Hello friends .... !!!

Back again with me Ichsan Angga P at Steemit Crypto Academy Homework.

Today I will finish the homework from professor @fendit.

The topic that I will choose to discuss from the work given by the professor @fendit This week's assignment is about Wyckoff Method

Wyckoff Method

The Wyckoff Method is a method that was successfully created and developed by someone named Richard Wyckoff in 1930. The Wyckoff Method is a set of principle methods and also a strategy that Richard Wyckoff developed from his own ideas, with the aim of targeting traders and investors. Wyckoff also tried to do further research on the method he had developed, and in the end he managed to make several other aspects in the development of this method, including the Composite Human Concept.

The Composite Man

Composite Man is a new idea created by Wyckoff, which has the function of making it easier to understand price movements in trading, where in this idea of Composite Man Wyckoff makes all operations under the control of one person. Composite Man only needs to monitor the market that is happening by looking at trades and then profit by trading by manipulating the market.

Wyckoff argues that, this composite human strategy can be done by reading the graphite and then making predictions for the next movement. Wyckoff made several phases to identify the current cycle or market movement, there are 4 phases given by Wyckoff, where we do and try to observe the behavior of Price, Volume and time movements, from that way we as composite humans can determine when good entry and also the right time out, Here are 4 phases that Wyckoff created :

1. Accumulation

The first is Accumulation, where in this Accumulation phase the composite human performs or tries to accumulate data on the trading market he is reviewing before other investors also enter the market. In this Phase we have to look at the Volatility and its volume, a composite human being must be careful in accumulating the assets under review, because we have to find the right entry and exit prices, so that when we enter and exit we do not exceed the review we want.

2. Uptrend

The second is the Uptrend Phase, where in this phase as a Composite Man it is the person who will make the price to soar upwards, where when a Composite Man saves or collects assets on a large scale, this will automatically invite other investors to invest. trade, so that when other investors come in and trade, this will help the price to soar upwards, but keep in mind which of these can be created. If, a demand for the asset is greater than the supply for the asset, then it will an Uptrend is created

3. Distribution

Distribution phase, where in this phase is when more and more investors trade in the same market, this will make a demand jump higher than an offer, this is a good side because it will push prices to soar upwards. Here as a Composite Man, we must be able to take action to be able to enter to sell the assets that we have, because if we are late in making decisions and price movements begin to appear to decline, automatically as a Composite Man this will be very disadvantaged, because we cannot receiving benefits.

4. Downtrend

So in the Downtrend Phase, this is the phase where when Composite Man sells very large assets, because the volume he has is very large, then this will affect the movement of the market, which if Composite Man sells assets with large volumes, generally speaking automatically the market will decline in price, when a Composite Man sells assets and then other investors see that there will be a deep decline, other investors try to sell their assets, and then automatically the result of all that is where the return Again, the supply of assets becomes large so that prices will continue to experience a downtrend.

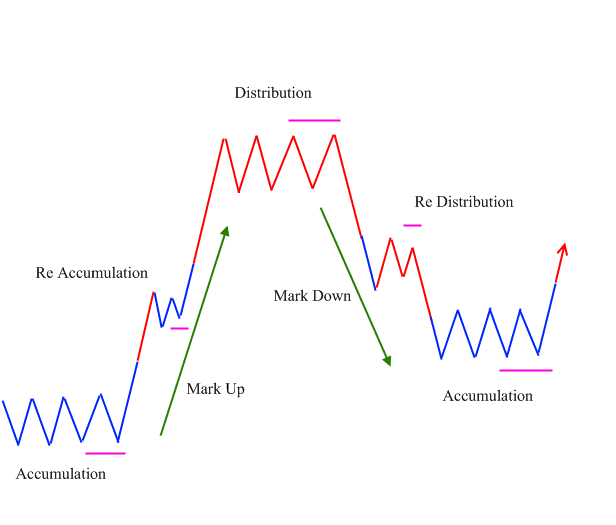

I will try to give an example through an illustration of an image about the phases above, it can be seen in the image below :

So it can be seen in the picture above, where when a market is going through a Accumulation phase and then Composite Man buys assets with a large volume and is followed by other investors, the market will automatically occur Uptrend or rise to a price level which is quite high. the price, but before the price rebounds, there will be a thing called Re-accumulation first, then the price will be at its highest point. Furthermore, when entering Distribution, here a Composite man determines when he sells his assets, massively he sells his assets, then there is a Downtrend or a decline in the price of the asset, but before a drastic decline occurs, there will be where Redistribution first then the price will touch the lowest point. and back will repeat like that.

The Fundamental Laws

In the Wyckoff Method he created a basic law to use this method well, of which there are 3 basics that can help us to determine the direction that occurs in the trading market and also the situation in the trading market, here are the 3 basic laws :

1.The law of Supply and Demand

The law of supply and demand is one of the laws that Wyckoff created. In this law, Wyckoff has the principle that if the demand is higher than the supply figure, then the price of the asset will increase, and vice versa where the supply is higher than the demand number, the asset price will decrease. So the task of a trader is to analyze when the volume of supply is high enough because the higher the supply, the uptrend will occur, as well as if the analysis results show a higher demand volume, the downtrend will occur.

2.The law of Cause and Effect

In the Law of Cause and Effect is a law that has a relationship between Cause and Effect that arises from the behavior of a trader, for convenience, we can see when the accumulation stage is complete, there will be or a sign appears for an Uptrend, this is because great demand for these assets. Furthermore, when the distribution stage is complete and a Composite Man sells the assets he owns in a large volume scale, automatically the trading market will also receive the impact, namely a decrease in the price of the asset or a downtrend

3.The law of Effort and Result

In the Law of Effort and Result Wyckoff has his own opinion which he says, a change in the value that occurs in an asset is the result of investors trading in large volumes. For example, if an investor buys an asset in bulk and the trading volume will increase, there will be an Uptrend, whereas if the trading volume is low it is certain that there will be no Uptrend or Downtrend due to low volume.

Technical Analysis on (ICP/USDT) : Wyckoff Method

.png)

So from the picture above I did a technical analysis using the Wyckoff Method on the ICP/USDT pair, here is a detailed explanation of the picture above:

1. Accumulation Stage

At the accumulation stage as the picture above shows that the accumulation process is a minimal movement because here Composite Man and other investors only keep their coins without making active trades.

2. Re-Accumulation Stage

The market then experiences a movement, which shows or is an indication that the market is starting to actively trade, but before the market experiences an Uptrend there will be a Re-Accumulative phase, after which the market will soar.

3. Distribution Stage

Where when the market has risen and is at the desired peak for a long time it has tried to rise to the current price phase, then there will be a price stabilization in ICP/USDT. It can be seen like the picture above that what makes the price not decrease immediately due to resistance so that ICP/USDT can still be stable at that price for some time.

4. Re-Distribution Stage

It can be seen in the red sign, after a long time the market has been at a stable peak price, and then Composite Man sells at the highest price, then it experiences a Downtrend, but here before the asset drops drastically, it has experienced Re-Distribution first, then it goes down. returned because other investors made sales, and there was a second Re-Distribution, then he touched his lowest figure.

6. Accumulation Stage

And then the assets in the ICP/USDT pair began to stabilize again at their starting point, it can be concluded that Composite Man managed to make a profit using the Wyckoff Method, because the Accumulated value managed to return to the initial accumulation point, and it was time for them to move back in the future.

Conculsion

Last word

Thus the task that I have completed this time regarding Wyckoff Method If in my writing there are still many mistakes, I apologize and I will be happy if other friends want to correct it through the comments column I will be very happy.

Thank you all, I hope this post can help you all to understand more about Wyckoff Method.

Regards

@ichsananggap

Note: Images that do not have a source are my own edits

Thank you for being part of my lecture and completing the task!

My comments:

Your explanations were ok and you were ble to identify properly the pattern into the chart, but i wish you had developed a bit more your analysis on the variations! :(

Overall score:

6/10

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit