It is an honor to be a part of this week's class and I must commend the effects of our amiable professors in ensuring that we are well equipped with knowledge in order to stand the text of time. This week, professor @wahyunahrul focused on fear and greed index and I will be attempting the questions as follows:

Market and Trade are as old as time. The term market as we know refers to an immense space or site for the gathering of people to purchase and sell and browsing the merchandise at a set time. Some markets are periodical while others are regular but one thing is common about every market, it comprises three elements, buyers, sellers, and commodity.

The relationship between the buyers and the sellers or what brings them together is Trade. Trade is the act of buying and selling goods, services, or commodities on a market or the system of bartering items in exchange for another. Trade can only take place when a good has been sold to a buyer by the seller or exchange has taken place.

In the market, the price movement of goods and/or is dependent on their demand and supply. The buyers and sellers that are involved in the trading activity buy and sell or exchange commodities in respect to their need which is driven by their emotions

As stated above, the price and value of any commodity or asset are relatively dependent on the level of demand and supply, that is to say when there is an increase in demand level, the value increases as well as the price. On the other hand, an increase in supply level will result in a decline in value as well as the price of the commodity or asset.

Traders buy and sell or exchange commodities or assets with respect to their feelings about the commodity or asset. These feelings that prompt the sale or purchase of commodities or assets could be that of greed or fear.

Whenever there is an increase in demand level, there is always an influx of traders into the market to make as many purchases as possible, and this results in rising in price. As explained earlier, traders buy and sell commodities or assets following their emotions. The emotion behind this influx of traders into the market increases the demand level is that of greed, on the side of the buyers, the reason being that traders (buyers) want to take advantage of the increasing market. The result of this act is a rise in assets prices.

On the other hand, when traders fear that something may happen to their commodities or assets, they tend to dispose of them and make an exit of the market, this brings about an increase in supply level and a decline in the price of assets or commodities.

With that being said, we can observe that greet is to buyers as fear is to sellers.

The cryptocurrency as a commodity or asset and its market is not exonerated from all the aforestated obtainable factors that affect the market and its activities. Therefore, the greed of the buyers and the fear of the sellers go a long way in affecting or influencing the price movement of cryptocurrencies.

An example of how the emotion of traders affects cryptocurrency price movement is given below:

In a statement released on 15th September 2021, China's central bank said all transactions relating to cryptocurrency are illegal adding that it was going to prevent the risk surrounding the trade of cryptocurrency.

On hearing the press release on China's feeling about cryptocurrency, traders were gripped byfear and investors started selling off their BTC tokens in an attempt to avoid and this led to the downtrend movement of the price.

Naturally, man is rational when it comes to satisfying needs, but the reverse is the case when it comes to trading as traders or investors are irrational when they are faced with some extreme market conditions. Investors tend to be fearful anytime the market appears to be pessimistic but anytime the market is fizzy, investors become greedy. Investors may be able to take advantage of their emotions are well comprehended. A renowned investor once said, “Be fearful when others are greedy and greedy when others are fearful.”

Consequently, the fear and greed index is a tool for gauging investors' level of sentiments towards the market. It is quite a good indicator of the market's emotional state as it is designed based on fear and greed to reveal whether the market is bearish or bullish.

In addition, the index is a conceivable and ideal means of observing or specifying investors' behavior towards Bitcoins which may also be applied to cryptocurrencies in general. The index as a combination of surveys, social media, momentum, trends, volatility, and dominance indicators can serve as a signal to mark the maximum and minimum of cryptocurrency's market circle.

Having said that, no matter how good the fear and greed index is, it ought not to be used alone in making conclusions as regards the market trend since the irrational state of the stock market can linger hence, safety should be the watchword while trading.

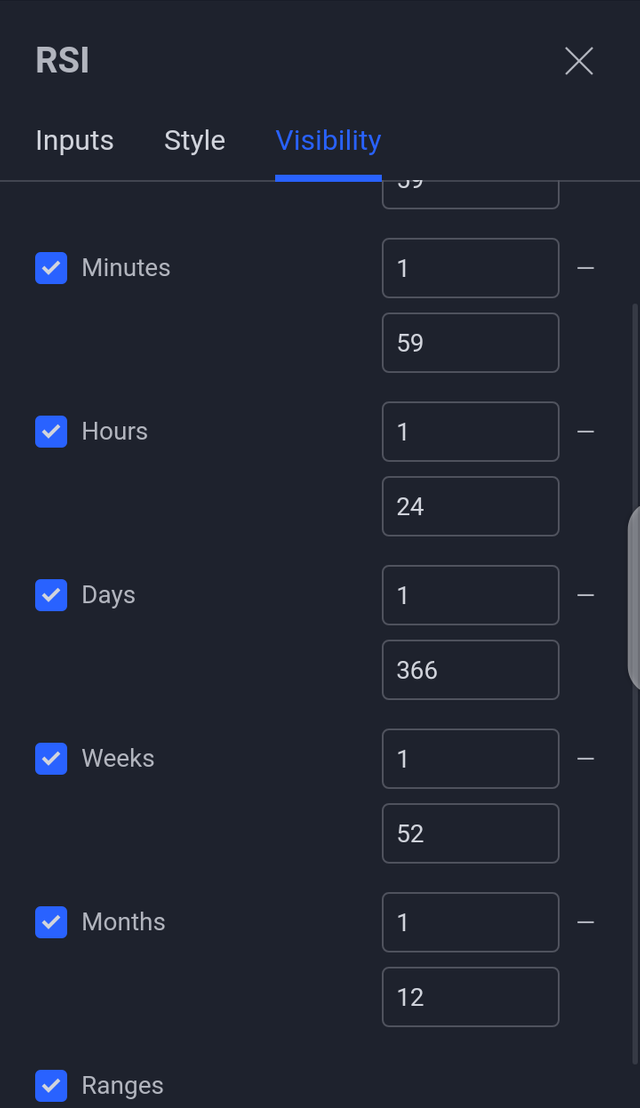

Let's take a look at the the Fear and Greed Indicator and others indicator RSI on TradingView with regards to their various time lengths.

Fear and Greed

RSI

Comparing and contrasting the time length of the two indicators, we observe that the RSI provides traders with multiple time choices ranging from 15mins to any time range as desired by a trader, but the fear and greed index provides a trader with limited time rage. On the other hand, the time range provided by the fear and greed index is unacceptable unlike the RSI time range which can be adjusted to one's desire. To this end, in respect of the time range, fear and greed index can be detrimental as long as trading is concerned.

I will be using Stochastic Indicator along with the FGI my analysis.

The range of the Stochastic indicator is between 0 and 100, having 0 to 20 as oversold and 80 to 100 as overbought. Using both Stochastic and Fear & Greed at a time that the Fear & Greed exceeds 60 but below 100 indicates that it is an emotionally greedy period hence, the Stochastic should be exceed 80.

Making analysis of the emotions for the past three days, I observed the previous week's chart on the Fear and Greed Index. On the 6th day of October, being three days ago, the Fear and Greed Index is seen to be 76 indicating that greed emotion.

As at the rime of compiling this article, 09-10-2021, the Fear and Greed Index is seen to be at 72 and this is a little drop of the greed market.

Going to the Stochastic Indicator to check on BTC/USD using TradingView. It is observed the %K line and %D line exceeds 75 indicating overbought on BTC.

From all indications, there is a probable reversal and a decline in the price of BTC. As for my trade, I couldn't execute trading as a result of some circumstances that were beyond my control.

The trader's emotions has been observed to have a great influence on the prices of cryptocurrencies, and the fear and greet index serves as a tool for measuring such emotions though being new. However, a good knowledge of emotions can help traders make the most trading. Notwithstanding, no matter how good the fear and greed index is, it ought not to be used alone in making conclusions as regards the market trend since the irrational state of the stock market can linger hence, safety should be the watchword while trading.

Thanks to you professor @wahyunahrulfor the lesson