Good day beautiful steemians, I am @hadassah26 and this is my week 13 homework for professor @yohan2on on: The Scalp trading style.

The Crypto market is wild like a ranging water, and very fast, one needs to stay still, pause and choose a trading pattern that best suits him to be able to decipher where exactly the trend is going.

Today I shall be discussing on the finger trap trading strategy which is under the scalp trading style.

Scalp trading

Scalp trading which is a short term trading style which range from between an hour and minutes even little minutes as the one minute.

Other trading styles include the day trading (for intermediate term traders), swing trading (ranging from a day to a week) and position or long term traders (who hold trades to upto a month and maybe even more).

The finger trap trading strategy which is coined from the Chinese open cylindrical bamboo trick toy called the "finger trap", which traps ones finger when they put it at one end and try to pull it out instead of Pushing it in for the ends to open up to remove their finger.

The finger trap strategy involves using different time frames usually starting from the hour to get the best market trend, then Pushing in to a lower time frame to find the right entry point.

Example of Using the finger trap strategy

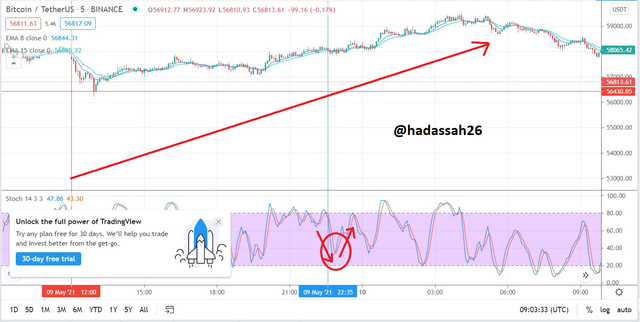

Here we will be using the BTC/USD as of early this week.

Looking at the chart we can see an upward trend starting at the $56,400 support line. We can confirm this new trend with the stochastic oscillator hitting the 20 margin and moving up to a new high.

Now to confirm when to enter the trend, we watch our moving average exponentials, we have our Moving average exponential 8 (MAE 8) and Moving average exponential 15 (MAE 15).

At $57,944 (at the red market circle on the chart), we see the MAE 8 crosses the MAE 15 upwards, signifying an uptrend confirmation, this tells us to be “ON OUR MARKS”.

We can now PUSH in to the 15 minutes to check for market momentum.

I like using the Momentum indicators as entry indicators because they have a higher probability of True signals.

On the 15 minutes, we see the MACD slow length MACD moving average 26 (red MACD line) just crossing crossing the smoothing signal line signifying good upward momentum confirmation. This is already a “GET SET” signal.

We can now go to the 5 mins to see the candle stick pattern to know if we “GO”.

On the 5 minutes time frame, we can see that it is still ranging a little but the stochastic oscillator is about hitting a downward reversal.

On hitting and reversing , we can now enter the market, with full confirmation of entry.

We hold the trade for say for 30 to 45 minutes, and close at what I call the best profit possible ( this is the profit at the price when U know the market may has hit its highest high on your five minutes time frame, the market fluctuates and waiting for too long may cause you closing when it has retreated back making you close at minor profit or even a loss.

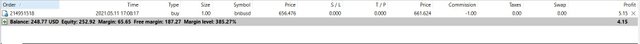

I will be using the Meta trader 4 desktop app for my own trading, I am using the Hotforex broker who are my broker as they also trade some cryptocurrencies.

For my own finger trap strategy, I will be using the stochastic oscillator as my trend signal indicator, I will be rather using the super trend indicator for a trend entry indicator instead of using the Moving average exponential, I prefer the super trend indicator because it shows when market has retraced and is making another bull run.

First the BNB

I am choosing the binance coin first for this practical because it has seen some upward strength in the past few days, I will be working with the hourly , 15 minutes and 5 minutes time frame.

On the BNB hourly chart, I see it is currently in an uptrend, but more it has had a recent downward facing fractal, signifying a new bullish run. The supertrend indicator also shows a straight line indicating a new upward movement for the next hours. This is a good entry point, I can now go down to the 15 minutes to see the price momentum and confirm for better entry.

On the 30 mins point, looking at the chart and MACD, I can see fast moving MADC signal line is about to cross upward the slow moving MACD moving average line. This shows an incumbent upward shift in momentum.

This is a very good entry point, I barely need to check the 5 minutes since the hourly and 15 minutes already give me an 80% to 85% entry position.

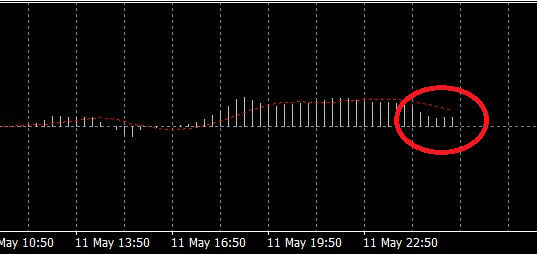

At the five minutes chart, we see it has had a recent downward facing fractal its a “GO!!!” for me, I jump in and catch some pips.

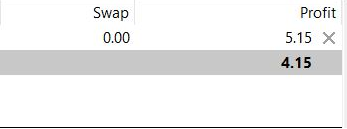

I close after about 20 minutes, with a profit of about 4.15 dollars profit removing spread, this is a good fast trade.

Second the LTC

I will be taking the LTC as my second coin for this assignment because for for the past few days its has been trying to hit the $380 price after making a dump last week. So it is currently in an uptrend, although not too strong. I will also be using the moving averages 8 and 15 to confirm trends, on the hourly time frame, then the 15 minutes and 5 minutes timeframes for momentum and candle stick pattern entry confirmation.

On the hourly time frame, we confirm the upward trend at the moving average 8 crossing the moving average 15 upwards. for re-entry into the trend we can see at 2, the super trend indicator showing a pause (straight line) about to enter a new upward bull run, we can now check the 15 minutes for a momentum entry signal.

On the 15 minutes, we can see the MACD fast signal line is about to cross upward the slow moving average line. This is a good entry point, momentum is giving an upward push on the 15 minutes.

Now we go to the 5 minutes to reconfirm entry.

On the 5 minutes chart, we can see price is already in a upward movement, we jump on it to catch some pips already.

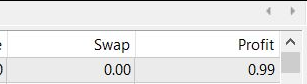

On entering trade, the market starts fluctuating and I close at 0.99 dollars to avoid making loss, this is a trade of speed.

Total from both trades I have made a profit of 5.14 dollars in less than an 2 hours. It is good money if it would always play out this way.

NOTE:

The finger trap trading strategy is a fast moving trade strategy and can be very risky, so one needs to be very cautious and take into cognizance various timeframes making sure that he is in trend. As they say “The trend is you friend”.

Merits:

The finger trap trading strategy is a quick way to make money from the crypto market, one can make say 10 dollars daily or even more depending on their leverage if they play it safe.

Finger trap trading strategy can be programmed on trading robots which make it easier to catch pips, giving one a money making machine if the bot makes substantially more good trades.

The finger trap trading technique as a fast trade involves less risk as you are always on the system while trading, it is just about going in and cashing out real quickly.

Demerits:

The finger trap trading technique usually requires one making more trades, bring about more trading fees, secondly since profits from this technique are usually small, one can end up making negligible profits or even loss on the long run.

Secondly since one makes more trades on the finger trap trading technique, there is a more probability of making loss on trades, this can bring to aggressive trading which makes the trader more impulsive and more prone to making bad trades.

The finger trap trading technique is prone to noise of the market. Since it is usually made on shorter time-frames, little market noise can make the trader doubt his signals and make bad trades or lose good market opportunities.

Scalp trading is a fast trading style, not everyone has the time leverage of always watching the market, so scalp trading can be useful in making some little profits within an hour or two.

The finger trap strategy lets makes use of trading within trend, more like putting a paper boat put on flowing water to flow with the stream. It is a good strategy but one must be very careful and cautious as to not get too aggressive and start making impulsive but non irrational trades.

Thanks.

CC

@yohan2on

Hi @hadassah26

Thanks for participating in the Steemit Crypto Academy

Feedback

This is very good work. Well done with your research and the practical demonstration of the scalp trading style using the finger trap strategy.

Suggestions

For the finger trap strategy, you only need 2 moving averages that are; 8 and 34 exponential moving averages. You get your trend in the 1-hour chart and then look for trade entries in the 5-minute chart. While in the 5-minute chart you have to always wait for the price reloads so that you can have a good point to place your stop loss.

You missed out on some other great important elements of the Finger trap strategy. Things like setting the stop loss and trailing the stop to +1pip when your trade makes for you at least 10 pips.

Homework task

8

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit