Indicators give traders an insight into various parameters on price, from volatility, trendiness, and momentum. Some give more than one of these signals, others concentrate on just one of these parameters.

Today we shall be discussing the Accumulation Distribution indicator and how it gives a true signal of price momentum.

Good day, beautiful Steemians, I am @hadassah26, welcome to my Steemit crypto academy season 4 week 5 homework for professor @allbert on Trading with Accumulation / Distribution (A/D) Indicator.

"1. Explain in your own words what the A/D Indicator is and how and why it relates to volume. (Screenshots needed)."

The Accumulation Distribution (A/D) indicator is a price/volume momentum indicator which tells us of the buy volume(accumulation) and Sell volume(distribution) periods of the market.

Explaining further, the Accumulation and Distribution periods of the market are the different times during which traders either have a buy pressure or sell pressure on the market.

The Accumulation Distribution indicator, therefore, tells us when we are in what season, it gives us a better confirmation of the current positions traders are taking in the market.

The Accumulation Distribution indicator trends upward during higher market entry periods and downward during higher market exit periods. This way we have a clue of other traders sentiment on the market.

We can now take advantage of the Accumulation and Distribution indicator by comparing it with the price and knowing when price is really trending upwards (therefore entering the market), price is really trending downward (therefore exiting the market), or when price and the indicator are having a divergence.

How the Accumulation indicator Relates to Volume

The AD indicator which is a multiple of the Money Flow Volume and the Price volume which will be properly discussed in question answer 3, the Money flow volume makes very good use of the price volume, as it weighs the volume of the market and multiplies it by price data, this way it has a positive correlation with price volume and gives traders a signal of activity in the market.

"2. Through some platforms, show the process of how to place the A/D Indicator (Screenshots needed)."

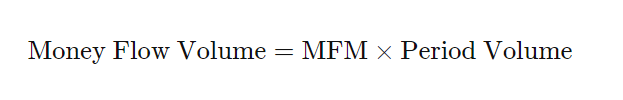

Using Trading view, the Accumulation Distribution indicator can be added to the chart by:

• Open the desired chart, here say BTC/USDT.

• Click on the "fx Indicators" button, a list of indicators and search area is popped up

.png)

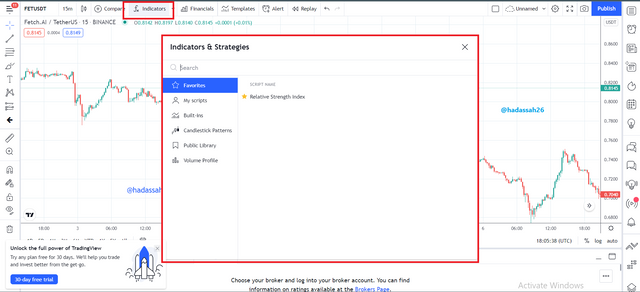

• Type in Accumulation and Distribution, it shows up on the search options, and then select

.png)

The Accumulation Distribution indicator has now been added to the chart, we can now start reading meanings to its signal.

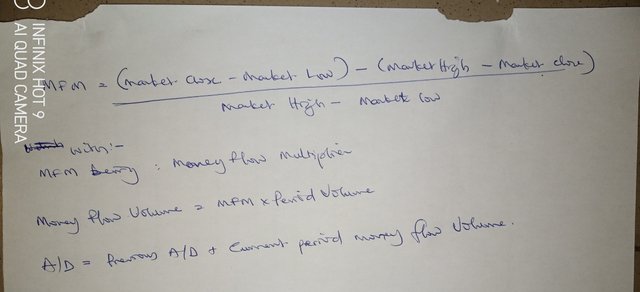

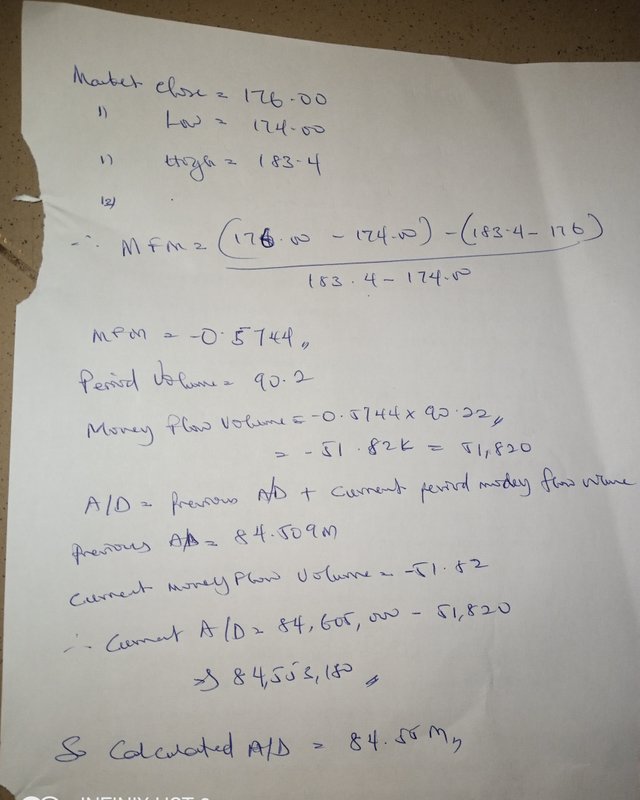

"3. Explain through an example the formula of the A/D Indicator. (Originality will be taken into account)."

Taking an example;

From the LTC/USD chart,

Our calculated Accumulation Distribution is equal to 84.553 M.

"4. How is it possible to detect and confirm a trend through the A/D indicator?"+

The AD indicator is a very easy to use indicator as it signals with just one line oscillating up and down telling the buy or sell volume of the market.

Using price volume as a major parameter, the A/D indicator gives either a buying or selling pressure of the market, therefore signaling price momentum (as the price volume is like a force behind the market price that pushes it to higher highs).

To use the A/D indicator one has to only check its current trend and then check how the price relates to it, if market follows the same trend, then it may be a good confirmation, else then there is a divergence and traders should do proper analysis as to know when and where next the price will go next.

The A/D indicator trends up when there is a market "BUY Volume" buildup, and downward when traders start withdrawing their positions "Sell Volume" buildup. This its trend which is independent of the price trend is used to detect future market trend.

Bullish Trend

Here we can see that the Bullish trend of chart coincides with the A/D indicator, it is a good "Buy" Opportunity.

Bearish Trend

Here we can see that the Bearish trend of chart coincides with the A/D indicator, it is a good "Sell" Opportunity.

When the price and the A/D indicator are going different ways, a situation known as divergence is said to occur;

Divergence

Divergence is the trending of an oscillatory indicator and price in opposite directions. This which may either give converging or diverging shapes tells the trader that the price is either about to see a bullish or bearish breakout.

Divergence with the A/D indicator is simple to detect and can be seen as shown below;

Bullish Divergence with the A/D indicator

Here we can see that there is a Bullish divergence of price with the A/D indicator, we further analyze the market before making trade entry.

Bearish Divergence with the A/D indicator

Here we can see that there is a Bearish divergence of price with the A/D indicator, we further analyze the market before making trade entry.

With the above discussion, traders can now detect incoming price trends with a divergence, and then confirm the trend when it synchronizes with the direction of the A/D indicator.

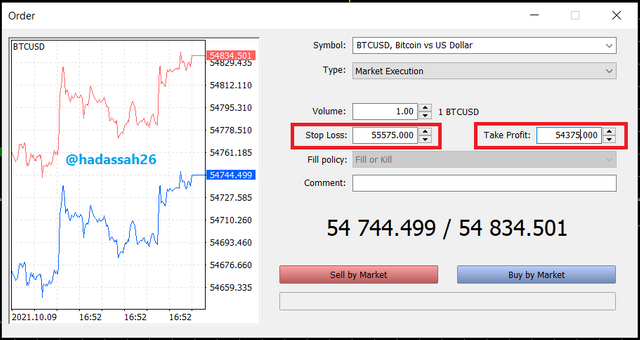

"5. Through a DEMO account, perform one trading operation (BUY or SELL) using the A/D Indicator only. (Screenshots needed)."

To perform this transaction, I will be using my MT5 desktop trader,

Watching the 15 mins timeframe of the BTC/USDT, I see the Accumulation Distribution is beginning to see a downtrend, I enter a sell position as price is also following suit.

Trade Data Below

| Currency Pair | BTC/USD |

|---|---|

| Sell Price | 54,800 |

| Stop Loss | 55,575 |

| Take profit | 54,347 |

"6. What other indicator can be used in conjunction with the A/D Indicator. Justify, explain and test. (Screenshots needed)."

As much as the Accumulation Distribution indicator is a great indicator, telling of market buying or selling power with the use of the market volume and current price data, the A/D indicator can also be supported with other indicators mostly to augument those parameters of price it doesn't signal, such as volatility, and trendiness.

A good example of such indicators is the Ichimoku Uno indicator.

Using the Ichimoku Uno indicator alongside the A/D indicator as shown below;

we can see that the Ichimoku cloud confirms trend direction from the Accumulation Distribution Sell volume buildup.

Using a second confirmatory indicator makes it easier and safer for trading.

Although the Accumulation Distribution Indicator is a lagging indicator, it is a great tool that helps traders tell when market volume has started going the other way, so they can start preparing to make different positions regardless of the current trend.

The Accumulation Distribution indicator makes trading with Indicators simple and fun. But traders should always be cautious to confirm entry positions.

Thanks.

cc @allbert

Hello @hadassah26,

Thank you for participating in Steemit Crypto Academy season 4 week 5.

You have tried to explain the A/D Indicator and its relation to volume through your own words.

In the 2nd question, you've successfully shown the process of how to place the A/D Indicator.

In the 3rd question, you've explained the formula of the A/D Indicator through an example. Also, it would be nice if you could explain the formula in your own effort. Furthermore, the explanation you have written by hand is a little unclear

In the 4th question, you've explained the possibility of detecting and confirming a trend through the A/D indicator

In the 5th question, you didn't mention important content in your chart.

In the 6th question, you've tried to explain and test another indicator that can be used in conjunction with the A/D Indicator.

As a summary, you have tried to explain all the topics in your effort. Some of your explanations were a bit shallow. Specially, you have to improve the quality of your presentation using markdown styles. I invite you to avoid all these mistakes in the next class.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit