"Inflation", and "enough for circulation" are two major criteria any financial system should consider.

There should be enough supply of a token (currency) that a central bank or cryptocurrency blockchain releases to the public so the token doesn't get scarce, causing individuals to lose motivation in getting it.

But also, with the oversupply of a token or currency, there is a quick loss in its value(devaluation), causing inflation in the economy/ecosystem.

To balance these two criteria, cryptocurrency companies or blockchain networks and centralized central banks supply more of their currency into circulation over time, but with a reducing volume, to cater for circulation and also curb inflation.

Good day, beautiful Steemians, I am @hadassah26, welcome to my steemit crypto academy season 4 week 5 homework for professor @imagen on Bitcoin's Trajectory.

"1. How many times has "halving" been made in Bitcoin? When is the next expected? What is the current amount that Bitcoin miners receive? Mention at least 2 cryptocurrencies that are or have halved."

Bitcoin halving is a method set by bitcoin pseudonymous creator Satoshi Nakamoto to curb overpopulation of the coin by rewarding its miners less bitcoin over time.

To fully explain how this works, first I will need to explain bitcoin mining and the reward of mining.

Imagine how gold was a federal reserve to some countries back then, thinking about it, how was the gold gotten and how were the miners paid since they had first contact with this "National financial backup"?

Well, they were paid in their gold which they sold, so also the creator of the Bitcoin decided to reward individuals who validated transactions on the bitcoin network through some mathematical pseudorandom calculation of this "virtual gold" by giving them more "virtual gold", which they could now sell for fiat currency.

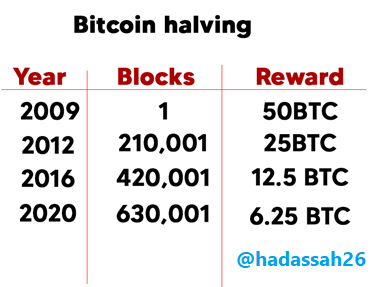

How many times has "Halving" been made in Bitcoin

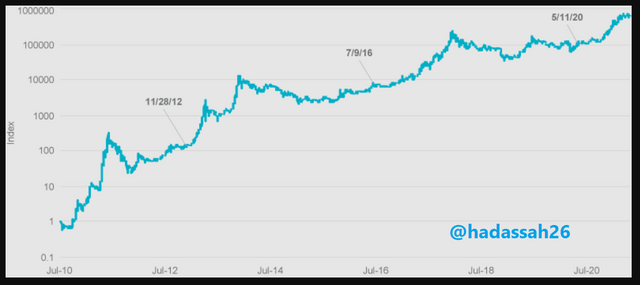

- First Halving: The first haling on November 28, 2012, with the validation time of 210,001 blocks with a reward of 25 BTC.

- Second Halving: The second halving of the Bitcoin occurred on July 9, 2016, after the validation of 420,001 blocks with a reward of 12.5 BTC.

- Third Halving : The third halving of the Bitcoin was on May 11, 2020 reaching 630,001 validated blocks with a reward of 6.25 BTC.

When is the next expected?

The next one expected to half would be in the next 4 years from 2020. if proper calculation is done, you will find out that it is 2024, and by then, there will be about 840,001 blocks. By then the Bitcoin will be reduced to 3.125BTC.

What is the current amount that Bitcoin miners receive?

The current amount of bitcoin that miners are 6.25BTC

Mention at least 2 cryptocurrencies that perform or have performed "halving".

Bitcoin Cash

Bitcoin cash launched in August 2017 was intended to be real cash like the version of bitcoin. The Bitcoin cash tries to increase the block size of its bitcoin identical blockchain from 1MB as with the Bitcoin to about 15MB, on the Bitcoin cash.

The Bitcoin cash halving happens every 210,000 blocks approximately every 4 years, reducing the reward of the bitcoin by half.

The next Bitcoin cash halving will occur in 910 days.

Lite Coin

Lite coin is also a mimic of the bitcoin and was developed in the year 2011 by Charlie lee.

it was meant to make bitcoin mining easier bringing about inclusion in the blockchain race.

The litecoin halving happens after every 840,000 blocks approximately after every 4 years.

The next bitcoin mining will be done in 975 days.

"2. What are consensus mechanisms? How do Proof-of-Work and Proof-of-Staking differ?"

We can't talk about the consensus mechanism without mentioning "agreement", an agreement is the coming together to accept a piece of information be it a declaration, opinion, or law.

Consensus in cryptocurrency is therefore the agreement of different nodes in a crypto blockchain network of a single data value, or set of data values such as transaction information, timestamps, harsh, or any random message in say a cryptograph.

Consensus mechanism is therefore the algorithmic structure set in a crypto blockchain to allow all nodes in the blockchain to agree on

The Proof of work and Proof of Stake which are the major cryptocurrency consensus mechanism used by the major Bitcoin and Ethereum blockchains, differ in some way although both are ways the blockchain finds validation in its token creation. Below I am going to show the difference in both consensus mechanism types in simple terms.

1. Definition

What is Proof of Work in simple terms

Proof of work is the consensus mechanism which gives reward to individuals who confirm transactions into blocks on the blockchain electronically through some computer iterative mathematical calculation such that new Bitcoins are generated in the process, and old transactions are confirmed properly.

What is Proof of Stake in simple terms

Proof of stake is rather a chest like consensus algorithm, like the federal reserve, it is about the validation of its token by individuals validating the creation of the token by putting in their own lot in a process of putting in their lot to the creation of more token which is then awarded as a reward to them.

The idea behind the Proof of staking is that the proof of work was too capital intensive as getting the computing power to mine would not be available to the common man, but with the proof of staking decimal amounts of money can be put in and rewards gotten per percentage. Therefore any one could join in the consensus and benefit from it.

2. Token Validation Method

From the above definitions, we can see that the major difference between the proof of work and proof of stake is in the token validation method.

- In proof of work, validators are "Nodes" which are high computational power systems used in verifying transactions on the blockchain and creating new blocks.

- On the proof of Stake, validation is done by "Individuals" who stake their lot in terms of funds, this way there is like a faderal reserve on the amount of coins in circulation.

3. Confirmation Time

The Confirmation time for the Proof of work and Proof of Stake are very different, majorly due to their different ivalidation mechanisms,

The validation time for the proof of work usually takes longer than that of the proof of stake, this which is because of the high computation needed in the proof of work algorithm, and only smart contract mechanism needed by the proof of stake mechanism.

The Bitcoin proof of work mechanism takes about 10 minutes for validation, while the proof of stake mechanism takes about 15 seconds for the validation of transactions.

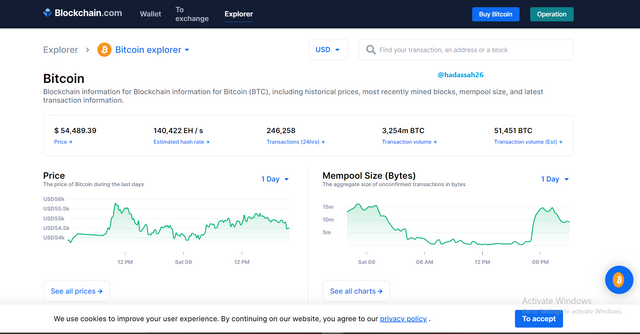

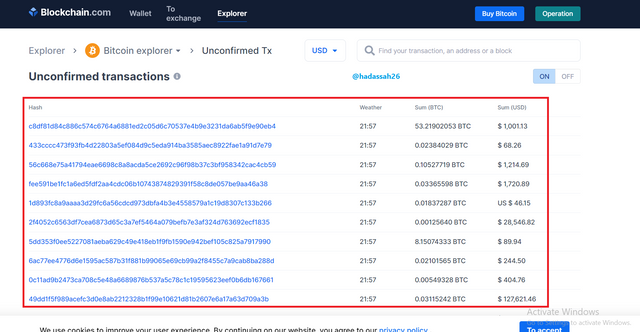

"3. Enter the Bitcoin explorer and indicate the hash corresponding to the last transaction. Show Screenshot."

To carry out this exercise, I followed the steps below

I Entered the site https://www.blockchain.com/es/explorer

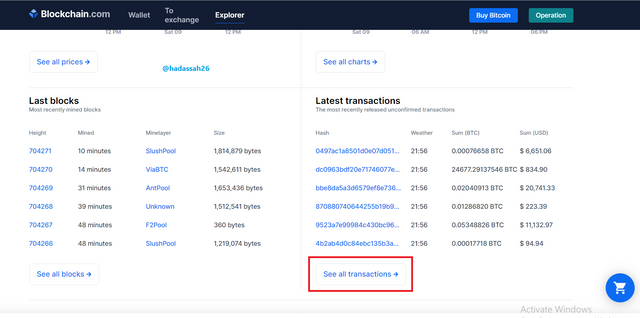

Then I clicked on see all transactions

I immediately saw all the Bitcoin blockchain transaction listed below, with the latest on the top

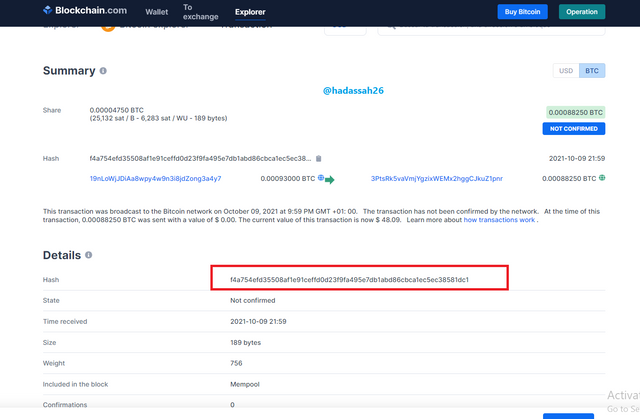

Clicking on the latest transaction, I was able to view its harsh.

Transaction Details

Transaction amount : 0.00093000 BTC

Sender's address: 19nLoWjJDiAa8wpy4w9n3i8jdZong3a4y7

Receivers address: 3PtsRk5vaVmjYgzixWEMx2hggCJkuZ1pnr

Block Harsh: f4a754efd35508af1e91ceffd0d23f9fa495e7db1abd86cbca1ec5ec38581dc1

"4. What is meant by Altcoin Season? Are we currently in Altcoin Season? When was the last Altcoin Season? Mention and show 2 charts of Altcoins followed by their growth in the most recent Season. Give reasons for your answer."

Altcoins are "other coins". With the evolution of Bitcoin, numerous other coins sprung up into existence trying to cover the lapses faced by the Bitcoin, and more assisting in some worthwhile projects aimed to aid humanity into a better standard of living.

Some crypto researchers still claim that altcoins are coins below the top ten crypto coins on Coin market capital, but below or above, as far it isn't the bitcoin, it can be regarded as an alternative coin.

Examples of altcoins are: Ethereum, Solana, TLOS, DOGE, STEEM, SHIBA Inu, DENT, etc

From the rise of the Ethereum, meant to make token creation validation more inclusive by its Proof of stake mechanism, uptill now the Solana, or the Shib coin which was just made as a competition to another altcoin the "Doge", the Altcoin season which can be referred to as the time of the reign of other coins, therefore outperforming the Bitcoin in market capital dominance.

This means that there has been a drift into the purchase of more altcoins than the bitcoin by crypto investors with the hope of making more profit.

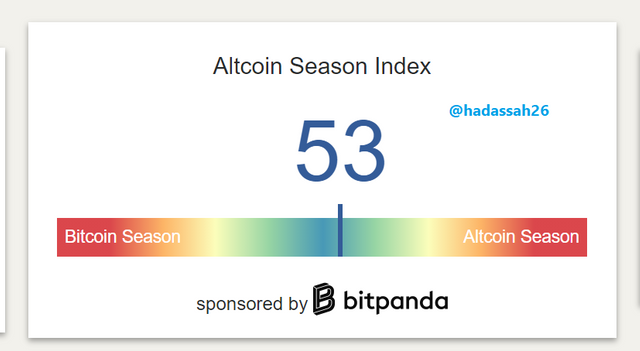

Are we currently in the Altcoin season?

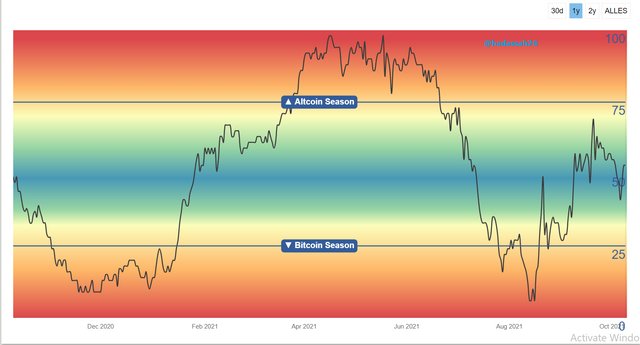

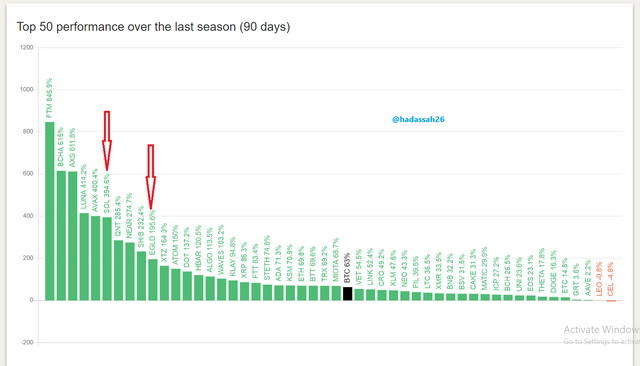

As I described earlier, the altcoin season is the time when altcoins have in cummulation gianed more market capital than the bitcoin. To check analitically, we can view the Altcoin meter below and coinfirm with the Bitcoin market dominace.

So from the charts above, we can realize that we are not on the Altcoin season for now since we are in the blue region. If the blue indicator enters the red region then we have entered the Altcoin season.

When was the last Altcoin Season?

The last time we experienced the altcoin season was on the 20Th may 2021, it can be verified from the graph above. It can be measured from 75 upward will be a Altcoin season .

Mention and display 2 charts of Altcoins followed by their growth in the most recent Season

We can see from the chart that there many cryptocurrencies that have grown tremendously, but I selected just two. The SOL which has an increment of 420.8% and the EGLD which has 210.7% growth.

We will go further in their analysis by looking at their monthly chart on tradingview.

The chart is the monthly chart of the ELGD/USDT showingg us how the growth of the ELDG has been so far. And from the chart we can that it has been on an upward trend for couple of months now

Here also, The SOL coin has also been on the uptrend for months now, making its value to be above the bitcoin.

"5. Make a purchase from your verified account of the exchange of your choice of at least 15 USD in a currency that is not in the top 25 of Coinmarket (SBD, tron or steem are not allowed). Why did you choose this coin? What is the goal or purpose behind this project? Who are its founders / developers? Indicate the currency's ATH and its current price. Reason for your answers. Show Screenshots."

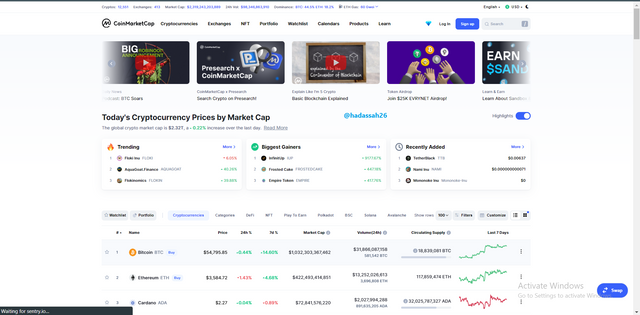

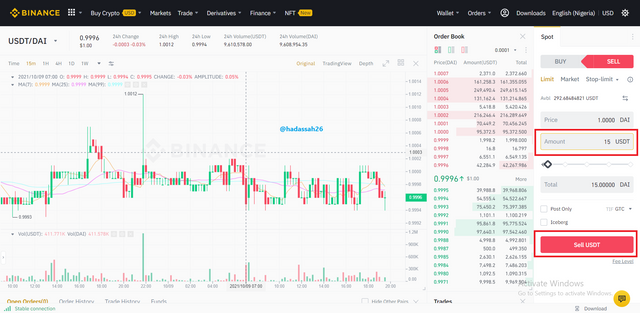

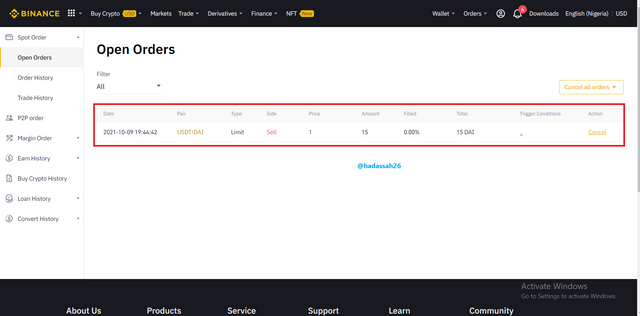

From my Binance verified account, I will be purchasing a stable coin not within the top 25 coins on coin market capital.

.png)

.png)

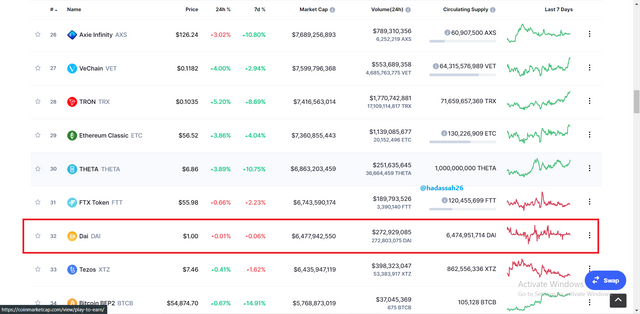

Seeing that the DAI stable coin is number 33, I will be purchasing some DAI and then doing other relevant exercises on this topic.

.png)

.png)

Why did you choose this coin? What is the goal or purpose behind this project? Who are its founders / developers?

I chose the Dai because it is a stable coin, therefore it involves less risk for me purchasing it.

What is the goal or purpose behind this project?

The purpose of the Dai stable coin is mainly for pegging a cryptocurrency to the United States Dollar. Most crypto investors get scared of the ever volatility of cryptocurrency, sometimes they just want a break from the volatility, though still wanting to be in the crypto business. the Dai stable coin offers this service by having a dollar pegged coin to the crypto market but more, one that is decentralized.

Who are its founders / developers?

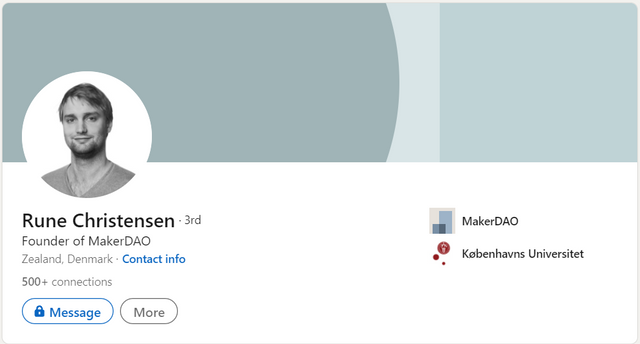

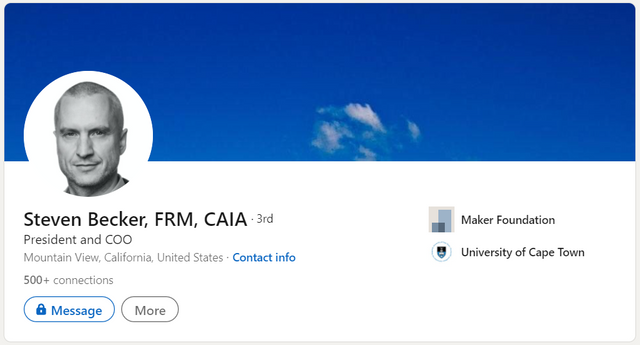

The Developers of the Dai stable coin is the Maker Dao network, with the team being:

Rune Christensen: Rune is the CEO of Maker Dao network, a crypto enthusiast, starting the company as at March 2015.

Steven Becker, FRM, CAIA is the Chief Operations officer at Maker Dao.

Indicate the currency's ATH and its current price. Reason for your answers. Show Screenshots.

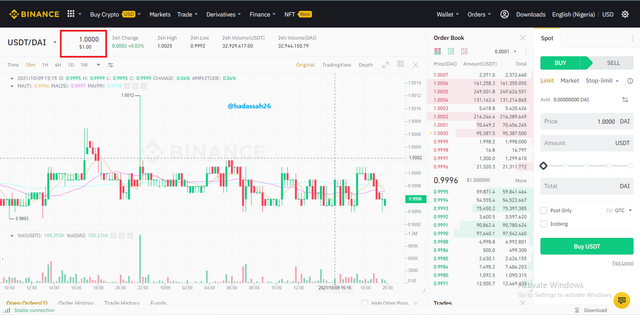

The All Time high of the maker Dao as compared to the USDT is 1.02 USDT.

Current Price

The Current price of the Dai is 1 USDT, Also 1 USD.

.png)

In conclusion, the Bitcoin trajectory has seen a tremendous uptrend due to its global adoption. The bicoin has proven that a trustless financial system is possible and affordable.

The Bitcoin halving is a method to checkmate over circulation of the coin, therefore devaluation. most other coins have some algorithm to treat this, from BNB regular burning of coins, or the STEEM deflationary model and other halving mechanisms in other coins.

Thanks to professor @imagen for this wonderful lecture.

Gracias por participar en la Cuarta Temporada de la Steemit Crypto Academy.

Continua esforzandote, espero seguir corrigiendo tus asignaciones.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit