Good morning, everyone!

I'm grateful to the Steemit team for providing me with the opportunity to learn about the cryptocurrency world.

Honorable @stream4u is a professor whose lecture delivery style (using simple and easy words) is my personal favourite.

I read the lecture in its entirety and did my best to respond to the questions posed by him.

Q-1. What is Price Forecasting?

Price forecasting can be achieved using charts and graphs on a technical basis since there are so many mathematical formulas.

We can define price forecasting as a future prediction of the price of any crypto asset in a simple and straightforward manner. If we can analyse the chart pattern and graph direction, we can better predict future prices, which will help us invest in crypto currencies for the long and short term.

The following three types of analysis are commonly used by people who trade in crypto currencies.

Technical Methodology Basic Methodology

The Sentimental Approach

Everyone uses these three types with their knowledge and skills to forecast price and profit from investing in or trading in crypto currencies.

Technical Method:

The market trend, bearish and bullish trends, market support, chart and graph, and price movement are all observed by technical analysts. When an investor or trader is satisfied with their investment, they invest and profit for the short or long term.Fundamental Method:

The success of a cryptocurrency business and team. They enjoy looking at the items below and attempting to find answers to the questions they pose.

Who is at the helm of the operation?

What does the team manager's role entail?

The amount of supply that is visible in the market.

In the future, what will be their mission?

What types of goods do they sell?

What is their weekly or monthly balance sheet displaying?

What do profit, loss, and depth ratio mean for a business?

When the trader receives a satisfactory response to the above questions, he is ready to invest in a business. Traders who use the fundamental method do not consider the current market trend.

- Sentimental Method:

Due to market volatility, sentimental analysis has the potential to generate profit and loss. Positive, negative, or neutral market trends are possible. Due to the market's high volatility, traders monitor and invest in crypto via various news, discussion, and media forums. Traders have always relied on media news to make market investments in order to profit.

Q-2. Discuss on why price forecasting is needed?

If a trader wants to invest for profit and grow his capital, he must look at price forecasting and find certain points that will help him make money.

Without price forecasting, a trader will not be able to get a clear picture of (buying or selling) at the right time. A trader can be certain of his or her profit and loss by using price forecasting. A trader can easily take advantage of and understand market trends after analysing fundamentally, technically, and sentimentally. In this way, a trader can avoid losing money and improve his trading skills in the world of crypto currencies.

Q-3. What methods................... prediction/forecasting?

Technical analysis, in my opinion, is an excellent method for market forecasting and is ideal for any trader or investor. Fundamental analysis can also assist in successful trading.

Sentimental analysis is a type of media analysis that may or may not be accurate, but it can be useful to traders and investors to some extent because people simply observe trends.

I believe that a trader/investor can evaluate the performance of a team and company using technical analysis. However, performing a fundamental analysis can be more beneficial because it demonstrates the team's future mission.

Q-4. Take any crypto asset chart...........on what basis you have predicted the price.

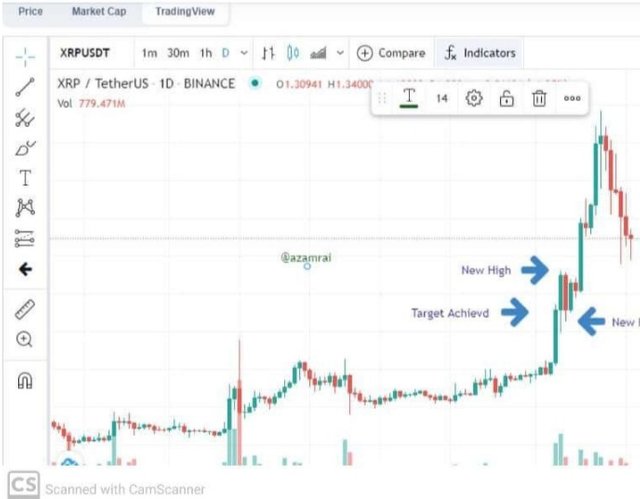

The price of XRP trended upward and remained high in the above screenshot from the first support, before declining and touching the second support on the line after volatility. The current price of XRP is $0.50. Before both of the supports, there was resistance.

Looking at the screenshot above, the price is now in a volatile state after two supports, indicating that it is time to buy. As a result, after purchasing, the target price for XRP is set at $0.90. After a long wait, the buyer has received good news: the price has reached the target price, and the trade has been completed.

Now is the time to trade again, as the market price of XRP is on the rise. In the screenshot, it is now high, so the trade can be closed, and the market is now falling, so the buyer is ready to make a new purchase for another trade.

Conclusion:

After all of the debate, it is clear that price forecasting is critical in trading, and that without it, a trader would fall into a black hole where he would be unsure of what to expect.

When it comes to trading time, respected professor @stream4u recommends setting time durations between 30 and 45 minutes for everyone.

Special Thanks To:

@stream4u

Best Regards:@hamidsab

Hi @hamidsab

Thank you for joining The Steemit Crypto Academy Courses and participated in the Week 10 Homework Task.

Your Week 10 Homework Task verification has been done by @Stream4u, hope you have enjoyed and learned something new.

Thank You.

@stream4u

Crypto Professors : Steemit Crypto Academy

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks professor

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit