What is Algorand blockchain?

The Algorand blockchain was founded by Silvio Micali, a professor of Massachusetts Institute of Technology (MIT) on June 2017 and officially launched on 12 June, 2019 after his successful research about the bitcoin scalability challenges.

Algorand is a permission-less network that is secured, fast and decentralized. Algorand does not trilemma because of using Pure Prove of Stake (PPOS) consensus mechanism and operate on Boston based platform.

Algorand blockchain operation is very fast. It can verifying thousands of blocks in seconds. The validation is done by miners who are randomly selected using cryptographic sortition method (typically a lottery). Algorand blockchain have main-chain network and off-chain which are regarded as lay-1 and 2.

Every simple and daily transaction is done on the layer one. The layer-2 is where more complex customization is done and development of decentralized applications (dApp). This lifts load off the main-chain hence fortifies scalability.

Algorand block validation takes place in two phases known as proposal phase and voting phase.

This method reduces computing power and expensive staking. The validator remains anonymous till their responsibility are fulfilled. This fortifies the blockchain security because an attacker does not know the next node that will carry out the process.

This process makes it a decentralized blockchain network since everybody stands a chance of been a validator. Enhance it scalability before of less computing power and still maintain a top notch security.

The success of algorand n blockchain does not anchor on the efforts of Prof. Silvio Micali alone. There are lot of professional that have work alongside.

Steve Kokinos is the Chief Executive Officer, W. Sean Ford is the Cooperate Officer, Keli Callaghan is the Head of Marketing, Jing Chen is Head of Theory Research and Chief Scientist etc.

Every blockchain have a coin. Algorand is not an exception. Algo is the blockchain cryptocurrencies which block validators are rewarded with on completion of their task. The Algo coin is number 20 in ranking and on a bearish trend below $2 in coinmarketcap

Lastly, Algorand have a non-profitable foundation runs the affairs of Algorand inc. This unique foundation have diversify their support to various unit including developers education etc.

What is PPoS

The Pure Proof of Stake is consensus protocol that operates on Byzantine Consensus. Algorand is the first blockchain to use it.

In Pure Proof of Stake, a group of algo token holders are randomly select to propose the next block. Participants have to generate a participation key as algorand spending key is not permitted.

The selected identity remains anonymous to others but the person knows itself by using secret participation key (private key) and selected seed to check Verifiable Random Function in which the person will be issued a cryptographic proof in a pseudorandom format. After confirmation, the participant can send their prove of selection to anyone.

The next stage is the voting stage. Double spending and any problem in a block is properly check by a randomly elected committee of nodes. Any node that propose a bad block automatically continue the process using a recovery mode without any charge.

The relay node in network take charge of creating a communication line for participants node. This independent node is not permitted to propose or vote.

The whole of this process is regarded as the Algorand Pure Proof of Stake consensus mechanism.

Explain the advantages and disadvantages of PPoS

Advantages of PPOS

Cheap Staking fee: Pure Proof of Stake is less expensive compared with other consensus protocols because as low as 1 Algo coin (less than $2) qualifies a participant to join the network and stand a chance of been select.

Environmental friendly: Since it does not require a high computing device which consumes much energy. Hence it is said to be environmentally friendly.

Less setup expense: Unlike other blockchain that requires expensive special mining equipment example Application Specific Integrated Circuit (ASIC), pure proof of stake does not require such expensive setup.

High Scaling capacity: It can validate 1000s of blocks in seconds. No other decentralized consensus protocol have ever reach such level.

Decentralization: Random selection of nodes makes it decentralized. Hence there is no central node.

Eradicate trilemma: Pure Proof of Stake remains a consensus protocol that have help to eliminate blockchain trilemma - a situation that developers have to sacrifice one of the three features (decentralization, scalability and security) to achieve the two. Pure Proof of Stake is highly decentralized, scalable and secured.

Penalty free: Even if a block is badly proposed, it does not slash off the validator reward

Immutability: The methodology of random selection of validators give it a strong security against that hackers.

Freedom of stake spending: Validators are not restricted to spend their token. They are free to spend anytime and still stand a chance of been select.

Disadvantages of PPOS

Limitation of participants: Although it a decentralize blockchain, pure proof of stake limits still limits the number of participants.

Poor Reward: The token issued to block validators is not encouraging.

Do you think that Algorand really solved the blockchain trilemma? Explain your answer

The aligorand have really proven to solve blockchain chain trilemma by performing the three features - decentralization, scalability and security.

In scaling efficiency, the blockchain perform thousands of transactions within seconds to avoid traffic (time wasting) in the blockchain. Algorand methology of selecting random validator proves uniqueness of it decentralization. The spread of datas to multiple nodes, making it an open source etc fortifies the blockchain network.

Checking the above feature simultaneous operation without paying off any have prove that algorand blockchain have solve the problems of trilemma.

QUESTION 5: Do you think PPoS is better than PoW? Explain your answer.

Yes, I think Pure Proof of Stake (PPoS) is better than Proof of Work (PoW)

PoW requires a high computing power in which miners compete to solve a cryptography algorithm problems i.e generate the hash of a block.

This consensus protocol consume lot of electrical power and space which extra expensive. Pure Proof of Stake does require such expensive setup. Anybody that owns/stake at least 1 ALGO token can participate in the process. This reduce the cost of set up to a very low rate.

Proof of Work (PoW) have a trilemma challenge. The scaling efficiency of the network is traded off to decentralization and security. This can be seen in it slow validation process which take approximate 10mins to process a block.

Pure Proof of Stake (PPoS) eliminates trilemma challenges and simultaneously balance the operation of the three features - decentralization, scalability and security. The scaling efficiency is far beyond satisfaction. Thousands of block can be validate and add to the blockchain within a second using a decentralized network and still maintain strong security of the network by making validator to remain anonymous till the process is achieved.

Although the Proof of Work (PoW) is a decentralized blockchain, it technically promote centralization of power. This means miners that have established a large mining farm with strong computing machines e.g Applications Specific Integrated Circuit (ASIC) stand a chance of control a great number of block validation.

Recently, it was noticed that China dominate Proof of Work mining operations. Pure Proof of Stake does not give anybody such opportunity no matter the number of token that they own.

Checking the above explained, I strongly believe that Pure Proof of Stake (PPoS) is better than Proof of Work (PoW).

QUESTION 6: Do you think that PPoS is better than PoS? Explain your answer.

Yes, I think that Pure Proof of Stake (PPoS) is better than Proof of Stake (PoS).

Proof of Stake does not solve trilemma challenges. It operation requires high stake. In order to become a validator, the person have to lock up a great number of token for certain duration and are totally restricted from using the token through out the period. Validators with higher stake are select to validate the block and are punished with a slash of stake for any mistake which is considered as dishonesty. Highest stakers have excessive influence on the blockchain thereby making it technically centralized.

The PPoS eliminates trilemma challenges and it apparent to everyone. Any holder of ALGO token that is in the network can propose and also vote for proposal. It staking duration is not fix. Withdrawal/spending is permitted any time. PPoS gives opportunity for both high and low stake holders this allows the low stake holder to stand a chance of earning from the blockchain too..

QUESTION 7: Explore and explain an ALGO transaction using Algoexplorer.io (Screenshot required)

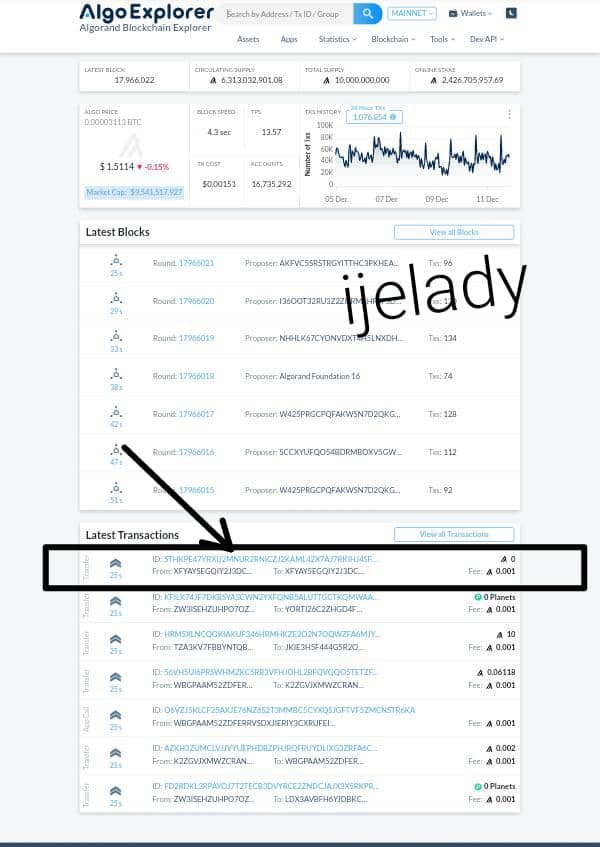

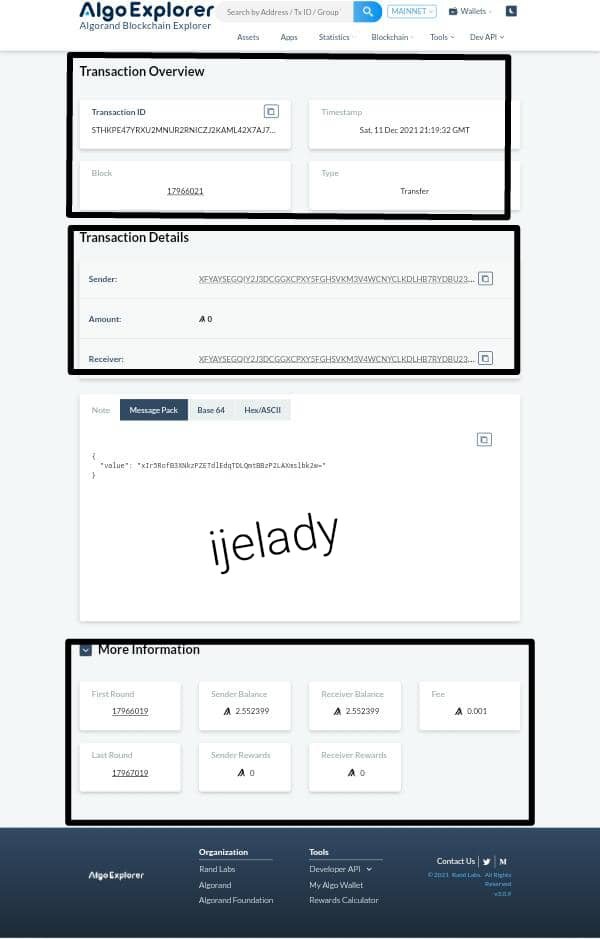

- Login to algoexplorer.io The website is subdivided into three units - overall details, latest blocks and latest transactions. Click on any transaction on the Latest Transaction unit.

- The transaction page is divided into three sections - Transaction overview, Transaction details and more.

- Transaction Overview: This first section contains the transaction ID, block number, timestamp and transaction type.

Transaction Details: This section shows sender Id, receiver Id, asset Id, sender ASA balance and receiver ASA balance.

More: This is the last section. It have a drop down arrow which shows first and last round, sender and receiver balance, fee and sender/ receiver rewards.

QUESTION 8: Perform an analysis of the price of ALGO from the beginning of the year to the present via graphic (screenshot required).

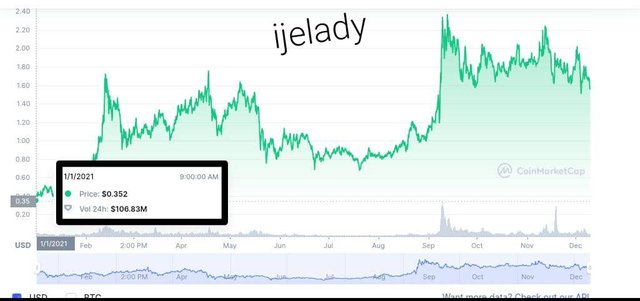

In order to get a concise overview, I’ll use the coinmarketcap price chat.

On 1 January 2021, ALGO bullish trend was $0.352. It maintained the bullish trend till 12 February at a price of $1.7124 and took a bearish trend till 26 February at a price of $1.0986. On 17 April, the ALGO make another bullish trend to $1.7028. On 7 July, ALGO coin bearish trend stop at $0.6934 value.

Since the beginning of this year, the highest price level of ALGO is $2.3634 which occurred on 12 September. A bearish trend occurred immediately, taking a flag pattern.

Today 10 December at 6:04am, ALGO coin is on a bearish trend at a value of $1.5617

Conclusion

Algorand blockchain is secured, decentralized and scalable. It is the first blockchains to use "Pure Proof of Stake" consensus protocol. PPOS consensus protocol is less expensive compared to Proof of Work (PoW) and Proof of Stake (PoS).

Algorand blockchain have many pros that keeps it on a save side. The most complaint con is poor rewards to validator.

Algo coin is expected to exceed $10 before December 2023. The trend will increase the value of validators rewarded token and more investors as well.

Thank you Prof. @nane15 for this lecture.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit