This week we had the opportunity to practically step into the crypto market as professor @fredquantum taught us Crypto Assets Diversification. This will be my assignment post

Q1. Explain Crypto Assets Diversification.

Don't put all your eggs in one basket We have all heard this countless times but have we practically exercised this? Well if you haven't you must practice this in the Crypto world, to increase your chances of profits and decrease the possibility of losses

This is a strategy implied by traders in the Crypto Market or any other markets in which you invest your capital in different assets. In the Cryptomarket, you do this by investing in more than one coin.

By doing this you increase the profit margin as well as secure your capital as well. For example, you have invested your complete capital in a single coin, and that coin's price decreases, you'll face heavy losses. On the other hand, if you have invested in 5 coins, and one of the coin's price decreases, you'll still have four other assets to cover up the losses.

A question arises here, that, should we blindly invest in 5 coins in hopes of gaining profits and minimizing loss? The answer is NO. The CAD should be done after a complete fundamental as well as technical analysis of the coins you intend on investing in. You should have proper knowledge of the projects, their vision, background, the core team, and use cases. After having the fundamental analysis of the projects you intend on diversifying your capital one more strategy that the professor mentioned in the lecture is the 1-4 Rule

1-4 Rule

According to the 1-4 Rule you should divide your capital investments into at least 4 crypto assets. So for example you have $100 capital, it would be divided into 4 sets, with $25 being invested in each of the four assets. By doing this you will have a strong position in the market as you will have your investments divided into more assets

In the Crypto Market, we can invest in different projects, such as Bitcoin, altcoins, and projects which have different visions and growth potential.

The ultimate goal is to minimize the risk of losses as much as possible by doing proper fundamental analysis and placing stop losses and take profits while trading

Q2. What are the Benefits/effects of Diversifying one's assets?

Let's shed some light on the benefits/effects of the diversification of assets

- Risk Management

The foremost and in my opinion, the most important benefit of asset diversification is minimizing your loss in case the market doesn't follow what you anticipated.

- Reduced Profits

With benefits come side effects. This is the exact case with diversification as well. While minimizing losses for a trader it also reduces profits as well. For example, you invested $100 in 4 different assets with $25 each. If one of the assets skyrocketed with an increase of 100% then you'll get a profit of $25 instead of $100 if you had invested all in that particular asset

- Increases Market Exposure and Experience

When you have invested in more assets, you get more information thus more knowledge. To have knowledge in the crypto market is a very important thing. You will be good in analyzing the market. On the other hand, if you had invested in a single asset, you would be overly involved and anxious about that particular asset.

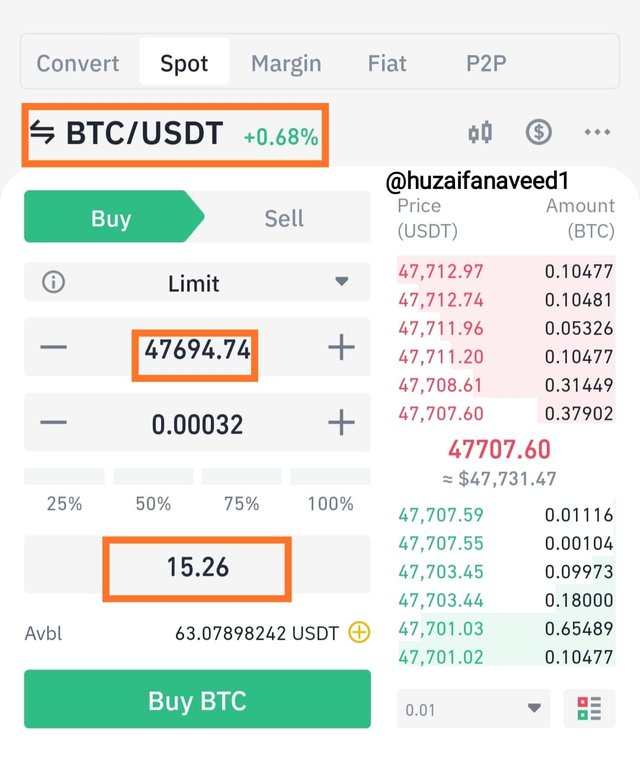

Q3. Crypto Asset Diversification According to 1-4 Rule

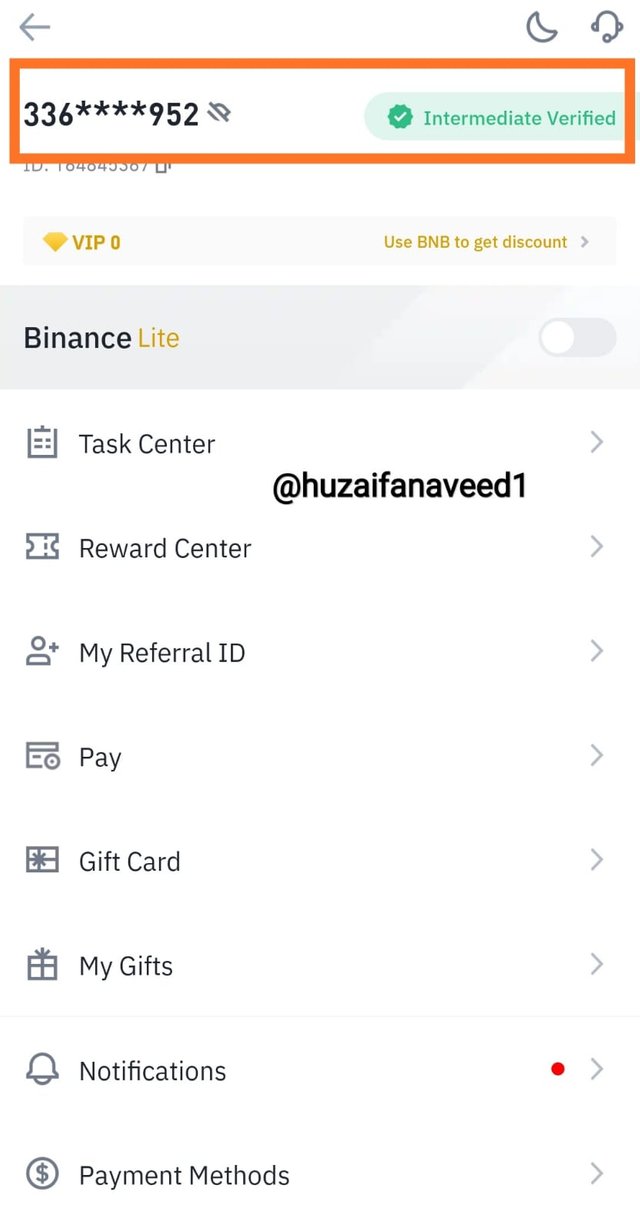

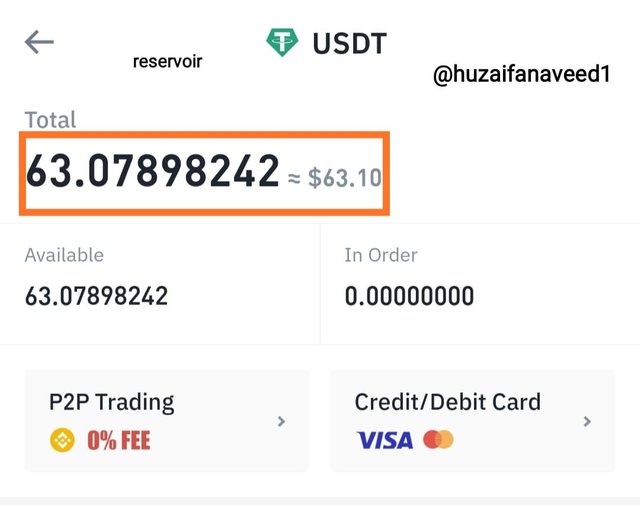

For this question, I'll be first sharing a picture of my Verified Binance Account and my USDT Reservoir

RESERVOIR

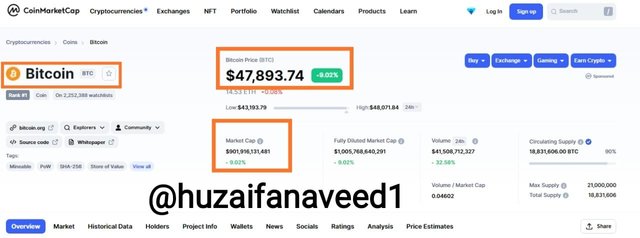

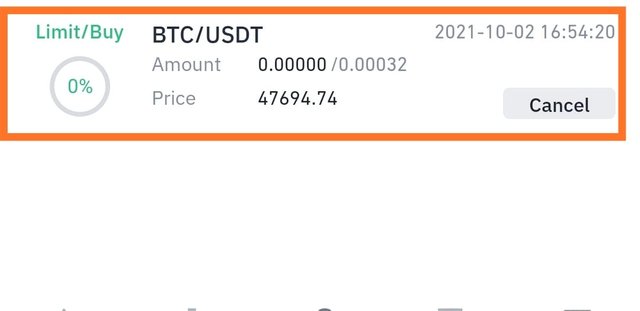

BITCOIN

Fundamental Analysis

It was launched in 2009 by an unknown character Satoshi Nakamoto. It is the world's largest Cryptocurrency as there are no other competitors even close to Bitcoin. It is characterized by its transparent nature, as chances of fraud in bitcoin are close to none. It works on a Decentralized blockchain and is not controlled by a central government or a bank etc. It is spread, traded, and stored all within the blockchain. Bitcoin has been a very successful Cryptocurrency since its invention. Even as of today, things aren't in much favor of bitcoin as it is going through a bear market, but still it is WAY ABOVE ANY OTHER CRYPTO COIN

BTC increased in price today as it is worth $47k at the moment with a Market Capitalization of $9 Bn

Technical Analysis

Bitcoin's price experienced a hike today as it raised from $42K to $47k and it is expected to break the next resistance that is around $53k

I observed and had my entry trade, by taking help with the William %R indicator.

Entry: $47,694

Stop Loss: a close stop loss above the support: 42.2K

Take Profit: 51k

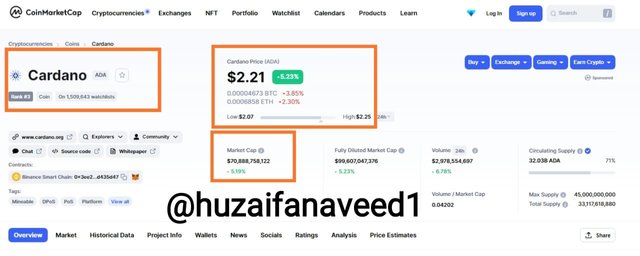

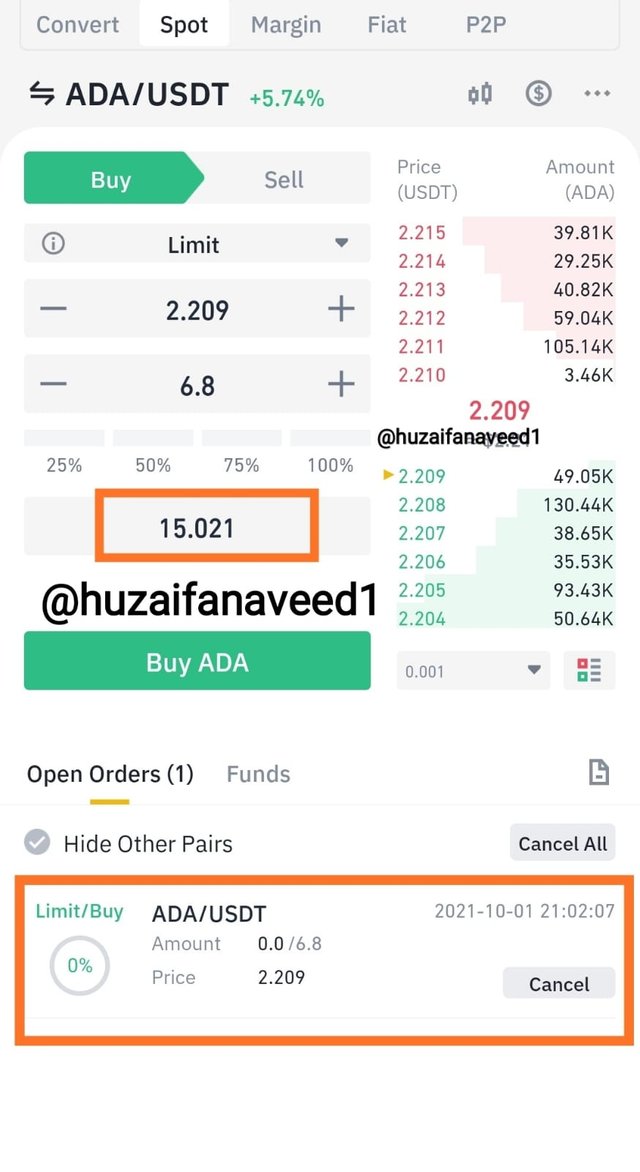

CARDANO (ADA)

Cardano (ADA) was developed by Charles Hoskinson, who is also the Co-founder of Ethereum blockchain, in 2015 and launched in 2017

Fundamental Analysis

Cardano (ADA) is a decentralized third-generation blockchain system with the objective of resolving the scalability issues associated with first and second-generation coins such as; BTC and ETH

It works on the Proof of Stake system which is significantly better than Proof of Work. In PoW immense amounts of energy is consumed in which miners have to sell their tokens. The Cardano blockchain overcomes these issues with the PoS in which the miners have the mining power according to the percentage of coins that they have held. The traders who have ADA coins also have a stake in the Cardano network in which they can get rewards for staking. This is one of the reasons why ADA attracts traders for investing in this coin.

Scalability

Cardano (ADA) has Excellent Scalability. Cardano has improved its Scalability by developing two layers, which are, Settlement layer and Computational layer, through which it offers unlimited scalability and very fast transactions.

Compared to ETH 15 transactions/sec, ADA is way ahead of ETH

Technical Analysis

There's a strong support level at $1.97 and it has rebounded upwards since. Taking indication from the Williams %R indicator I see a strong move towards the overbought conditions. I have placed my entry with stop loss and take profits at R: R (1:2)

Entry: $2.2

Stop Loss: $1.9

Take Profit: $2.74

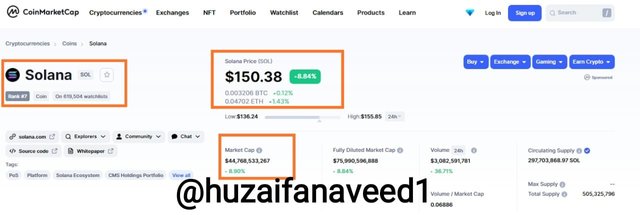

SOLANA

Fundamental Analysis

Solana has attracted a lot of traders recently with its price hiking within the last two months. The Solana ecosystem is a very strong one. It will only be a matter of time that it will be in direct competition with Ethereum. Furthermore, SOL has an extremely high transaction speed.

Currently, Solana has the price of $153.40 with a Market Capitalization of $45B

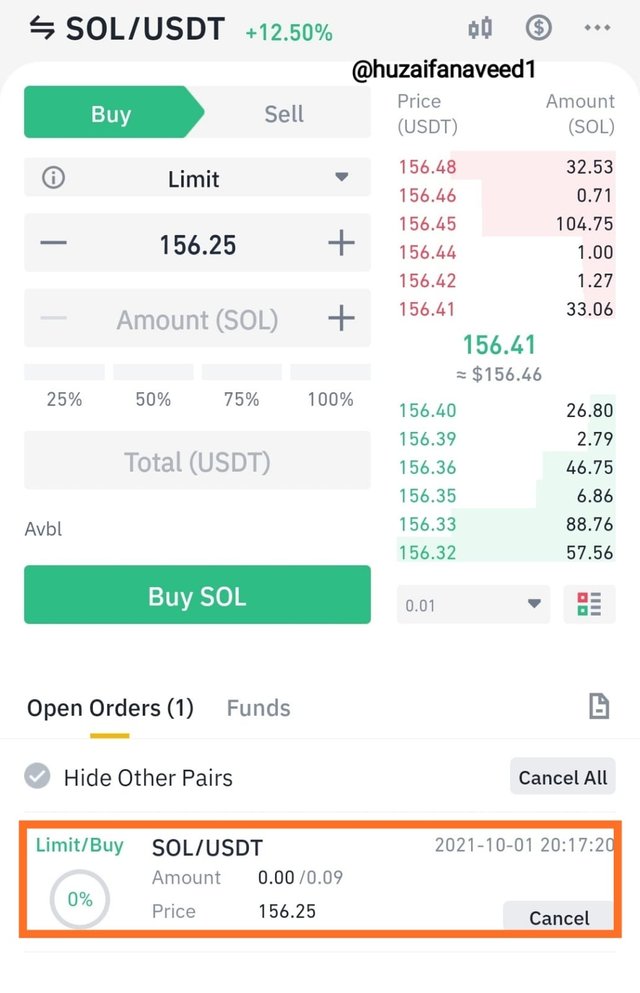

Technical Analysis

According to the technical analysis, Sol has rebounded from its major support level. Its price has raised today, as we also noticed Bitcoin raised as well. With the Williams %R indicator at my aid, I see the line is approaching the overbought conditions, so it is a good time to invest in this coin.

Entry: $156

Stop loss: $122.5

Take profit: $215

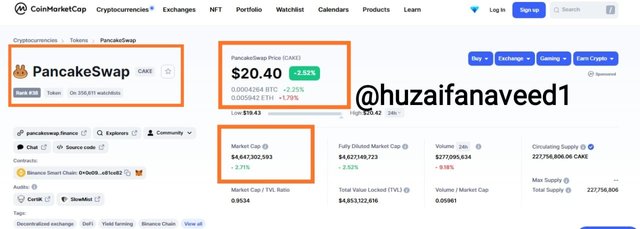

PANCAKESWAP [CAKE]

Fundamental Analysis

PancakeSwap is the world's second-largest Decentralized Exchange after Uniswap. It was launched by an anonymous set of people in 2020 with its own currency known as Cake. The PancakeSwap platform offers multiple benefits to the users which include Staking, Trading, Farming, etc

Cake is a BEP-20 token on the Binance smart chain and it has a good supply as it is not correlated to other coins which means even if the market is on a decline it won't be majorly affected.

Cake currently has the price of $20.41 with a Market Capitalization of $4 Bn

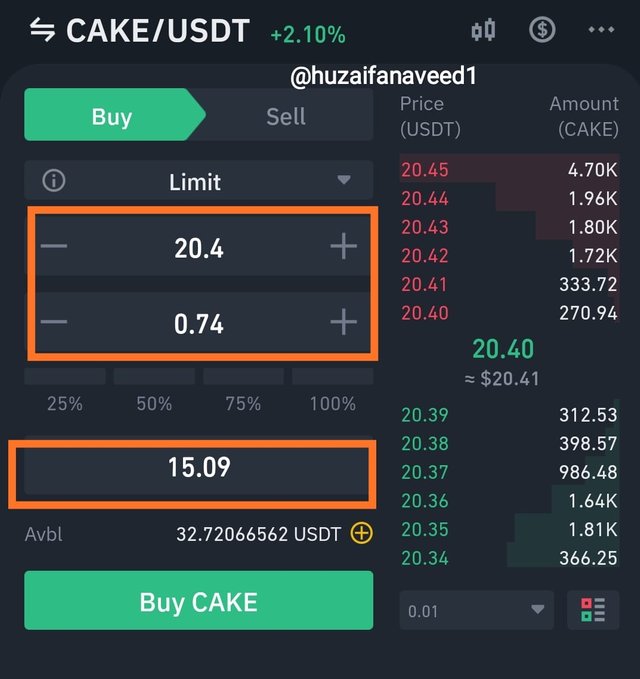

Technical Analysis

According to my analysis, Cake has had a rebound from the support level, and it is now on its way up. Having Williams %R at my aid, I see the indicator approaching the overbought conditions, I invested in this coin.

Entry Price: $20.42

Stop Loss: $17.4

Take Profit: $26

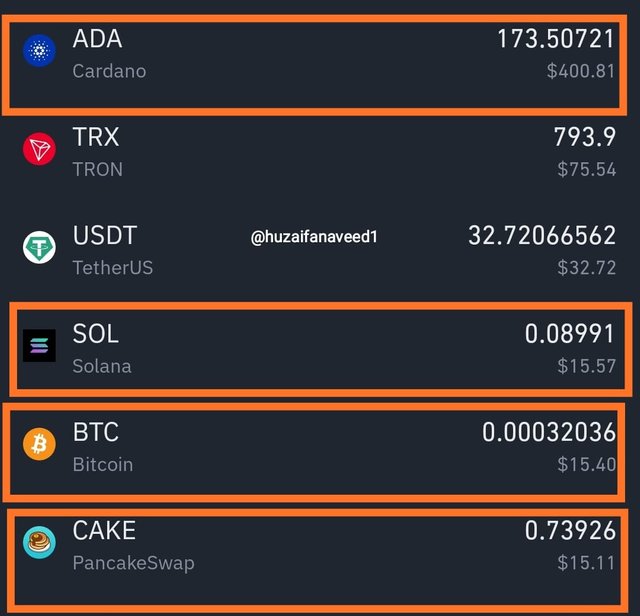

My Wallet After investing

This is the illustration of my wallet after successfully applying the 1-4 Rule according to the Crypto Assets Diversification.

Note: I equally invested $15 in ADA similar to all the 3 other assets I invested according to the 1-4 Rule (as shown in this question) but due to my previous investments in this asset, I have more than $15 illustrated in the above screenshot.

Q4. Explain Arbitrage Trading in Cryptocurrency and its benefits.

Arbitrage Trading is an excellent strategy used by traders where they use multiple exchange platforms to Capitalize on the assets and the difference of prices those assets have in these exchange platforms. Sounds interesting right? Let's understand how.

In Arbitrage trading you buy an asset on one exchange account at a lesser price, then sell that same asset on another exchange platform at a higher price. Through this, you can make small profits in a small period of time. You can also take advantage of Arbitrage Trading with crypto pairs where the price of an asset with a particular pair is lesser while the price with the other pair is higher. Let's discuss the types of Arbitrage Trading below

Types of Arbitrage Trading

- Exchange Arbitrage

Different exchanges have different prices for the assets. You can take this to your advantage and make small profits through this.

- Triangular Arbitrage

In this type of Arbitrage trading, you make use of three assets. You sell the asset that you possess for another asset and then the asset that you bought is sold for the first asset. In this way you can make profits within the same exchange platform due to the differences in prices.

Benefits of Arbitrage Trading

- No Advanced Knowledge Required

For Arbitrage Trading to work for you, you don't need any advanced knowledge regarding the assets or you do not need any fundamental analysis.

- Quick Profits

This is an excellent way of making small quick profits. As you just buy one asset and sell it off in a higher price.

Q5. Discuss with illustration how to take advantage of Exchange Arbitrage.

In this question, I'll be demonstrating the application of Exchange Arbitrage Trading.

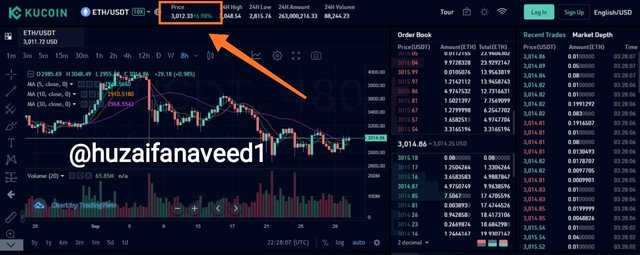

I chose Ethereum on KUCOIN and Binance exchange platform.

Now I will buy ETH/USDT on KUCOIN in which the price is $3,011 and then sell it on Binance on which ETH/USDT price is $3,017

In this way I made a profit of $6 by the Exchange Arbitrage Trading in which I traded the same asset on two different exchange platforms.

Q6. Creatively discuss Triangular Arbitrage in Cryptocurrency. How to identify Triangular Arbitrage opportunities and the risks involved

Triangular Arbitrage in Crypto Market involves 3 assets, which can be within the same exchange platform. There is a price difference between these assets through which the traders make profits.

Illustration of the Triangular Arbitrage Trading

I'll be using three assets for this illustration which are:

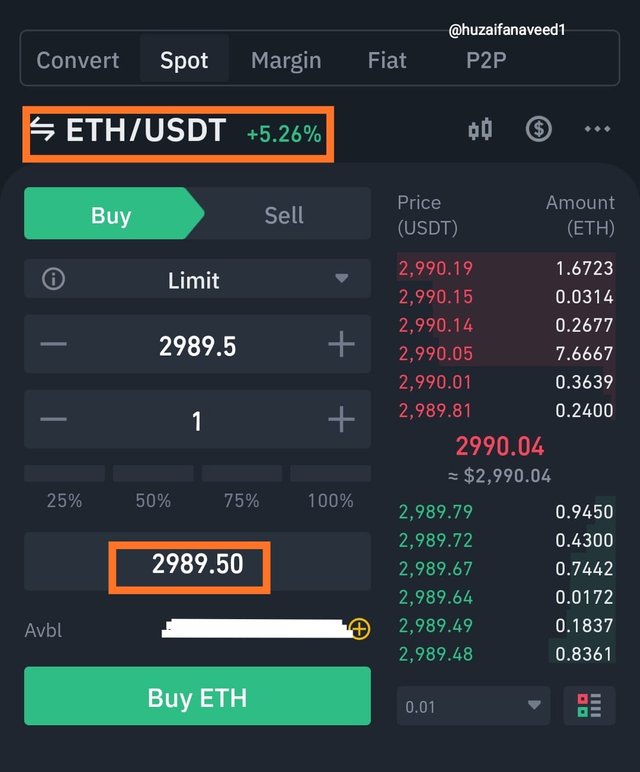

- ETH/USDT

- USDT/EUR

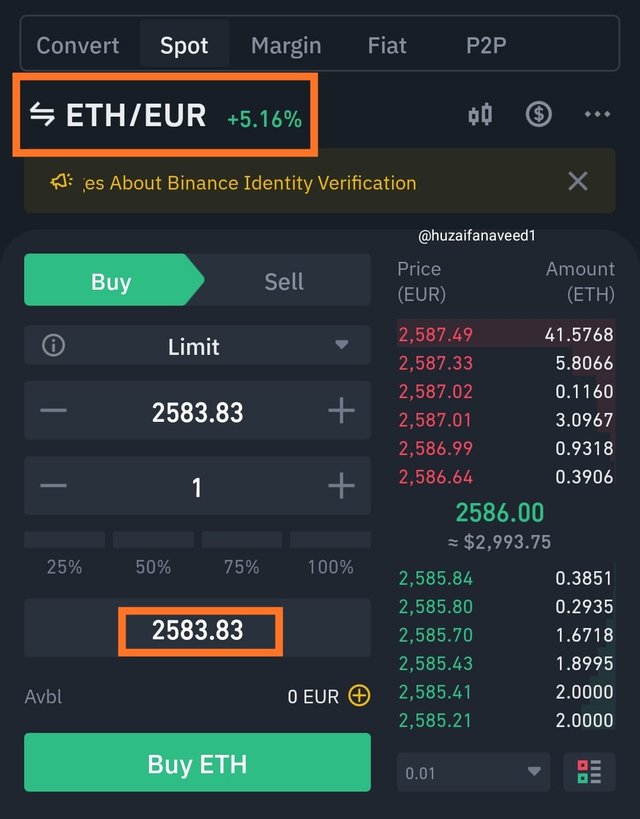

- ETH/EUR

- The trading price ETH/USDT = $2989

- The Trading Price of ETH/EUR = €2583

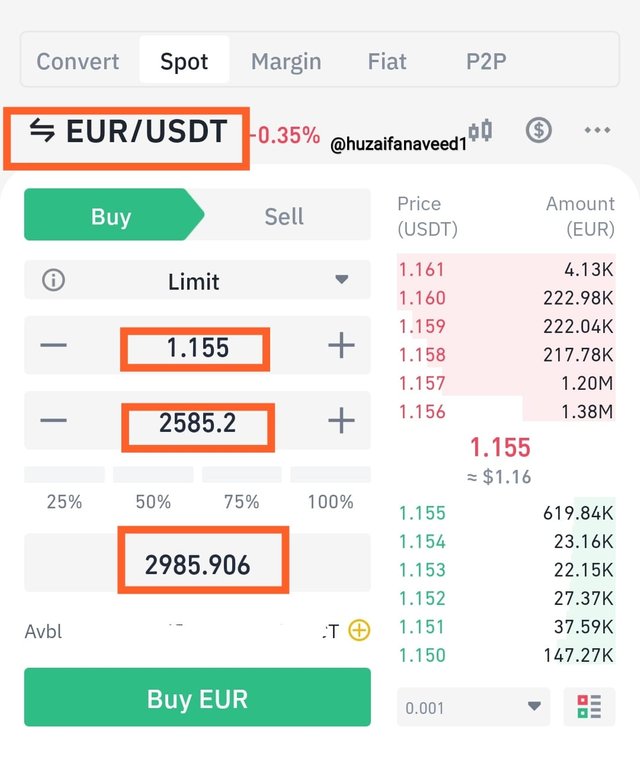

- The Trading Price of EURO/USDT = $1.155

Cross Rate

- 1 ETH = $2,989 = €2583

Now for Triangular Arbitrage:

- ETH/USDT

For the first trade we would sell 1 ETH for $2989

EUR/USDT

For the second trade, we would buy Eur with the USDT. For $2989 we would get €2588 at the rate of 1.155

ETH/EUR

Now for my third trade, I would buy ETH again against EUR at the rate of €2583

Due to Triangular Arbitrage Trading, I was able to make a profit of 5 EUR

Risks Involved:

- The fluctuation in the market might change the rates within minutes si this sort of trading should be done quickly.

- if there is less liquidity, you trade might take more time to take place due to which you might not get successful in getting profits through the Triangular Arbitrage.

Crypto Asset Diversification is a very useful strategy which is used by the traders for risk management. It is necessary to minimize your losses while trading in the market.

Other than that we learned about arbitrage Trading and how important it is for traders. Arbitrage Trading is not that simple. You have to be cautious of the market volatility and liquidity in the market as well, so that you do not suffer through losses. No matter what strategy you use, risk management is very important.

This was an interesting lecture professor.

Thank you

ps; All pictures are taken from Binance.com kucoin and Tradingview

Regards,

@huzaifanaveed1