Hello everyone how're you all. We're in the 8th week of the CryptoAcademy season 4 and this week we learned about the Zethyr Finance by professor @fredquantum. This will be my assignment post.

Q1 What is Zethyr Finance?

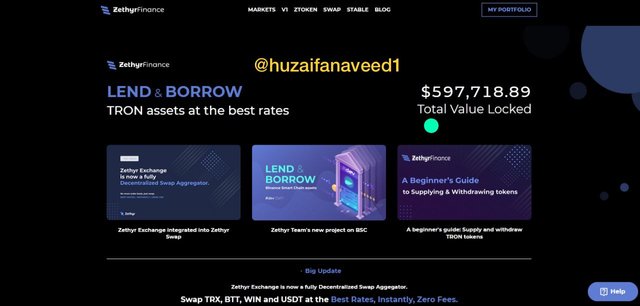

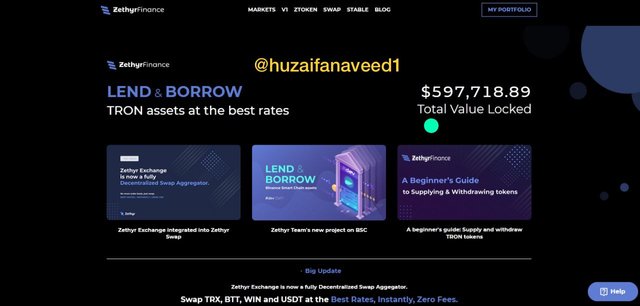

Zethyr Finance is a Decentralized Exchange App, which is built on the Tron Ecosystem. It ranks #158 on the Defi App rankings which shows the competitive nature of this application.

Zethyr Finance has enabled users to lend and to borrow the TRX tokens as well as USDT, WIN, and BTT

There are two funded pools on the Zethyr Finance known as the Supply and Borrow pools respectively. If you have Tokens such as TRX or USDT held on the finance you can earn interest by supplying your tokens. The borrower who borrows from the pool needs to pay a percentage of that token that he is borrowing

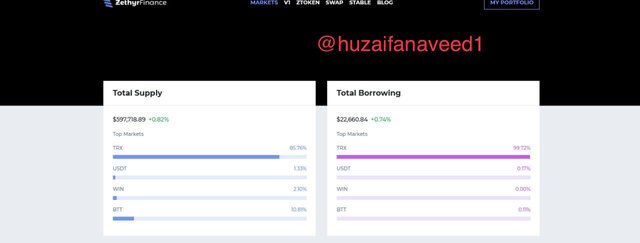

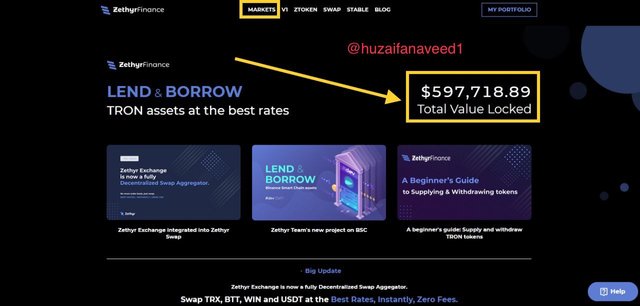

At the time of this article, the total supply on the Zethyr Finance is $597,718.89 with TRX being on top at 85.76% USDT with 1.33% WIN with 2.10% and BTT has a supply of 10.81%

The total borrowing on Zethyr Finance is $22,660.84

TRX has a percentage of 99.72% USDT has been borrowed on a percentage of 0.11% BTT has a percentage of 0.11% while WIN hasn't been borrowed at all.

With these assets on the Zethyr Finance market, we can have an analysis of the Annual Percentage Yield of these listed tokens. USDT has the highest Supply APY while WIN has the highest Borrow APY.

Q2 What are the features of Zethyr Finance? Discuss them. What's your understanding about DEX Aggregator?

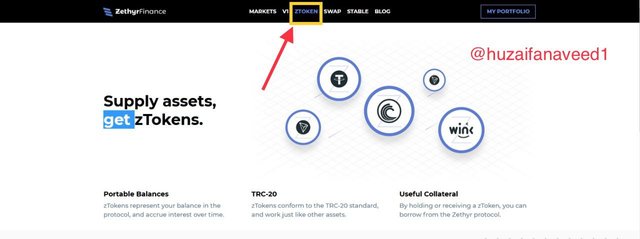

ZTokens

The liquidity rewards on Zethyr Finance are provided in the form of Ztokens which are TRC-20 tokens. The Ztoken is the Zethyr Finance native token. The Ztokens can be used as collateral to be able to borrow on the platform as well

Zethyr Swap

Through Zethyr Swap function, you can have instantaneous swaps between coins, that too, with no feed when the assets are swapped between the JustSwap and Binance platforms.

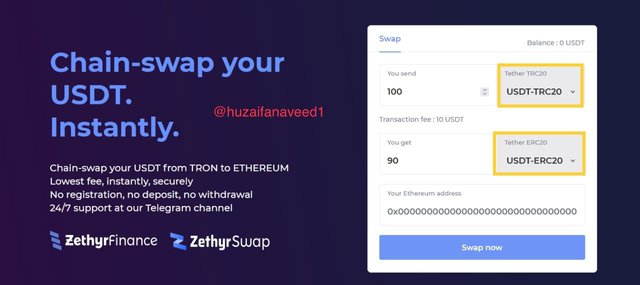

Zethyr Stable Swap

This is one of the best features of the Zethyr Finance which allows users to swap a stable coin on the Tron Ecosystem, with tokens of other ecosystem, such as the Ethereum. This has increased the interoperability within the Tron Blockchain.

For example, we can swap a stable coin USDT-TRC20 to USDT-ERC20 directly.

On the stable swap feature, there is a transaction fee of 10 USDT* so if I am swapping 100 TRC-20 tokens, I will be receiving 90 ERC-20 tokens.

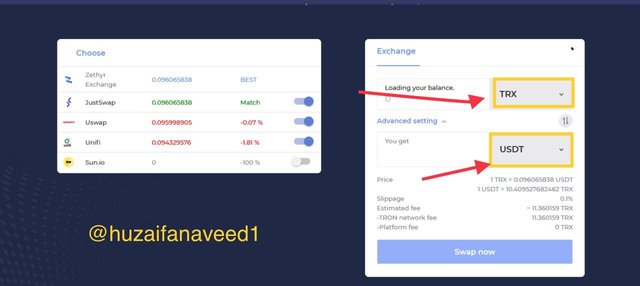

Zethyr DEX Aggregator

This is the amalgamation of the Zethyr swap and Zethyr Exchange to provide the users with the very best rates and liquidity in the market. Let's understand how.

The Zethyr Finance team removed the Order Book model from their platforms and instead aggregated various exchanges and swaps to provide the users with the best rates for exchanging and that too, with zero fees. The exchanges which have been aggregated are:

JustSwap

Uswap

Sun.io (coming soon)

source

Zethyr Lend/Borrow

On the Zethyr Finance, you can actively take part in the Supply and Borrow liquidity pools. The Suppliers are rewarded whenever they lend tokens to the borrowers. The tokens which are open for the supply and borrow functions are:

- USDT

- TRX

- BTT

- WIN

If you're providing liquidity, you'll be granted some rewards.

The true essence of decentralization is found on the Zethyr Finance Platform. The first thing is that a swap of tokens between two users does not require any third-party involvements which makes the process quicker, safer, and more secure.

Alongside this feature, due to the decentralized nature of the platform, Zethyr ensures complete Transparency as the information of all the transactions carried, are shared by the users, which makes it difficult for fraudulent activities to take place.

The total locked value at the time of this artice is $597,718.89

Q3. Explore the Zethyr Finance Markets and show your observations in terms of profitability of Supply and Borrow (Hint: Best Supply/Borrow APY). Screenshots required.

- First of all I'd visit the Zethyr Finance Markets from the homepage of Zethyr Finance

- The total supply in the Zethyr market is $597,718.89

- Total Borrowing is $22,660.84

- If we were to look for the individual supply and Borrowing percentages of the available tokens on this platform, we can look for that in all markets.

- At the time of this article:

| ASSET | SUPPLY % | BORROWED % |

|---|---|---|

| TRX | $512,623.53(85.76%) | $22,596.52(99.71%) |

| USDT | $7,932.48 | (1.33%)$38.99(0.18%) |

| WIN | $12,555.22(2.10%) | 0(0.00%) |

| BTT | $64,607.64(10.81%) | $25.32(0.11%) |

- TRX has been supplied and Borrowed in the most abundant amount while WIN has been supplied and Borrowed in the least amount.

- We can also have a look at the Supply APY and Borrow APY

| ASSETS | SUPPLY APY | BORROW APY |

|---|---|---|

| TRX | 3.92% | 10.80% |

| USDT | 21.49% | 8% |

| WIN | 5.73% | 23% |

| BTT | 4.80% | 20% |

- from the information above, we can observe that USDT has the best supply and Borrow APY with 21.49% and 8% respectively.

Q4. Show the steps involved in connecting the TronLink Wallet to Zethyr Finance. (Screenshots required).

- For the completion, you need to have the Tronlink Wallet App on your mobile or a chrome extension obviously.

- I will demonstrate this on my Tronlink Wallet Mobile Application, as I have been using that for a long period of time.

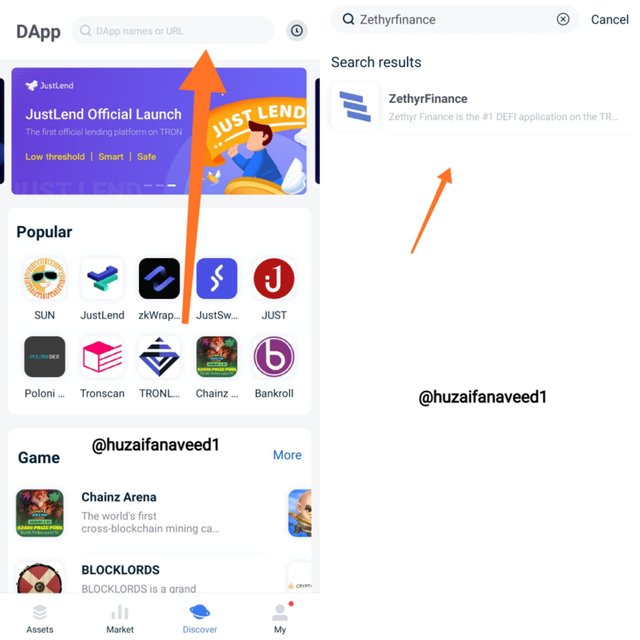

- The first step is to launch your Tronlink wallet on your mobile and click on the Discover Option.

- Click on the search bar on the opened tab and search for Zethyr Finance

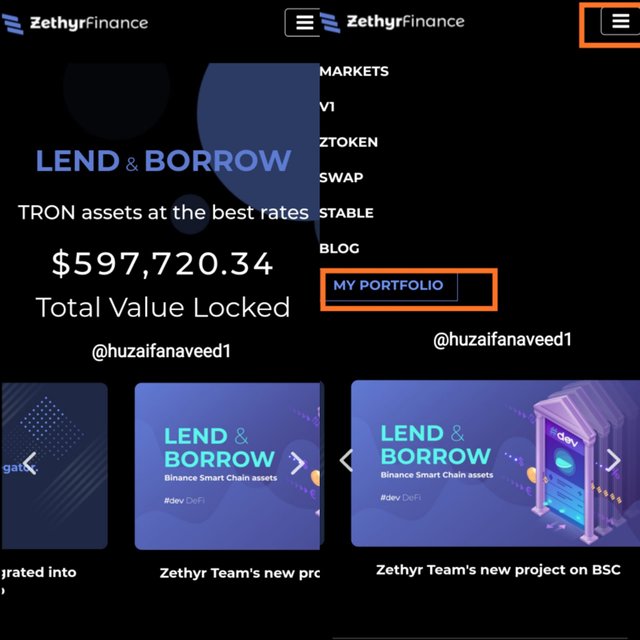

- After you have searched for Zethyr Finance, click on it, and then you'll be redirected to the Zethyr Finance where your wallet will be connected.

- you can see that my wallet is connected and I have 79 TRX available ready to be swapped.

Q5.Give a detailed understanding of ztoken and research a token of another project that serves the same purpose as it.

The Ztoken is a TRC-20 token that is built on the Tron Ecosystem and is the native token of the Zethyr Exchange. The Ztoken is pegged to the other tokens in the ratio of 1: 1

Whenever there is a transaction carried out by you, of any token on the Zethyr Exchange, you will get zTRX for supplying TRX to the liquidity pool. In the same way, you will get zUSDT, zBTT and zWIN for supplying USDT, BTT, and WIN respectively.

The interest paid on the Zethyr Exchange is also in the form of zTokens. For example, you are providing liquidity to the protocol, the interest earned on it will be deposited to your wallet in the form of zTokens.

If you're taking out any token from the protocol, zToken gets burned in order to give you that token. The more zToken you get, the more authority, you can say, you get on the protocol.

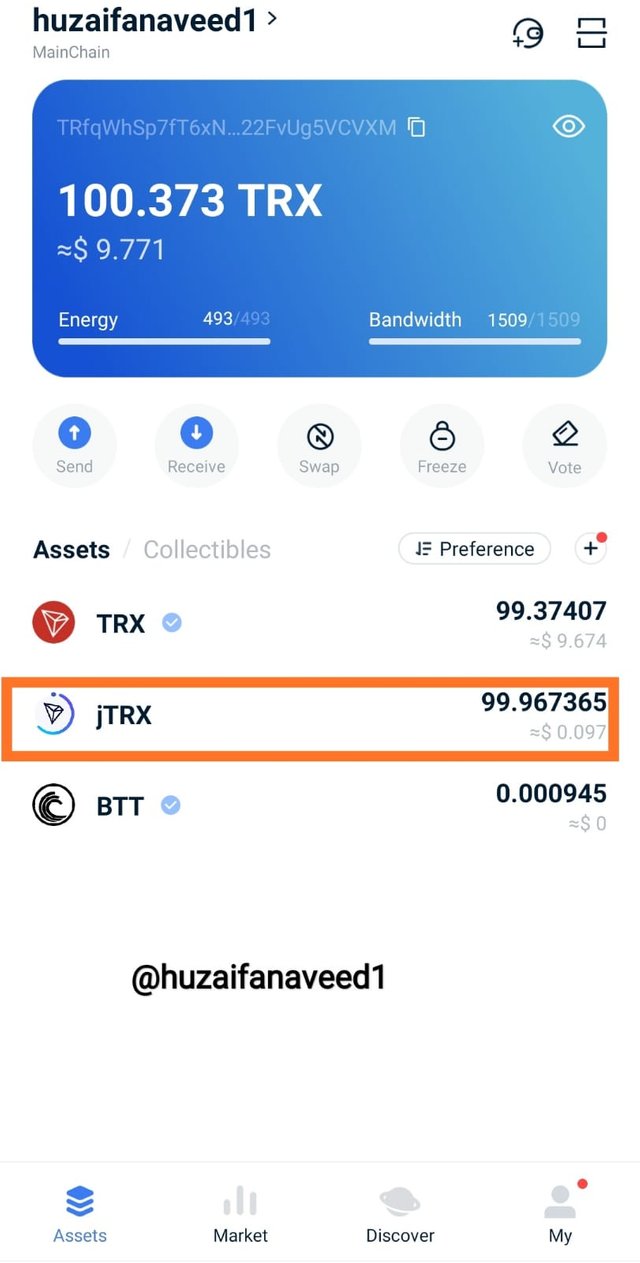

jtoken

This is another token (TRC-20) built on the Tron Ecosystem which is used on JustLend platform.

On JustLend platform, you can lend your TRC-20 tokens easily and when you supply a token, you get an interest paid to you in the form of jToken, which is given to you from the transaction fee. The jToken is also pegged to the TRC-20 tokens available on the platform.

If you use the Tronlink Wallet application, you can see the jTRX there as well. Whenever you send TRX to someone from your Tronlink wallet, a small amount of jTRX gets deposited in your wallet

Q6 Perform a real Supply transaction on Zethyr Finance using a preferable market. Show it step by step (Screenshots required). Show the fees incurred.

I'll be demonstrating how to perform a supply transaction on Zethyr Finance in this question.

- go to your Tronlink wallet application, click on the Discover option. Search for Zethyr Exchange and then connect your wallet to it.

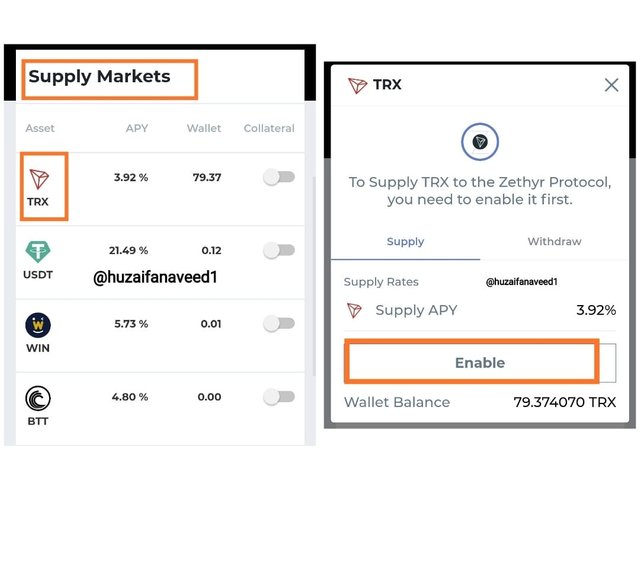

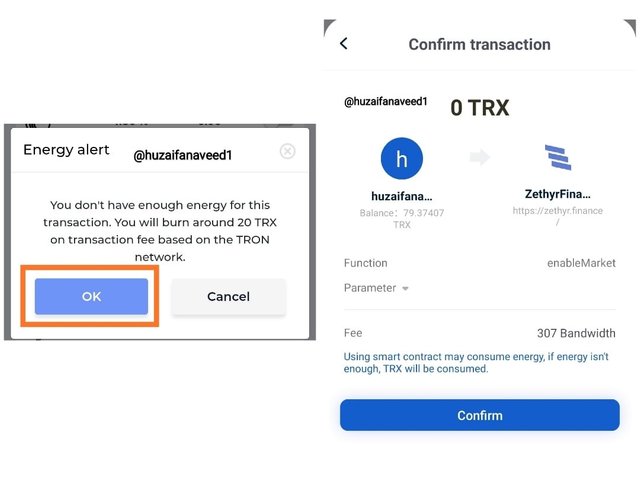

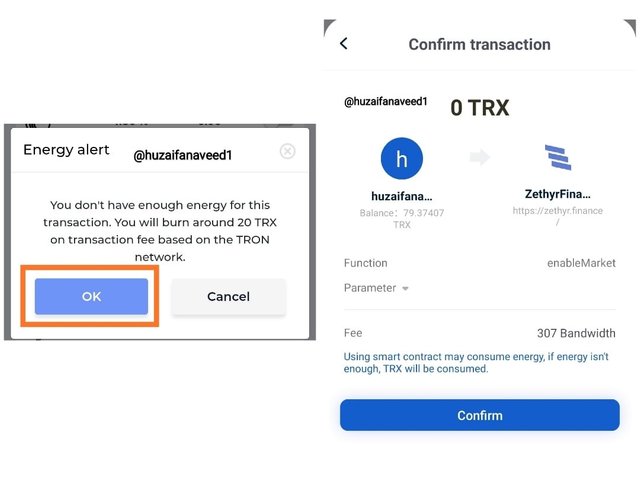

- after that click on portfolio and then on the supply Market I will click on TRX as I have that available. Then I will click on enable to supply TRX

- for supplying TRX I will have to burn 20 TRX to continue.

- A total of 307 Bandwith was also required.

As we need to Borrow token in the next question so I will enable borrow as well

in the borrowing market, click on the token and click on enable.

after that write down your password and then the borrowing will be enabled

- a fee of 20 TRX will be consumed.

- 307 Bandwith will also be used.

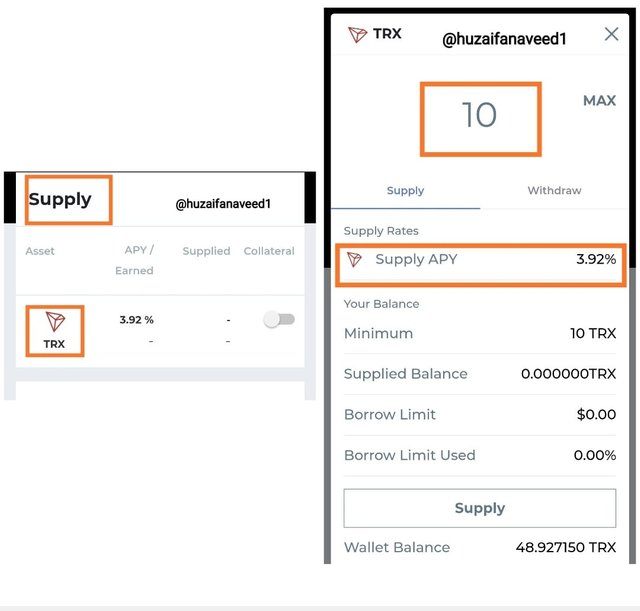

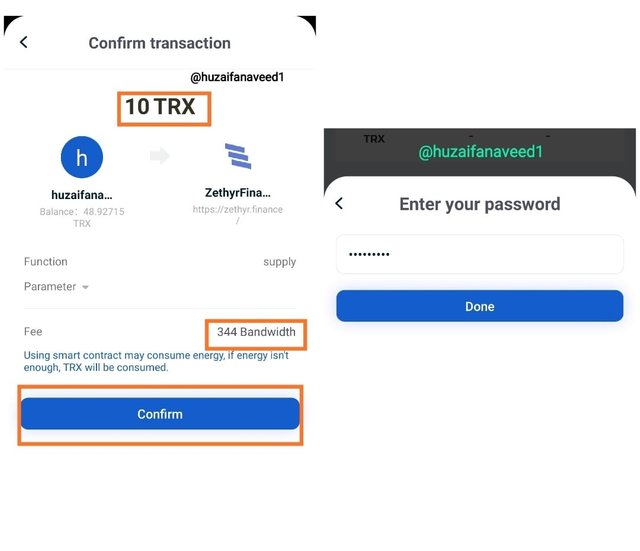

Supplying TRX

it's a very simple process and I will guide

you through it.

Click on TRX

Enter the amount of TRX that you want to supply

- after entering the amount, click on supply

- A total of 20 TRX were burned for this supply and 344 bandwith was used.

- Enter your password to proceed with the transaction.

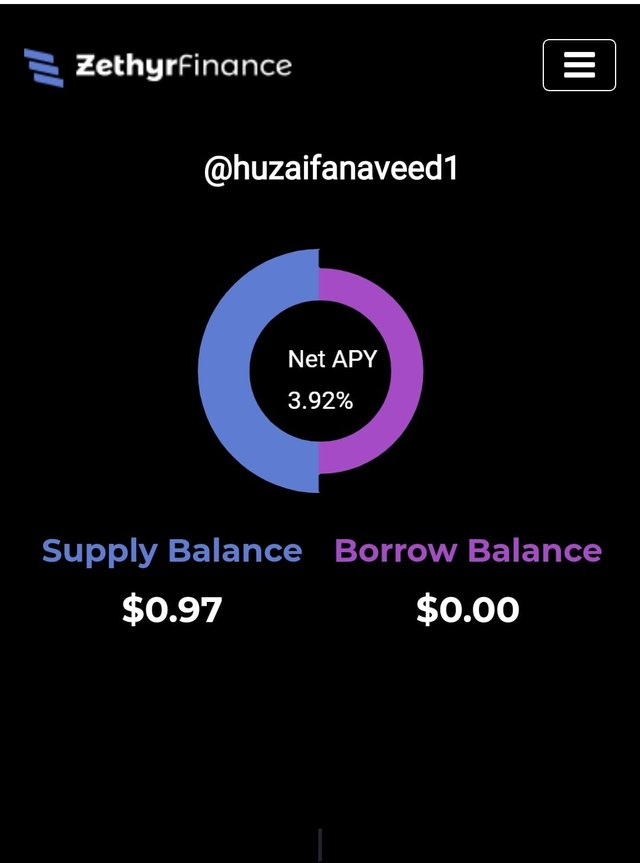

The supply process was successfully done, as I can see my supply balance

A fee of 20 TRX was used to supply TRX to the protocol

Q7. Collateralize your asset to Borrow on Zethyr Finance, repay the borrowed asset and withdraw your supply. Show the steps involved and your observations (like the fees incurred). (Screenshots required).

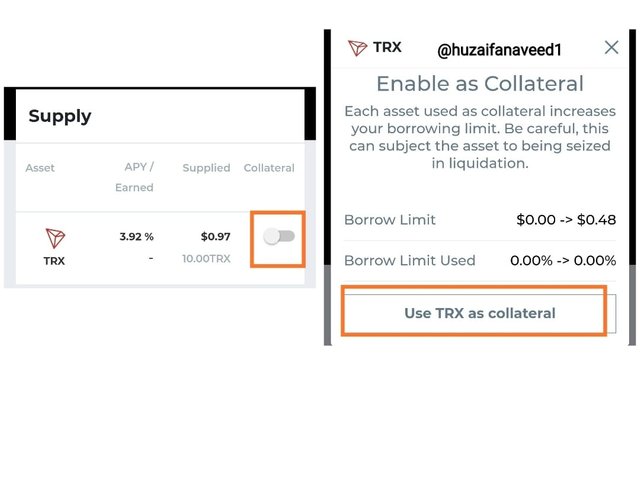

Collateralizing

Let's guide you through the process

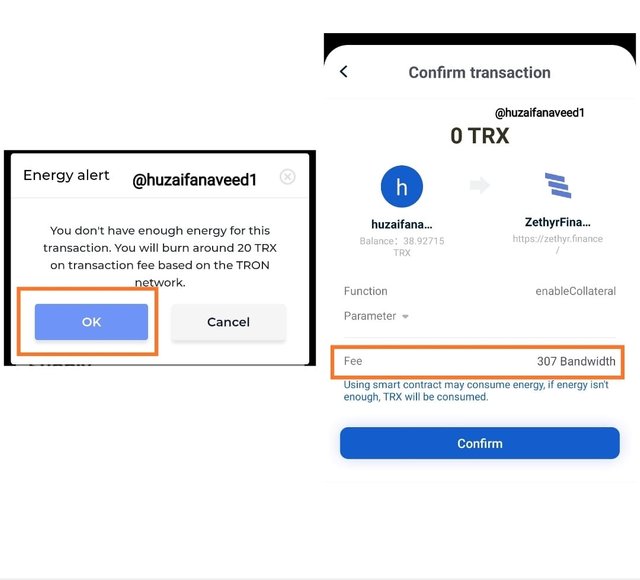

Click on collateral on the asset in the supply tab.

it will ask for your permission to enable collateralization.

- Click on use TRX as collateral

- a fee of 20 TRX will be used for collateralizing and 307 bandwith will be used.

- enter your password to complete the process

- Collateral will be activated.

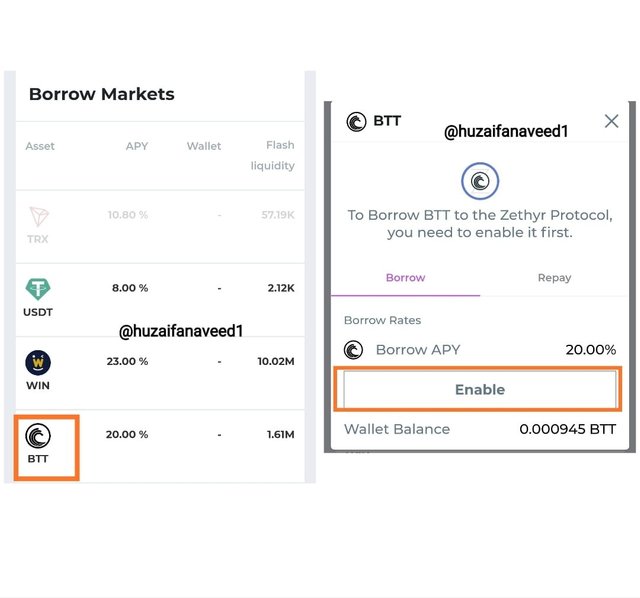

Borrowing

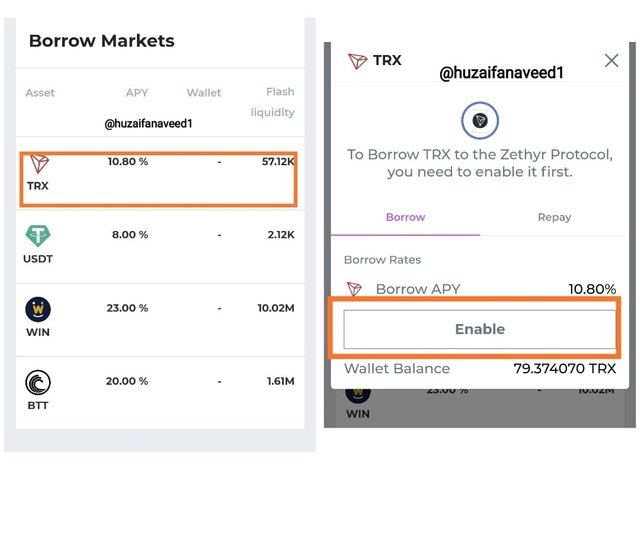

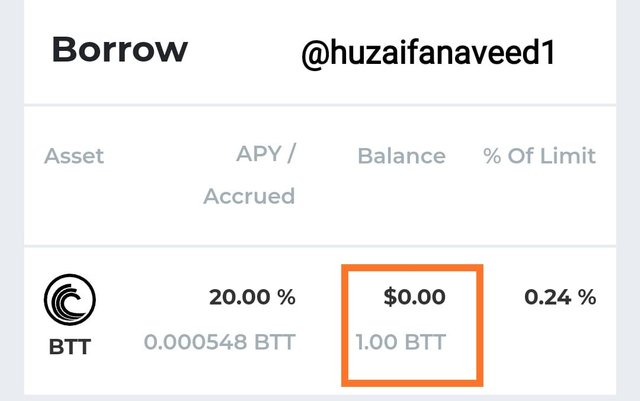

I will be demonstrating the borrowing of BTT

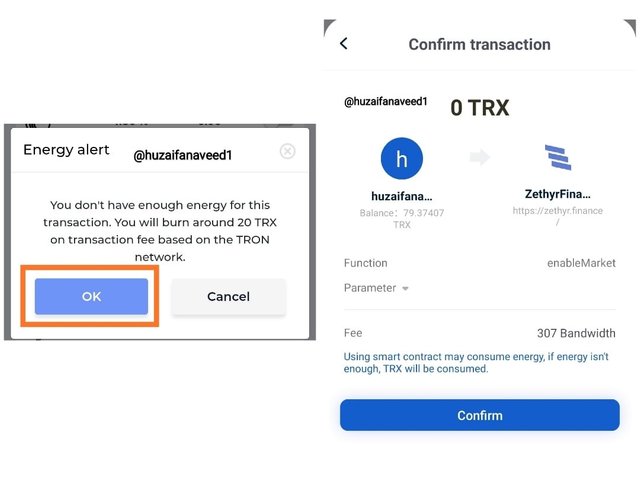

from the borrow markets click on BTT and then enable the borrowing.

- a fee of 20 TRX will be used and 307 bandwith

- after entering your password, it will be enabled.

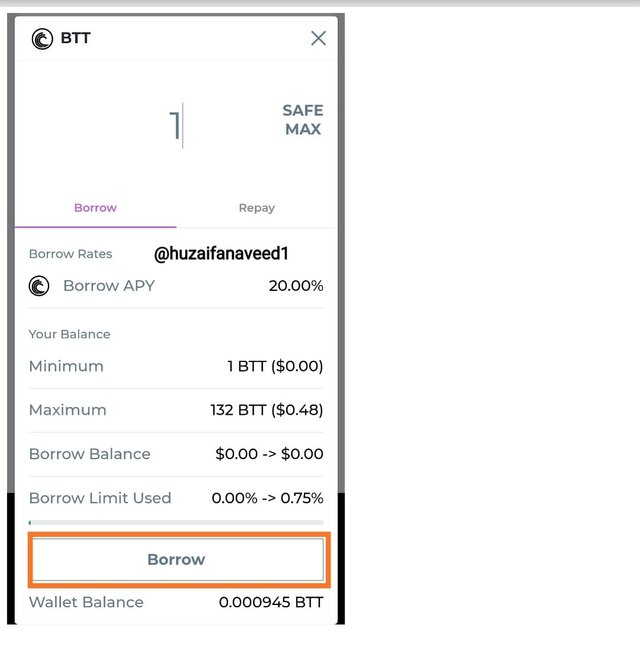

- after that enter the amount to be borrowed

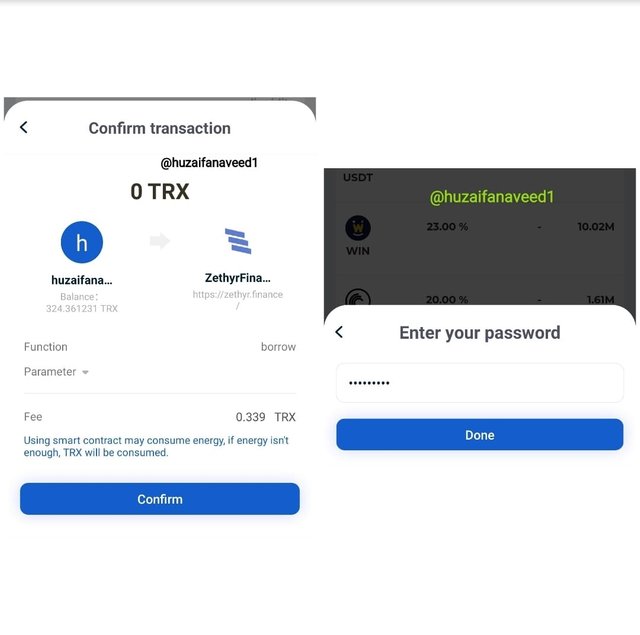

- I then borrowed 1 BTT for which 20 TRX were deducted.

- it has an %APY of 20.00%

- a borrowing limit of 0.49% was used.

Hash of this Transaction: 3b037e83162552de435eb37d5f66f0d489a8a23503e4aec633fd8fea9f97b243

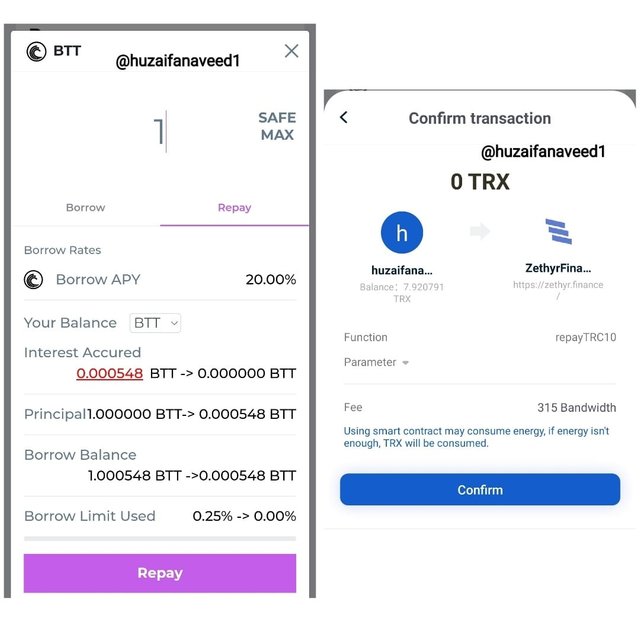

Repaying the Borrowed Asset

Now to repay the Borrowed asset, follow these steps

- Click on the Borrowed asset.

Click on repay option

enter the amount to be repaid

confirm the transaction.

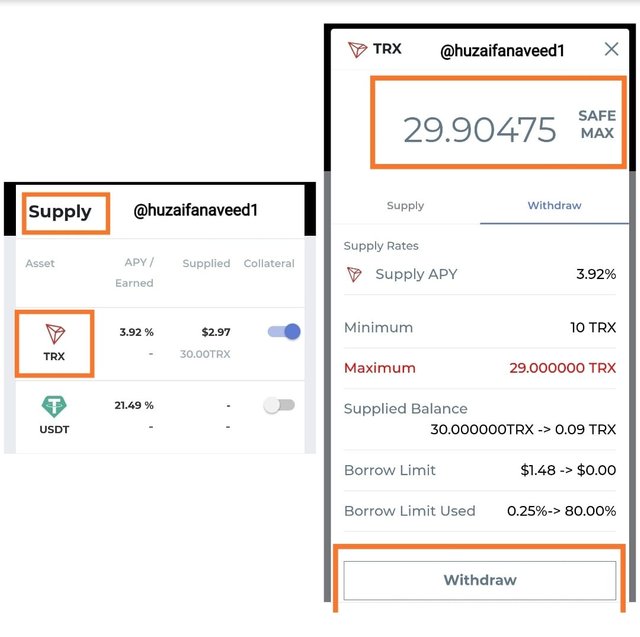

Withdrawing Asset from Supply Pool

visit the Supply option

there you will see the Asset (TRX) that you have supplied. Click on it.

Click on withdraw

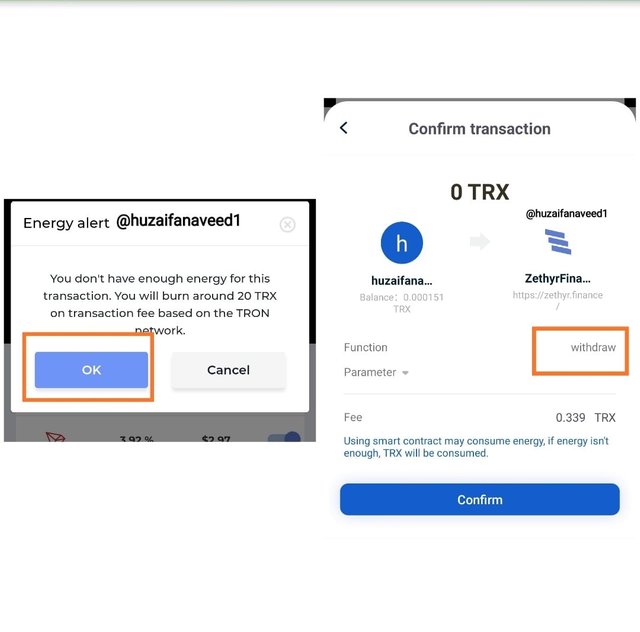

enter the amount or opt for SAFE MAX

confirm the transaction

- after the completion of the process, the supply and borrow balance are shown as 0.

Ps: I lost over 500 TRX in this question while i was trying to borrow USDT. As the professor hinted that the minimum amount that can be borrowed is $1

I kept that in mind and tried that but still the transaction didn't carry out, instead my Trx kept on being deducted, every time I tried to borrow. I checked Tronscan and there I had enough Energy and bandwidth. So I'm still not sure what failed the transactions honestly.

Q8. What do you think of Zethyr Finance? Is it great or not? State your reasons.

In my opinion, Zethyr Finance is another excellent addition to the protocols on the Tron Ecosystem. Zethyr Finance enables its users to lend and borrow assets with no fees

The stable swap and the DEX aggregator has really benefitted the users as it makes sure that the providers get the best rates and liquidity in the market.

There are a lot of Excellent features on the Zethyr Finance platform:

- users can supply their assets and can earn rewards in it in the form of zTokens. As mentioned above the liquidity on zethyr is way better due to the use of DEX Aggregator.

- there is interoperability within the Zethyr Finance as you can transfer TRC-20 tokens to Ethereum Blockchain as well.

- Users can borrow assets in the borrow market and get benefits from this platform.

With all these features, I think Zethyr Finance is a good option for users who intend on earning good APY on their assets. You have an excellent opportunity of earning on your assets by just supplying it to the pool.

This was a huge task to make as we had to analyze a whole platform. In this lecture I learned about another platform on the Tron Ecosystem, of which I had no idea before.

Zethyr Finance is a really good platform which allows users to supply and lend on the platform. By supplying you can earn through the APY. Another great feature of Zethyr Finance is that the TRC-20 USDt token can be swapped for ERC-20 USDT.

Thank you professor @fredquantum for this lecture. Hope you have a good read

Ps: all screenshots are taken from Zethyr Finance and Tronlink Pro

Regards,

@huzaifanaveed1

Thank you for your masterful explanation, this leads us to have more knowledge about this platform that is starting and in the immediate future we will be registered and operating on this very good platform, best regards.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

thank you

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit