Background

BackgroundINTRODUCTION

In the cryptocurrency market, there are techniques that helps traders or miners in trading on the market chart, Perhaps those tools which enable them is known as indicators, There many types of indicators used by the trader of each I will be explaining one of them which is CCI this is an elision of Commodity Channel Index. These deals on the calculation that takes place in a specific duration or time between an average price tag and an actual current price that reflects on a chart of a particular cryptocurrency. This Indicator has a formula that is been followed in the system which specifically works on searching out bifurcation in a market chart. Now, I will proceed with the questions line-up for this task.

OPEN A DEMO ACCOUNT ON ANY TRADING BROKER AND SELECT FIVE CRYPTOCURRENCY PAIRS

According to the instruction, I will be using Trading view platform to connect with the Paper trading demo account I created, I have already registered my email and other necessary details with Trading view for an easy navigation process.

MY TRADING VIEW HOMEPAGE CONNECTED WITH PAPER TRADING

From the image above, You will understand that the Paper Trading Demo account has successfully be connected that is why at the right side of the image, you can see an account balance of 100.000.00 with an Equity of 100.000.00 with no open profit made yet, this is to say that there is non actual transactions made in it.

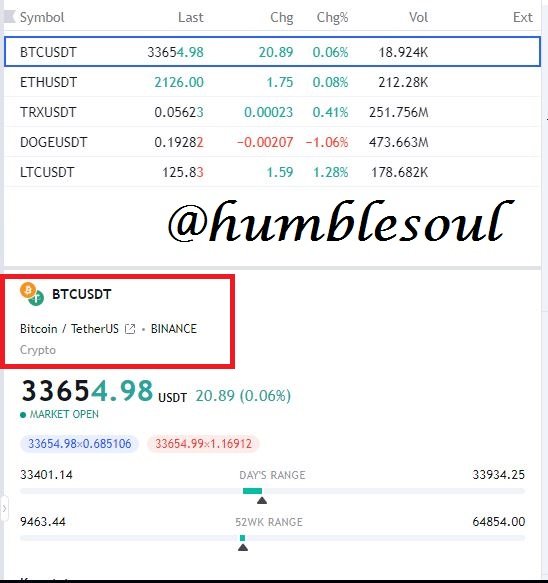

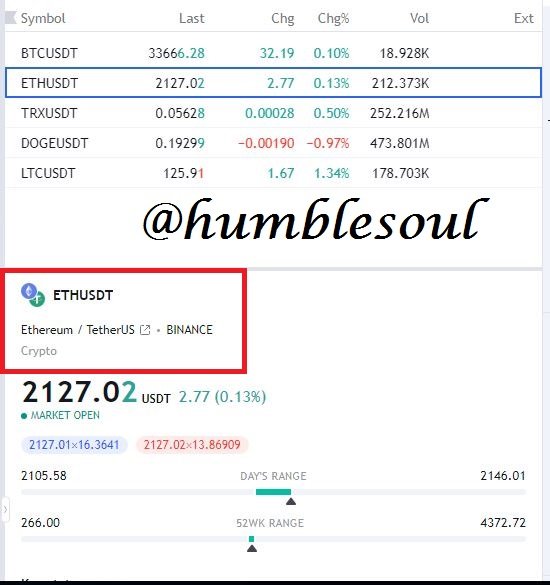

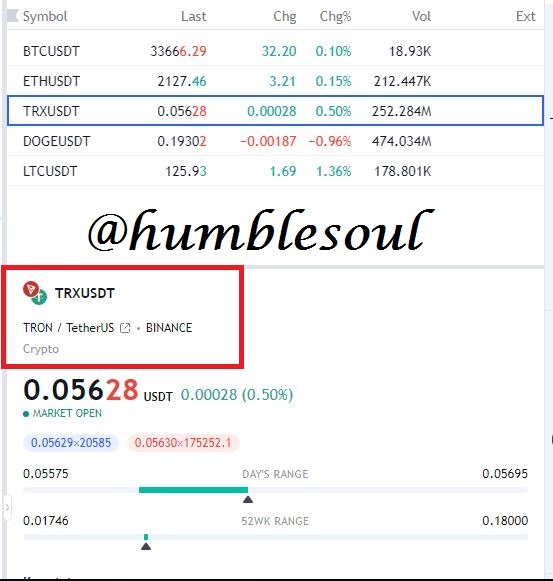

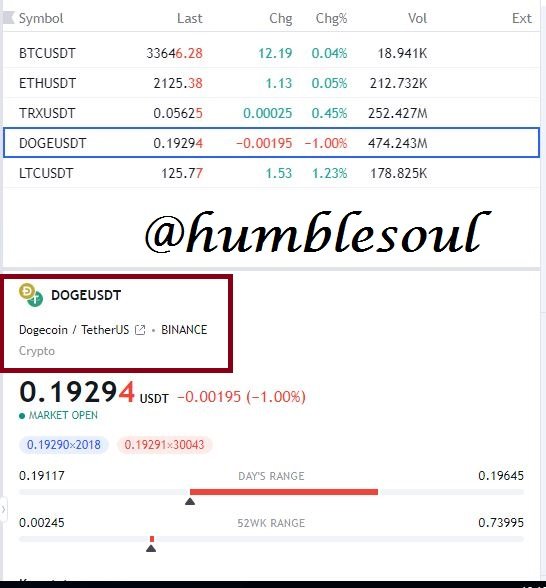

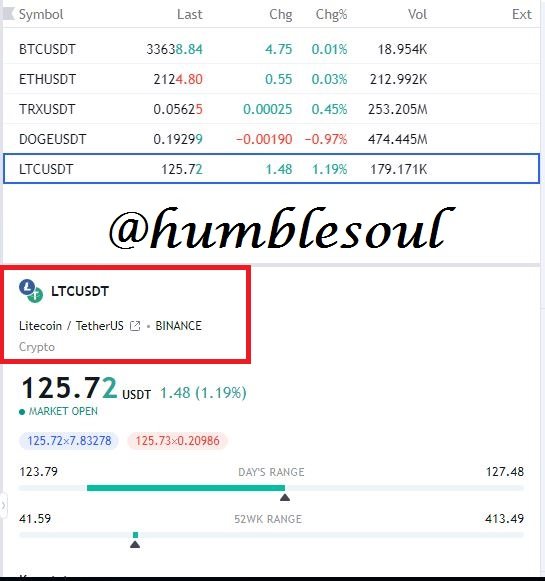

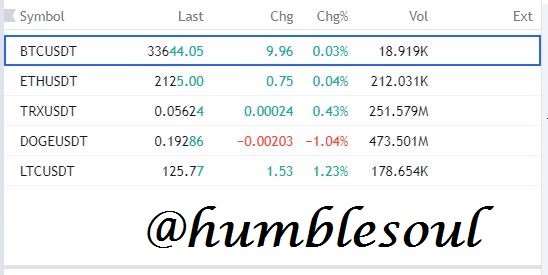

THE CRYPTO PAIRS DESIGNATED

From the image above, I have designated the following coins:

Bitcoin /Tether US (BTC / USDT)

Ethereum / Tether US (ETH / USDT)

Tron /Tether US (TRX / USDT)

Doge / Tether US (DOGE / USDT)

Litecoin / Tether US (LTC / USDT)

CREATE A MARKET ENTRY AND EXIT STRATEGY

In this, CCI is the indicator we are using but much reliance won't be given to it because the possibility of failing is there (man-made). However, since the cryptocurrency market system can't fully be trusted, there are other related helpful tips and indicators a trader can implement whenever a trading plan is about to begin to avoid potential loss or better off gain from it trading.

MASTER-PLAN

In order to reduce the loss which might happen in a trading and weight more on the profit arena, I professionally utilize my tools for trading along with a well-detailed analysis of the chart before I proceed with any trading activities.

APPROACH STRATEGY

- I need to carefully analysis the market chart to identify it objective as to the price movement, and of which is best to invest or trade on it. Although it might take much technically analysis in order to get them notified, it will be of best concern to the trader to take such step and fully detail his or her involvements in the market so that at the end of the trade duration, loses that are found can be handled accordingly and benefits will lay on the trader not for the market.

EVACUATION STRATEGY

- As a trader, a price limit is expected to be tagged at any investment or trade process of which when such limits hits, withdrawing from the market will be of more profit than loss to the trader. At some point, a trade which was backed with an awe expectation might begin to diminish from it profit rate therefore the doorway is the best option for a trader in such circumstance.

ILLUSRTATION BASED ON BTC/USD (1HOUR)

From the chart above, you will understand that the market has not been stable for this coin, that is why their is always a down and up trend movement, but later par shows when the raise of the coins is up trending. Looking at the CCI indicator gives hope of an uptrend in the coin market before a reversal trend period will take place. The stoploss had a figure target of 1.5.

USE THE SIGNALS OF THE COMMODITY CHANNEL INDEX (CCI) TO BUY AND SELL THE COINS YOU HAVE SELECTED

TRADE 1: DAY CHART OF BTC/USDT

From the chart above, the CCI Line shows that there has been a increase in sells which has made the coins to downtrend and not been stable. Looking at the chart risk level has increase which as a trader I need to carry out my investment before time befalls me.

TRADE 2: DAY CHART OF TRX /USDT

From the chart above, We will understand that the coin has been sold out at most time which has made it to have downtrend phrase, the chart also showed the period where little uptrend took place but later signify that the rate of risk might increase.

DECLARE YOUR PROFIT OR LOSS

From the account summary above which is from trading chart, shows that an investment which started with the amount of 100.000.00 at the end give me a total of 99 973.9 which means that I had a loss of 0.0261 from the trading in order words no profit was made.

TRADE MANAGEMENT TECHNIQUE

As a trader, the need to monitor my trading activities is essential, this is because the inspiration to earn big from the trading is always part of a traders and if cautions are not taken, the trader might be bank-robed based on his ambitious expectations.

Therefore, While trading, stop limit are expected to tagged at any trading process to avoid harsh lost.

As the cryptocurrencies market system flood with more users, Now is the time for a trader to technically and fundamentally analysis any trading engagement.

CONCLUSION

The invention of indicators have been a helpful tool to traders in the ecosystem because it ease the stress involved in brain-stressing one self while trading Infact this can be of aid to analysis market movement and technically handled any issues related to it by a trader. During this class, I will amazed to realize that a demo account can be created by a trader in order to test-run it system and possible benefits, Thank you for bring such great lessons to me, once more I say thank you professor @asaj for your well-detailed lecture, I promise to learn more from you in your next class.

Hi @humblesoul, thanks for performing the above task in the fourth week of Steemit Crypto Academy Season 3. The time and effort put into this work is appreciated. Hence, you have scored 5 out of 10. Here are the details:

Remarks:

You did not provide the level of depth that we look out for in the academy. Also, your work could use another round of proofreading. As a suggestion, make use of the Gramarly plugin. Thanks for the effort Humble John.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit