Hey Steemit!

Here is my homework post for Professor @image. This is undoubtedly a great lesson, and I hope that you will enjoy reading this post.

.png)

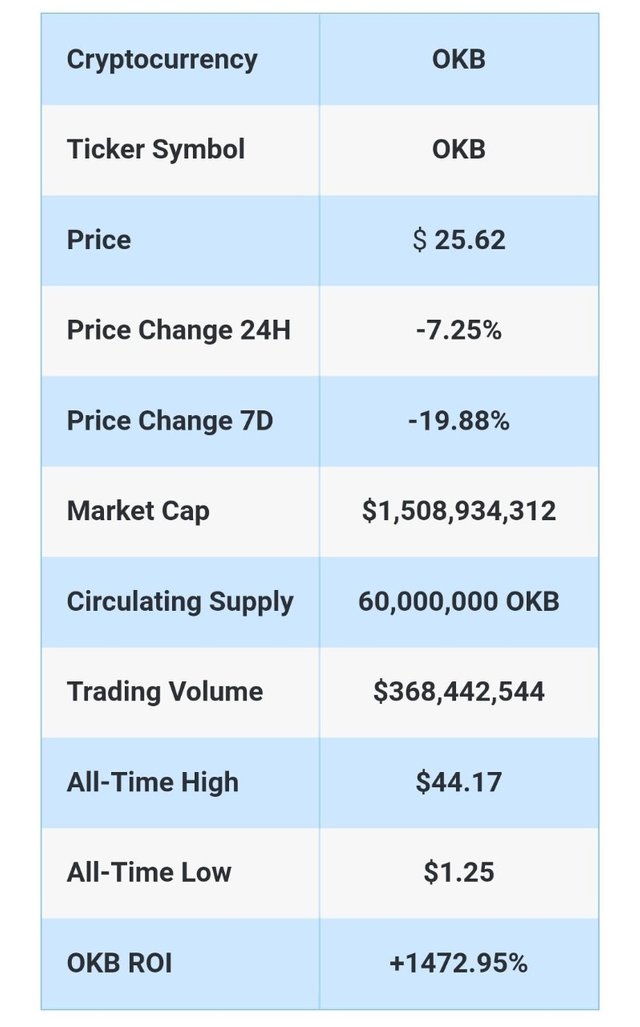

1.) Perform a complete analysis of the currency of some exchange. Not allowed: BNB, KuCoin, Cake and Uniswap.

OKB is a cryptocurrency created by the OK Blockchain Foundation and the Maltese cryptocurrency exchange, In terms of trading, it is one of the world's major exchanges and presently ranks third in liquidity and fourth in trading volume. However, there are several important distinctions between OKEx and the cryptocurrency exchange Binance. Users of the OKEx platform may trade options on a cloud mining service provided by the platform itself. It's no secret that Binance is offering a wide variety of crypto services.

To utilize the crypto exchange's unique features, you need the OKEx utility token or OKB. OKB is used to compute and pay trading fees, provide users access to voting and governance on the platform, and reward users who possess OKB.

As of 2017, OKEx is the world's top trading floor. In 2017, the platform was established as an extension of the main OKCoin platform (operating since 2013 in China). In contrast to OKCoin, OKEx has a built-in API for algorithmic trading and concentrates on exchanging crypto for fiat currency. A multi-currency wallet and margin trading options are also available to consumers.

Tokens such as OKB have a significant impact on the OKEx ecosystem. Users may save up to 40% on their purchases using this method (depending on the number of tokens a user has). The exchange classifies its users as either "regular" or "VIP." Each regular user receives a level based on their OKB stock, whereas VIP members are given levels depending on the number of trades they have made. Depending on their status, users get a reduction in their daily commissions.

If you own OKB tokens and the token is included in OKEx Earn, you may earn passive income (this project helps users earn on their assets). The OKB token may also be used to distribute money on the OKEx Jumpstart platform. To participate in Jumpstart, you must first log in with your MixTrust account.

The original asset of OKExChain is OKB (the OKEx blockchain). It is possible to run several scalable apps in parallel by using the OKB token on the chain to promote spot trade and derivatives trading. A layered design also decreases consensus times, enhances scalability, and increases security.

For the sake of enhancing the value of OKB and attracting new investors, OKEx burns tokens every quarter, documenting the event on the company's website. 30% of the commission fees are used for this operation at OKEX.

Future Price Predictions for OKB:-

While OKB's losses aren't as severe as those of Bitcoin and Ethereum, they are significant. On the other hand, OKB's Blockchain has made it a hot topic. For OKB, the spirit of the same kind of success on the exchange may be quite beneficial. According to the most recent data, the current price of OKB is $23.49, with a market value of $1,385,462,828 and a supply of 300,000,000 OKB in circulation. The current trade volume is $693,189,066.22.

How Does The Okb Network's Security Work?

Proof-of-Stake (PoS) consensus is used by the token, which is an ERC-20 token on the Ethereum blockchain. Initial operations were conducted on the Ethereum blockchain, but OKB eventually switched to its own, the OKExChain.

Security is a primary focus for the developers of OKEx as the platform ensures a stable and trustworthy trading environment. To defend themselves, they use load balancing on servers, distributed clusters, and other technologies.

OKEx has also created hot and cold wallets, one of the safest ways to store cryptocurrency. Security and functionality are two of the most important considerations when using a hot wallet. Therefore, OKEx incorporated a semi-autonomous multi-signature function that facilitates quick, easy, and secure transactions.

2.)Make a purchase equal to at least US $ 10 of the currency you explained above. You must make some movement with that currency within the exchange that created that currency. Show screenshots and explain in detail the steps to follow. Example: transfer of funds, Staking, participation in a Launchpad, trading in futures, etc. Indicate the reasons why you chose that option (operation) on that platform.

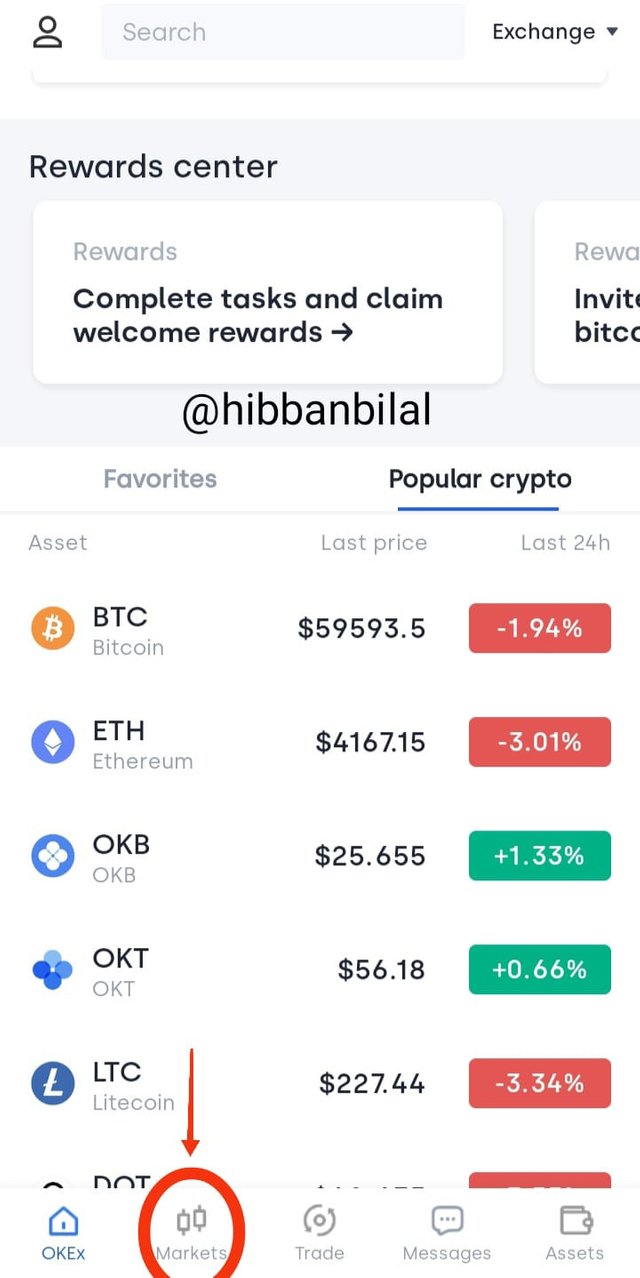

Step 1: At first, I opened my Okex App and click on the Market, Afteryou'll search for OKB/USDT and after it, a new page will be opened as you can see below and After it, you'll click on the BUY which is also highlighted by me :

.jpeg)

Step 2: After it I selected the option of Market Order by which I bought the coin without any waiting at the current Market Price which was 25.798 and I bought the coin for the worth of 15 Usdt. After it, I got the Confirmation Option and in it, you can see the Amount, Order price and type. After it, I clicked on the Confirm as you can see in the Screenshot Below:

.jpeg)

.jpeg)

Step 3: After it I went to the History and checked the Date/Time, Average price of Buying, Amount of Usdt etc and I also attach the Screenshot as you can see below :

.jpeg)

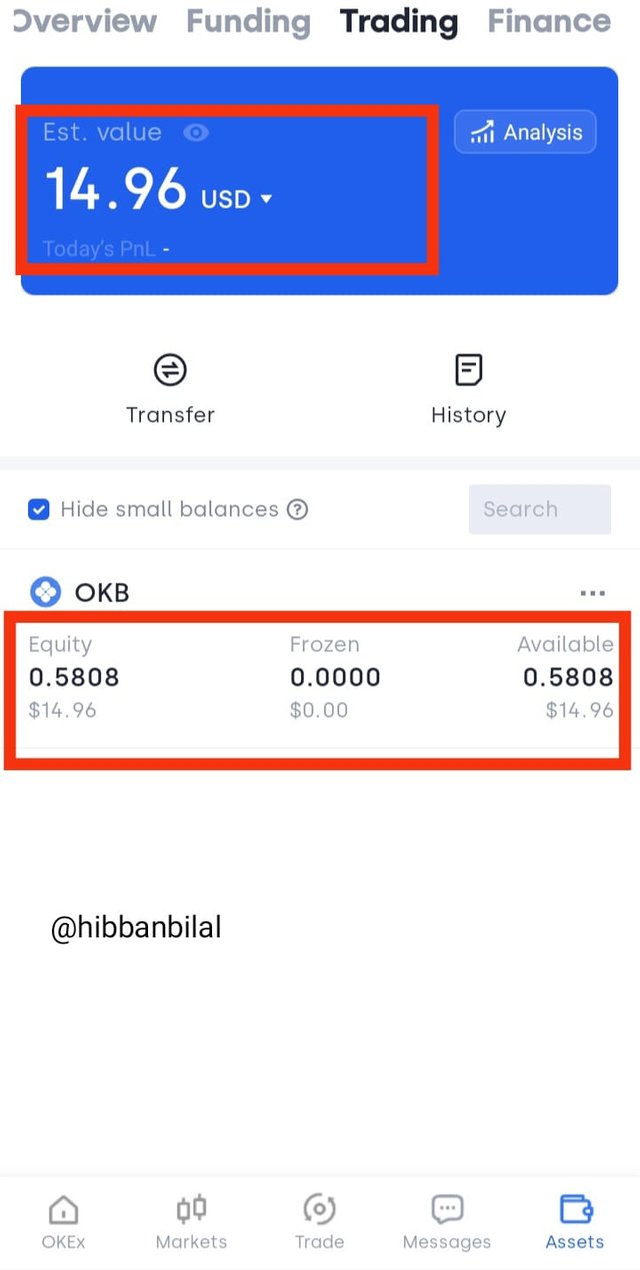

Step 4: After I went to my wallet / Assets and checked the Price of the Token and it had dropped 0.04 Cents just after I bought it. After it, I clicked on The Finance Option And decided to put these coins in the Savings so I can earn Passive Income and Interest from time to time.

.jpeg)

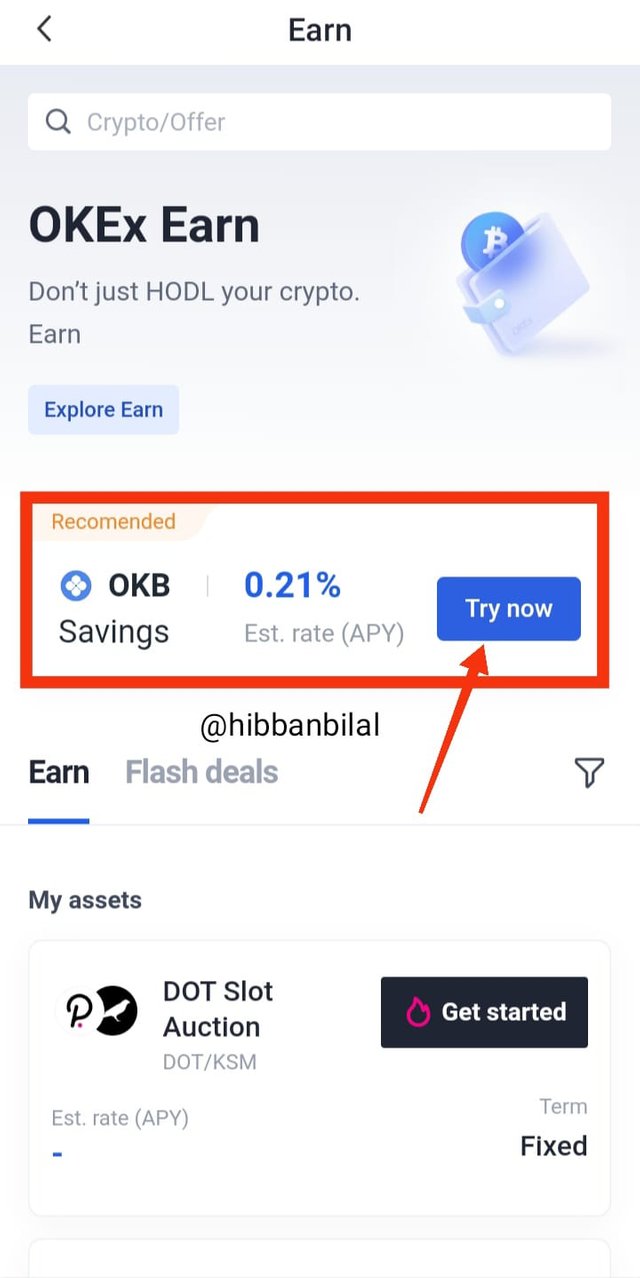

Step 5: A new page has opened with the name of Okex Earn and there I got a suggestion of OKB Saving with the APY of an Estimated 0.21 %, I clicked on Try Now and put all the OKB I had which were 0.58 Okb , There all of the Information was written like Time / Date, Est Interest and Est Rate Etc. After it, I clicked on Continue as you can see below :

.jpeg)

3.) Show the return on investment in time frames of 0, 24 and 48 hours from the moment you bought. Take screenshots where you can see the price of the asset and the date of capture.

RETURN ON THE INVESTMENT AFTER 24 HOURS

After I checked the Return after 24 hours I've got no returns at all due to low APY RATE, but the price of the coin has dropped. When I bought the coin the amount being shown in my wallet were 14.96 but after 24 hours the amount in the walled being shown is 13.96. , As you can see in the ScreenShot Below:

.jpeg)

RETURN ON THE INVESTMENT AFTER 48 HOURS

When I checked my wallet after 48 hours I still didn't get any returns on the savings due to the same reason which is Low APY, But the amount in the walled become different after 48 hours and it become 14.35 USD from 13.96 USD in 24 hours , You can see in the ScreenShot Below:

.jpeg)

3.1) Has the asset's price acted independently or does its price strictly follow the correlation with Bitcoin? You can add the information you want, creativity will be taken into account

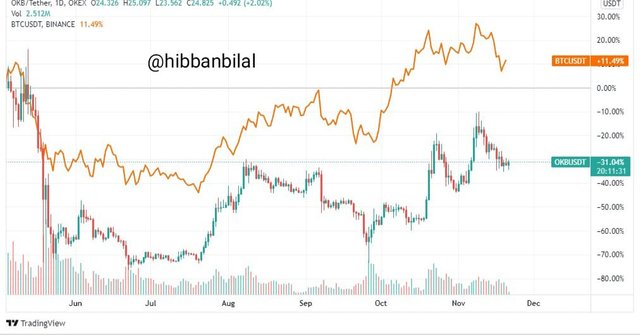

If we talk about the relation between OKB and BTC's price, it's clearly visible that OKB strictly follows BTC in price action. All the movements are almost the same. If we talk about the movement in the very recent days that are the same. We get to see a decline in price in both of currencies.

4.) What are futures trading?

An agreement to acquire or sell an asset or security at a certain price in the future is called a futures contract. If you're interested in trading futures contracts, you'll need a brokerage account that's been authorized for futures trading.

In futures trading, both seller and buyer are involved, which is comparable to an options deal. Expiry of a futures contract obligates both the buyer and seller to acquire and deliver the underlying asset, unlike options, which might be worthless at expiration, unlike futures.

Futures-related Applications

Hedging (risk management) and speculating are the two most common applications of futures contracts in the stock market.

Using Futures As A Hedge:

It is common for institutional investors and enterprises to utilize futures contracts to hedge their operations or investment portfolios against the risk of future price fluctuations in the commodity they are trading.

Speculating With Futures:

It is possible to buy and sell it as long as the contracts open; because they don't intend to own the underlying commodity, speculative investors and traders benefit greatly from this attribute. If they want to convey an opinion about the direction of a commodity's price, they may purchase or sell futures contracts to do just that. By buying or selling an offsetting futures contract position before its expiry, they will remove any reliance on the real commodity.

What's the point of futures trading?

In most cases, individual investors and traders utilize futures as a tool to predict the future price movement of an asset. They make money by predicting the direction of a given commodity, index, or financial instrument in the market. Additionally, some investors utilize futures as a hedge to protect their portfolios or businesses against future market movements in a certain commodity.

Of course, stocks and ETFs may be used in the same manner to hedge against or speculate on market swings. Futures trading has several benefits over the stock market, but you must be aware of the risks involved with everyone.

5.) What is the margin market?

It's possible to acquire stocks on the margins if you don't have the money. You may acquire stocks for a fraction of their true worth. This margin is paid in either cash or stock as a kind of collateral. Investors may leverage their holdings in the market via margin trading, which can be done with either cash or securities. Your broker funds margin trading transactions. Settling the margin may be done at a later date. To generate a profit, you must have a bigger profit margin than the money you earned.

Features Of Margin Trading:

● Investors may use margin to borrow against holdings in assets other than derivatives.

● Licensed brokers are permitted to provide margin trading accounts by SEBI rules.

● Securities that may be traded on margin are specified by the Securities and Exchange Board of India (SEBI) and its stock exchanges.

● There are two ways investors may hedge against the margin: they can either use cash or collateral in the form of shares.

● To the limit of N+T trading days, the margin-created positions may be carried over for a maximum of N+T days, which varies from broker to broker.

● To use the margin trading facility, investors need to open an MTF account with their brokers, which means they must agree to all terms and conditions.

6.) What happens to the cryptocurrencies of an exchange when they suffer from a hack or it turns out to be a fraud? Present at least 2 real life examples.

Recently, there have been many high-profile events employing various tactics to steal bitcoin, and they are not new. NiceHash, a Slovenia-based cryptocurrency-mining marketplace, was breached in December 2017, and cybercriminals stole the contents of its Bitcoin wallet.

Cryptocurrencies like Bitcoin and Ethereum are attractive targets for hackers because of their widespread appeal. Aside from deploying phishing schemes, they exploit malware like the Digmine bot, which spreads over Facebook Messenger, to mine cryptocurrencies like Bitcoin. Another Satori botnet version was also recently utilized to mine ethereum using Claymore mining machines.

Even though Bitcoin and other cryptocurrencies are still a relatively young technology, they have already proved to be a lucrative target for various disruptions and threats. The necessity for cryptocurrency security, such as employing a split wallet to keep bitcoins safe from viruses, is still present, though. In unregulated exchanges, bitcoin is held digitally in wallets, which attracts the interest of hackers who think they may exploit a flaw.

To avoid falling prey to phishing scams, here are some tips:

● People or organizations requesting personal information should be avoided at all costs. The vast majority of businesses will not ask for consumers' private information.

● Validate an email's sender by looking at the sender's display name. A single domain will be used for both URLs and e-mail addresses.

● Even if the source seems to be trustworthy, do not click on links or download anything.

Examples:

- Taxi driver lose over 2,500 euros

He's always checking his phone for updates as a taxi driver, Chris.

"I'm going to lose over 2,500 euros (£2,100) worth of bitcoin coins," he claims.

On Liquid Global, Chris defines himself as "a tiny Austrian crypto-holder" who lost money in a cyber assault last week.

Customers harmed in the $100 million (£72.8 million) cyberattack have been assured that they would be compensated.

Customers remain concerned until they receive their money back, though.

For 38-year-old Chris, who drives an outdated Volkswagen, the stakes could not be higher.

"My automobile is almost 20 years old, and I could have purchased a new, used car with that money," adds Chris. "For me, it's still a significant amount of money. That cash will take me at least a year to save."

- Almost $100 million (£73 million) is thought to have been stolen from leading Japanese bitcoin exchange Liquid.

Digital currency wallets belonging to the corporation have been "compromised," according to a statement. It is the second large cryptocurrency heist in the last few days. ' At least $600 million was stolen from a digital token platform called Poly Network last week.

Conclusion:

People are afraid to trade in cryptocurrencies since they are considered to be very volatile. Even amid a pandemic, investors' interest in crypto assets has remained strong because of the promise of substantial long-term gains for traders, private investors, and institutions alike.

There is one remedy to all these issues, and that is the Blockchain. For this to be possible, there must have been a great deal of effort put into it over many years. With time, cryptocurrencies appeared on the digital roadmap with pre-determined milestones, and then OKB was born. As a worldwide utility cryptocurrency, OKB is the origin of the OK Blockchain network.

It was a great lesson, and I appreciate the work of Professor @imagen. Thank you!

Gracias por participar en la Quinta Temporada de la Steemit Crypto Academy.

Continua esforzandote, espero seguir corrigiendo tus asignaciones.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@steemcurator02

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@steemcurator02

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit