Good day Steemians. How are we today? I hope we doing quite well. It is my pleasure to present my homework task this week.

Question 1: Define and Explain in detail in your own words, what is a "Trading Plan"?

A Trading Plan can simply be defined as a set of guidelines that is well researched on written down or documented that must be strictly adhered to by an investor or a trader in order for him to engage successfully in trading digital asset(s) of his choice. It can as well be regarded as a compass that directs a trader, helping him to implement all the strategies or methods stated in the written-down plans.

In other words, it is a well thought-out procedure that must be followed before starting a trade and it will assist him to take necessary actions that will allow him to be in full control of his money or capital that he invested as he apply these methods listed in his trading plan. That is why this statement is true:

"Most trading experts recommend that no capital is risked until a trading plan is made"

Hence, this plan must be critically studied before embarking on any trade, because all the rules and regulations guiding his trading decisions are contained in this plan he has written down on paper, adherence is absolutely needed.

However, trading plan can be built in such a way that it can benefit active traders by being so detailed or simple so that automatic traders (those that want to put in a particular amount) can benefit also. Trading plan as important as it is must not be altered by traders, just because the market is not favorable to him, but the only factor that may warrant its alteration is when he finds out that he is not making profit from following the plan or he wants to make improvements on these techniques based on his aims and objectives.

Question 2: Explain in your own words why it is essential in this profession to have a "Trading Plan"?

The need for trading plan in cryptocurrency trading cannot be overemphasized. As mention above, a roadmap will lead a traveler to his right and desired destination, likewise a trading plan when a trader meticulously followed the rules as he stated it. It can direct him to find a suitable digital asset to trade with, the right market, the best time to trade either to enter or exit the market, how much capital should be involved, the expected risk. What position he will take in the market - either a short term trade or long term trade.

By implementing the rules from the trading plan, he learns to interprete market conditions and take the needed actions, like when the market is not stable, either to take his gains and leave the market for another day. The plan will also help him to determine the percentage of risk and gains to take, the capital to start with, when and where to place stop loss, at what price level from a given chart to enter the market and also when to exit the market with gain or loss.

From the trading plan he has drawn out, he knows the most suited time to trade, the number of days to engage in trading in a week/month. Also worthy of note is the emotional aspect of trading that help in getting the best deal of profit and to bring loss to the bearest minimum as well as factors to that can prevent him from trading. The trading plan can guide him to be up to date with his monthly calculations on how much he is earning. what he is expecting the following months. The importance of building a trading plan are so numerous that a trader in cryptocurrency must do it first and follow it to the core, so that he gets the most out of it.

From the above points, cryptocurrency trading definitely requires a well researched and thought-out Trading Plan that will lead him to successful trading activities and to endure the ups and downs of the cryptocurrency market.

Question 3: Explain and define in detail each of the fundamental elements of a "Trading Plan"

- Risk Management

As one of the rules included in a trading plan, is the way of ensuring that the percentage of our capital mapped out for loss do not pass our profit margin or should not be more than our gain each time or day that we engage in trading. The procedure is put in place so that we take note of the trades we make profit on or make loss in order that most of our capital should not go to loss. Rather our gains should be more than our loss when this factor (risk management) is tactfully followed or managed.

To illustrate, if I choose to take only 3 rounds of trade in a given time or day, I will follow the rule in my trading plan that said when I reached the highest point of gain, which is 3 and my point of loss is 1. Then, if I am at these points, I take my profits and leave the market for another day. Nothing will trigger me to take on extra trade, and my loss will not exceed 1. if the loss is at one (1), I take whatever gain I have and exit the market.

Thus, by following this rules, I am putting my risk management into good use. My risk management ratio is 3:1

- Capital Management

In our trading plan, capital management is a yardstick for managing our investment or capital as we engage in trading. Thus, it refers to that part of our overall money that we can afford to part with or loose/gain during each of our trading activities in the market. It consists of percentage loss and gain.

As a beginner, I may choose to state that I can bear 2% of my total capital to loss. This means that each time i trade, from my capital of $150, I risk $3, If I have $250, i risk $5 and with $700 I will lose $14.

Then on my percentage gain, as I have stipulated 2% on risk, invariably my gain will be on $5. So each day I put in $150 as capital, my gain will be $7.5, at $250 I will gain $12.5 and $700 will be $35. My ratio is 5:2, which I need to stick to each day of my trading and then take my gain as my aim has been reached.

Days of Operation

The element of trading plan is determined by the purpose that we have in mind to achieve and on the days we may like to trade. On my of point of view, I will choose work four (4) days in a week, so that I have time for shopping on Fridays, spend time with my family on Saturdays and then my Spiritual activities on Sundays. Thus, in a month, I will trade 16 days and that is not bad.Trading Psychology

As one of the key factors in building a successful trading plan, we need to trade with our own capital, so that we can fully implement the rules/guidelines outlined already, thus we will taste and see that it is possible to engage in cryptocurrency trade and come out with good profits and also be able to manage the risk that will definitely be experienced.

Under this rule, our emotions or feelings are put into consideration when undergoing trading, as this can lead to market reactions either negatively or positively. For instance, I learn earlier, greed as an emotion can lead to increase in demand of an asset, thereby causing a hike in the price of the asset. Thus, psychology rules states the following:

- If a trader is low in emotion or stressed as a result of one problem or another, he should desist from digital trading.

- If a trader/investor is busy with household chores, he should not carry out trading operations, as this engagements will becloud his investment decisions, hence, he may not follow strictly lay-down rules of trading.

- The risk and capital management techniques must be abide with even to the least one.

- The best time to carry out trading in cryptocurrency market is in the early hours of the day (morning).

The above-mentioned rules/plan will aid us in managing our feelings towards trading, in order to maximize profit with minimal loss.

Planning and Control of our Trading Account

The element involves proper handling of our monthly income or earnings, so that we can keep track of what or how much comes into our account daily. From there, we determine how we can increase our capital and this can only be done through calculations. I use Microsoft Excel to keep track of my records.

Practice (Remember to use your own images and put your username)

Build a "Trading Plan" and cover all the basics discussed in class. For this, you should NOT take the examples that I put in my class (Including the example amounts), use your own examples and your own images to make said plan, you must also base this "Trading Plan" as if you were operating on the platform of " Binance ”, taking into account that the minimum amount of exchange or investment is $ 10.

Remember the plan you build should have the following:

Your own Risk Management

Your own Capital Management

Say in detail, what are the rules or Psychology that you yourself would use to fully comply with said plan and be able to operate the cryptocurrency market

These are my roadmaps or compass I have researched on that will guide me to make good trading decisions as well as for me to maximize profit and minimize loss through trading. There are:

- Risk Management

Under my risk management, the ratio is 3:1, i will only trade 3 times a day and my expected maximum profit is 3% and the percentage loss is 1%, when I reached these marks, I will exit the market for another day.

My Capital Management

Out of my total capital I put in, I will be able to mappout 2% of it to loss, under percentage loss on each trading per day. However, on percentage gain per round of trade, I state 5% to profit. This means I will be working with the ratio of 5:2 and whenever I attain these points, I will have no option than to exit the trade for another day.

Days of Operation

I can only afford to trade from Monday to Thursday, that is 4 days per week and 16 days per month. The remaining days will be used for shopping, resting, family needs and spiritual activities.

Psychology/Rules

As I am trading with my own money, I will strictly comply with my set rules above, so that I will not be carried away by my emotions like greed and others that may force me into trade while I am not ready. Therefore, I will abide by these laydown rules:

- Any day I feel low in spirit because of troubles around me. I will not participate in trading that day.

- If i have work at home in any of the four days of my trade, I will desist from trade.

- I will only trade during morning hours when I am still agile and focused, so that I may not be confused on the strategy I want to use.

On the other hand, I must stick to my monthly update on earnings by calculating how I earn, the loss and the profit, so that I will know if I can increase my capital by 3% at the beginning of the each 16 days trading.

I will not alter my trading plan, even when the market is not favourable, I can only be forced to change them if these strategies are not working or I am not making any money from them.

Finally, make a table with the strategic planning of your capital, covering at least 6 months.

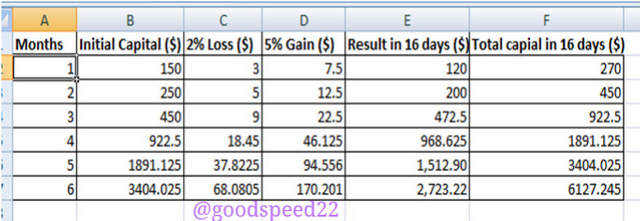

Below is my table with the strategic planning of my capital for 8 months. I used Microsoft Excel to prepare the capital management. i started compounding my profits in the third month.

From the table above, colum 1 is the number of months - 1 to 6 months.

Column 2 is the initial capital for each month and the compounding started in the third month.

Column 3 is the percentage of loss, which is 2%, the 4th column is the percentage of gain (5%), 5th column is the total gain in 16 days and the last column is the total capital, which I added the percentage gain in 16 days to the initial capital. from there I reinvested the profits.

Conclusion

I really appreciate this week's lectures as it has opened my eyes more on the need to build my trading plan first before proceeding on any trading activities. I so much welcomed especially the psychological aspect of the rule.

So I will absolutely stick and follow this procedures in order for me to trade successfully with good profit and less loss and I want to trade with my own capital so that I experience the true market position, so that I take good trading decision as I implement these plans.

Best wishes to my professor @lenonmc21

cc: @lenonmc21

Hi Prof @lenonmc21, thanks for going through my post. But I am surprised to see your comments on plagiarism . I submitted my post on Friday evening. I didn't use your own example, neither did I copy from any of those Steemians, which I did not in any way open their post links. It is absolutely my original content.

The spreed sheet I used is from Microsoft Excell and I did it myself, because I work with Excel very effectively.

I am still very dumbfounded. Since I have been participating in your lectures and homework task, I have never and will never copy from anybody.

If you notice I used only one source because the topic was very clear to me, thus, i will like you to check exactly those two Steemians you mentioned and know when they submitted theirs. But the fact still remains that I did not copy from any of them.

Please I want this issue to be critically looked into.

I am eagerly waiting for your response today.

Cc: @sapwood

@endingplagiarism

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi Prof, @lenonmc21, the two Steemians you mentioned that I copied from, did their own home work task from different points of view, which are all based on your lectures likewise my own. So go through it critically and do the needful. Absolutely, I did not open their posts before I did mine. May be others do so, but count me out of them. Just go through all my Academy post and others I don't engaged in plagiarism at all.

Thanks.

Cc: @sapwood

@endingplagiarism

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

From what i see these are questions,and have nothing to do with the answer. So personally i do not see a fault in someone copying a question. The answers one gives should be the priority i suggest.

cc:

@sapwood

@endingplagiarism

@goodspeed22

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for spotting out his statement on plagiarism. I have to repeat the questions so that anyone going through will know what I am talking about. This has been the norm in the Academy to State the question first and then the answer follows.

If it's no longer the requirement, Prof @lenonmc21, should state it as a rule, that repeating question is not allowed.

Thank you.

Cc: @sapwood

@endingplagiarism

@lenonmc21

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi @lenonmc21, good evening. You have not gone through my complian, that what I recopied was your questions. Or what do you mean by PLAGIARISM details and the two post links that you said I copied from

Related original sources

Post by @breeze.com

Post by @msquaretk

Kindly look into this and give me the right grade, because I didn't deserve the score you gave me - zero, for what I did not do.

My post is remaining 3 days to expire.

Cc: @sapwood

@endingplagiarism

@breeze.com

@msquaretk

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit