Hello friends. Greetings to you all. Below is my homework post for this week's lesson: Technical Indicator 2

*Question 1a: Explain Leading and Lagging indicators in detail. Also, give examples of each of them.

Leading Indicators:

These are those indicators that permit a trader to clearly identify price position or where it is going in the market either upward or downward. They help a trader to receive prompt signs about price, thus, he takes entry decision into the market without further delay. In other words, leading indicators assist traders get the information on price movements in a market and then he takes action. This action will help him bring the quantity of their stop losses to the barest minimum. Hence, leading indicator assist traders get these information before price takes up its real position in the market.

Yet, traders need to purse and see exactly what the true position is before making the prompt entry decision, because at times price may take a new trend or retains its position in the oversold or overbought areas for sometime before it takes a new position and this false pretense can take place in a strong trending markets. So traders need to apply caution in using these indicators.

Examples of leading indicators are Relative Strength Index, Stochastic, Donchain channels, etc.

Lagging Indicators

This refers to indicators that provides traders with the information on market trend when the trend is ongoing or has begun. it notify the trader what is happening in the market when that trend has gone to some extent. So, it can never give a false information about the true position in the market as it is already ongoing. They can be called behind time indicators and they are good indicators especially for long-term market trends.

But it causes traders to be behind others or coming late to the market and possibly the traders may loose some benefits that early traders enjoys or gain. Because at the time of receiving this signals, the market may not be strong enough and they may experience some reversals.

The good thing about this indicator is that, it can be applied to a market that has long-term trending assets. Also a tool to indicate a solid or strong trending market.

Examples of this indicators are moving average and others.

b) With relevant screenshots from your chart, give a technical explanation of the market reaction on any of the examples given in question 1a. Do this for both leading and lagging indicators.

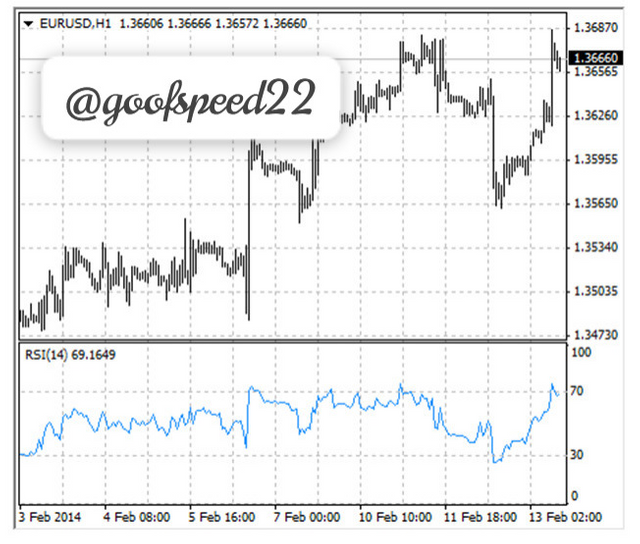

leading Indicator: RSI

This indicator (RSI) examines overbought or oversold situations in the chart below. It gives a true position that when an asset is overbought, then there will be price reversal or turn around. This also indicates that traders should anticipate price change.

Image source

Lagging Indicator - Moving Average

Simply, moving shows the direction of market trend not putting into consideration price.

Image source

Question 2a: What are the factors to consider when using an indicator?

Understanding Your Trading Strategy

First of all, a trader need to know the approach or tactics he want to use in the market while trading before choosing any of the indicators that will assist him or that will work with his plans. Like using 40 day Moving Average indicator in his plan. it will only lead him to make a decision that will be for a short period of time as the chart will be based on price movements for this short period.

Understanding the market trend:

A trader must have a full knowledge of were the market is going or its direction, the type of market, so that he will know exactly the type best analysis of that market. For instance, if the market is a trending one, it will only be appropriate to use trending indicators or is a sideways market. The most suited indicators will be those that can allow him identify important areas like overbought and oversold areas of price and others. By so doing, he will buy and sell at good prices in order to maximize profit.

Understanding the type of indicator:

Also knowledge of the kind of indicator to use is very vital to traders. Knowing the type to use will enhance his ability to get the true market conditions, instead of using those that will give false information of price movement, thus leading him to make quick entry decision. Moreover, he must know if the indicator is a lagging one, which will cause him to loose some benefits from early entry or when the market is already full of traders, making it a weak market at the time of entry. Likewise, if it is the leading ones. Therefore, it is very imperative for a trader to be careful of his choice of indicator.

Question2b: Explain confluence in cryptocurrency trading.

Confluences:

This term in cryptocurerrency refers to a position or a point from a chart under analysis, where two indicators give similar results or interpretations. For instance, using Relative Strength Index in the overbought area and at the same time seeing another pattern that forms in the same region. This two signs area confluences and they will show the same result - price reversal or change.

Also using Moving Average indicator, that shows the same price inverse positions. This situations will help a trader to be more efficient in applying these indicators, thereby leading to a better analysis of an asset for better result in trading.

**Question 2, part b: Pick a cryptocurrency pair of your choice and analyze the crypto pair using a confluence of any technical indicator and other technical analysis tools. (Screenshot of your chart is required ).

BTC/USD pair using confluence technical indicator

Image source

Question 3a: Explain how you can filter false signals from an indicator.

This can be done through the critical study of examination of how market respond to price movement or action, When an indicator shows a signal, then the market follows the signal and act according to the action of the price, we can absolutely conclude that the signal or indication is a true one.

But if the price indicate a particular position and the market act in the opposite direction, it means that the signal is a false one, From this, we can say that in order to filter false signal from any indicator, the trader will make sure that the technical tool he is using is giving the same meaning to a price action. For instance, if an indicator is in the oversold region, then the price of that asset suppose to be low, but if it goes high despite this position, it is a fake signal.

b) Explain your understanding of divergences and how they can help in making a good trading decision.

From my own knowledge, divergences are situations that occurs or observed from a chart when using technical tools in analyzing price actions and reactions of the market and then is observed that an indicator is showing a lower low, whereas the price is going to the higher high direction, which means the two goes in different directions. One is moving down and the other is moving up, showing false interpretation or information.

Divergences is an important tool, as it helps the trader to spot false information about the market, but at the same time they also give him hope that there will be price change soon. Then he will use this changes to make good trading decision.

c) Using relevant screenshots and an indicator of your choice, explain bullish and bearish divergences on any cryptocurrency pair.

Bullish Divergence

This is when an indicator is showing an upward trend, taking a lower high position, whereas the price will depict a downward trend position (lower low). This means that the downward position will soon end and there is going to be a turn around in the upper position, thus leading to price change in the upper side. The image below shows RSI indicator with BTC/USD pair

Image source

Bearish Divergence

This divergence happens if the indicator is producing a lower low effect whereas price on the other hand is assuming or taking a higher high position. This condition from the indicator and price, indicate a remarkable change or turn around in price no matter the upward signal.The image below show this condition with BTC/USD.

BTC/USD

Image source

Conclusion

I so much appreciate this lecture on technical indicator. I can now see clearly how to use an indicator, the type I should use and to know how to interpret their signals. Also, when to enter the market and trade and when I see a particular price movement and trend, I do not need to be afraid, it may a time of price reversal, thus I can make good use this market situation to trader better.

Thanks to my professor @eminiscence01

cc: @reminiscence01

Hello @goodspeed22 , I’m glad you participated in the 4th week Season 4 of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Recommendation / Feedback:

Thank you for participating in this homework task.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit