INTRODUCTION.

Just before I start answering the questions, I will like to describe the idea of ''Trading''. Trading literarily describes the process of exchanging goods and services, trading is done in virtually every human sector even in traditional markets. Trading is important because it helps humans get an exchanged value for the things they have either it is in a physical or a virtual setting.

The concept of trading could be traced back to the age of trade-by-barter, when the existing humans at that time realized that one person could not own all the required food items, consuming one type of food every day was also not helping out, so the idea of exchanging food items was initiated and it turned out to be a very good idea after all.

Currently, on a larger economic scale, trade is initiated as a form of exchange between buyers and sellers or producers and consumers.

Trading in cryptocurrency is different from other trading patterns and that is because cryptocurrency systems are decentralized which means they do not require a central authority for operations. Cryptocurrency trading can be carried out in two ways:

Buying and selling of coins through an exchange.

Speculating the movement of the price through a CFD trading account.

Define and Explain in detail in your own words, what is a ''Trading Plan''?

Trading in cryptocurrency is a lot riskier than any other trading platform and this is because the market is extremely volatile therefore huge profit or loss could be generated within seconds. Anyone trading in cryptocurrency needs to be extremely careful and calculative and that is where the need for a trading plan arises.

Image Credit

While planning is extremely important in order to achieve success in every area of life, the aspect of trading is not excluded. A set plan is extremely important if success is to be actualized. A trading plan is a personal plan put into place by a trader while trading, this is to minimize risk in every possible way and generate profit as well. A proper trading plan guides a trader through the right time to buy or sell a crypto token.

A properly written trading plan guides a trader through the right path of making healthy trading choices. A trading plan is unique to specific traders, working with another trader's plan might not yield an effective result.

In order to have a trading plan that works, here are basic necessities that need to be met by the trader:

The trader must have acquired sufficient skill: Trading is extremely technical and requires a lot of gained knowledge, before you slide into trading and setting down trading plans, it is a necessity that you accumulate the required skill and information in regards to the trading journey. The truth about the trading world is that there are a few smart people who have taken time to gather appropriate information's and they are the ones who end up with good profit regularly and on the other hand, there are traders who lack the necessary information and are always losing money while trading.

Emotional preparation: While trading may appear simple from a glance, it requires a lot of mental effort and strength. In order to trade effectively, you must set aside every form of distraction that could either be emotional or physical. On those days when you do not feel emotionally ready for a trade, it is best to just ignore trading for that day.

A target for every trade: I believe this is what the entire process of trading entails, having a set target that needs to be reached for a certain trade period is extremely essential before going into a trade. Loss usually occurs for traders when there is a strong desire to make more money, but with the help of a set fixed target or expected profit and loss, it will be quite easy to control excessive loss from occurring.

An explicit understanding of entry and entry routes: As a trader, understanding signals and knowing the best time to enter into a trade as well as exit a trade, will give you an advantage over the market and help you make a maximum profit overall.

Cultivate the habit of keeping records: The habit of keeping records will help a trader understand the degree of profit or loss being generated on a trade. This habit of record-keeping, also helps a trader figure out the mistakes made and helps him avoid them in the next one.

Explain in your own words why it is essential in this profession to have a "Trading Plan"?

A trading plan will help minimize loss to a great extent: There is a temptation that comes with trying to make more profit while trading and most often that zeal always results in huge loss, however, with a trading plan in place, it will be quiet convenient to overcome the temptation and loss will be reduced.

Improved discipline plan: Discipline is very important while trading and having a trading plan is one of the best ways to develop an extremely disciplined path that will boost trading confidence.

A good trading plan will help you monitor your trading performance, when you have your trade monitored, it becomes easy to identify if the trading plan you are working with is a good or a bad one. It helps you identify if you are making an accurate trading decision or not and of course improve on the areas that are necessary.

A good trading plan helps to eliminate trading mistakes that would have occurred as a result of fear.

A trading plan prevents the trader from making irrational decisions.

A good trading plan will boost a person's zeal to gain more knowledge in the world of trading. It is expected that in order to have a trading plan, then you must have acquired sufficient knowledge and you will only want to gain more knowledge in the field.

Explain and define in detail each of the fundamental elements of a "Trading Plan"

As established earlier, a trading plan will help a trader gain more profit while trading and reduce the amount of loss to the barest minimum. There are fundamental elements that need to be associated with every trading plan, they are:

Risk Management.

Every initiated trade will only generate two types of results: There might be a profit or a loss. The essence of risk management is to be able to reduce the loss associated with the trade and have more profit than loss.

The concept of risk management helps us to exit the market at an appropriate time so we do not run on a great loss. Trading is extremely risky and even after earning huge profits in one or two trades, the trader can lose all his capital in a single bad trade if risk management is not properly put in place. Risk management entails knowing when to stop trade and move on with the acquired profit.

Example of Risk Management.

If I plan to make trade entries six times a week and out of those six trades, according to my plan, I want to make a profit of four entries and lose in two. If during the course of my trading, I already made a profit from 4 trades, then following my risk management scheme, I will withdraw from trading for the rest of the week.

Capital Management.

The idea of capital management is to help traders understand how much of their capital they are willing to lose on each trade. When a trader already has a plan on the amount of capital he is willing to risk per trade, it becomes very convenient to know when to stop the trade in order to avoid the generation of more loss.

The asset of every trader is their capital and once the capital is gone, there is nothing more to work with and that is the reason why it is better for every trader to guard their capital judiciously.

Example of capital management.

The one-percent rule is a good example that traders use to safeguard their capital. The one-percent rule makes traders not lose more than one percent of their capital. This means if a trader has $5,000 as trading capital, he should not lose more than $50 on every trade.

The idea of setting stop-loss and take-profit is a very good measure to help traders guard their capital effectively and avoid running at loss during the process of trading.

Take-profit: This helps a trader quit a trade after he must have acquired a significant level of profit before the market takes a negative turn.

Stop-loss: This helps a trader quit a trade when the market price is already declining, in order to avoid getting into a huge loss, a trader decides to quit the trade.

Trading Psychology.

Emotions are only natural in humans and now that money is involved, we need to be careful about permitting our emotions to control us during the trading period. It is, therefore, necessary to put certain emotional and psychological rules into practice in order to succeed in the world of trading.

Examples of trading psychology.

Here are some of the set rules that need to be considered seriously while trading:

Emotional balance is one of the strongest features that experienced traders work with. Try not to enter into a trade if you feel emotionally unbalanced.

If you have some family issues troubling you, it will be wise to suspend trading for that moment until you become emotionally strong to run the trade without any bad feeling.

Prepare your mind for the worst, irrespective of how good a trader is, the market can choose to go against him at any point and this is a huge reason behind the huge need for mental stability in every trader. Mental strength is highly necessary before going in on any trade in order to avoid loss of mind. We have heard stories of traders committing suicide after a trade and you definitely do not want that to happen to you.

Know when to take a break: It is a great misconception that you need to participate in every trade, sometimes you just need to let some trade slide irrespective of how juicy it may appear.

Never ignore the need to use risk and management options.

If possible, operate at the early hours of the morning or simply operate during your best hours, that time when you still have your head cool and properly in the game.

The right trade tools (Planning and Control).

This is the final and extremely important point to look out for as a trader. A good trader knows the importance of record-keeping, you want to know if progress is being made or otherwise, and one easy way to get this done is through the use of a Microsoft Excel program. Keeping every transactional detail of the amount gained and lost while trading is a good path for effective trading management.

While speaking about tools, we must also state the need to have a good and reliable computer to trade with. There is also a need for a strong internet connection while trading.

Examples of planning and control.

Let' assume that as a trader, I begin my trade with $5,000 at the end of the month, I was able to generate a profit of $200. At the beginning of a new month, I will add this profit to my capital which will increase my capital to $5,200 for the new month.

Practice (Remember to use your own images and put your username).

- Build a “Trading Plan” and cover all the basic elements discussed in the class. For this, you should NOT take the examples that I put in my class (Including the example amounts), use your own examples and own images to make a said plan, you must also base this "Trading Plan" as if you were operating on the platform of " Binance ”, taking into account that the minimum amount of exchange or investment is $ 10.

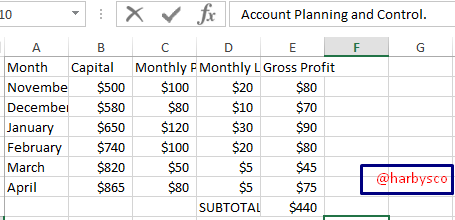

Column 1: This column describes the month of operation, I will be running the trade transactions for a period of six months, from November-January. At the end of every month, I will carefully calculate the amount I have acquired as gross profit and add it to my capital for the following month.

Column 2: This column entails the amount of capital I will be working with at the beginning of each month. At the end of the month, the generated profit will be added to the capital to begin trade transactions for the new month.

Column 3: This column entails the profit made on a monthly basis, following a good trading plan, I should be able to generate substantial amount of profit to a reasonable extent.

Column 4: This column contains the amount of loss acquired every month, loss happens even to the best traders out there, but with the strategic use of a good trading plan, we should have our losses reduced.

Column 5: This column entails the gross profit generated at the end of each month. That is subtracting monthly loss from monthly profit. Gross profit= Monthly Profit-Monthly Loss.

I will be starting this trading experient with $500 and I hope to run it for an estimated period of six months. Within the period of six months, I will be adding every interest I make to my capital in order to have increased capital in the long run.

Capital Management: I am aware of the fact that the market cannot be completely predictable during these six months of trading, there will be days that I will make a profit, as well as days when a loss will be recorded. In order not to lose my entire capital, I will be careful to set stop-loss and take-profit. I will be setting my loss at 1% so in any case where there is a possible loss while trading, I will not be losing more than $5 of my entire capital.

Risk Management: I will be entering into a trade at least five times every week and I hope to make a profit at least three times every week so even if there are going to be cases of loss, it will not happen more than two times. During the trading period, if it happens that I make profit three times while trading, I wouldn't bother to make more trading investments, as I will simply stick with the profit I have made from the three trade entries for the week.

Trading psychology.

I am mostly active in the early hours of the morning, so I plan to make my trade entry very early in the morning when my brain is still smart and ready to function very well.I will also not be entering into a trade whenever I have urgent issues to attend to and I know the trade will not be having my full attention.

Once I am not sure about the market I will not risk my capital at all. I will study the market more effectively until I am sure that it is sure to dive in.

Conclusion.

I understand that experiencing loss while trading is inevitable, but a good trading plan will help to minimize those losses to the barest minimum. Trading plans clearly helps a trader to understand the right time to enter and exit a trade. This assignment is indeed an eye opener to a lot of details as regards trading, before jumping into trading from the juicy information we get about the possible interest, we need to understand how risky it is, as well as the control measures that needs to be put in place to avoid acquired loss.