Background

BackgroundINTRODUCTION

Before I proceed, I will like to talk on what staking has to do in the cryptocurrency market? Literally, Staking can be refer to as the act of wagering something valuable in placement for an outcome of a reward. Similarly, Staking in cryptocurrency can be known as a state of one depositing a particular amount of money which might be in a crypto assets into a cryptocurrency wallet which are set aside and locked up within a particular period of time with the aim of gaining reward in return which might return as liquidity.

These process takes places on a proof-of-stake blockchiain transactions Proof-of-stake has been a helpful tools in a decentralized platforms because it helps to ease transaction in it. In staking, while you are sleeping the cryptocurrency you invested on will work for you with earns.

Therefore, with that in mind, In this homework task, I would be staking in TRON FAMILY EXCHANGE WITH MY TRUST WALLET

(TRON FAMILY EXCHANGE WITH MY TRUST WALLET)

This exchange platform is a decentralized system which most importantly allow staking for it users along with other necessary assistance or facility that can be helpful to it users.

Now, let start up with the process in staking in trust wallet for tronfamily exchange:

Firstly, I downloaded my Trust wallet app from Googleplaystore or IOS Store (depending on the operating system you're using) after the necessary registration in the application, I proceed with the following steps below:

STEPS TO FOLLOW:

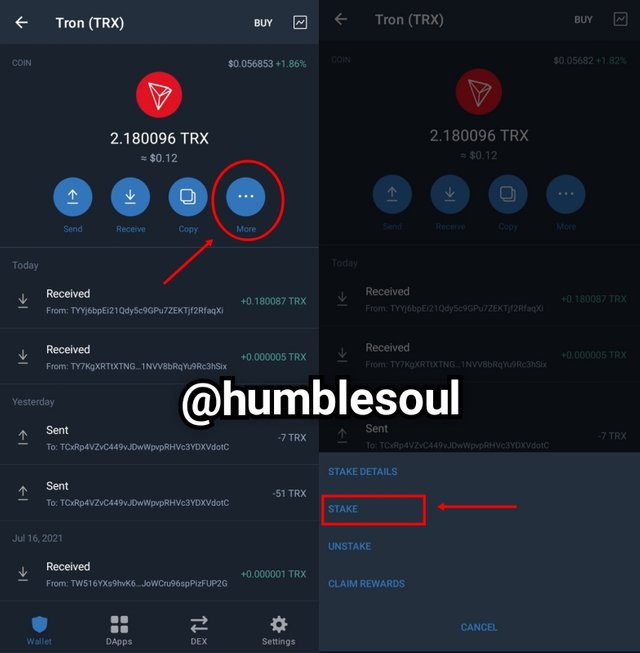

1: Open the application and click on TRON(TRX) on the homepage, then the left-hand-image below will appear, then click on the three straight dotted line for more details.

Based on the right-hand side image above, when you click on the three dotted lines as aforementioned, the box will appear then you will click on STAKE.

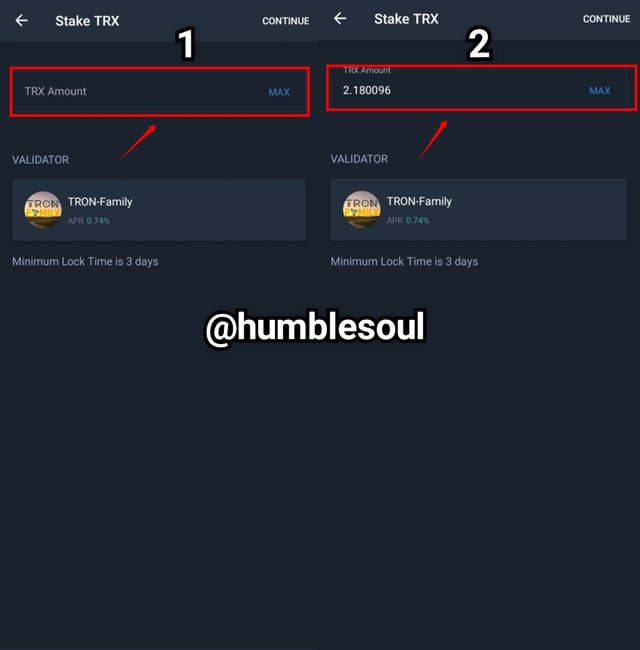

2: Following the pervious step, the box below will appear with a gap to fill in the amount of Tron you will be staking on.

From the right-side image, I filled in the least amount i have in my wallet and I clicked on CONTINUE to proceed.

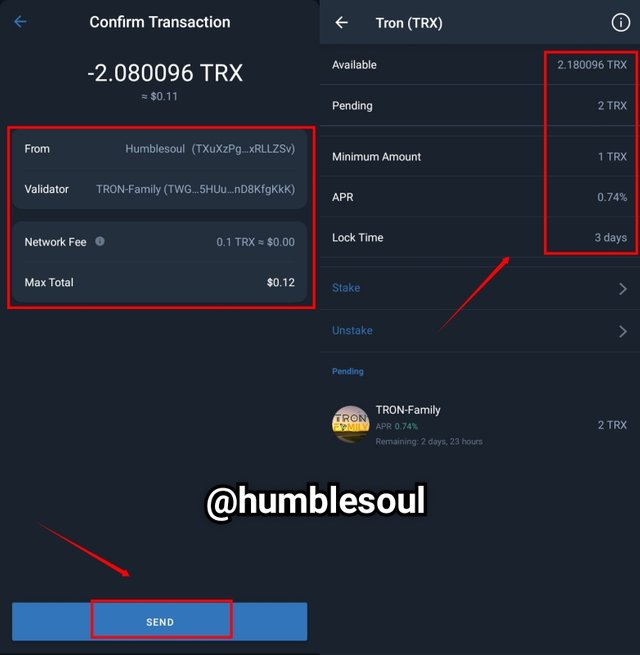

3: Confirmation box will appear which contains in full staking details for that coins and at that particular time then you will Click on SEND to finalize and wait for reply.

.jpg)

Based on the right-side image above, the details summary of the stake will save in the history area of the coin.

MY STAKE APR FOR TRONFAMILY EXCHANGE IS:

- The Daily Interest: 2 TRX

- The APR: 74%

- The Daily Interest Rate: 0.2 (i.e. 74 divide by a year of 365 day)

- The Interest which is 2 Tron multiple by the interest rate of 0.2 gives us: 0.4

- the figure from the interest and the rate give us 0.4 multiple is by 365 of a year gives us: 146 Tron (8.206480 US Dollar)

PICK 3 CRYPTOCURRENCIES AND PERFORM A 7-DAY AND 30-DAY TECHNICAL ANALYSIS. DRAW TREND LINES AND DESCRIBE WHETHER THE COINS ARE IN A CONTINUATION OR REVERSAL PATTERN. TAKE SCREENSHOTS

On this, I will be using the BTC/USDT, TRX/USDT and STEEM/USDT to analyze it markets state and behavior and reveal other important details under the days and month requested for in this homework task:

1: BTC/USDT (7-DAYS ANALYSIS)

Based on the image above, the assets charts is a a one week duration of BTC/USDT and from the chart we will understand that there was a bullish period during that time which prompted an uptrend in charts along that new high were created although after some period of time there was a roll over that double the candle patterns and lead to the downtrend phases as we see in the charts.

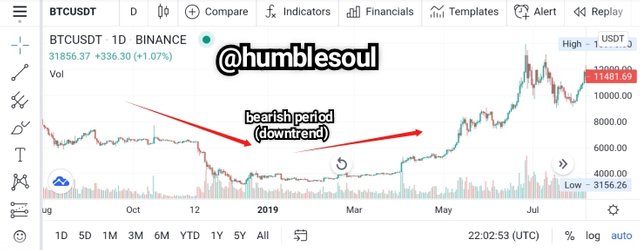

1: BTC/USDT (30-DAYS ANALYSIS)

Based on the image above, the chart shows a 30- days analysis of BTC/USDT, from the charts there was a period of bullish (Uptrend) although during a particular phases, there was a reverse of the uptrend heading downwards as to downtrend (Bearish period) shows a fall in the coins charts.

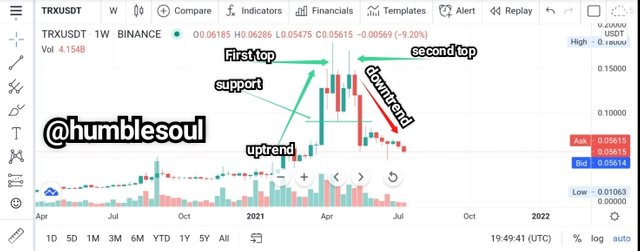

2: TRX/USDT (7-DAYS ANALYSIS)

From the chart, We can see the 7 days chart period of TRX/USDT which was miraculously moving during the months of April-May but as time goes by, the otherwise took place in the senses that it turned bearish during the second top notch of the trend movement, though there was a support period, it was noticed and according to statistics that during the raise of the uptrend that they was a great take-profit phase which turned the tables upside down.

2: TRX/USDT ((30-DAYS ANALYSIS)

Based on the above chart, we first notice a signal that appeared in the TRX/USDT candle chart that creates an expectation of the chart or coins uptrend movement (Bullish) Currently, on the chart we can see that the coin reflecting on the chart shows a downtrend period which is signifying a resistance level.

3: STEEM/USDT (7-DAYS ANALYSIS)

From the chart above, we can see the STEEM/USDT 7-day chart market data, during the month of march there was an increase (Uptrend) period which lead to the tremendous chart lift, although there was a little downtrend that was surpassed by current downtrend period.

3: STEEM/USDT (30-DAYS ANALYSIS)

The chart above shows a 30 days chart of STEEM/USDT which currently is falling to the least rate (too bad) , from the chart I noticed that the coins hasn't been on a steady uptrend movement. but hopefully it will uptrend in the near future.

All screenshot are from Tradingview

HOW CAN WE DIFFERENTIATE A BEARISH SEASON FROM A BULLISH SEASON IN THE MARKET

BULLISH SEASON

Simply put, this is known as a price raise season, This is a time when an investors or trader is always eager to see because it a time to cash out or take-profit from an invested cryptocurrency or asset, this time can also be called an uptrend season, Whenever this period takes place, it signify that the demand of that said cryptocurrency is high or that there have been a huge whale that has invested on the crypto coin.

Example of a bullish trend:

BEARISH SEASON

There is a time to laugh and a time to cry with that in mind, This seasons is when a prices of a cryptocurrency is falling at it dip which at most time it falls off it balance. Whenever, the supply of this coin is greater than otherwise this shows that the take-profit time has occupied the market gap. When this occur if an investor or trader is not careful might loose a huge investment to the least.

Example of a bearish Period:

All screenshot from Tradingview

CONCLUSION

Staking is a good tool that can be of benefit to investor who has keen interest in multiplying it investment however whenever one is involved in such, The need to analysis the market behavior is vital. since staking can be done on a decentralized platforms it can go a long in profit making. The lecture has really explored my knowledge on how a technical analysis of chart can be fully dealt on. Thank you professor @imagen for your well-detailed lecture, I hope to learn more from you.

Hola @humblesoul, lo siento mucho pero el tiempo de la tarea había expirado, te invito a que leas las reglas para la próxima asignación, éxitos

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Please professor @imagen, my laptop was faulty and I lost my access to login into my steemit account, i just did that yesterday.

Please sir, do reconsider my entry and have mercy on your student .

It's disheartening to complete your assignment and at end because of unforeseen occurrences is not reviewed.

Cc:@imagen.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit