appear that will require your active or owner to finish the operation. Then after providing your active key, the process will be complete and the order will be applied.

- Accepting the Lowest Ask

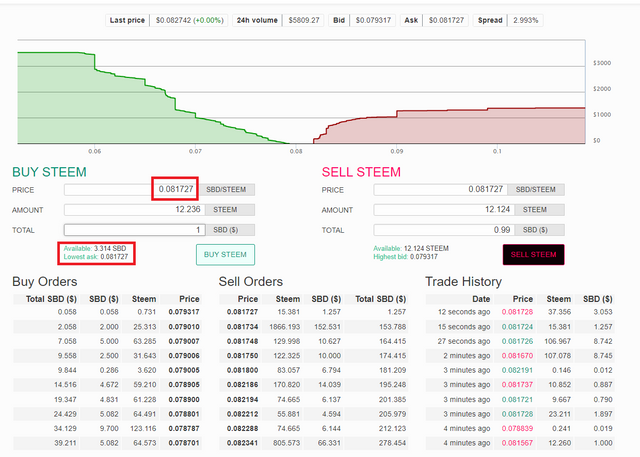

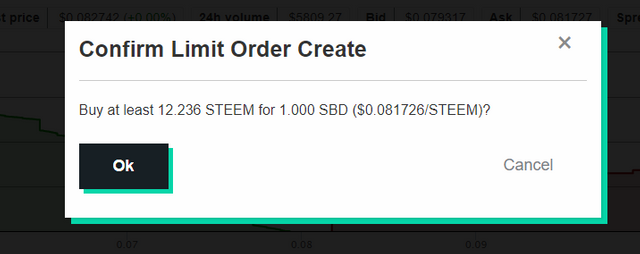

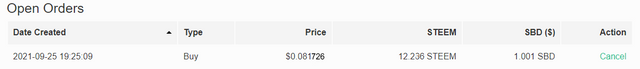

I will place a limit order below the price and take the role of the market maker and now I will check low ask.

Low ask 0.081727

Order: 0.081727

Answer Question Number Six

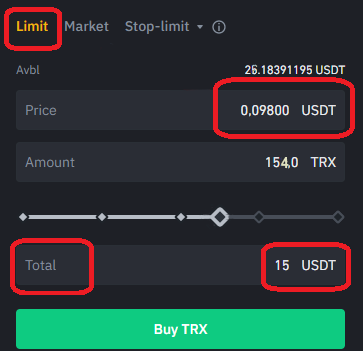

Place a TRX/USDT Buy Limit order on the Binance exchange for at least $15. Explain your steps and explain the impact of your order in the market. (Give Screenshots).

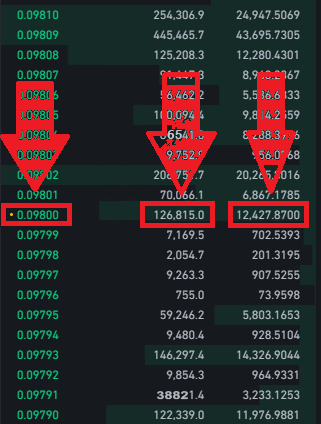

I saw the order book as I logged into the market stock open trade on the TRX/USDT on Binance.

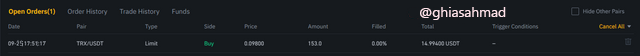

I wrote my order at the level of a market taker on the level of 0.9800 and here trading will be useful and meaningful and here my order of limit is waiting for being filled.

I will wait as the market taker to receive the liquidity that I have creates and when I look at the buy order, my order was displaying there.

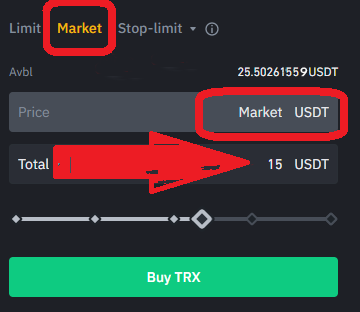

Place a TRX/USDT Buy Market order on the Binance exchange for at least $15. Explain your steps and explain the impact of your order in the market. (Give Screenshots of the completed order).

Answer Question Number Seven

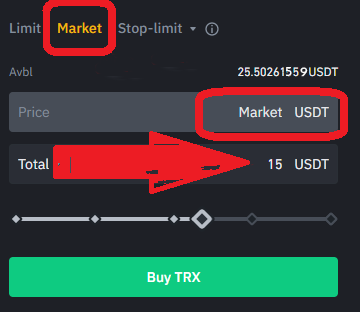

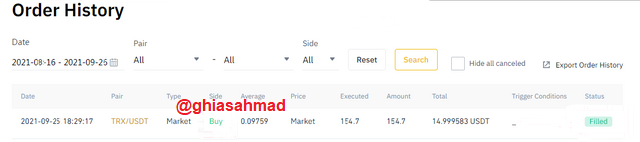

Now this time I am in the role of a market taker and again I choose the pair of TRX/USDT but now I choose the market.

The liquidity is high by market makers and I executed my market order of 15 USDT and received liquidity from the market maker.

Take a Screenshot of the order book of the ADA/USDT pair from Binance on the day you are performing this task. Take note of the highest bid and Lowest ask prices:

a) Calculate the Bid-Ask.

b) Calculate the Mid-Market Price.

Answer Question Number Eight

The mid-market price is the average ratio of sell and buys rates of the asset. It can also be called the average of the current offers and the difference between the highest price a buyer willing to trade to pay for the asset and the lowest price at which a seller willing to sell the asset is calculated and the mind-market price is found. Now I will calculate the mid-price in the pair of ADA/USDT.

Highest Bid: 2.410

Lowest Ask: 2.387

The formula is given to calculate the Mid-Market Price.

Mid-Market Price = (Bid Price +Ask Price) /2

Mid-Market Price = (2.410+2.387) /2

Mid-Market Price = (4.797) /2

Mid-Market Price = 2.3985

So mid-market price is 2.3985.

Hello @ghiasahmad,

Thank you for taking interest in this class. Your grades are as follows:

Feedback and Suggestions

Thanks again as we anticipate your participation in the next class.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit