THE CONCEPT OF DOMINANCE

The concept of dominance in the everyday world could be viewed as the situation where the strong overwhelms the weak. This “overwhelmingness” could be attributed to a product or to an individual, depending on the context.

In the world of digital currencies, the term “dominance” refers simply to the superiority of a crypto currency over others in terms of market share. It is a measure of how much of the total crypto market capitalization is made up of a given crypto. In other words, how much value of the market available does a crypto has in its control?

If crypto A has 55% of the market share while crypto B and C shares the rest of the shares, we can conclude that crypto A has a dominance of the market.

Yes! Believe it or not, there are over 2000 digital currencies in the crypto currency world. However, only few are relevant with even just few having a market capitalization of $1million

With the invention of Bitcoin by Satoshi Nakamoto in January 2009 and with 10,000 BTC only able to purchase just only two pizzas, BTC enjoyed full market share.

Ha! Permit me to ask: can you imagine yourself purchasing just two pizzas with 10,000 BTC today? That would be outrageously expensive given that a Bitcoin is worth over 56,000 USD as at the time of writing.

DOMINANCE OF BITCOIN

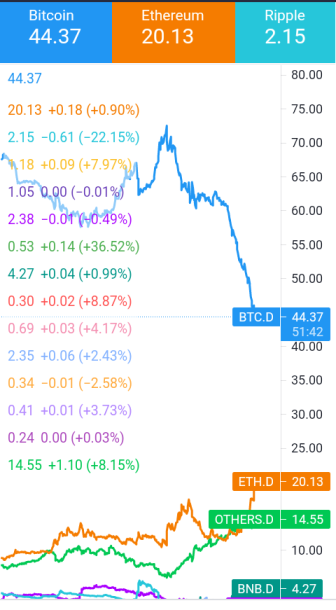

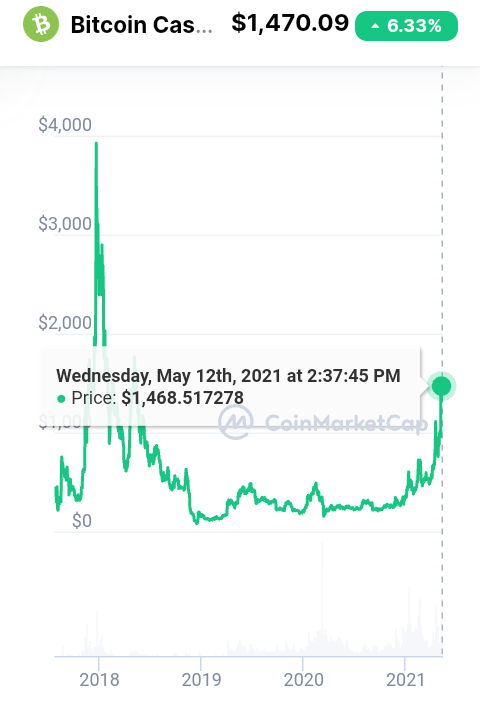

Observe the chart

Rival digital currencies began to emerge in Litecoin, Namecoins, Swiftcoin and most notably Ethereum from 2011 till date. Hence BTC market capitalization began to drop. It has since being facing great challenges from emerging crypto and as if today, 12th May 2021, Bitcoin has a market dominance of 44% from almost 70% in 2020. Though it is still the most valuable in the world; with a price tag of over $56, 000 and more than 1 trillion in market cap. It is followed by Ethereum (ETH) with $4,116, Binance Coin (BNB) comes third and Dogecoin follows behind.

Irrespective of the assertions above, note that Bitcoin is still the rreason anyone is talking about crypto in the first place.

THE STRONG FALLS

The crypto currency realm is of high volatility, strongly affected by market trends, rumours, government policies and other ground breaking news. It is no different from the traditional stock markets in various countries which had had various crashes with investors counting their losses. Still remember the stock market crash of 1929 in United States and Black Monday of 1987. The crypto world has had its own share of dips.

It is worthy of note that digital currencies are dependent on each other. A downward trend in the price of Bitcoin is likely a downward trend for other major altcoins and vice versa. It is somewhat a kind of gambling right?

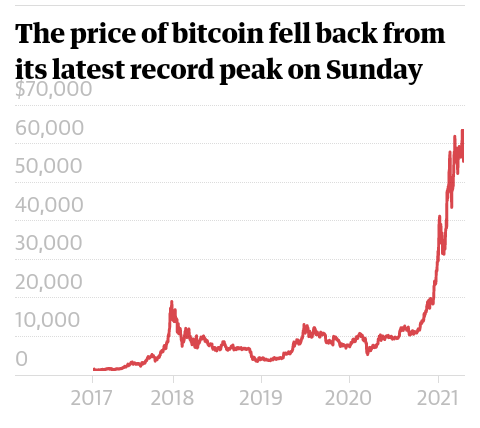

One recent time Bitcoin and other major altcoins had one of their biggest fall was on the weekend of April 18, 2021. Bitcoin broke to a record high of $64,000 on April 14 for the first time in its history. This bullish trend bounced on to Ethereum which surged to as high as $2,547 and Ripples (XRP) hovers at $1.4409. dogecoin also skyrocketed.

Zoom down to April 18, Bitcoin shed almost $8000 in 24 hours to a low of $51,000. It was its biggest drop since February 2021. Ethereum (ETH) fell 22%, trading at $1,500 and Litecoin (LTC) dropped 24%. Dogecoin plummeted to a low of 24 cents and Binance coin dropped to $285 from $325. The fall could be attributed to concerns about regulations in the US financial sector.

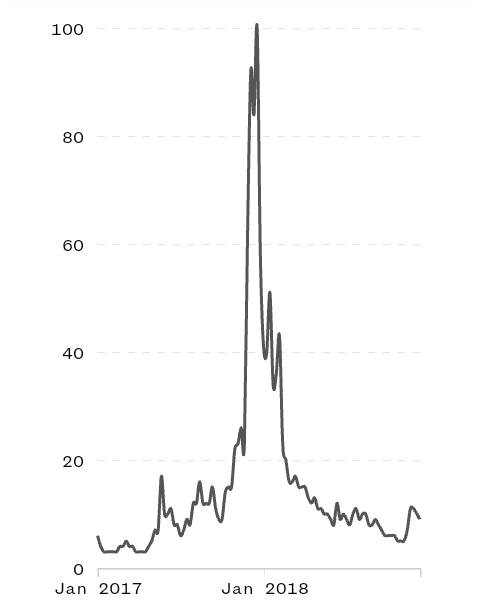

Another dip was experienced in the January of 2018. Bitcoin had surged up quickly to $20,000 in December 2017 from $9,000. It later crashed to below $10,000, almost 50% of its peak. Ripples XRP had hit $3.80 before it dropped to $1.90.

The value of all crypto in December 2017 was over $800 billion. After the crash in January 2018, it dropped to around $460 billion. It was a bloodbath. Aren’t it?

ALTCOIN SEASON

In life, there is almost alternative to everything; even humans have robots. So Bitcoin is no exception. It has a lot of alternative with more springing up every day, even though they may just worth a fraction of what Bitcoin is. Mind you, they have chopped off a significant part of Bitcoin’s market cap. So “cryptographically” altcoin are all other digital currencies that are not Bitcoin. They are alternative crypto assets to Bitcoin. Examples are Ripple, Litecoin, Bitcoin cash, Tron Dogecoin to mention but a few.

The altcoin season is that market cycle when all other crypto currencies aside Bitcoin begin to make big gains and have the possibility of tripling or even gaining more than ten times their value in a given period of time.

In crypto currency parlance, this is called “moon”, that is, to go up speedily in price or value. This happened in late December 2017 up to January 2018. It is always an exciting period for crypto traders.

TWO ALTCOIN IN TOP 50

Litecoin (LTC)

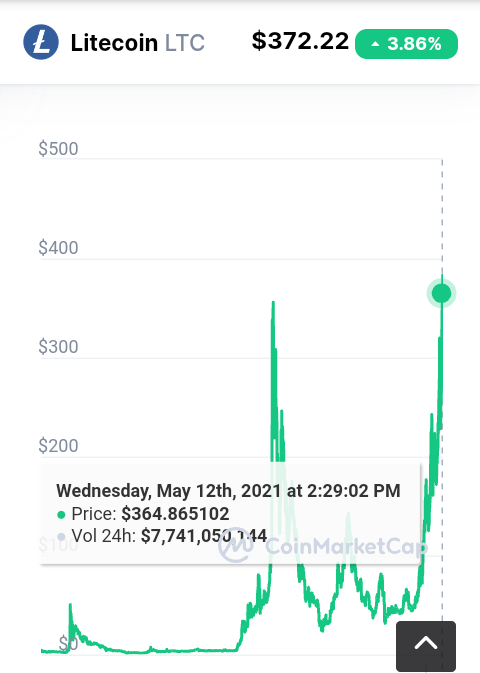

Litecoin was created in 2011. Given how crypto currencies come up and off, Litecoin has stood the test of time. It was created by a former Google employer, Charlie Lee to overcome some of the flaws of Bitcoin, in particular, the slow transaction speed of Bitcoin. It is “lite”

Litecoin has grown to become one of the great altcoins with a market cap. of $8.2 billion. In January 2017, it grew from $4 to $350 in December of the same year. That’s a good return. As of today, it is trading at $364 and has a market cap. of $24 billion.

Bitcoin cash (BCH)

Bitcoin cash could be said to have developed out of Bitcoin itself by miners in 2017, who were concerned about the transaction speed of Bitcoin. Its main selling point is its ability to process transaction faster than Bitcoin, hence its competition against Bitcoin itself.

Bitcoin cash surged to its peak in December 2017, trading at $4,147 and had its lowest point in March 2020 at $144. It has notable support from John McAfee. As of today, May 12, 2021, it trades at $1,469 with a market cap. of $27 billion.

The volatility of crypto currency could sometimes be blamed on the going-ons in the society, in similarity to stock market. Ground breaking news could pull up bullish or bearish runs; News relating to economic policies, government regulatory decisions, black outs, etc,

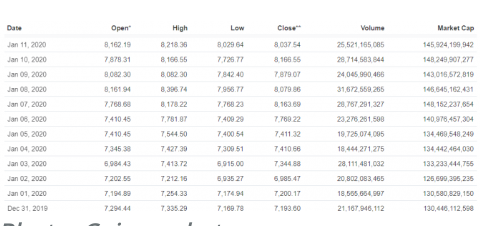

The conflict between US and Iran in January 2020

The tension, brought about the killing of Iranian General Qussem Suleimani in January 3, impacted on the price of crypto as Bitcoin increased by 5% after.

On January 8, it also surged after Iran retaliated. See the shot.

Japan Recognition

Another example was when Japan decided to recognize Bitcoin in April 2017. Bitcoin surged to $1,000 and went even higher three months later to $4,000.

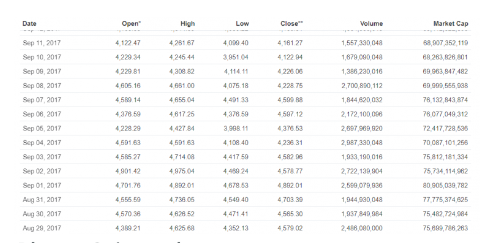

Also, we cannot forget quickly China’s ban of ICOs (Initial Coin Offerings) in September 2017. Bitcoin dip from $4,400 to $3,900

SHIBA INU (SHIB)

Little is known about this latest altcoin currently. It has gone off to attract the interest of crypto enthusiasts probably because it claimed to be the Dogecoin killer. It has the same meme dog as Dogecoin just as being humorous in penetrating the market. It has gone up in value as trader rushes in given FOMO (fear of missing out) hoping it would be the next success.

Shiba Inu allows traders to hold its tokens in trillions. Its price has been skyrocketing since its emergence; getting listed on some popular crypto currency exchanges such as Binance, OKEx and Huobi. Its price today is 0.00027 USD with a market cap. of $10 billion. Could it be that Dogecoin success is being replicated here? Time will tell.

Hola @hannah220

Gracias por participar en la Academia Cripto de Steemit.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit