1.- What is Terra Station? Explore Terra Station on the web, Download the wallet and connect the wallet to Terra Station. Screenshots required.

Terra station is the name of the Terra blockchain wallet, where the tokens of the blockchain such as Terra Dollar (UST) and LUNA token are stored. It can be downloaded as a mobile wallet via Google play store for Android and is also available for iOS. As we know that there are several use cases of Terra ecosystem, Terra station enable users to explore those functions using the blockchain tokens. With the security requirements associated with the usage of the Terra station, the security of tokens stored in the wallet is guaranteed. This wallet gives users the avenue to explore the Terra ecosystem and also have an interaction with it.

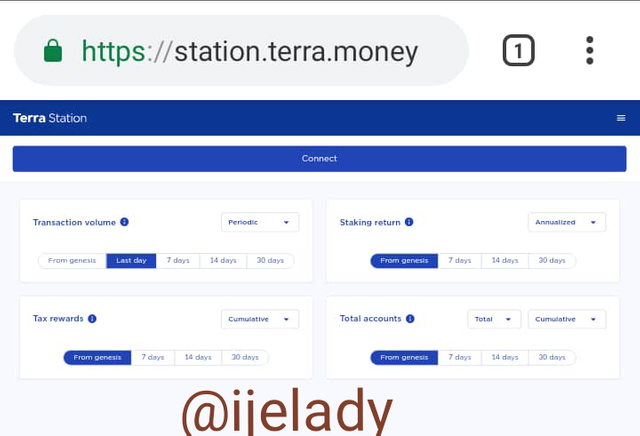

Exploring Terra Wallet

Main Page

Once the page opens, you will see on the home page the tokens and the amount of coins that is in the wallet. There are no much crypto coins stored my wallet for now. The wallet public address to be used for transferring coins into the wallet is also displayed on the page. You can also add tokens you wish to, using the add token tap provided in the page. There is also an option for wallet exportation. This is for people who already have an existing wallet and would want to link it. At the top right of the page, we have settings. Here you can explore other functions such as resetting of password and so on.

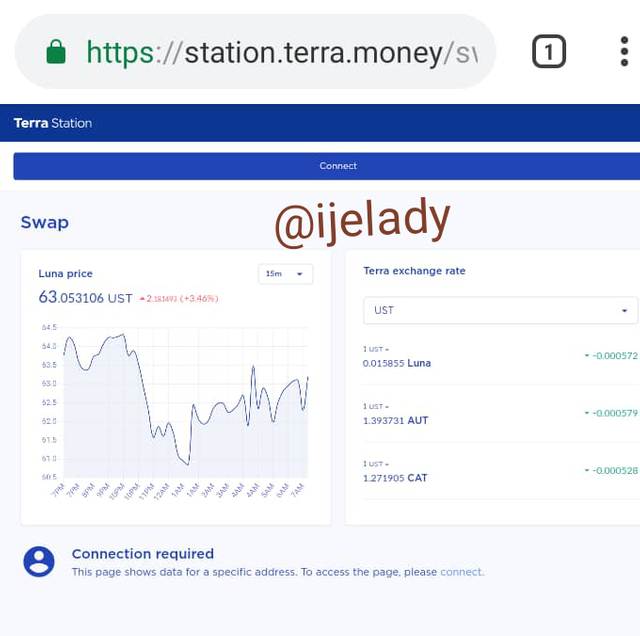

Swapping function

This function is provided to enable users exchange one token for another. By clicking on swap, you can swap one token with another at a rate that depends on the price of that token at that time. Here, you will be asked to choose the token you are swapping from as well as what you're swapping to.

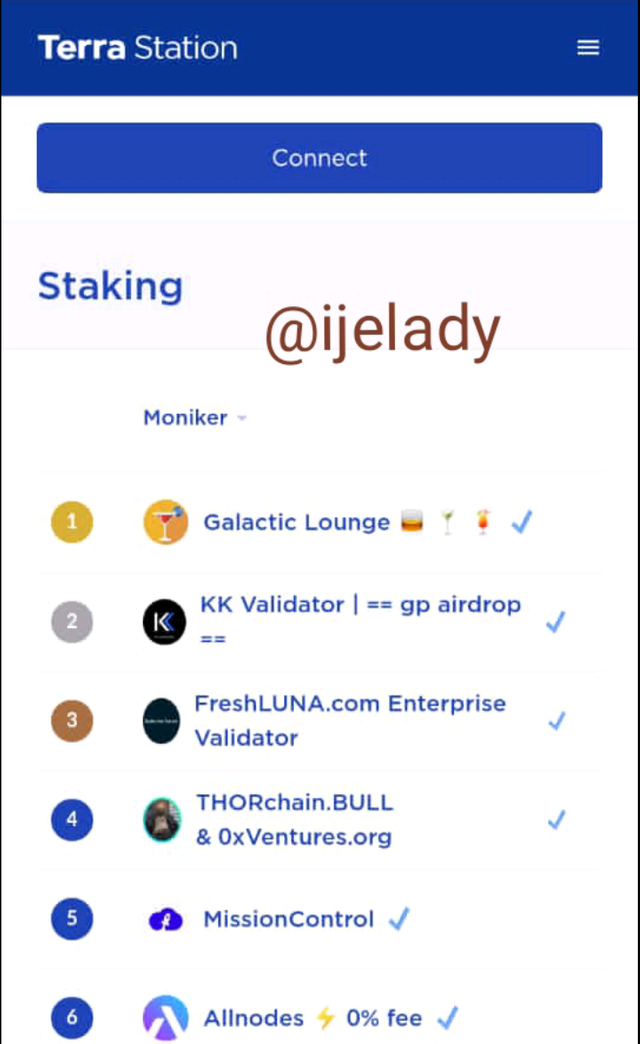

Staking

This is one of the most attractive features of any wallet that offers the staking function. This feature allows users to lock their coins in the wallet for a period, in order to provide liquidity, and in return, earn interest in an APR provided by the platform.

Connecting Wallet to Terra Station

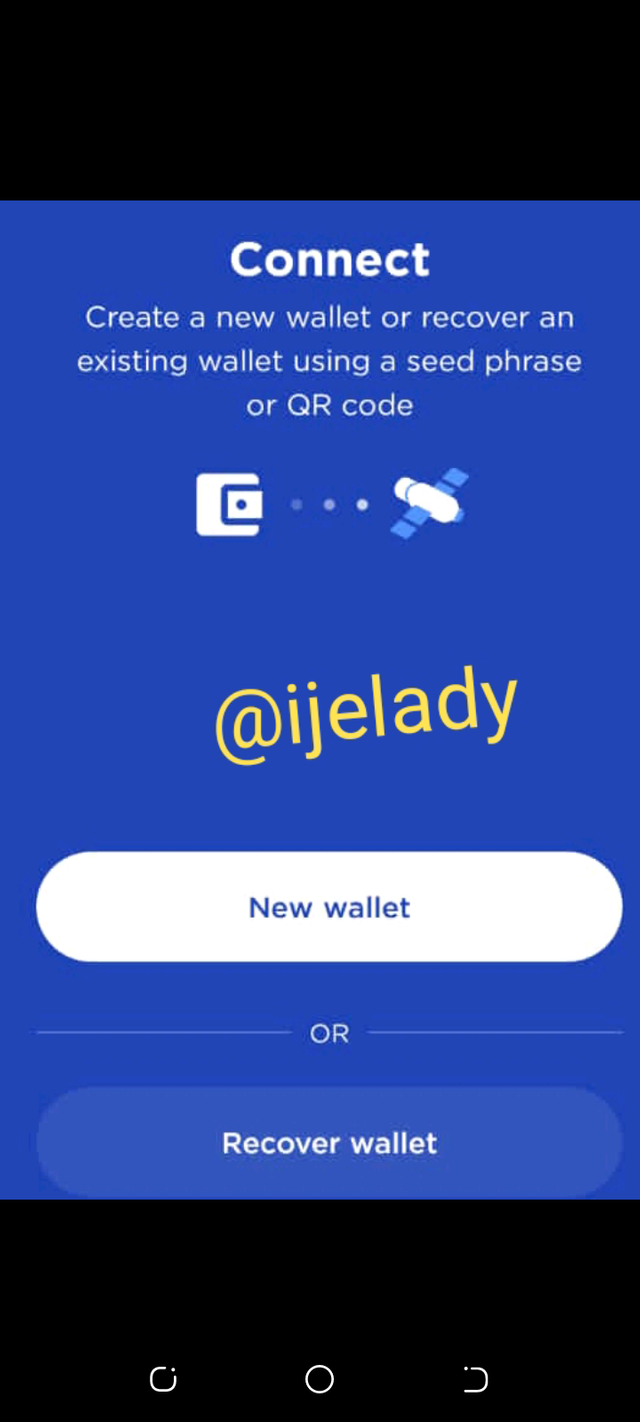

In order to connect the wallet to Terra station, we have to first of all download it. For Android users like myself, I'll do that via Google play store. Once downloaded, we launch it to get started.

- Launch the application and click on the 'new wallet creation' tap for those who are new to the platform. People who have already been registered will need to click on recover wallet.

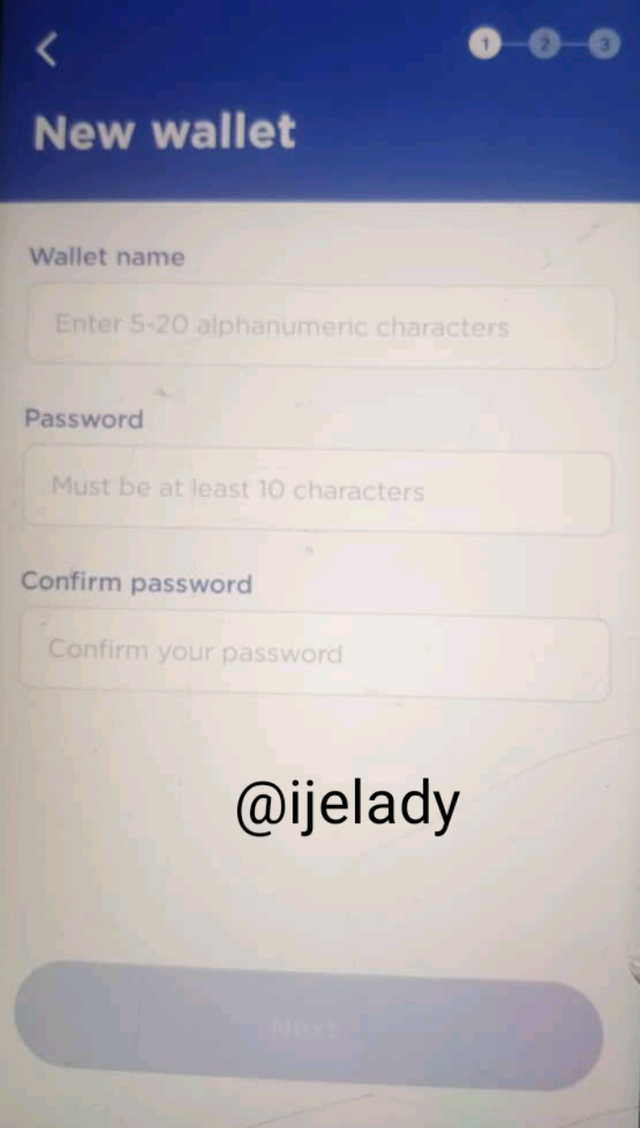

- Choose a name for your wallet and then choose a password for the wallet. It must be 10 or more characters. Tap next to proceed.

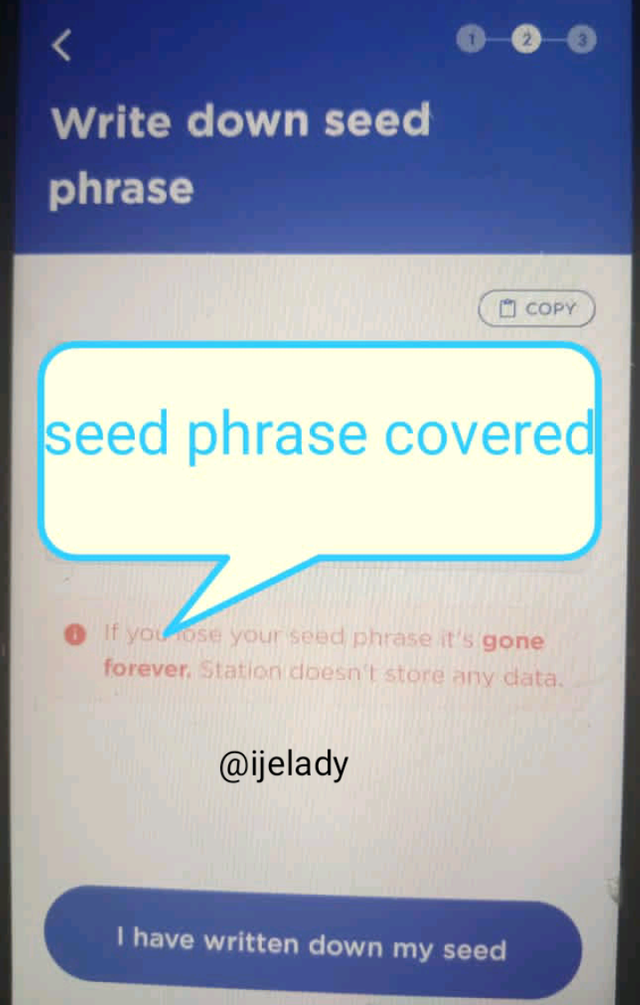

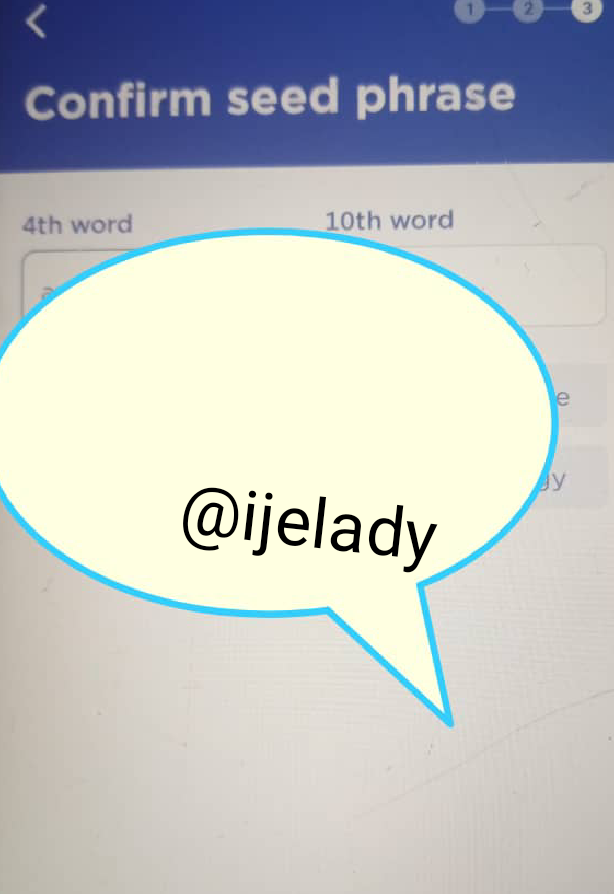

- You will be shown a seed phrase and will also be asked to write them down. These phrase must be written in the order it is given. This is what you can use in your wallet discovery so it is very important. Once you finish, click on 'I have written down my seed' to proceed to the next registration stage.

- For Terra to be sure that you have written down your seed, you will be asked to enter two random words from it and the numbers will be provided. Maybe number 8 and 12 for instance. Once you do that, click on 'confirm and finish'.

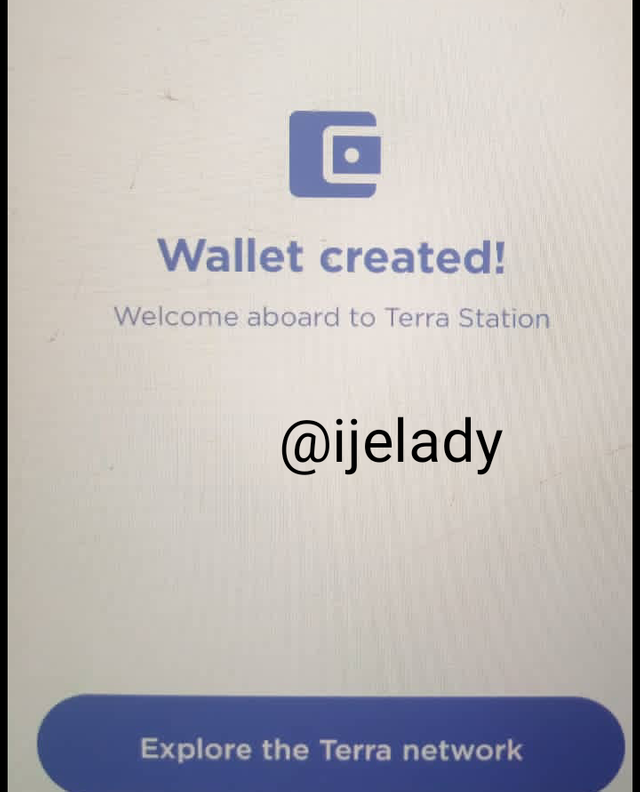

- Your wallet will be created successfuly and you will be welcomed to Terra station.

2.- Explain Anchor Protocol, explore the application and connect the Terra Station wallet. Show screenshots.

Yield farming and staking is one of the most fascinating features of Decentralized finance in the blockchain system. These features have helped investors to use the available funds in their disposal to earn interest by simply locking it up or providing liquidity to the platform they operate.

Yield farming specifically is the process of supplying tokens (providing liquidity) to the network or platform in order to earn interest. These funds supplied are used in both lending and trading. Interest gotten from borrowers of the funds are then distributed to those who supplied the token. This yield farming feature is Paramount in Anchor protocol.

Anchor protocol is a protocol that serves as a money market, bringing together lenders and borrowers of stablecoins. All that is needed from users of anchor to access funds, is to lock up Bonded assets known as bAssets in order to be able to borrow some stablecoins. The bAssets are used as collateral for the loan, and the loan amount must be below the LTV ratio set by the protocol.

Anchor protocol is an open savings protocol which doesn't require permissions. This means that it is unrestricted, and can be accessed by any third party app. The stablecoins deposited in the protocol are represented with aTerra which represents Anchor Terra. The higher the percentage of tokens supplied to the liquidity pool, the higher the yeild.

Funds supplied are in UST and are being used for several purposes. Interests gotten are shared among fund suppliers in form of aUST, and these aUST are paid back when withdrawing the supplied funds. Bonded Luna (bLUNA) is also a kind of token used in the Anchor protocol. bLUNA tokens are gotten by minting Luna and transforming it to another token. These tokens are used as collateral to borrow UST in the Anchor protocol.

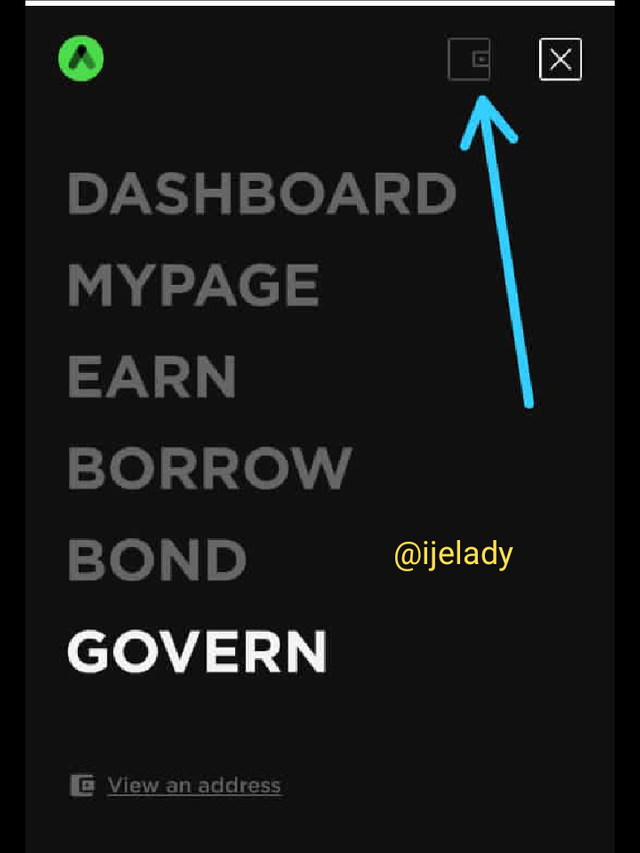

On the homepage of the Anchor protocol you have the dashboard my page and borrow Bond and governance pictures.

Dashboard:

On the dashboard our Data for TVL, yield reserve, ANC price, ANC market capitalisation, ANC circulating supply, ANC BUY-BACK, price of aUST to UST, total deposit, total borrow, deposit APY, stablecoin markets, etc.

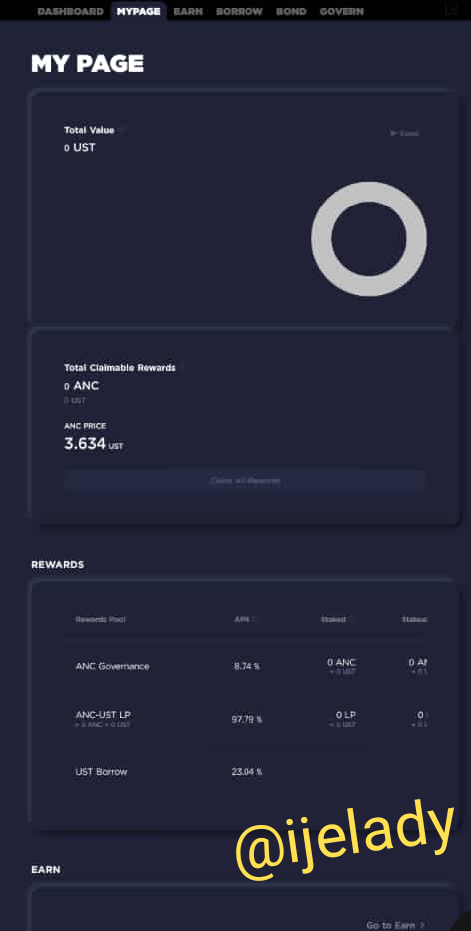

Mypage:

Here, user's holdings, claimable rewards, deposit, farming, governance and total value of holdings are shown

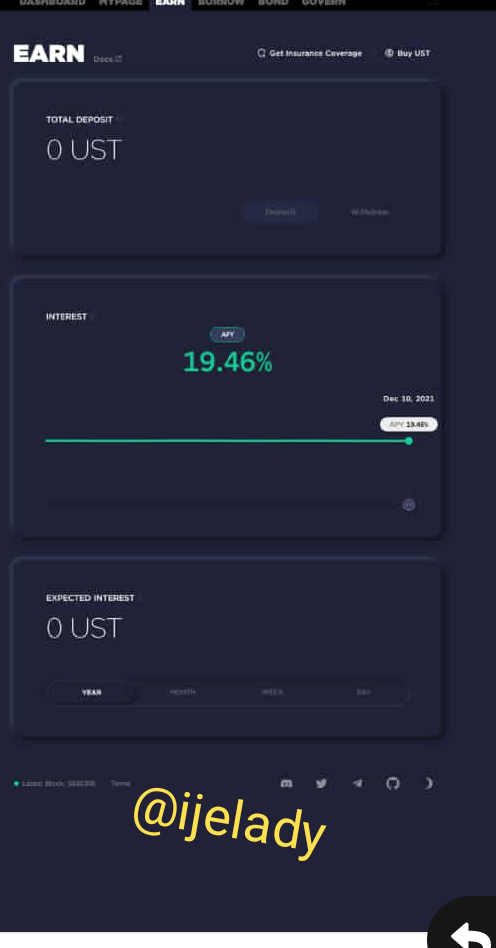

Earn:

Here, the tap for deposit and withdrawal are shown as well as the APY which is 19.46%. The expected interest is also displayed.

Borrow:

This is where the borrowed value as well as the collateral value and net APR is shown. The collateral list jfscxis also outlined.

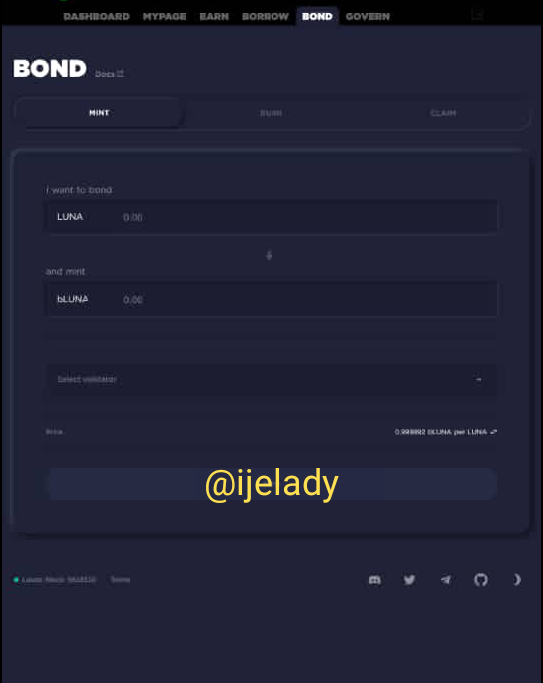

Bond:

This is where users can mint, burn and claim tokens. The user can select the token to burn, mint and also select a validator in order to mint.

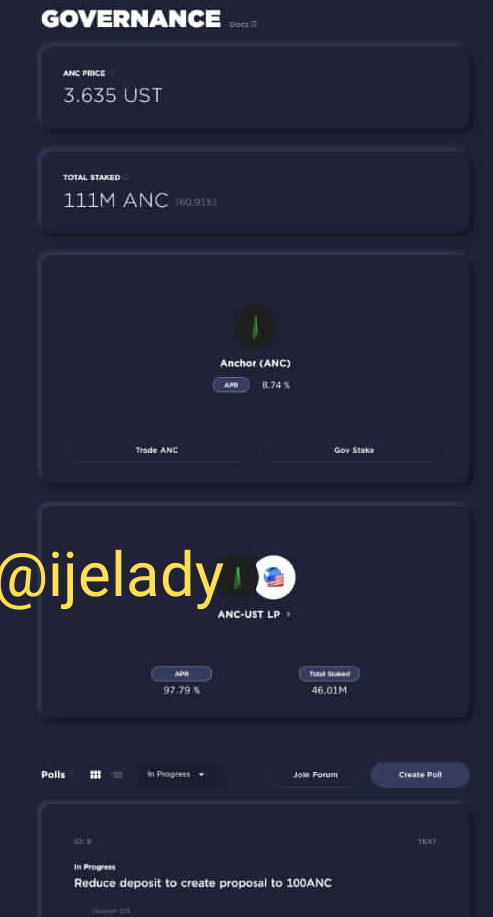

Governance:

Here, users can stake or supply ANC, which is the governance token of the protocol for staking.

All screenshots are directly from Anchor website

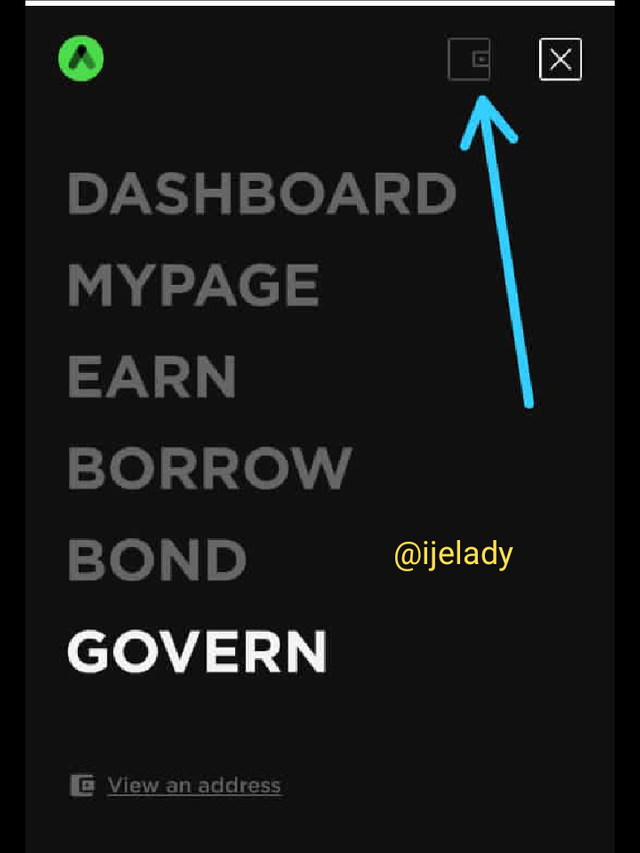

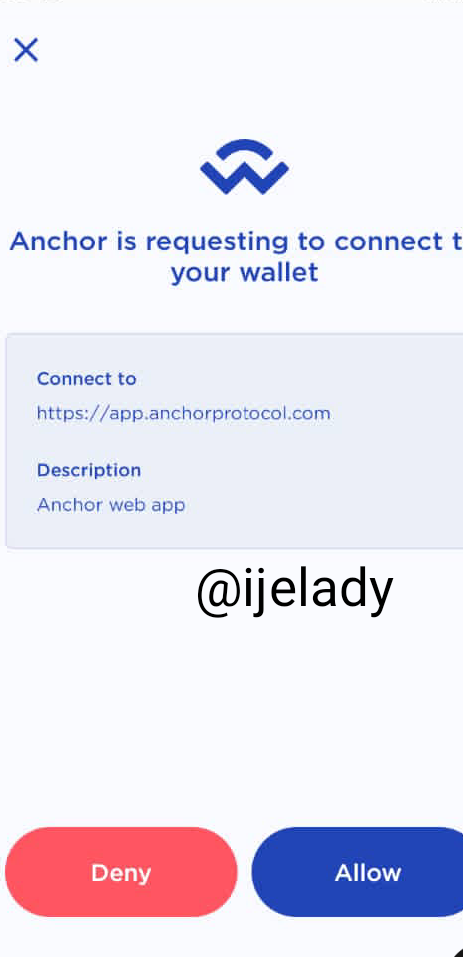

Connecting Terra Station to Anchor protocol

In order to connect the Anchor protocol to Terra station, we first log in to Anchor protocol here

- At the top of the page we click on the 'find wallet' tab.

- A pop-up will appear requesting to access and connect to Terra station. We click on 'allow' to connect wallet.

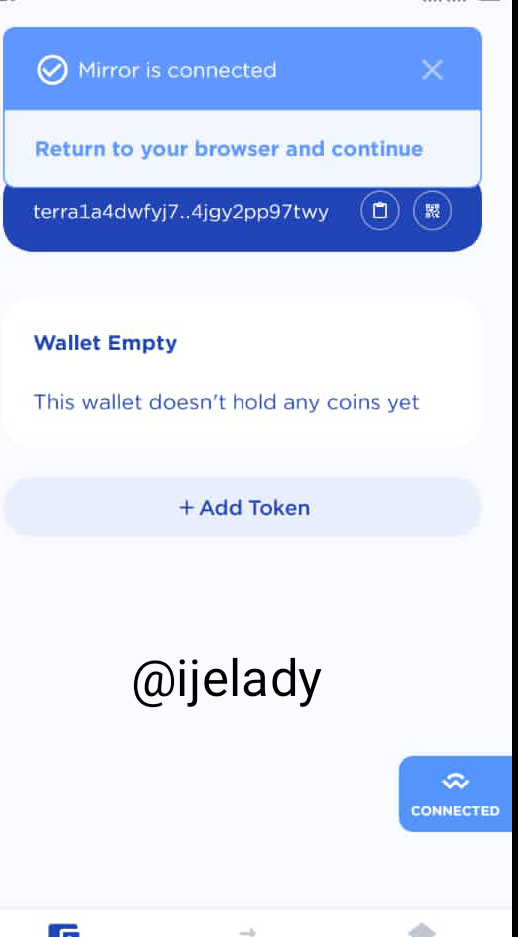

- On the next drop down, we will be asked to return to browser and continue.

- The wallet is successfully connected here.

All screenshots here are gotten directly from Anchor

3.- Explain Mirror Protocol, connect Terra Station and explore the Mirror Protocol application. Show screenshots.

Mirror protocol is a DeFi protocol of Terra Blockchain which offer users an avenue to trade synthetic assets also referred to as mirrored assets. These assets usually cannot be traded otherwise. Some mirrored assets include mFB, mGOOGL, mTSLA, mABNB and so on.

Mirror protocol is based on the Terra network and it allows the creation of mirrored assets. Such assets can only be created after collaterals in UST are deposited. Users can issue crypto tokens (synthetic assets) here and these assets will likely track the price of real assets like stock.

Exploring Mirror Protocol

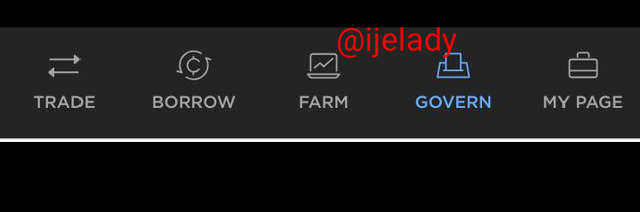

After logging in to the official mirror protocol website, we can see several features such as trade, borrow, farm, governance and my page.

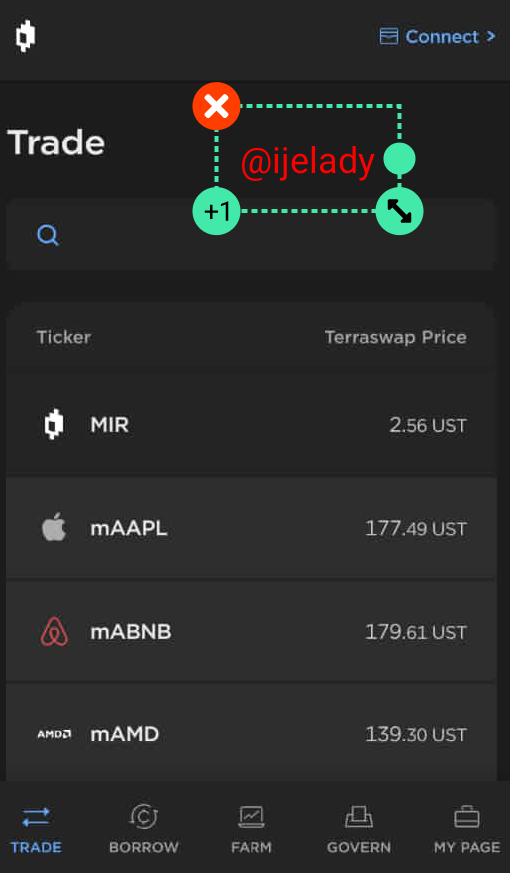

Trade:

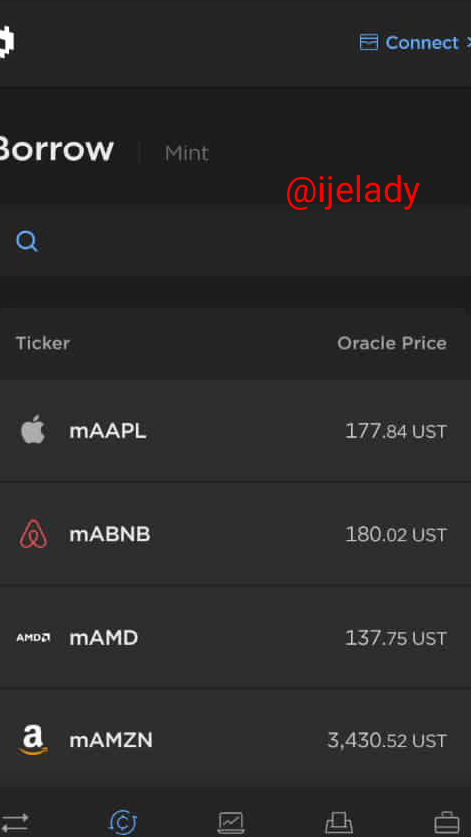

Borrow:

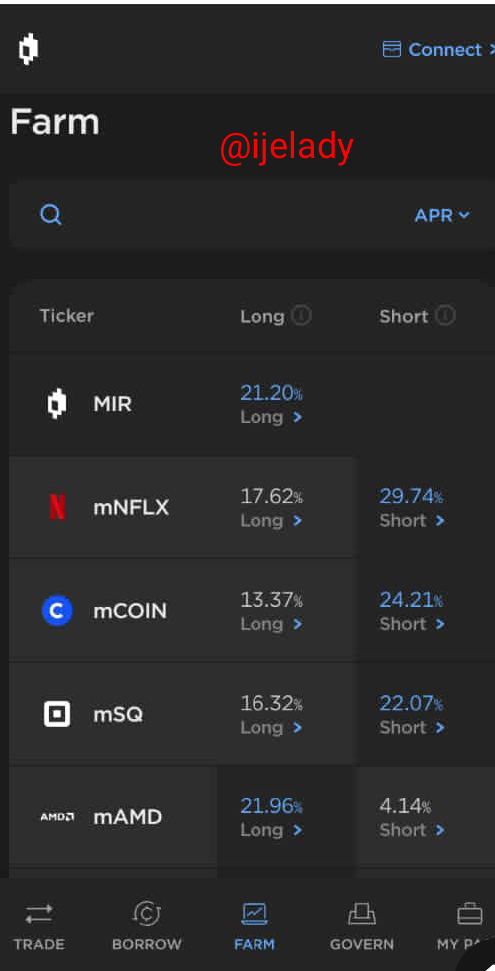

Farm:

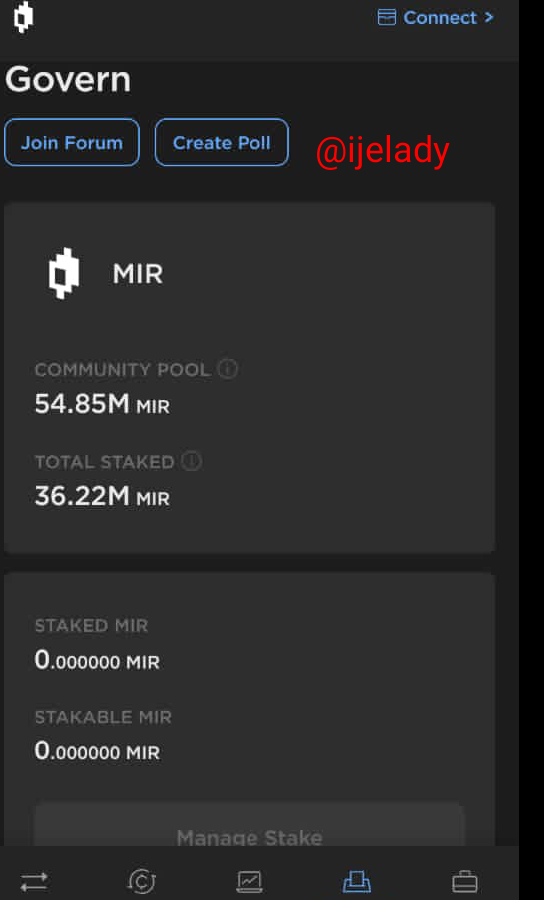

Governance:

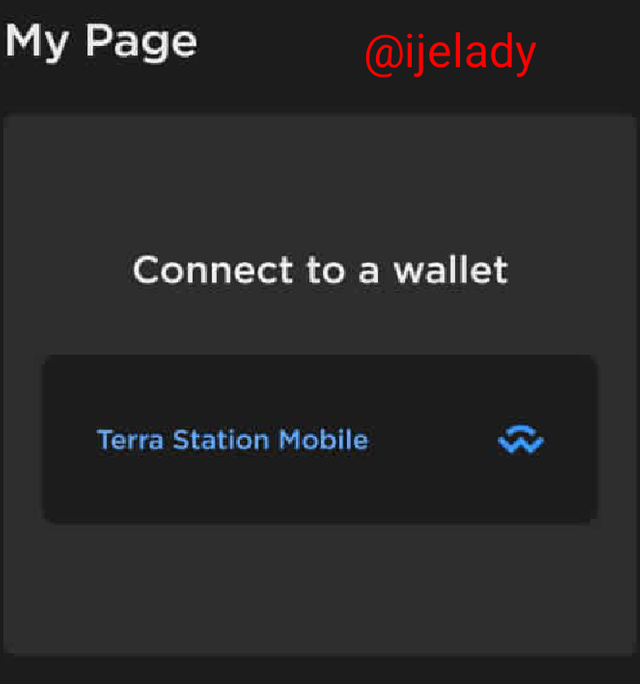

My page:

All screenshots here are from Mirror

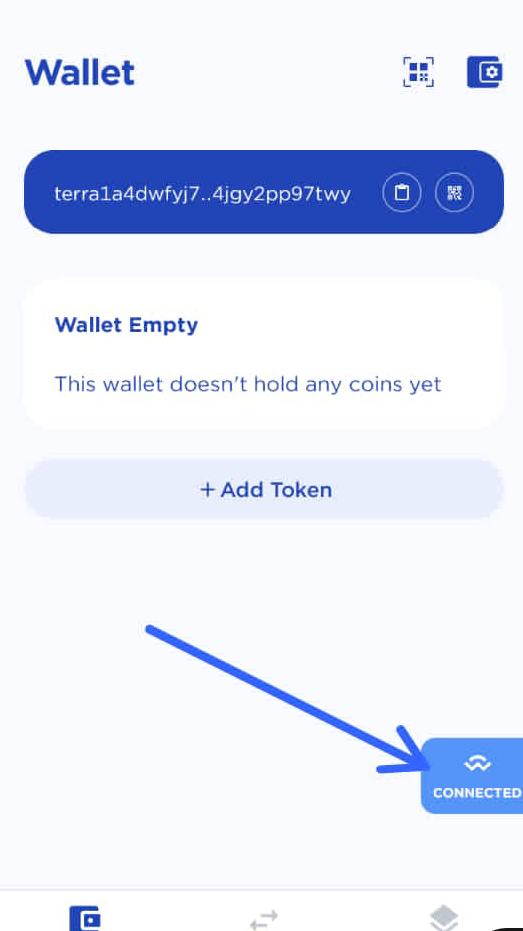

Wallet connection

In order to connect the mirror protocol to Terra station;

- We login to mirror protocol

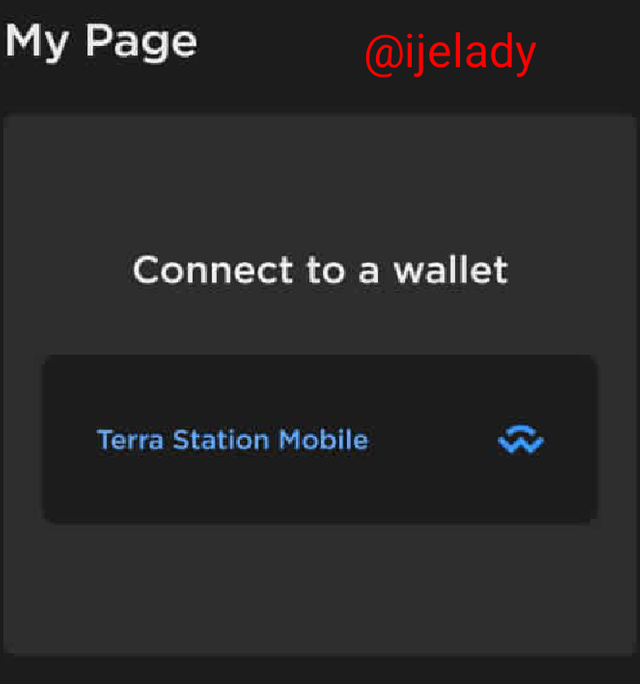

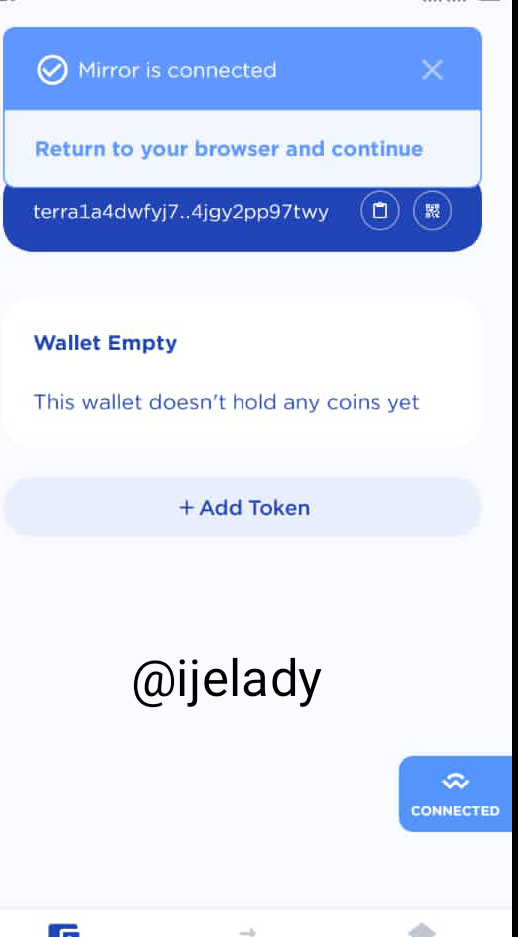

- On the top of the page we click on connect wallet. You will be taken to a wallet connection page.

Clicking on 'Terra station mobile' will take you to your mobile wallet.

Select 'open Terra station mobile' to be able to complete the connection procedures.

A request to open wallet will pop up, click on allow. Wallet be successfully connected. You can go back to your own browser to continue from where you stop.

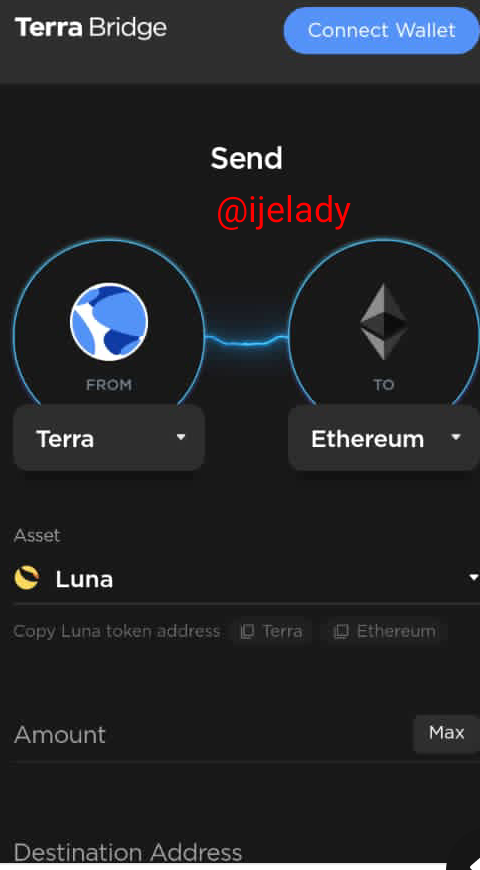

4.- What is the Terra bridge? Explain, show screenshots.

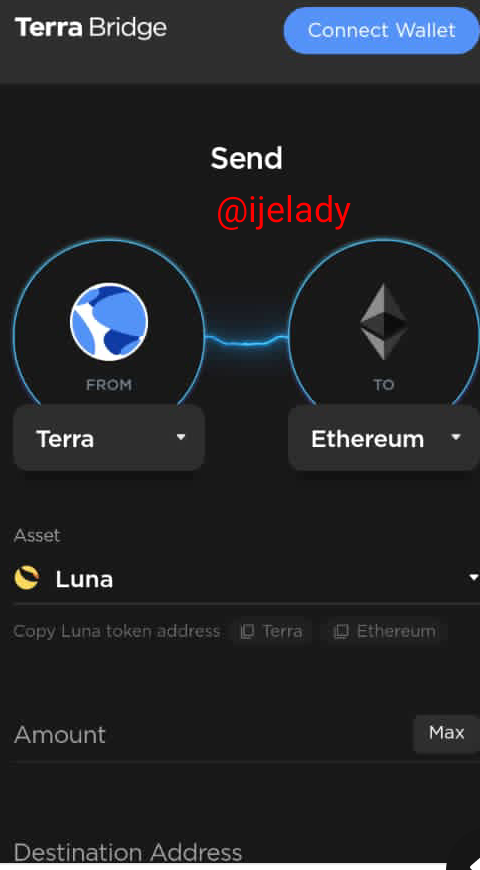

We all know that the Bitcoin Blockchain is separate and totally different from the Ethereum blockchain. In the same way, the Terra ecosystem is a different network on its own. But there is a cross chain function that enable the Terra Blockchain to be linked with other blockchains such as the Binance smart chain and Ethereum blockchain.

5.- Explain how it works and what the Terra Stablecoin are.

The mirrored tokens of Terra as well as other tokens can be sent to other networks, with transfer fees being charged either at 0.1% or $1, depending on which is higher.

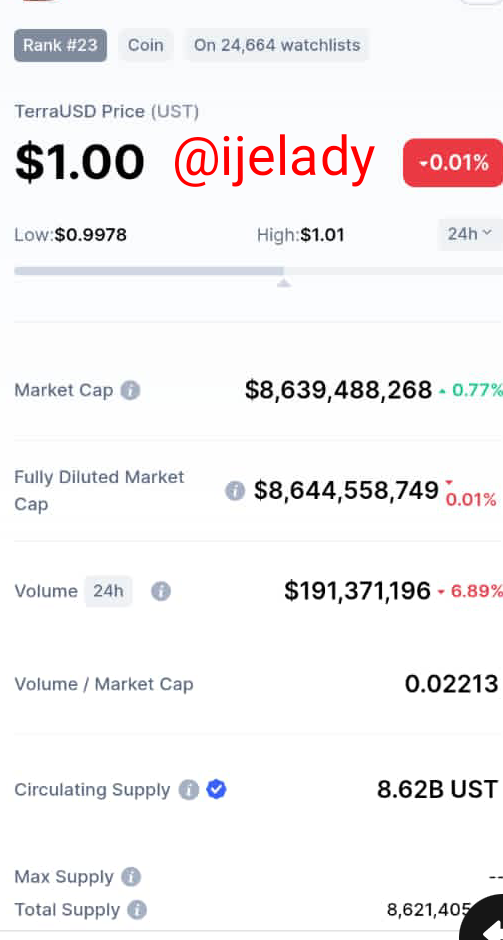

Terra Stablecoins

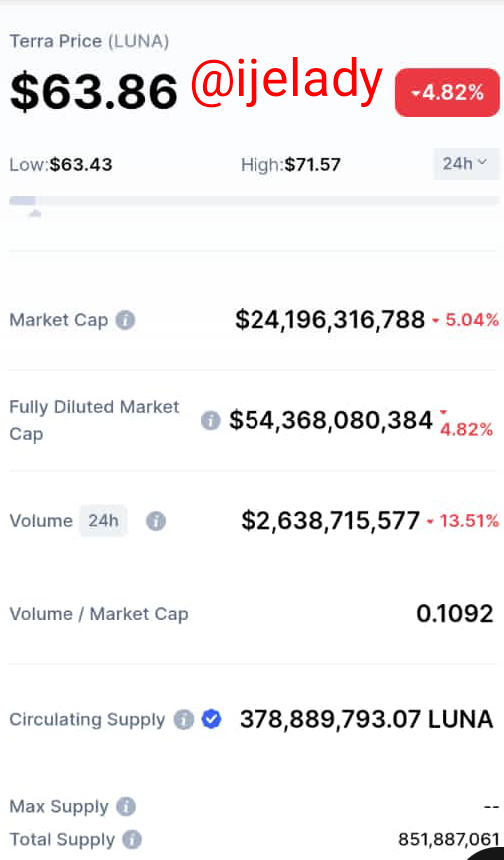

The stablecoins available on the Terra network is TerraUSD (UST) and LUNA. These two coins help in stabilizing the volatility associated with digital assets. With UST, users of the Terra platform can carryout some functions with some degree of certainty that the value of the token in the short run is safeguarded. UST and LUNA exist in the Terra ecosystem for use in the execution of some functions such as collateral for borrowing, yields, supply to liquidity pool, etc.

These tokens are currently doing very well in the market. For instance, according to coinmarketcap, UST has a current rank of #23, a market price of $1.00, a market capitalisation of $8,639,488,268 and a circulating supply of 8.62 billion UST. It also has a 24 hour trading volume of $191,371,196 at the time of writing.

In the same direction, LUNA has a current market price of $63.86 and a market capitalisation of $24,196,316,788 and a circulating supply of 378,889,793.07 LUNA. The total supply of LUNA is 851,887,061.

6.- You have 1,500 USD and you want to transform it into UST. Explain in detail and take the price of the updated LUNA token.

If I have 1500 USD and I wish to change it to UST, I have to first convert it to LUNA tokens. It is already established that 1,500 USD will equal 1,500 UST.

So in order to convert the 1,500 USD to UST, I have to find the amount of LUNA equivalent to 1,500 USD. To do so, I divide 1500 USD by the updated amount of LUNA which is $63.86.

1500/63.86 = 23.48 LUNA.This means I will have to convert 1,500 USD to 23.48 LUNA before minting.

Now you have those 1,500 USD and you want to make a profit, since 1 UST = 1.07 USD. Explain in detail and take the price of the updated LUNA token.

If 1 UST = 1.07 USD, then 1500 USD will give us 1,605 UST, that is 1500 × 1.07. This means that I have an extra 105 UST because of the rise in USD price.

1,605 ÷ 63.86 = 25.13 LUNA. This means that I have 1.65 extra LUNA compared to when USD was 1:1 with UST.

25.13 × 63.86 × 1.07= 1717.13

1717.13 – 1500 = $217.13

CONCLUSION

Terra blockchain in summary is a great blockchain that promotes DeFi in a different and unique way. In this blockchain, stablecoins are being minted easily and investors can also farm in order to earn yields. There are also some mirrored tokens that track the prices of real-time assets and these tokens have their use cases in the platform. The cross chain function also is a unique feature offered by the platform. The projects that have been developed and the ones to be developed places the Terra network in a higher rank and its token has the potentials of going even higher. LUNA and the Terra Blockchain as a whole is investor friendly and I think it will do great in the future.

It was nice being here. Thanks for having me. Thanks to professor @pelon53 for this one.