Question 1: Algorithmic Trading, Brief Introduction

The word, algorithmic trading, itself signifies using computer generated algorithms of predefined criteria to execute trades. Making decisions at jaw-dropping speeds, trading algorithms are able to enter or exit in and out of positions with very high accuracy: no human emotions included. Algorithmic trading is becoming prominent in the modern-day markets as it can work with huge amounts of data and execute orders faster than human traders. That has increased market liquidity, reduced trading costs and given a more precise pricing.

Example using Moving Averages (MA):

If you are a beginner in using moving averages, the most basic strategy is watching two moving averages; one is a fast-moving average ( short-term) and another one is slow-moving average( long-term). The algorithm can buy, for example the STEEM/USDT trading pair when the MAfast is slighlty below MAslow and means a bullish crossover, and sell when it crosses above that is a bearish crossover.

Question 2: Moving Averages in Algorithmic Trading

Types of Moving Averages:

- Simple Moving Average (SMA): This is the average price over a specific period, giving equal weight to all periods. It is easy to calculate but responds slowly to recent price changes, which can cause delays in trading signals.

Exponential Moving Average (EMA): This gives more weight to recent prices, making it more sensitive to price changes. It responds faster than SMA, providing earlier signals, but is also more prone to false signals in a volatile market.

Weighted Moving Average (WMA): This places even more emphasis on recent data by assigning different weights to each period. It is faster than both SMA and EMA, but also more reactive to short-term fluctuations.

Preference: EMA is often preferred in algorithmic trading because it strikes a balance between responsiveness and smoothness. It adapts to price changes quickly, which is crucial in fast-moving markets like cryptocurrencies.

Practical Example:

On a Steem chart, the EMA (20-day) can be used alongside a longer-term EMA (50-day) to generate entry and exit signals. A bullish crossover (when the 20-day EMA crosses above the 50-day EMA) can signal a buy, while a bearish crossover can signal a sell.

Question 3: Design an Algorithmic Trading Strategy

Strategy Design:

- Entry Signal: Buy when the 20-day EMA crosses above the 50-day EMA (bullish crossover).

- Exit Signal: Sell when the 20-day EMA crosses below the 50-day EMA (bearish crossover).

- Stop-Loss: Set a stop-loss 2% below the entry price to protect against adverse price movements.

- Risk Management: Use position sizing rules, such as risking no more than 2% of the account on any single trade.

Backtesting: To backtest the strategy, historical Steem/USDT data can be used. The strategy would be tested across various market conditions (bullish, bearish, sideways) to evaluate its performance. Metrics such as the win rate, average profit/loss, and maximum drawdown should be analyzed.

Question 4: Implementing Algorithmic Trading

Tools for Implementation:

- Python: Ideal for backtesting and implementing trading algorithms. Libraries such as pandas, NumPy, and backtrader are often used.

- TradingView: A web-based platform with Pine Script that allows for charting and strategy automation.

- MetaTrader (MT5): A popular platform for automating trades with MQL5.

Code Snippet (Python using EMA Crossover Strategy):

import pandas as pd

import talib

# Load historical data

data = pd.read_csv('steem_usdt.csv')

# Calculate 20-day and 50-day EMA

data['EMA20'] = talib.EMA(data['Close'], timeperiod=20)

data['EMA50'] = talib.EMA(data['Close'], timeperiod=50)

# Define signals: Buy when EMA20 > EMA50, Sell when EMA20 < EMA50

data['Signal'] = 0

data['Signal'][data['EMA20'] > data['EMA50']] = 1

data['Signal'][data['EMA20'] < data['EMA50']] = -1

# Implement strategy (buy on 1, sell on -1)

Question 5: Performance Review

To evaluate the strategy’s performance, historical data for Steem would be reviewed under different market conditions:

- Bullish Market: The strategy tends to perform well, as moving averages capture upward trends, allowing traders to hold long positions.

- Bearish Market: The strategy may struggle as price reversals are common, and false signals could be generated.

- Sideways Market: Performance would typically be poor in choppy, sideways markets, as moving average crossovers may generate multiple false signals.

Findings and Improvements:

- The strategy may benefit from adding a filter (e.g., RSI or ADX) to avoid entering trades during sideways markets.

- Adjusting the EMA periods could help optimize performance for Steem's unique volatility.

Thanks to @crypto-academy for organizing this contest.

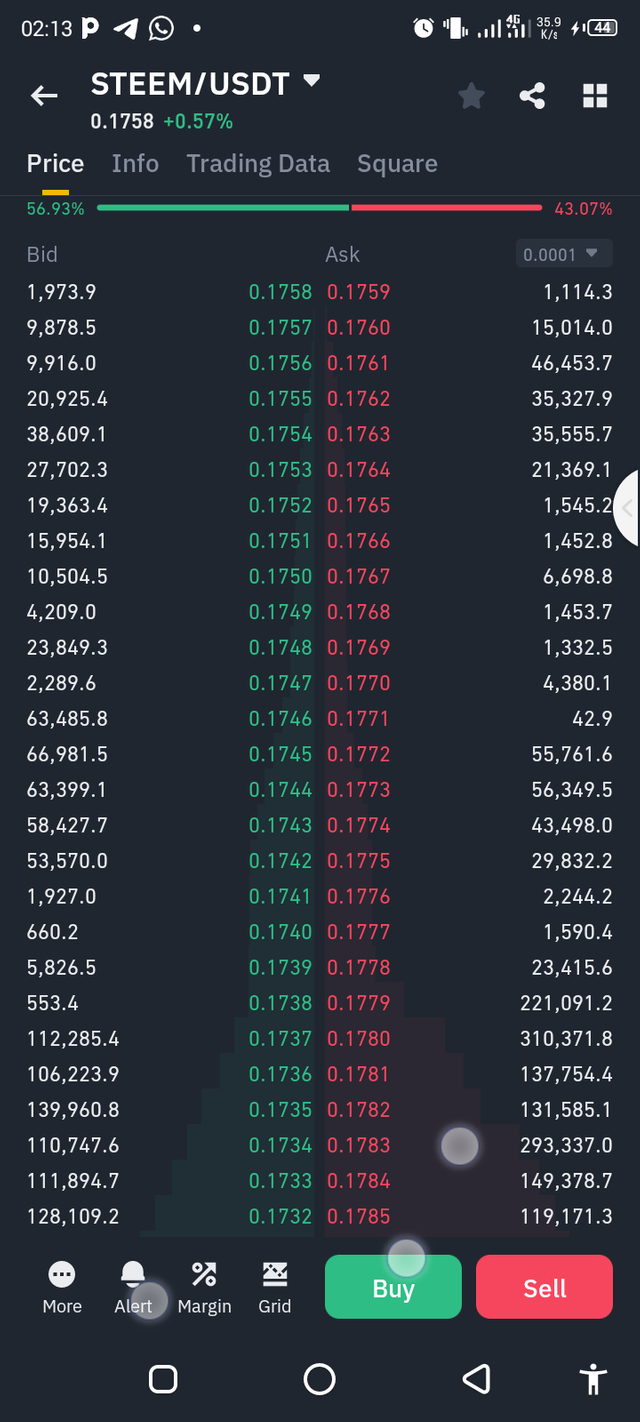

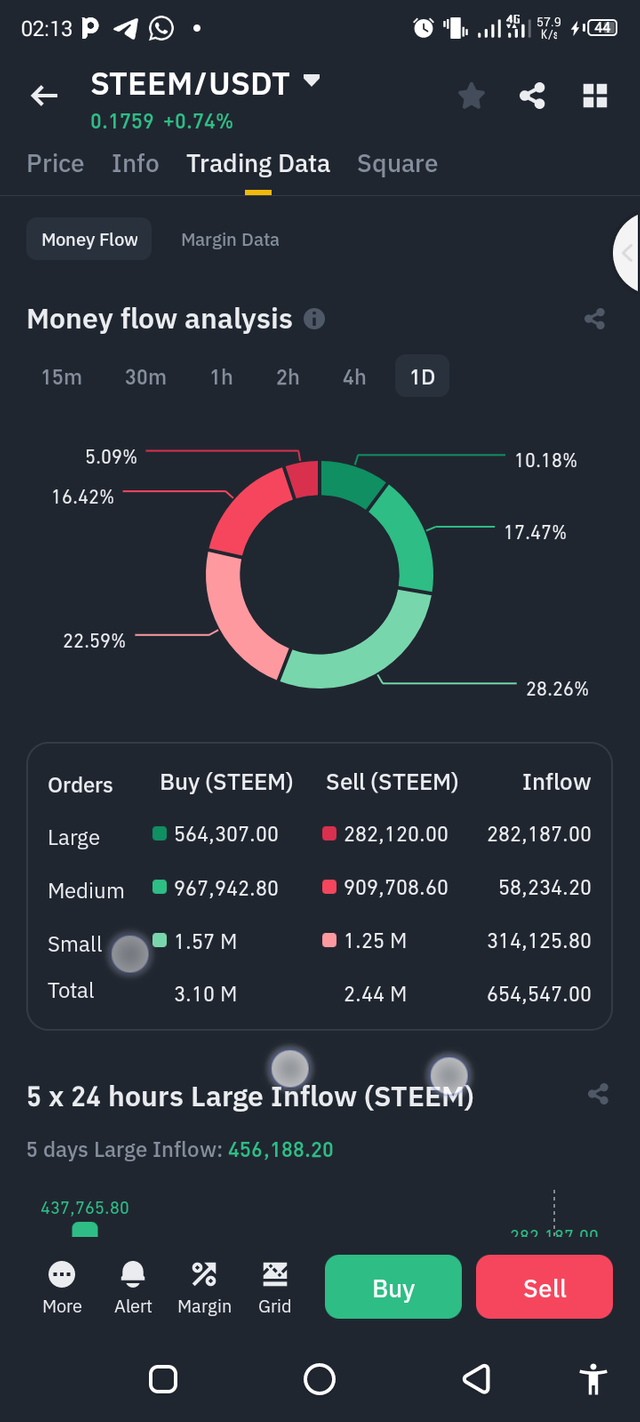

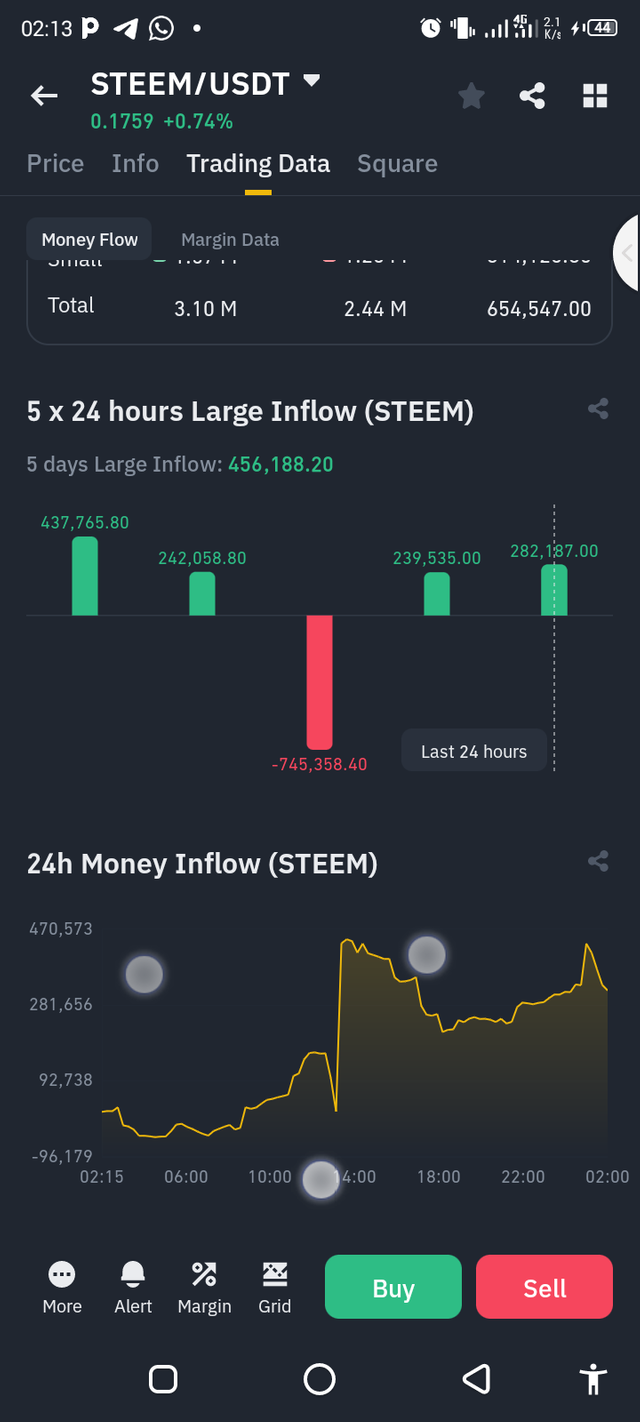

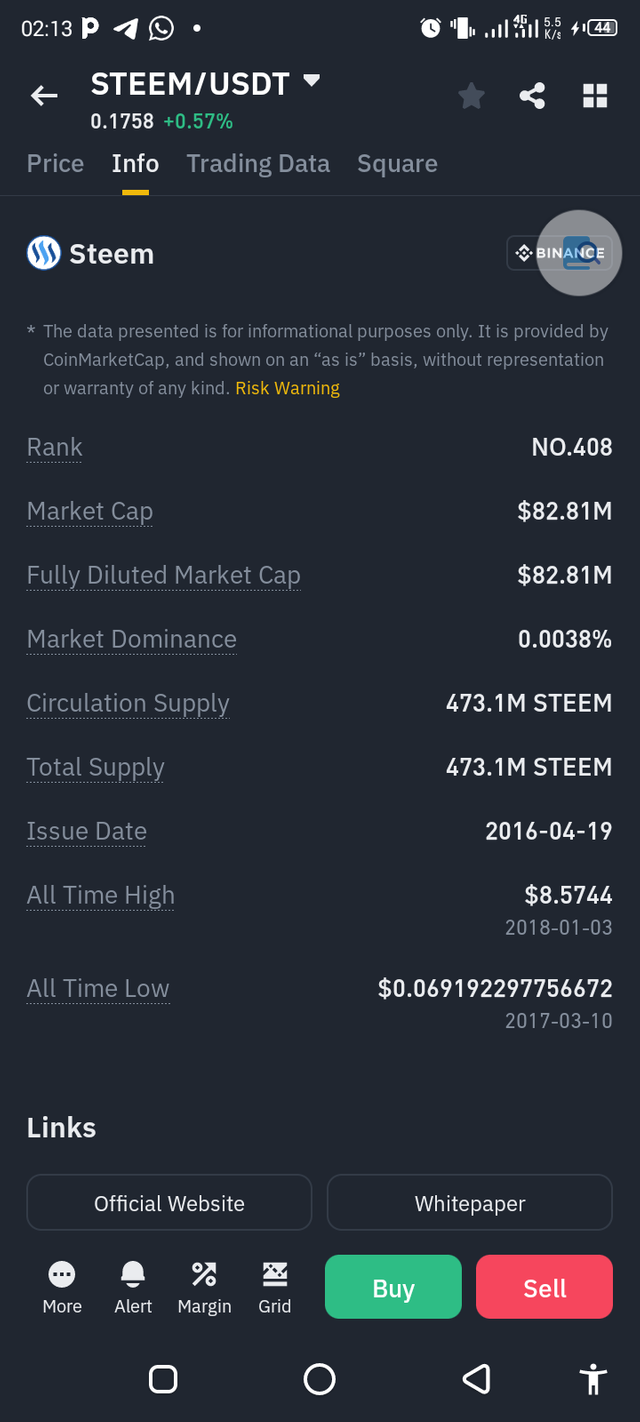

Note: All images from my binance.

I invite @wealth2, @jozzie90 and @samuelnkenta

good entry post but you need to do more research about this topic i hope next time i will see your entry more good

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Sure 😊

Thanks for reading my post

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you so much for trying here I see a lot of things that the screenshots don't match with the writing anyways keep trying good things will happen and keep analyzing good luck

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

💯⚜2️⃣0️⃣2️⃣4️⃣ This is a manual curation from the @tipu Curation Project

@tipu curate

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Upvoted 👌 (Mana: 1/7) Get profit votes with @tipU :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice try bro, I was happy to also see you participating in this contest, you really did a great job but I think your screenshots are too long and it made your post unattractive abit.

Another is that id not proper to make the first image of your post long, it should have a media size, observe other people's posts and you will understand what am saying.

Goodluck to you in this engagement challenge, learning never ends.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you bro

I have seen and understand your point, I will try more better next time

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit