Good day, beautiful Steemians, I am @hadassah26, welcome to my Steemcrypto Academy season 4 week 4 homework for professor @reddileep on Cryptocurrency Triangular Arbitrage.

"1. Define Arbitrage Trading in your own words."

Arbitrage is simply buying an item at a cheap market price at one market and selling at a more expensive market price at a different market at a relatively same time.

Arbitrage is also very known in betting, this rather is staking on an event with only two opposite odds, by staking on both odds on different betting websites when the odd margin becomes profitable to you the bettor.

Arbitrage trading cuts across stocks, currencies, commodities, and now cryptocurrencies. I will define it as making profits out of the simple gaps of different markets prices.

Arbitrage has been considered unfair by some investors as they claim it doesn't involve the "investing" principles such as "risk" taking, and they consider it swindling of markets due to differences in exchange rates.

"2. Make your research and define the types of Arbitrage (Define at least 3 Arbitrage types)"

Arbitrage is taking advantage of a slip in the financial market prices and then making quick profits,

Below are some Arbitrage trading types.

Retail Arbitrage

Markets though vary from internet financial markets to real-world physical markets, an example of this is retail arbitrage where one can buy a currency at a local exchanger that sells at a cheaper price, then goes to sell to another exchanger say in a different location that buys at a cheaper price.

Here the trader has to have an edge of information amongst the traders so he knows when there is a slip in prices and then can quickly make profits from them.

Statistical Arbitrage/Computational Hedging

Hedging is common amongst traders, trying to argue a bought position they are not so sure of by selling a similar stock or currency to wedge their initial bought position.

But some traders have found that there may be profitable slips in hedging as the rates of decline in both currencies or stocks may vary, they then try to calculate the rates of decrease and then buy more on slower moving currencies or asserts and sell more of the faster moving currencies or asserts. Using computer algorithms to get quick calculations and fast trade triggering, they can make some profits from these slips although it may involve some risk.

Risk Arbitrage/Merger Arbitrage

Risk/Merger Arbitrage is common among stock trading, where investors take advantage of a gap in-between two companies' stock prices when one acquires the other.

Explaining this properly, say company A declares acquiring company B, and with company A's stock price being $50 and company B's stock price %20, at the declaration of the acquisition, company B's stock skyrockets to say $45, close to $50, this is because company B would soon be company A, but not yet, so there is a gap.

Investors can now take advantage of this gap by buying company B's stock awaiting to make $5 per stock on the completion of the acquisition.

Investors on the other hand also short company A's stock as they believe after the merger, company A's stock may drop say to $48 per share.

This makes them have a double chance of profiting on the close of the deal, although it is called a risk arbitrage because if the merger deal doesn't go through, then the trader may lose much money.

"3. Explain the Triangular Arbitrage Strategy in your own words. (You should demonstrate it through your illustration)"

Triangular Arbitrage like Statistical arbitrage is mostly used in the crypto sector because of the ease of buying and selling crypto assets and the low trading fees on exchanges.

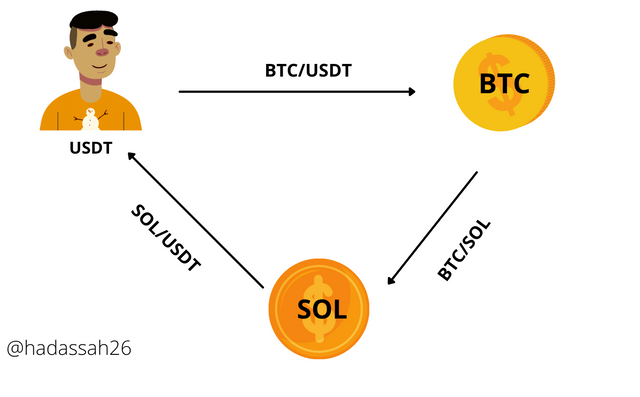

Triangular arbitrage is finding a difference in price in one crypto coin on two of its pairs in different exchanges or one exchange and taking advantage of it.

How triangular Arbitrage works

Say SOL/USDT is $139.15 on Binance But the calculated dollar rate of SOL/BTC is equal to $138.50, Traders see the difference and then can take advantage by buying BTC at a standard rate and then buying SOL with their BTC and selling it back to USDT, this way they make the small slip in price of $139.15-$138.50 and take the profit provided it is more than the total trading fees.

Crypto Triangular arbitrage became very common during the year 2018, and it caused a lot of liquidity to the crypto market.

"4. Make a real purchase of a coin at a slightly lower price in a verified exchange and sell it in another exchange for a higher price. (Explain how you get your profit after performing Arbitrage Strategy, you should provide screenshots of each transaction showing Bid, Ask prices)"

Although there are apps that signify when there are discrepancies in different coins on different exchanges, so one can arbitrage trade, one can also manually look for differences in coins on different exchanges and then trade arbitrage, to do this successfully I usually use some pointers.

Straight USDT pairs / Calculated USDT pairs

Coins traded as different pairs on different exchanges tend to have more likelihood of discrepancy in price value.

Examples are coins traded with the USDT on one exchange and then with the BTC on another exchange.

Examples include SOL/USDT on Houbi and SOL/BTC on Binance. Another says, FTT/BTC on Houbi, and FTT/USDT on Binance, the picture below;

.png)

.png)

From the above charts, we can see that the calculated price of FTT/BTC is $52.27 on Houbi exchange, while on Binance exchange FTT/BTC is equal to $52.22, that is a 0.095% discrepancy in exchanges, sometimes this discrepancy gets up to 0.4%-0.5%, traders can then quickly transfer coins from one exchange to the other and trade.

Big Difference in Trading volume on different Exchanges

Coins which have seen a very big difference in trading volume on different exchanges seem to show more discrepancy in their prices on both exchanges, example is STEEM/USDT on Poloneix and STEEM/BTC on Binance;

.png)

.png)

From the screenshots above we can see that the volume of Steem/USD on Poloniex is only 3,363 USDT, while on Binance it has a trading volume of 1,369,591 Steem which can be calculated as 1,369,591.00 * 0.46 = 630,000 USDT, we can see here the very wide difference in trading volumes, this affects the price as we can see STEEM/BTC on Binance is $0.463, while on Polonies it is $0.462, small difference during the time of this analysis but sometimes it gives a very wide difference.

For the sake of time, I will be trading a much faster coin on both exchanges, but with a substantial difference in volume. I will be trading the TRX/USDT on Poloniex, buying TRON via poloniex, transferring it to Binance, and then selling it at a more expensive rate at Binance.

.png)

From the Screenshot above, I Buy 22 USDT worth of tron at 0.09396264 USDT per tron,

.png)

from the above screenshot, I now transferred the bought Tron to my Binance wallet.

.png)

From the above screenshot, I have now sold the TRX (Tron) on Binance exchange for 0.09441 USDT per Tron, making a profit of 0.00044736 USDT per Tron, that's about 0.4% profit for the total trade.

"5. Invest for at least 15$ worth of a coin in a verified exchange, and then demonstrate the Triangular Arbitrage Strategy step by step using any other coins such as BTC and ETH. (Explain how you get your profit after performing Cryptocurrency Triangular Arbitrage Strategy, you should provide screenshots of each transaction)"

Triangular Arbitrage, similar to statistical arbitrage, but here with assets that can be bought and resold very easily and at a cheap rate, which is very common in crypto markets is the taking advantage of different price discrepancies on a single coin in an exchange platform, in different cryptocurrency pairs.

It involves cycling through an exchange when a trader notices that the calculated price of a coin in one crypto pair is greater than or less than its price in another pair.

This trading can be a little risky as one is moving through 3 crypto coins, (1,2,3), coins 1 and 3 being exchange coins, but coin 2 being the target coin. Either of coins 1 or 3 are volatile coins, and with coin 2 also being a volatile coin means the trader has to target trade.

This means the trader has to take into account;

- The trading fees of the exchange platform

- The Trend of the volatile coin of coins 1 and 3 using the estimated timeframe to transact trade.

- The general trend of coin 2 in question using the estimated timeframe to transact trade.

Let us take a practical example to explain all these;

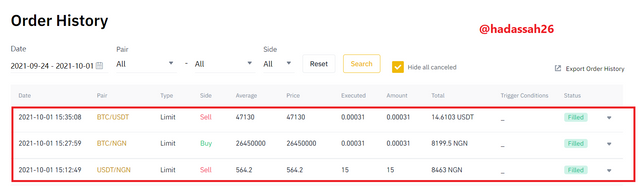

For this exercise I will be choosing a coin that has both a very high volume on one pair and a very low volume on another pair (as from points in Answers to Question 4), I will be choosing the BTC/NGN and BTC/USDT.

The BTC/USDT has the highest volume on the Binance exchange of about 2,805,829,675.84 USDT, while the BTC/NGN only has about 356,795,261.30 NGN, which can be calculated as 356,795,261.30 / 564 = 632615.71 USDT. This shows that the BTC/USDT trading volume is 2,805,829,675.84 / 632615.71 = 4,435 (Four thousand four hundred and thirty-five) times larger than the BTC/NGN trading volume, satisfying one of the pointers of question 4.

Also noticing we can see that the BTC/NGN and BTC/USDT both trade the BTC but on different currency pairs (as also mentioned in Answers to Question 4).

Next checking the trading fees of Binance exchange we can get as low as 0.075% if we have some Binance in our wallet, I can convert my dust crypto to Binance to cover that cost,

Now we check for the trend of the BTC, this is to make sure the value of the BTC doesn't go down during the trade, else we end up making a loss, so we await an uptrend.

Seeing an uptrend in the 10 mins time frame since we estimate the total transaction may take about 10 mins, we confirm that the BTC/NGN is lower in price than the BTC/USDT, we can now make our trade.

.png)

First, we buy our NGN using a total of 15 USDT, as shown below;

.png)

Then we buy BTC using our NGN at 26,450,000 NGN as shown below;

.png)

Now we trade BTC/USDT on the international market, at 47,130 USDT

.png)

Looking at my trading history below;

| Trade Data | Value 1 | Value 2 |

|---|---|---|

| USDT/NGN (SELL) | 15 USD for 8463 NGN | 564.2 Naira per USDT |

| NGN/BTC (BUY) | 8199.6 NGN for 0.00031 BTC | 26,450,000 Naira per BTC |

| BTC/USDT (SELL) | 0.00031 BTC for 14.6103 USDT | 47,130 USDT per BTC |

It may seem as though I made a loss, but let us calculate together to find out how I made a profit.

Total USDT sold = 15 USDT

Total NGN bought = 8463 NGN

Total USDT bought = 14.6103 USDT

Total NGN sold = 8199.50

Remainder (DUST) NGN = 8463 - 8199.50 = 263.5 NGN

Converting Remainder NGN to USDT(say we sell at the buying price, with USDT being stable) = 263.5 / 564.2 = 0.4670

Total USDT gained = 0.4670 + 14.6103 = 15.0773 USDT

Profit = 15.0773 - 15 = 0.773 USDT

Profit percent % = 0.0773/15 = 0.00515333333 *100 = 0.51%

We can see that we made a total of .51% profit in less than an hour. Now considering the crypto market runs 24/7 automating this can give substantial profiting at the end of the day or month.

"6. Explain the Advantages and Disadvantages of the Triangular Arbitrage method in your own words."

Arbitrage trading can be profitable more giving quick profits, but also has some drawbacks, below I have compared its advantages with its disadvantages.

Advantages / Disadvantages

Fast profit with little risk/ Usually considered unfair trading by investors.

Arbitrage trading can bring in quick profits with little risks and even investments unlike normal risk investing or contract for difference trading, although on the other hand it is usually considered unfair trading by some investors since the trader only takes advantage of a slip in the market and doesn’t necessarily do price analysis.

Easily automated, meaning continuous profiting if deployed to an automatic trading algorithm / Can involve some computing power and caution so as not to trade wrongly.

Using the exchange platform’s Application programming interfaces (API) one can easily find real-time prices of crypto coins and then find arbitrage to trade across, although this may need some computing power especially in a case where the computer does the trading itself, the trader might want to input some algorithm that will be profitable to his trades else he might make huge losses.

Easy to learn by newbie traders | Doesn’t improve one's trading skills.

Arbitrage trading can be very easy to learn and can be easily used by newbie traders to make some profit although a little technical, on the other hand, arbitrage trading doesn’t teach traders some technical analysis skills which are ephemeral to profitable trading long term.

Adds liquidity to the market | Risk also involved

Arbitrage trading adds liquidity to the market since traders input and outputs their tokens through crypto exchanges causing an increase in trading volumes and more liquidity, on the other hand, arbitrage trading can be risky too.

With fast-moving information, the world being a global village, and cryptocurrencies making financial transactions seamless, arbitrage trading has become a trend in crypto market trading. Even though profits may seem very little per trade, multiplying the trading times can bring substantial profit.

Thanks to professor @reddileep for exposing us to this knowledge, we hope to advance on it and make some profits from the crypto market.

CC @reddileep