It feels good to be opportune to join the academy again this session. After attending the classes presented by smart professors, I decided to answer questions from professor @reminiscence01 for this week.

Just before I proceed to answer these questions, I will love to explain the idea of trading and what cryptocurrency trading means?

The idea of trading involves the process of buying and selling, it is also a process of exchange of goods and services between two parties. The essence of trading is for the parties involved to be able to get value for their desires.

Cryptocurrency trading is a point of exchange where traders get to sell, buy and even exchange tokens. As a result of the extremely volatile nature of cryptocurrency, traders could record huge profits and they could also record huge losses depending on the nature of the market during the trading period.

However, there are measures that could be taken in order to minimize the risk associated with trading. It is always advisable that beginners understand the safety precautions involved in trading before diving into it.

Question 1- Explain the following stating its advantages and disadvantages:

- Spot trading.

- Margin trading.

- Futures trading.

Spot Trading.

This method of trading is the most advisable one for beginners in the crypto trading world. The process simply involves, buying a token and simply holding unto it until the point when the price of the token appreciates. After the price of the token must have appreciated, then the trader can sell it and record a huge profit

Advantages of spot trading.

There is no fear of liquidation, the trader can simply decide to hold tokens until the time when the price becomes favorable to sell.

Investors can trade with extremely low capital. This offers an opportunity for low investment holders to also enjoy the associated benefits of trading.

Traders have the complete right to their assets, they can choose to buy and sell their assets at any point they deem fit.

Disadvantages of Spot Trading.

Beginners might purchase the token at an inflated rate, therefore, leading to a huge loss on the part of the trader and discouragement from trading further.

Setting up an exchange wallet is a part of the required necessity for spot trading and this might not be convenient for all traders.

Having to use a trading application might also come with its own difficulty of hanging/freezing, therefore possibly permitting price change before a transaction is complete and of course causing the trader some level of loss.

Margin Trading.

Margin trading is usually very helpful for traders who have low trading capital, with the little trading capital available, traders have the option of borrowing more funds from a third party which could possibly lead to an increased profit if the trade is recorded as a successful one at the end of the day. For example, an investor can have a trading capital of $10 but with margin trading, he has the option of getting an asset worth $50, a trader can get these added trading funds by either borrowing from an exchange or from another trader who is willing to lend him.

This is a very risky thing to do because if the trade does not go as planned and there is recorded loss, it only means the trader will be left with an acquired debt on his portfolio. On the other hand, if the trader makes a profit he will be able to sort out the loans acquired and also have an increased positive portfolio as well.

Advantages of Margin Trading.

It allows traders who have little capital to also enjoy the luxury of having an increased portfolio if all goes as planned.

With better access to funds, traders can split investment options and make investments in different available opportunities.

Disadvantages of Margin Trading.

The risk of losing entire trading capital without the possibility of a refund whenever trade does not go well is a huge demerit to this trade type.

This trade option, requires a great level of expertise and as such it is not advisable for beginners.

Futures Trading.

Futures trading is totally for experts, this trading option is not advisable for newbies at all. This trade option allows traders to make possible predictions of the future price of an asset would be, the system also offers them the opportunity of having higher leverage which makes them trade with more capital than they have and in the process, they will be able to maximize profit to a large extent.

Trading on futures could help traders make a huge profits within few minutes, and at the same time, they could make a huge losses and get liquidated within the shortest possible time.

Advantages of Futures Trading.

Futures trading makes it possible for traders to predict the rise or fall of the market, this means that either there is a bull or bear run, traders can make a profit as long as they are trading in the right direction.

With futures trading, traders can make a huge profit increasing their portfolio a hundred times over just from a single trade.

Future trading provides traders with the opportunity to utilize other available trading strategies in order to get an efficient trading result.

Disadvantages of Futures Trading.

This trading method has the highest associated risk involved, when predictions go wrong it could lead to account liquidation.

There is no purchase of assets like that of spot trading. This means traders do not have the underlying right to the ownership of the asset.

Question 2.

(2a). Explain the different types of orders in trading.

(2b). How can a trader manage risk using an OCO order? (technical example needed).

Different types of orders in trading.

The importance of order in trading is that it helps traders to minimize the risk associated with trading. There are mainly three types of orders namely: Market order, pending order, and exit order.

Market Order.

A market order is the fastest type of order amongst all order types. Traders who use market orders usually have their trade executed with the current market price. A market order is a safe choice for traders when the market has a huge user base, giving access to continuous buying and selling regularly. The traders who use market orders are called market takers.

Pending Order.

Pending order is an order type that is executed once the speculated price target has been reached. When traders make use of pending order, they believe that the price of that asset will get to the speculated point and the system immediately triggers the order once the price is attained. Some examples of pending orders are Limit orders, stop-limit orders, and OCO orders.

Limit Order.

A limit order is an order set for future lower execution. Either the trader is available or not, at the time when the order price hits the set price exactly, the system immediately triggers the transaction to occur. For example, if the price of a certain asset M is currently $1.5 per token and the trader wishes to purchase the token when it reaches $1.2, he can set a limit order to $1.2 and when the price gets to that point, the trade order will immediately get executed.

Stop-limit Order.

Stop-limit order requires two prices, one is the stop price and the other is the limit price. A trader will be required to set a limit price in order for the stop price to get executed. For example, if we have the current price of an asset Z to be $1.89, and a trader wishes to have an executed order when the price reaches $1.69, then he will need to set a stop price to be $1.67. This means, if the price gets to $1.69 then the order to execute the trade at $1.67 will be instantly executed.

OCO Order.

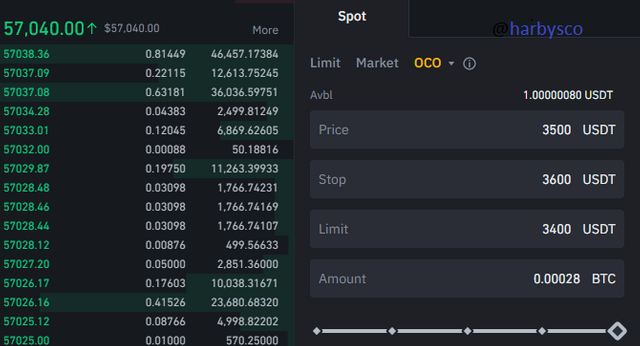

Like the name implies one cancels the order, a trader will be required to set two trade orders, at the execution of one trade the other will be canceled immediately. A trader might speculate the continuous increase in the price of a trade and there could also be a reversal in price, whichever way the price turns, this trade order helps traders to minimize the loss in either direction. For example, the price of a crypto asset X is currently worth $40, the trader can set a stop-limit order at $39 and the trader can also set his profit to be around $42.

With this, whatever direction the market takes will guarantee the immediate cancellation of the second order and as a result of this, the trader has a minimal loss.

Exit Order.

Exit order as the name implies is a trade decision where the trader exits the market after a set trade order has been executed. There are two ways to this order type:

Stop order: Traders can use this trade order to exit a trade the moment the trade stops moving in a favorable pattern. Sometimes, after predicting a trade movement, price movement may start going in an opposite direction but when a stop order has been set, even while the trend is experiencing a bullish movement, the stop order will automatically exit the trade.

Take profit order: Traders can conveniently use this option to exit a trade when an attained level is reached. Every trader has a certain level of profit they wish to get and once this profit level is reached, the system automatically makes the exit possible.

How can a trader manage risk using an OCO order? (technical example needed).

This order type has loss completely minimized, either there is a bullish or bearish trend, the trader is sure to remain on a safe spot. It is normal for trade to either move in an upward or in a downward motion, so in this case, the trader will be safe irrespective of the trade pattern.

##Question 3a- Open a limit order on any crypto asset with a minimum of 5USDT and explain the steps followed. (Screenshots needed from any cryptocurrency exchange).

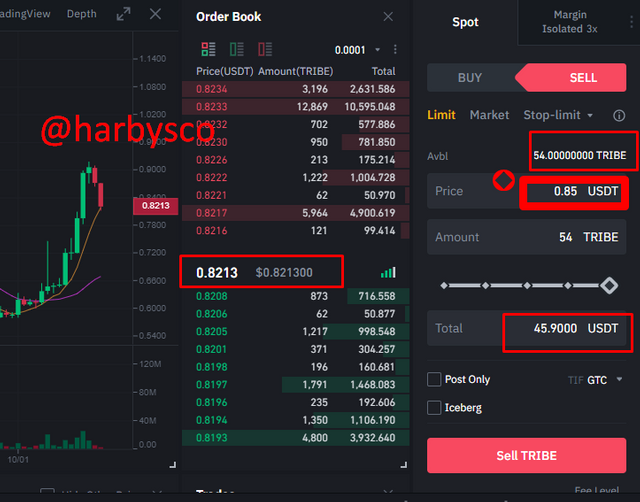

To get this done, I will be using the Binance app to illustrate.

- The first step is to log into the Binance application. I am using the Binance Desktop so it can be a little different.

- Click on the trade button.

- Click on Spot then click on the pair Icon to choose a trading pair. I will be trading TRIBE/USDT. After clicking on the trading pair, I will click on Limit.

- I will search for TRIBE/USDT

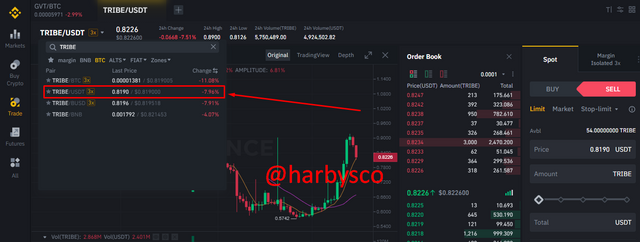

- Since I own TRIBE before in my portfolio, I will be opening a sell limit order.

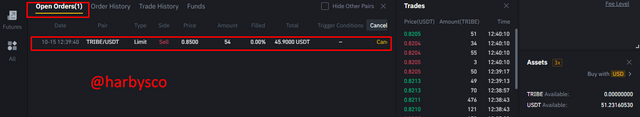

- As in the screenshot above, I will be trading 54 TRIBE, at the price of $0.85 to get 45.9000 USDT. Since I want to create a limit order, I can set the price of my choice compared to the last price of $0.821200.

- After placing the order, it will reflect on the open order page while I wait for the order to be filled.

Question 4- Using a demo account of any trading platform, carry out a technical analysis using any indicator and open a buy/sell position on any crypto asset. The following are expected.

(i) Why you chose the crypto asset.

(ii) Why you chose the indicator and how it suits your trading style.

(iii) Indicate the exit orders. (Screenshots required).

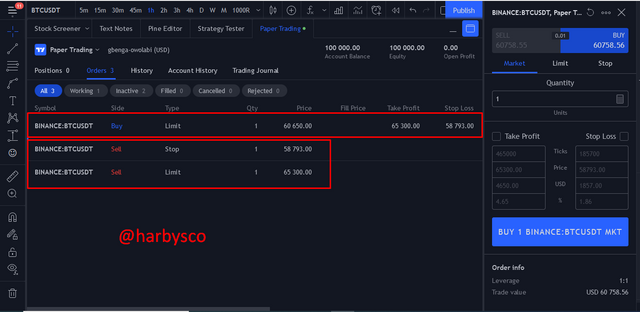

To perform the technical analysis using any indicator, I will be making use of Tradingview paper trading account. I will be trading the BTC/USDT trading pair. I like to trade using chart patterns and indicators as confirmation, so I will do this in this post.

Timeframe: I will be using multiple timeframes, the higher timeframe to determine the trend and the chart pattern, and the smaller timeframe to determine the entry and exit point. The timeframe used will be 4hrs and 1hr.

- The 4hrs timeframe will be used to determine the major trend of the market (remember that the trend is your friend). In our chart, BTC/USDT is in an upward trend

- Since we know that a smaller timeframe gives details, I will be using the 1hr timeframe to determine the chart pattern as well as the use of indicators.

Using the 1hr chart, there was an ascending and inverted scallop that appears during a bull run or at the beginning of a bull run. The subsequently inverted scallop will be higher than its previous ascending and inverted scallop high.

Using RSI as an indicator, the indicator shows a rise from below the 50 mark (46.37). The RSI indicator shows when a coin is overbought or oversold. With the RSI retracting upward, the market is about to start rallying upwards.

Why you chose the crypto asset.

BTC is the main coin and it has a lot of volume and liquidity. It is a coin that follows technical analysis and can be easily speculated.

Why you chose the indicator and how it suits your trading style.

RSI is used to determine the volume, the level of oversold and overbought, and determining an uptrend and downtrend. above 50 is an upward trend, below 50 is a downward trend, when RSI is below 20, it is oversold and when RSI is at 80, it is overbought.

Indicate the exit orders. (Screenshots required).

Buy limit: 60,650.00

Take Profit: 65,300.00

Stop Loss: 58,793.00

Conclusion.

I must confess that this is a wonderful class and I am really excited that I participated in the assignment. Trading is indeed profitable but we must learn that it has a lot of downsides as well, newbies need to be extremely careful when it comes to trading and adhere to the necessary safety precautions required. Thanks to @steemitblog for the amazing opportunity to learn and once again to professor @reminiscence01 for the assignment.

Hello @harbysco , I’m glad you participated in the 6th week Season 4 of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Recommendation / Feedback:

Thank you for participating in this homework task.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks professor, have a lovely week.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit