(Design and edited on canvas)

I'm so excited in my entry of this contest, how are you all, how is your family and I hope everything is fine, I'm here again to participate in this contest but before I proceed I will like to appreciate SteemitCryptoAcademy for organizing this interesting, unique and wonderful contest that base on Stablecoins so stay tuned and enjoy my article without any further ado let's get started.

Stablecoins are revolutionary types of cryptocurrency designed in other to reduce inbuilt volatility of other digital coins and token. Their aim is to provide a medium of exchange that maintains a relative value overtime. Stablecoins are well-built on distributed technologies ledgers such as blockchain, allowing them to leverage the trust, transparency and associated of immutable with such systems. This gives them the ability to be an attractive solution for digital transactions, most commonly those involving payment and other financial activities. Improbable to traditional fiat currencies, which are subject governing influences, they are moreless prone to manipulation. In additionally, these coins are expectedly pegged implicit or underlying assets, like a precious metals or a basket of fiat currencies. ensuring a measure of stability for users. This makes them most especially suitablility for use in cross border hedging, transactions and portfolio diversification. And also Stablecoins have the potential to revolutionize global payment and create of new investment opportunities and as well be of help as bridge between the world of cryptocurrencies and the traditional economy.

In my own understanding Stablecoins are cryptocurrencies that often attempt to peg their market value to some external reference. they are useful in more-volatile cryptocurrencies as a exchange of medium. Stablecoins are usually pegged to a currency like the U.S. dollar, gold and other price of a commodities.

When it comes to managing of this a stable price, I will employed several strategies to ensure a stable price. negotiating contracts with my suppliers to guide and secure a consistent price, policies implementation to limit fluctuating demands. and I will offered incentives to customers for purchasing at the agreed upon price. This resulted in a predictable price model, which will allow us to keep a steady price for our products and services.

In maintaining a stable price,issuer of stablecoin must create an elastic supply and demand mechanism,whereby the price of the stablecoin will be always thesame. This is achieve through a mechanism varieties such as liquid pools, dynamic market makers and entity centralizes like banks. Algorithm are employed to verify and migrate any shock in the demand and supply. stablecoin are also use collateralization, where real world assets like cryptocurrencies are held as a guarantee to stabilize the value of the coin and other commodities.

Stablecoins were stabilitly created to solve a valuable pressing need for a cryptocurrency. Traditional cryptocurrency like Bitcoins, while wildly popular, which have an unstable price that can quickly swing in either direction due to the market they are traded in. The aim of stablecoins is to tackle this problem by pegging their value to a stable asset. like gold or a fiat currency and make ensure it maintains the same value regardless of market fluctuation. moreover this makes them incredibly useful for a wide range of application like remittance, trading, hedging investment, making payments in both fiat and cryptocurrencies. stablecoins offer greater financial security and protection in the cryptocurrency space.

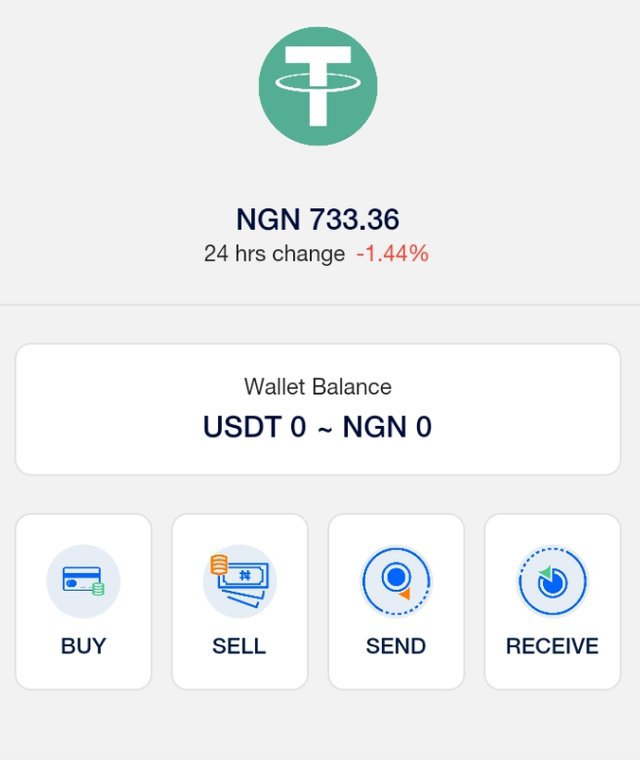

(Source from roqqu)

Currently the most popular stablecoins are USDT coin, Tether, and paxos standard. all of these, I use USDT coin the most, because I prefer the transparency that comes with it. In every transaction made on the blockchain is verifiable, permitting for an accurate accounting of supply.

This also guarantees that all assists within the USD coin ecosystem are backed by fiat reserves in a reliable bank. also I find the stability from this type of transparency invaluable in an increasing uncertain world.

Yes, stablecoins can lose their stability. This can be due to a variety of reasons. For example, makerDAO is a decentralized stablecoins whose price stability was reliant on ETH, the underlying collateral assets. As the value of ETH dropped significantly during the coronavirus pandemic, the value of makerDAO fell by half.

In other cases, hackers have exploited vulnerable in smart contract that allowed them to increase the supply of the stable, effectively making the assets no longer stable. Another issue that can destabilize a stablecoins is lack of adoption, which can result in fewer market participate and thus increase volatility in price. In order to prevent these scenarios, developers must constantly evaluate the code and improve the overall stabilitly of their coins.

The advantages of stablecoins compared to traditional crptocurrencies are as follows:

Firstly, stablecoins are pegged to a particular assets such as the US Dollar, meaning their value does not fluctuate with the same volatility that regular cryptocurrencies do. This stability can help ensure long term investment stability and confidence, and also means less chance of financial losses from rapid price movements.Additionally, because they are more stable, they can be used to more easily facilitate trades and other transactions on exchanges and blockchains.

Furthermore, they offer advantages over traditional fiat currencies such as the ability to perform transaction much faster and more securely, as well as the ability to transfer money and access the value stored within stablecoins almost anywhere in the world with a network connection.

In additionally, because they are more stable, they can be used to more easily facilitate trades and other transactions on exchanges and blockchains. Finally, they offer advantages over traditional fiat currencies such as the ability to perform transactions much faster and more securely, as well as the ability to transfer money and access the value stored within stablecoins almost anywhere in the world with a network connection.

Disadvantages.

The main disadvantages of stablecoins compared to traditional crptocurrencies is that they are not truly decentralized. They are tied to an external assets such as a currency or commodity, which means that the coins is not protected from any government intervention. moreover, since stablecoins are not as volatile as other cryptos, they lack the same potential for growth that can make investing in traditional cryptos more lucrative. finally, since stablecoins rely on an external asset to maintain their value, they can be more difficuit to move around and exchange.

In conclusion, stablecoins provides a stable option for we cryptocurrency users. With their ability to peg the price of cryptocurrency to an external asset such as the US dollars, they offer a remede for we crypto users who want to mitigate the effect of market volatility and seek more finance stability. With a wide range of stablecoins currently on the market, and new versions of them continually being developed, it's likely that stablecoins will continue to provide a safe haven for crypto users for years to come.

I will like to visit @beautiful12,@nadeesew and @elrazi to join me in this contest

Thanks you all 💛

This post was selected for Curación Manual (Manual Curation)

@tipu curate

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Upvoted 👌 (Mana: 3/7) Get profit votes with @tipU :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello friend @goodness2,

You have done a great job in this entry you have submitted.

You have explained in your own words what a stable coin is and the methods you will employ to ensure stability of the coin.

You also explained the reasons stablecoin were created and this is to ensure stability of cryptocurrency because other currencies like Bitcoin are too volatile.

You also went ahead to explain the advantages and disadvantages of stablecoin in comparison to our traditional currency.

Overall, you have done a very good job, the gradings now belong to the professor to do.

I wish you all he best 😊

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks alot

I appreciate your good compliant

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit