Image made from canva

It feels great to be a part of this week's lesson, and I want to thank you professor @lenonmc21 for introducing such real-life applicable lesson that is very impactful. To all of you my fellow steemian and crypto academy students I say welcome. The topic of discussion is Capital Management & Trading Plan so let's get started.

The trading plan refers to a systematically laid-down technique for specifying and trading assets that encapsulates what should be done, when, how, and objectives of doing it. It also comprises and takes cognizance of time, personality, investment goals, risk management statutes, as well as the system of trading. This is to say that a trading plan is a diagrammatic outlay of the means by which a trader will execute a trade, comprising of the condition that will surround the trade, a comprehensive and elucidated means of position management while in trade, the extent of position that would be taken, the kinda assets worth trading as well regulations on when/when not to trade.

A trading plan helps mitigate negative trading errors, decision-making as well as reduce losses. It can be constructed in assorted ways however, each trader or investor can build or modify it to suit their personal preferences, specifications, or motives. For day traders or swing traders, it can be long and overextended while it is uncompounded for investors that like to make a monthly automatic investment.

Let me start by saying that in the process of decision-making, the trading plan enables the elimination of the emotions of fear and greed in addition to empowering a trader with the proficiency in keeping an eye on performances, taking outcomes into considerations, and redesigning the approach. It offers a regulated environment and an evaluated set of results that allows for making informed decisions.

The trading plan constitutes either the progress or success if it is properly adhered to or the failure of trading if not properly followed, stick to or something isn't right with the plan. This is to say that the success and failure of trading are, to a significant level, tied to the trading plan. If the trading plan is fine-tuned and stuck to, then success is anticipated. The trading plan helps to distinguish trading and discover what is being done right or wrong, and carry out evaluations to have improved performance. Additionally, the trading plan would help discover trading problems and proffer possible solutions as well as to measure results.

Below are three unique elements I think should be found in the trading plan:

- Mindset or Psychology

Trading is known to have various methods hence, it is important that a trader chooses the method that is most suitable to his psychological composition. However, not all category of trading is suitable for every person.

Hence, the trading plan should have well-elucidated objectives that make sense to the user with means or method of execution. It also needs to be comprehensible such that a trader will be relaxed with the method and technology controlling the process of moving the strategy from concept to reality. The trading plan must be trusted by the trader to guarantee constant execution of strategy.

- Risk Management

Risk management is another crucial part of efficiency in trading. It is obvious that trading is risky, that is to say, that any time capital is invested, it is put to risk and this risk is unavoidable however, irrational trading is avoidable. Management of risk is one of the basic aspects for successful trading as risk has been seen to be an element that can change without a hint. Nevertheless, a strong trading plan guarantees productive or efficient utilization of capital despite an unanticipated state of adverse conditions thereby putting the trader in great control over the amount of risk inferred on a particular trade.

- Market Entry and Exit

In trading, it is very imperative to put into work a set of substantial protocols or strategies that regulate market entry and exit. Executing trade is quite simple but the procedure supporting the determination to buy or sell spikes of the achievement. Consequently, a trading plan consists of an achievable method that exhibits the market entry and exit thereby promoting consistency and efficiency of trading, creating a track record that can be statistically verified, as well as mitigating the effects of fear and greed on the capacity to make a profit.

Practical

- Risk Management

I will have to find out skepticisms that seem to pose a danger on my trading capital utilizing my trading plan. Since I know that the trading plan could contribute to the success of trading, I will stick to it and make use of trading the methodology I am conversant with. To be on the safe side and avoid false signals, I will deploy at least two personally-trusted indicators.

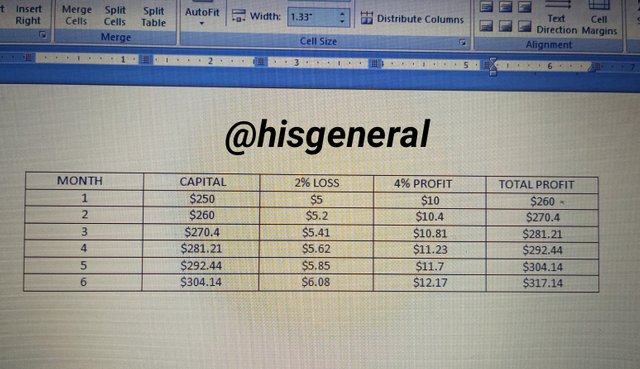

- Capital Management

*I will need to apply wisdom and put certain things into consideration in order to judiciously utilize my capital. With regards to my risk aversion, out of my capital of $250, I am willing to map out a maximum 2% loss. On the other hand, the span of percentage profit will be 4%

- Trading psychology

It is imperative to have a clue of the nature of the market, as well as one's risk aversion good perspective. Though I would be a bit curious, it was quite helpful to put my emotions to check and stick to my trading plan.

Trading plan has been seen to have a great influence on the trading as the success or failure of trade is, to a great extent dependent on trading plan. However, it is important for traders to stick to their trading plan whatever the case may be. In addition, the trading plan helps to bring our emotions to check promoting improved focus and increased risk management.

A big thanks to you @lenonmc21 for the lesson