Hello Steemit:

How are you all, hope you all are doing well. So, today I am very thankful to professor @pelon53 for teaching us a very important topic about Solana blockchain and its main features. After attending this lecture, I understand many important features of Solana and what are their use cases, and SOLA token.

Let's start with the answer to the given questions,

1.- Explain in detail the PoH of Solana.

Solana Blockchain

Solana is a web-scale blockchain that provides fast, secure, scalable, decentralized apps and marketplaces. The founder of Solana Anatoly Yakovenko worked at Qualcomm before founding Solana. He has a wide range of experience with compression algorithms after his previous experience at dropbox as a software engineer.

Solana:

Solana supports the ecosystem together. Solana supports smart contracts, this means that the developers can create decentralized applications like a decentralized exchange on top of Salona. Solana scales to hundreds of thousands of transactions per second.

Proof of History:

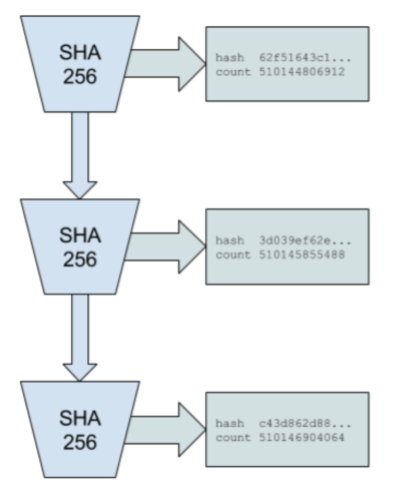

Solana uses a proof of history method. With proof of history, users are able to create historical records that prove that an event occurs during a specific moment in time. The algorithm is a high-frequency verifiable delay function. This function requires a specific number of sequential steps to evaluate transactions or events that are evaluated will be given in unique hash and account that could be publicly and effectively verified. The count allows us to know when each transaction or event occurred functioning like a cryptographic timestamp. Within every node, there is also a cryptographic clock that keeps track of the network's time and the ordering of events. This allows high throughput and more efficiency within the Salona network.

Image Source

Transactions are entered into blocks through Solana's sequential pre-image resistant hash. Simply referring to hashes that cannot be altered. These hashes are then used as an input to the next transaction. Then these entries are time-stamped to record their actual sequence and eventually save time on having to revalidate each hash function together. So by having historical records of events and transactions, it allows the system to more easily track transactions and keep track of the ordering of the events.

2.- Explain at least 2 cases of use of Solana.

There are many projects that are built on the Solana blockchain. The two projects which are explained by me are given below,

- Raydium.

- Mango Market

Raydium (RAY)

This is the largest Automated Market Maker (AMM) in the Solana ecosystem. Basically, it's like their uni swap or sushi swap, so you can swap tokens, provide liquidity, yield farm. But they do offer something different, when you trade on Raydium, they check two places to get you the best price, their own liquidity pools and the decentralized order book run by Serum which is another Solana ecosystem project. Raydium can offer built-in limit orders and it is very useful. If you're traded on uni swap, you'll know that you have to pretty much take the price that the pool gives you, you can't place a limit order like you can on coinbase.

Look at the chart of Raydium. You can clearly see that it hit the exchanges in February of 2021 at around $6. It rocked quickly to around $16 in may before crashing with all of the cryptos to around $4 and consolidating for a few months from there then they broke out of that range and pumped a couple of times until now when it's chilling at around $12.

Mango Markets (MNGO)

This is also a trading-related project but their platform specializes in things like margin trading and perpetual futures. They offer up to 5x leverage whereas other D5 protocols only offer around 2x and their perpetual contracts go up even higher to 10x initially.

The mango market is targeting an incredibly lucrative niche because leverage and derivatives are what make centralized exchanges a ton of money like BitMEX and ftx are rolling in the dough because of these products. So, mango's goal of creating these for the decentralized world could help them generate a ton of revenue.

It started trading at around 18 cents and it's been climbing steadily and is now at around 36 cents which corresponds to a market cap of 360 million dollars.

3.- Detail and explain the SOLA token.

SOLA:

SOLA token was made by Solana Market maker. SOLA token is run on the Defi platform. Solana Market makers included many other features while creating the SOLA token. The main feature is, if you are holding a SOLA token then you are able to participate in governance activities. The other feature is, you are free to participate in the decision-making process while holding this token.

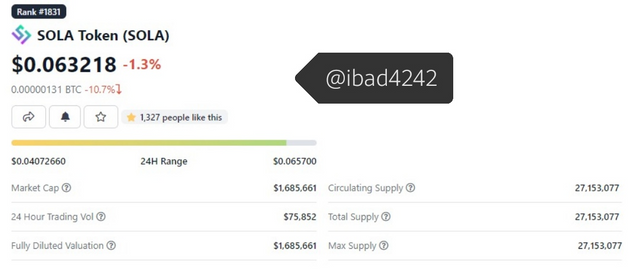

Screenshot taken from Coingecko

At the time of this post, The price of SOLA is $0.063218 and it is -1.3% down. Raydium exchange is the most active exchange that trades SOLA tokens with a pair of SOLA/USDC.

The other important numbers of SOLA are,

- Market Cap: $1,685,661.

- 24 Hour Trading Vol: $75,852.

- Fully Diluted Valuation: $1,685,661.

- Circulating Supply: $27,153,077.

- Total Supply: $27,153,077.

- Maximum Supply: $27,153,077.

4.- When did Solana Blockchain see its operations interrupted? Why? Explain.

Interruption of Solana Blockchain

On 14th September 2021, Solana announced it was experiencing intermittent instability on the network's mainnet beta. The company later confirmed the problem was due to a massive increase in the transaction load that peaked at over 400,000 transactions per second, as well as 65,000 transactions per second. The speed has been seen in dubbed as an Ethereum killer as Solana is roughly 2,000 times faster than Ethereum.

The overload caused the network to start forking resulting in some nodes going offline. Shortly after that happened, the validator community opted to restart the network. They providing instructions on how to do so via Twitter and discord. Solana tweeted that the mainnet beta restart was successfully completed after an upgrade to 1.6.25. Block explorers and supporting systems would recover restoring full functionality within a few hours.

5.- Check the last block generated in Solana and make an approximate calculation of How many blocks per second have been generated in Solana, taking into account from the initial block to the current one? Justify your answer and show screenshots.

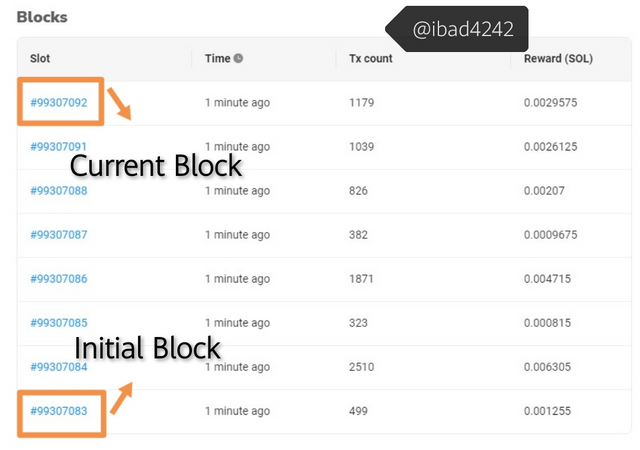

I used Solscan explorer to extract information about blocks generated in Solana.

8 blocks are captured with the time frame. You can clearly see the blocks in the screenshot.

Screenshot taken from Solscan explorer

These are the details of initial and current blocks.

Screenshot taken from Solscan explorer

Screenshot taken from Solscan explorer

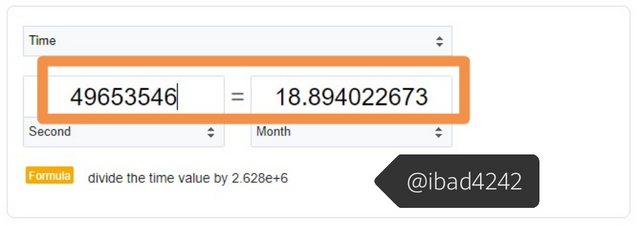

Calculation of How many blocks per second have been generated in Solana

Initial Block time:

Current Block Time:

Difference:

If 8 blocks are generated within 4s.

Then (8/4) = 2 blocks are generated in 1s and 1 block is generated in 0.5s.

The current block number is 99307092.

Total Seconds = Current block number / 2.

Total Seconds = 99307092 / 2.

Total Seconds = 49653546.

So, it is clear that 99307092 blocks are produced in 49653546 seconds which is equal to 18.894022673 months.

Conclusion:

In this informative lecture, I understand many important things about the Solana blockchain. As we know, in the future this blockchain beat other blockchains by their speedy transactions, low transaction fees, and technology. We also use 1 Solana explorer and learn how to retrieve block information.

The most important thing in this blockchain is the transaction speed. Many experts think that Solana will beat Ethereum and no one knows what happened in the future but Solana blockchain has some guts to beat Ethereum.