Hey there everyone. A warm greeting to professor @allbert and everyone reading this

This week's lecture focused on DCA, White paper,Solid Projects, garbage coins and much more

Lets jump on to my assignment without any further ado.

Here we go:

Q1

For this question I'll be doing a complete fundamental analysis on Cardano (ADA) and Polkadot (DOT)

CARDANO (ADA)

Cardano (ADA) was developed by Charles Hoskinson, who is also the Co-founder of Ethereum blockchain, in 2015 and launched it in 2017

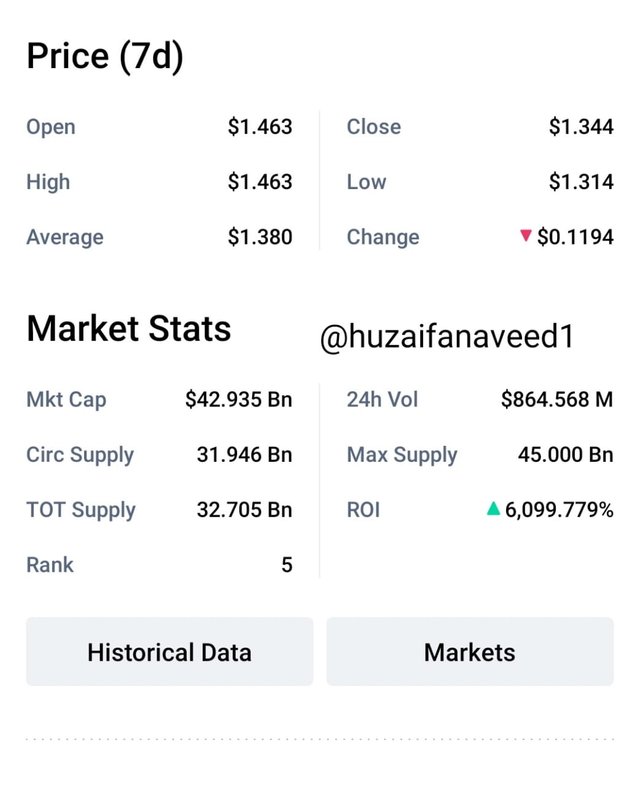

With a Market Capitalization of $43 Billion and a circulating supply of 31.9 Billion ADA stands on the 5th position in the market ranking

overview of ADA

Fundamental Analysis

Cardano (ADA) is a decentralised third generation blockchain system with an objective of resolving the scalability issues associated with first and second generation coins such as; BTC and ETH

It works on the Proof of Stake system which is significantly better than Proof of Work. In PoW immense amounts of energy is consumed in which miners have to sell their tokens. The Cardano blockchain overcomes these issues with the PoS in which the miners have the mining power according the percentage of coins that they have held. The traders who have ADA coins also have a stake in ghe Cardano network in which they can get rewards for staking. This is one of the reasons why ADA attracts traders for investing in this coin.

Imagine you went to a Mart to buy a washing machine. In front of you, you see two machines. One, from a very famous company which has a history of making good machines, with good warranty and with a recognised team. Second, a machine from a company you've never heard about before. You don't know anything about it's manufacturers or anything related to it. Which one would you prefer buying? I'd be buying the first option for sure.

similarly, before investing in a coin in the Cryptomarket we need to have prior knowledge about that particular coin of how secure is it. Is it trustable or not and many other factors. Lets discuss them below:

Trustworthy Development Team

Developed by Charles Hoskinson who's also the Co-founder of Ethereum, which is on the 2nd position of the Cryptomarket, Cardano (ADA) had already a lot of demand in the market. Furthermore the development team also has an advanced blockchain system.

Scalability

Cardano (ADA) has Excellent Scalability. Cardano has improved its Scalability by developing two layers, which are, Settlement layer and Computational layer, through which it offers unlimited scalability and very fast transactions.

Compared to ETH 15 transactions/sec, ADA is way ahead of ETH

Security

As mentioned above, Cardano (ADA) works on the Proof of Stake consensus which has increased its security. Cardano has a modified PoS protocol known as Ouroborus which has increased its security.

Analysis on ADA chart

Since the start of 2021 things have worked out for ADA except for the last month as we've seen a bear market.

In the first two months of 2021 the price of ADA increased by 720% according to capital.com

In march, ADA was listed on coinbase.com which further increased its price.

Since the start of June, ADA's price started depreciating because of BTC. ADA is an altcoin. As any other altcoins, which are correlated to BTC, the price movement of BTC affects the prices of Altcoins alot. If the prices of BTC increase, ADAs price will increase as well. If it decreases, ADAs price will depreciate as well.

Currently ADA is facing a bear market trend with a price of $1.3 But still if you compare ADA since its start of 2021 to its prices in 2020, it's price has raised significantly

current price of ADA

PolkaDot (DOT)

Polkadot was founded in 2016 and launched in May 2020 by Gavin wood who is also the former Co-founder of Ethereum.

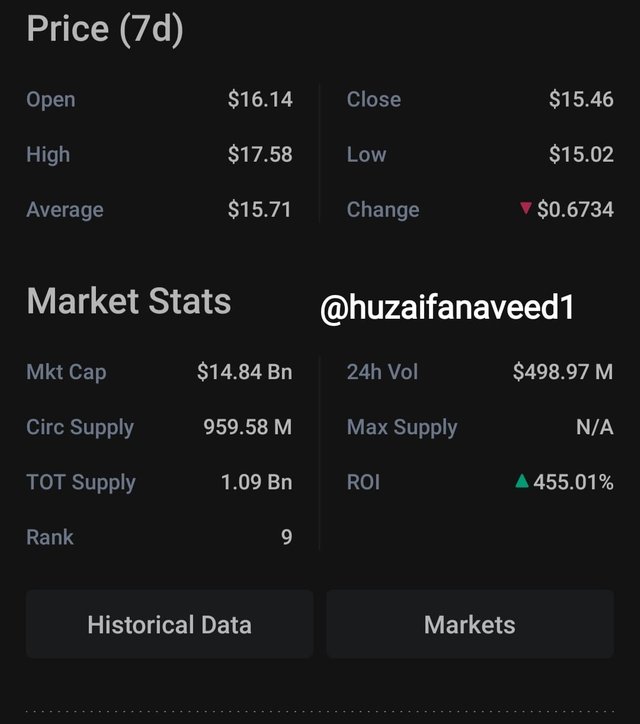

With a Market Capitalization of $14.84 Billiom and a circulating supply of 959 Million it stands on the 9th position in the Cryptomarket.

overview of DOT

Fundamental Analysis

Polkadot works as an open-source sharding Multi-chain protocol with interoperability which allows the cross-chain transfer of tokens as well any other assets between blockchains. Polkadot also works on the Proof of Stake mechanism.

Scalability

As you know scalability has always been a hurdle in the way of a crypto asset. The top two coins in crypto are very less scalable. But in polkadot this issue has been resolved.

Polkadot has Excellent Scalability with over 1000 transactions per second compared to Bitcoin's 4.6 per second, Ethereum's 15 per second and Litecoin's 56 per second.

the only coin more scalable than Polkadot is Tron which can transact upto 2000 per second

Interoperability

Polkadot enables different kinds of blockchain platforms to interchange the information provided on its platform making it absolutely decentralised. Because of this feature, cross-chain transfers of assets is possible on it.

Developing Team

The developer of Polkadot is also the former Co-founder of Ethereum. According to Sanbase.com there are 437 developers creating new protocols on this Network.

Analysis on DOT chart

DOT had a price of $2.90 on late August 2020 with a rise of price in September 2020 to $4.35

By the end of 2020 DOT had increased by 200% reaching $9.2

In 2021 DOT raised significantly as at the start of January it was at $9 and at the end of January it hit $16.12 as more and more traders invested in it.

DOT price increased Significantly in February and it touched as high as $40

As any other altcoin, DOT depends upon the movement of BTC prices alot as well. In February 2021 BTC prices increased which resulted in the hike of DOT price as well.

DOT hit its highest price on 14th May 2021 where it reached to $47.9

Since Late may it's price has decreased and it's currently on $15.46

current price

peak point

Both ADA and DOT have founders who have also co-founded Ethereum.

Polkadot has comparatively better scalability than ADA at the moment and also a better price as DOT open price is $15 compared to ADA's $1.3

Talking of Developing, Cardano (ADA) has the most smart contracts blockchain developers, counting to 469 while Polkadot has 436.97

These both are extremely promising crypto assets with bright future ahead of them. That is why I chose them for a fundamental analysis in this question as well as I have invested in both these coins as well. In the next question I'll be demonstrating the procedure of buying on of these coins.

Q2

In this question I'll be demonstrating the complete procedure of buying ADA feom my verified Binance Account.

First of all, a Verification screenshot of my Binance account.

Step 1

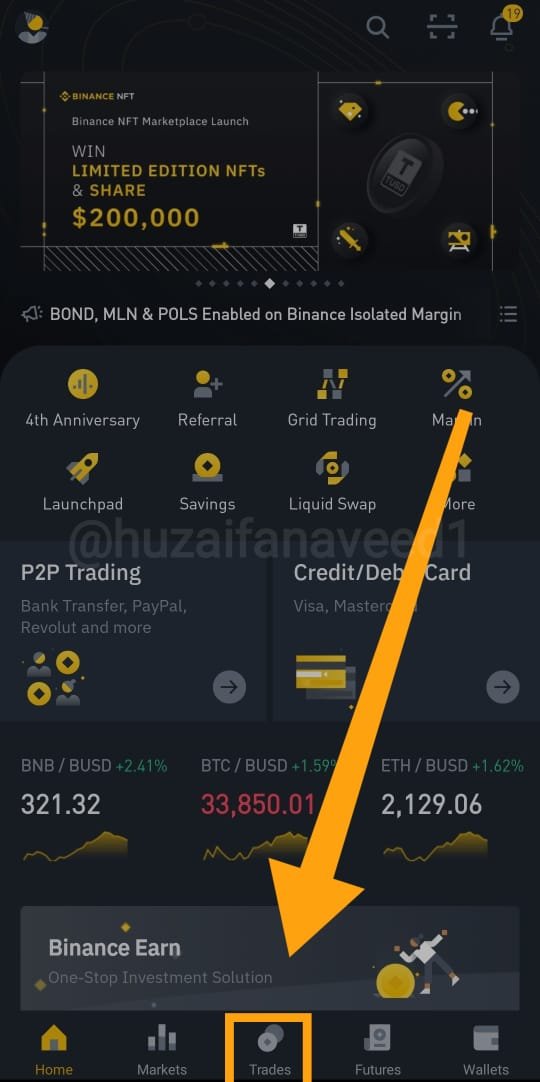

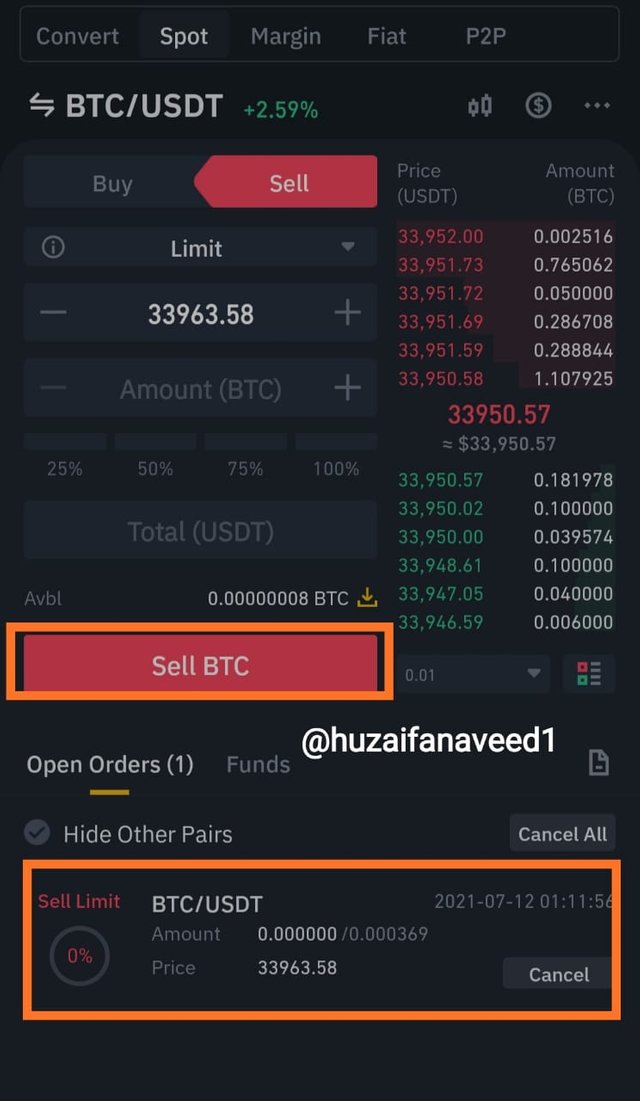

Once you have opened your binance app, you'll see different options of as marked in the screenshot below. Click on trades. As I didn't have any USDT. I first converted my BTC to USDT

I got 12.5 USDT by trading 0.00036 BTC.

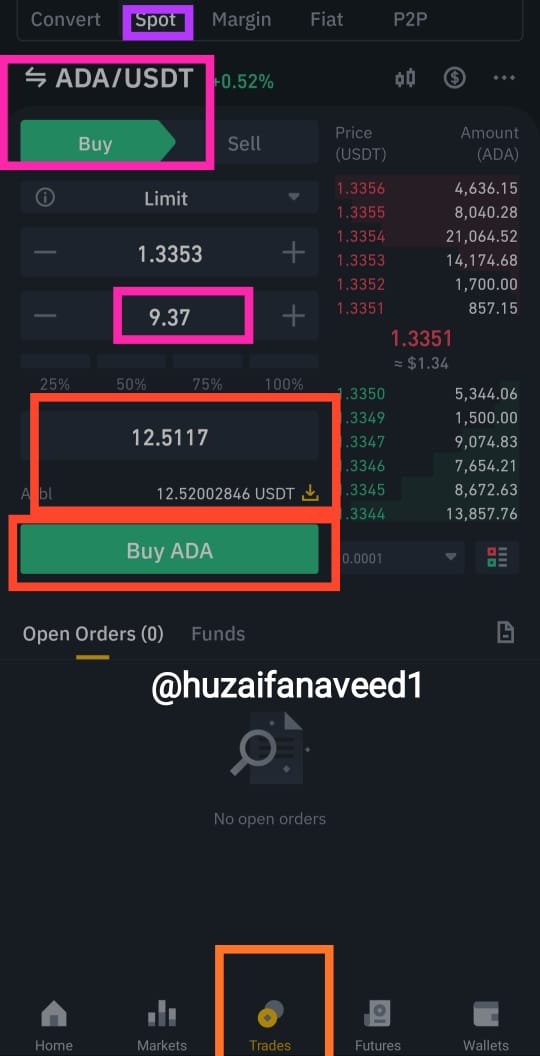

Step 2

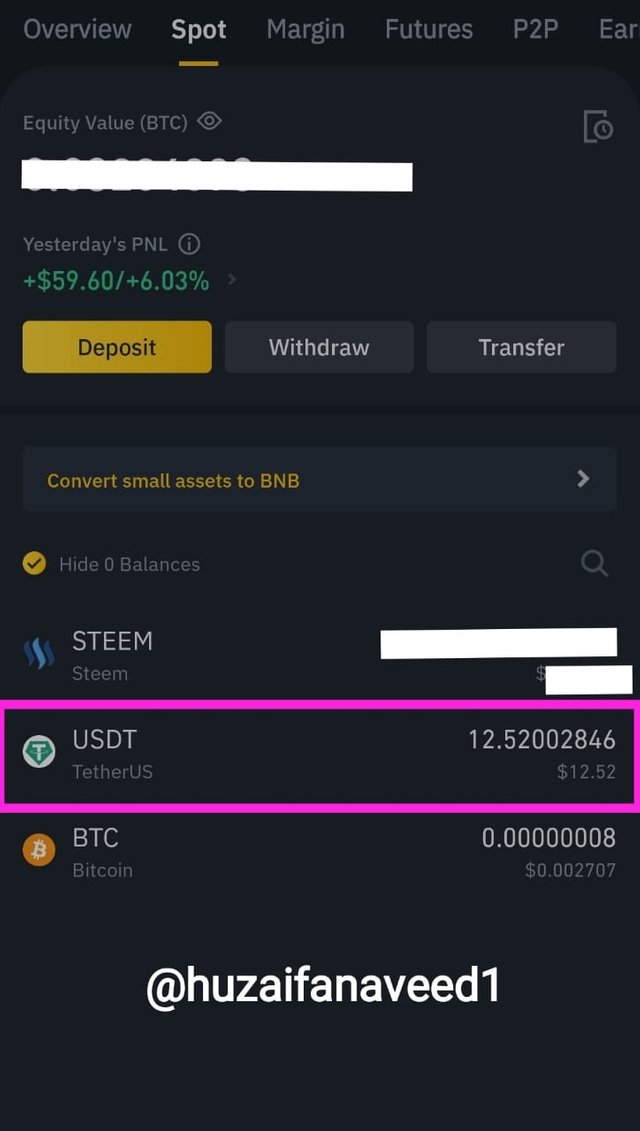

After trading BTC/USDT I check my wallet to see the USDT i received.

USDT in my wallet

Step 3

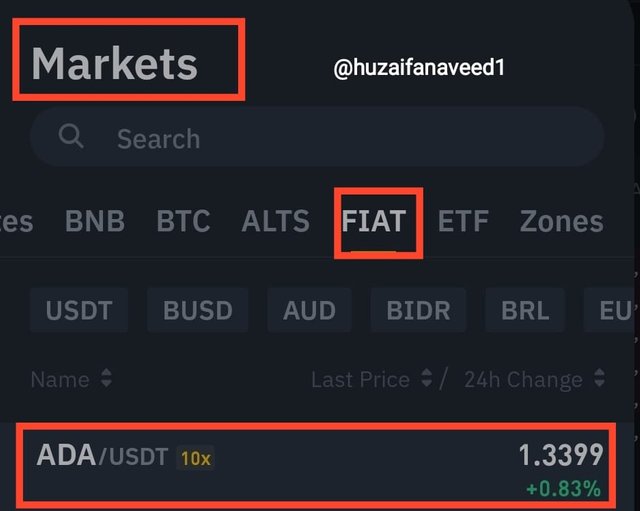

After that I clicked on markets and chose the FIAT pair ADA/USDT

ADA/USDT

Step 4

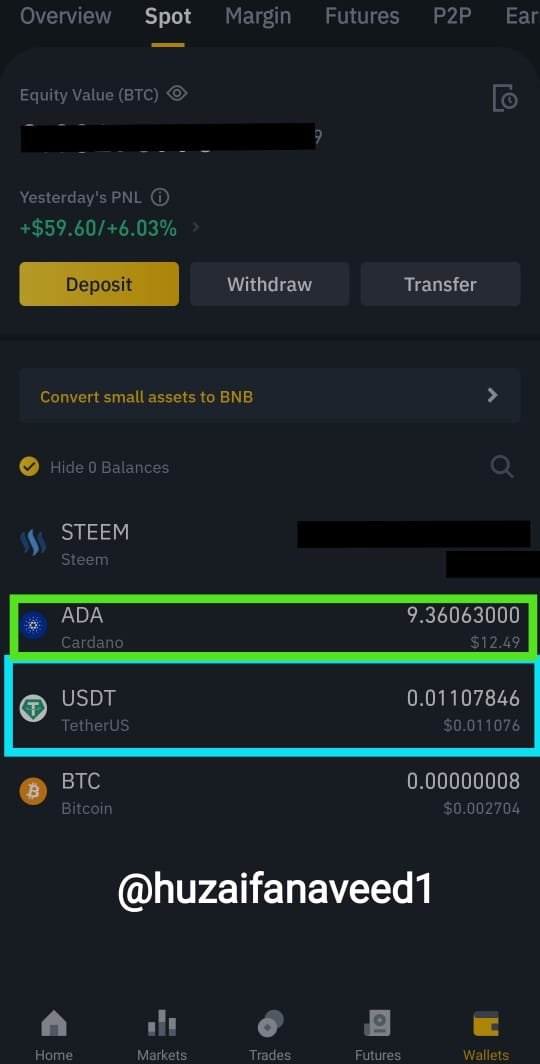

I, then put the amount of USDT i had, that is, $12.5 for which I received 9.36 ADA at the market price.

The trade was confirmed imminently and I recieved ADA

Amount of ADA in my wallet after the trade

This is the simplest way of buying a Cryptocurrency.

Q3

Case 1

ADA/USDT

Lets assume a trader has decided to invest $90 over a course of 9 weeks

| Investment | Week | Price | Amount of ADA |

|---|---|---|---|

| $10 | 1st Week | 1 | 10 ADA |

| $10 | 2nd week | 1.8 | 5.5 ADA |

| $10 | 3rd week | 1.2 | 8.3 ADA |

| $10 | 4th Week | 1.18 | 8.4 ADA |

| $10 | 5th week | 1.26 | 7.9 ADA |

| $10 | 6th week | 1.28 | 7.8 ADA |

| $10 | 7th Week | 1.09 | 9.1ADA |

| $10 | 8th week | 1. 25 | 8 ADA |

| $10 | 9th week | 1.77 | 5.6 ADA |

Investment of $90 over a period of 9 weeks decreased the average share of ADA to 60.6, had the Investor invested all his $90 in the first week the share value would have been 90 ADA

The DCA method lessened down the loss from 60.6% to 33%

DOT/USDT

lets presume a trader invested $800 in Dot, over a course of 8 weeks.

| Investment | Week | Price | Amount of DOT |

|---|---|---|---|

| $100 | 1st Week | 48 | 2.4 DOT |

| $100 | 2nd Week | 28.8 | 3.472 DOT |

| $100 | 3rd week | 24 | 4.1 DOT |

| $100 | 4th Week | 24.9 | 4.01 DOT |

| $100 | 5th Week | 22.6 | 4.4 DOT |

| $100 | 6th Week | 22.5 | 4.4 DOT |

| $100 | 7th Week | 15.9 | 6.2 DOT |

| $100 | 8th Week | 15.2 | 6.5 DOT |

The first trade was at $48 but as the weeks progressed the price dropped significantly. If we look at the price in the last week it hit $15.2

After 8 weeks we hit an average of $25.23

The Investor's total investment of $800 using Dollar-cost averaging results in 35.482 but had the investor invested $800 in the first week the share value would have been 16.66 so this increased significantly with a percentage of 200% using the Dollar Cost averaging.

The DCA strategy is an amazing method for a long run. Through DCA you reduce the impact of making an entry at the wrong time. When you divide your money and make trades at regular time inntervals, such as weekly, You reduce the risks by making fractions of your money and make small trades at equal time intervals.

This was excellent lecture on practical trading in the Cryptomarket. I think it is very important for you to research on ajy asset you intend on investing. You have to check it's credibility as well.

Fundamental analysis before creating a portfolio is very essential.

You should have a proper grasp of the market by doing technical as well as fundamental analysis.

the Dollar Cost averaging, helps the trader in uptrend markets as well as downtrend markets. It helps you in getting minimum losses if there's a bear market. Furthermore it is a constant process which helps you in building a portfolio as well.

All in all, this was a very informative lecture professor @allbert I enjoyed making it hope you had a good read as well.

Regards,

@huzaifanaveed

NOTE: all screenshots were taken from tradingview.com and my verified binance account.

Hi @huzaifanaveed1, there's something that's not really clear to me about the 3rd Question.

Do I need to connect my Binance account to trading view before I'm able to get the DCA charts?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hey @timileyin988 for this question we were not asked to do a real trade. It was just a demonstratio on how DCA is executed.

For applying DCA practically you can use any of your exchange accounts, such as Binance.

Hope its clear. Feel free to ask any more questions

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for your lovely response! @huzaifanaveed1

How do I go about getting the chart is my problem now, I can interpret the chart.

Or do I need to search the internet for DCA chart on any coin I choose?

And I will be glad if I can participate in the assignment, I will need your tutor on getting the chart.

Kindly drop your contact for convenient chat.

Here is my link https://wa.link/2ajixp

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@timileyin You do not need to search onn Internet for DCA chart on any coin.

DCA is executed by evenly spreading your investments over equal periods of time. for example you have $100, in DCA strategy, you can invest $10 for 10 weeks. This is a practical strategy

Regarding this assignment you need to give an example of DCA strategy on any coin chart of your choice. You can give example on any amount of dollars that you want. You do not have to make real trades for this particular questions, as the DCA strategy requires more than 1 week for its results.

Hope it clarifies

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Now I'm getting it, due to the day interval it means we are not to be real in the trade chart we will be using.

It's just that we need to pick an amount of dollars we will be using for example 400usd will be 20 USD in 20 weeks and we will edit the chart ourselves

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit