Good night everyone. Tonight I will write a post for my Steemit blog. This post is a homework that I will submit to professor @allbert. The topic discussed in this class is about “DCA to Create a Portfolio” and the Professor has given 3 questions as homework for the students. Immediately, let's write and answer it...

Q1.) Select two Crypto, perform fundamental analysis, and based on your fundamental analysis explain why you chose them. Exclude BTC, ETH, RUNE. Develop and justify your answer. Be original

Fundamental Analysis and Technical Analysis are two types of analysis that are very important to understand and consider before deciding to trade and invest in cryptocurrency. In this class we will focus more on Fundamental Analysis, because based on the Fundamental background, I will choose two cryptocurrencies that have a large market capitalization or are in the top 100. The cryptocurrencies that I will discuss are Stellar Lumens (XLM) and Tron (TRX) .

Fundamental Analysis about Stellar Lumens (XLM)

XLM is a cryptocurrency developed by the Stellar Company and launched in 2014 by presenting a distributed payment system that is secure and capable of connecting the banking sector with the blockchain system, XLM also has high transaction speeds on the blockchain network with very very low transaction fees. Based on the XLM whitepaper consisting of 32 pages, it shows that the launch of this coin is also an extraordinary innovation, especially innovation that brings progress to the banking system by utilizing blockchain technology.

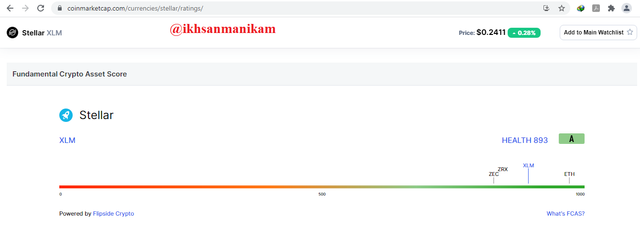

Currently the FCAS (Fundamental Crypto Asset Score) value of XLM coin is 893 and this shows that XLM is one of the coins with very strong fundamentals.

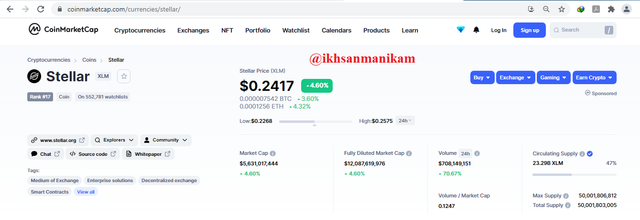

| Cryptocurrency | Stellar (XLM) |

|---|---|

| Market Rank | 17 |

| Price | $ 0.2417 |

| Low –High in 24h | $ 0.2268 - $ 0.2575 |

| Volume in 24h | $ 708,149,151 |

| Marketcap | $ 5,631,017,444 |

| All Time High | $ 0.9381 Jan 04, 2018 |

| All Time Low | $ 0.001227 Nov 18, 2014 |

| Circulating Supply | 23,290,000,000 XLM |

| Total Supply | 50,001,803,005 XLM |

| Market Dominance | 0.44% |

| Official Website | https://www.stellar.org/ |

| Whitepaper | https://www.stellar.org/papers/stellar-consensus-protocol.pdf |

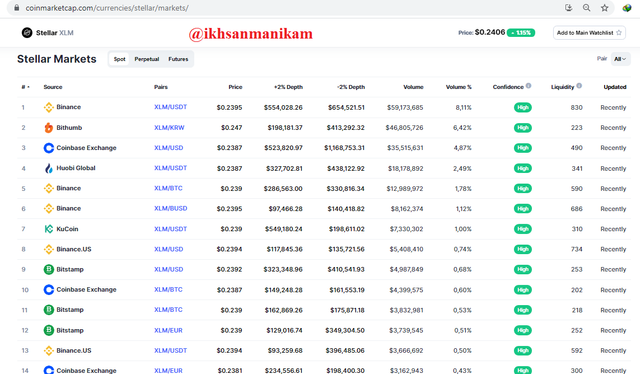

Based on the above data, the contents of the whitepaper, and visiting the official website, we can see that XLM is currently more growing and is very well received in the market. Has a high market rank, large market cap, good market dominance, and is very actively traded on various exchanges with high volume. Based on historical data and charts, the price of XLM is also very suitable for investment because we can take advantage of its volatility to make a profit.

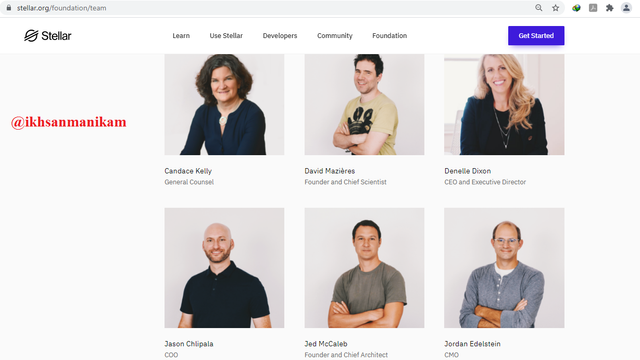

XLM also has an excellent team background. This can be seen based on the profile displayed on the official website. Based on the whitepaper, XLM also has future progress with a very good vision & mission. Since first launched until now, it has proven that XLM has been very successful in the cryptocurrency world and all of that is the hard work of their team of great and competent people.

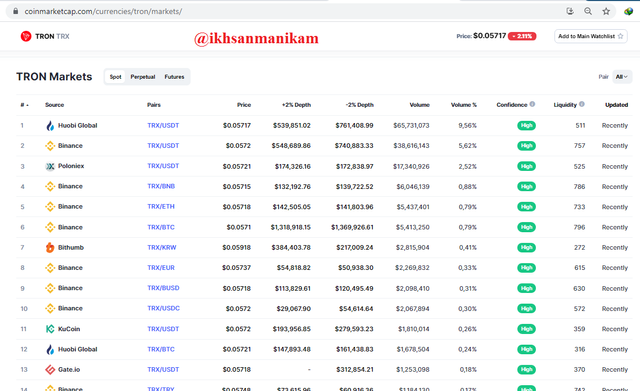

Fundamental Analysis about Tron (TRX)

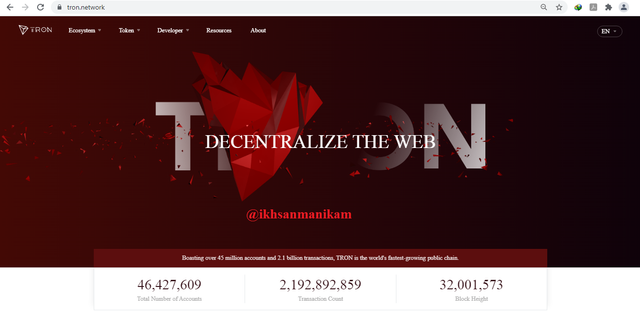

TRX is a cryptocurrency that was developed by Justin Sun in 2017 through his company called Tron Foundation and this coin runs on the tron blockchain network. Tron has a very active ecosystem with almost 47 million users and offers a variety of interesting services, such as the creation of DApps and others. TRX's transaction speed is also very high and the transaction fees offered are also very very low. Transactions here are also supported with high security.

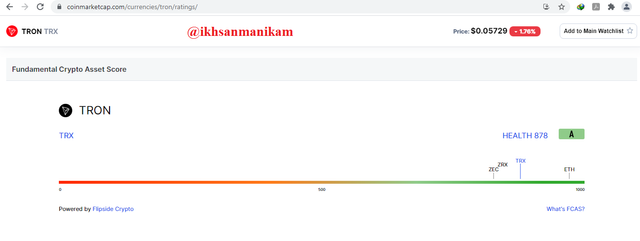

Currently the FCAS (Fundamental Crypto Asset Score) value of TRX coin is 878 and this shows that TRX is one of the coins with very strong fundamentals, not much different from XLM.

| Cryptocurrency | Tron (TRX) |

|---|---|

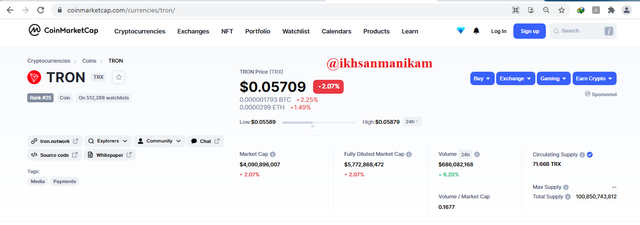

| Market Rank | 25 |

| Price | $ 0.05709 |

| Low –High in 24h | $ 0.05589 - $ 0.05879 |

| Volume in 24h | $ 686,082,168 |

| Marketcap | $ 4,090,896,007 |

| All Time High | $ 0.3004 Jan 05, 2018 |

| All Time Low | $ 0.001091 Sep 15, 2017 |

| Circulating Supply | 71,660,000,000 TRX |

| Total Supply | 100,850,743,812 TRX |

| Market Dominance | 0.31% |

| Official Website | https://tron.network/ |

| Whitepaper | https://developers.tron.network/docs |

Based on the above data, the contents of the whitepaper, and visiting the official website, we can see that TRX is currently more growing and is very well received in the market and plays an active role in the blockchain network. Has a high market rank, large market cap, good market dominance, and is very actively traded on various exchanges with high volume. Based on the data and charts, the price of TRX is also very suitable for investment because we can take advantage of its volatility to make a profit.

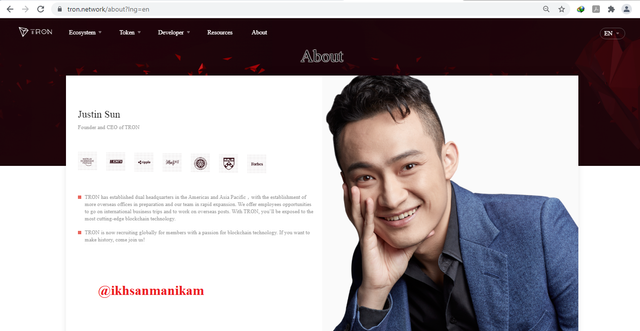

TRX also has an excellent team background, particularly Justin Sun's leadership in leading the team and developing this project. This can be seen based on the profile displayed on the official website. Based on its whitepaper, TRX also has future progress with a very good vision & mission to continue to grow in the blockchain network.

Since first launched until now, it has proven that TRX has been very successful in the cryptocurrency world and all of that is the hard work of their team of great and competent people, especially Justin Sun.

My Reason Why I Chose XLM & TRX (Based Fundamental Analysis)

These two coins are my favorite coins because their fundamentals have proven to be very good and are in the top 25 with high market capitalization value. In addition, the two coins also have good percentage of market dominance to date.

The price movements of the two coins are also volatile, so they can be used as a choice of investment assets that must be in my portfolio. These two coins also have an excellent background and are backed by a very competent team and people. These two coins have also been very well received in the market, as evidenced by their very high daily transaction volume and are traded on nearly 200 exchanges from all over the world.

With various advantages, these two coins have been proven to have high fundamental value. I've been investing in both coins for the past few years and it's my choice to trade frequently until now, and even though I got both coins through the airdrop program in the early days. I'm also staking amount TRX coins on the Poloniex Exchanges platform.

Q2.) Through your verified Exchange account (screenshot needed), make a real purchase of one of the cryptocurrencies selected in the first assignment and explain the process. The minimum investment must be 5USD (mandatory) and must present screenshots of the verified account and the whole operation

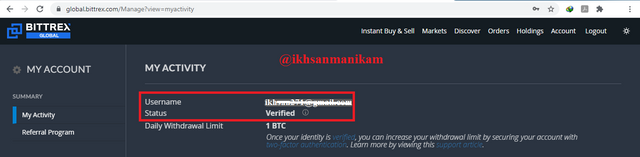

In this post I will show you the process of buying TRX using 5 USDT of capital through the Bittrex Exchanges platform. Here is proof that my trading account has been verified on Bittrex.

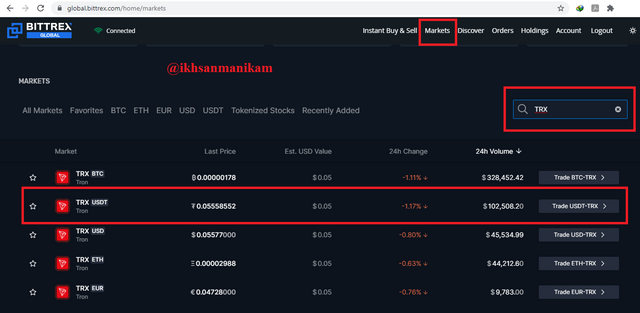

XLM and TRX are two coins that I have traded frequently so far and both are very suitable to buy at this time because they are in a downtrend, especially in pairs trading using USDT. Immediately, here is the process of purchasing TRX using a capital of 5 USDT.

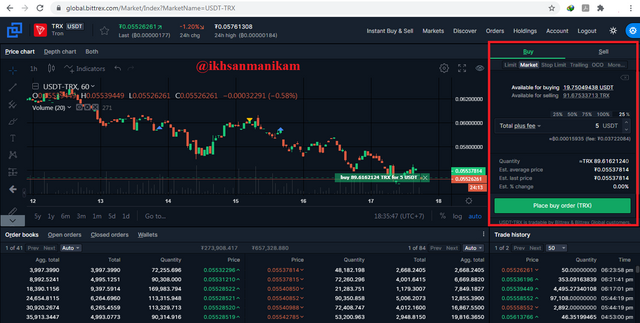

- First of all go to the “Markets” page on Bittrex. Then write the word “TRX” in the search field and click the “TRX/USDT” icon that appears in the search results section.

- Then the TRX/USDT trading screen will appear as below. In the upper right corner there are "Buy" and "Sell" columns. Select the “Buy” column to make a purchase of TRX using USDT.

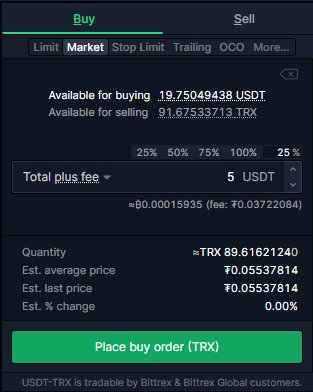

- Fill in the "Buy" column according to your wishes. I made an order based on the market price using the “Market” feature for quick order.

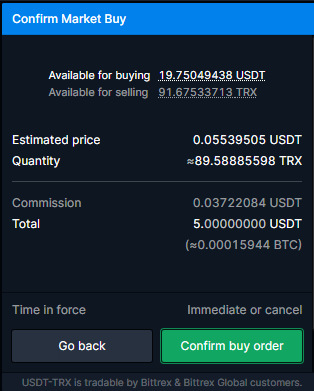

- Purchase confirmation to ensure that your order is valid, click "Confirm Buy Order".

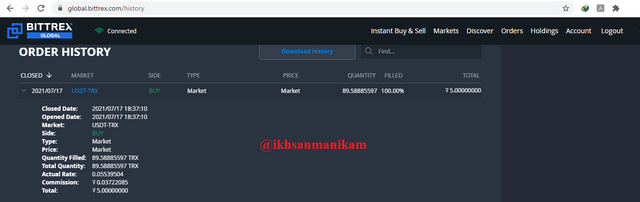

- Because I made an buy order based on the market price, my order was immediately filled and I managed to buy 89,58886 TRX. Here is evidence of its history.

Those are the simple steps to make a "Buy Order" on Bittrex and you can try it because it's not difficult. Good luck and happy trading....

Q3.) Finally, make a simulated exercise, using the DCA method to perform the purchase of two assets and present charts showing the data of days in which the operation was performed, price of purchases, average price, sell point, percentage of profit or loss. (include screenshots)

DCA or Dollar Cost Averaging is an investment asset purchase strategy that is very suitable to be applied in the cryptocurrency markets. By using the DCA strategy, we will buy the same cryptocurrency with the same time interval and divide the investment capital in the same amount.

For example, I have a capital of $40 and then I buy asset “A” once every 7 days at a certain price and in a certain amount with a capital of $5 each and that means I will do it for 56 days. The DCA strategy is not very good for bullish market conditions because it is very risky and you should buy assets when it is bearish because it is better for your investment.

With the DCA strategy, the risk of loss has been divided into several buying prices. In addition, you should not invest only in one asset because it is too risky. I recommend you to invest your capital in several assets so that the risk of loss is more minimized.

DCA Simulation based XLM/USDT Trading Chart

With an investment of $140, I will make 7 trades in time intervals every 6 days with each using a capital of $20.

Purchase 1 (June 06, 2021): $20/0.38 = 52,631 XLM

Purchase 2 (June 12, 2021): $20/0.32 = 62,500 XLM

Purchase 3 (June 18, 2021): $20/0.30 = 66,666 XLM

Purchase 4 (June 24, 2021): $20/0.26 = 76,923 XLM

Purchase 5 (June 30, 2021): $20/0.28 = 71.426 XLM

Purchase 6 (July 06, 2021): $20/0.26 = 76,923 XLM

Purchase 7 (July 12, 2021): $20/0.24 = 83,333 XLM

Total XLM = 490.402 XLM

Average purchase price = $140 / 490.402 XLM = $0.285

So I managed to get 490,402 XLM with average price is 0.285 USDT per XLM. If I want to end the investment now then I will incur a loss because my average purchase price is still far above the current price. My average purchase price is $0.285 while the current price is $0.2304. If 490.402 XLM is multiplied by $0.2304 then I will get $113, while my capital is $140 which means I have lost as much as $27 or 19%.

By using the DCA strategy it is proven that the risk of loss can be reduced. Imagine if I spent all that capital ($140) on the first purchase price ($0.38) then I would only get 368,421 XLM and based on the current price ($0.2304) it means I have lost as much as $55 or 39%. So, in this experiment I managed to reduce the percentage of losses that almost doubled, from 39% to 19%.

To avoid losses, I will "hold" the XLM for a while and monitor market conditions because sales should be carried out in bullish conditions. To make a profit, I will sell it above the average purchase price, which is above $0.285.

DCA Simulation based TRX/USDT Trading Chart

With an invested capital of $70, I will make 7 trades in time intervals every 6 days with each using a capital of $10.

Purchase 1 (June 06, 2021): $10/0.076 = 131,579 TRX

Purchase 2 (June 12, 2021): $10/0.068 = 147,059 TRX

Purchase 3 (June 18, 2021): $10/0.070 = 142,857 TRX

Purchase 4 (June 24, 2021): $10/0.057 = 175,439 TRX

Purchase 5 (June 30, 2021): $10/0.064 = 156.250 TRX

Purchase 6 (July 06, 2021): $10/0.065 = 153,846 TRX

Purchase 7 (July 12, 2021): $10/0.060 = 166,667 TRX

Total TRX = 1,073,697 TRX

Average purchase price = $70 / 1,073,697 TRX = $0.065

So I managed to get 1,073,697 TRX with average price is 0.065 USDT per TRX. If I want to end the investment now then I will incur a loss because my average purchase price is still far above the current price. My average purchase price is $0.065 while the current price is $0.0555. If 1,073,697 TRX is multiplied by $ 0.0555 then I will get $ 60, while my capital is $ 70 means I lost as much as $ 10 or 14%.

By using the DCA strategy it is proven that the risk of loss can be reduced. Imagine if I spent all that capital ($70) on the first purchase price ($0.076) then I would only get 921,053 TRX and based on the current price ($0.0555) it means I have lost $19 or 27%. So, in this experiment I managed to reduce the percentage of losses that almost doubled, from 27% to 14%.

To avoid losses, I will "hold" the TRX for a while and monitor market conditions because sales should be carried out in bullish conditions. To make a profit, I will sell it above the average purchase price, which is above $0.065.

Keep in mind that good portfolio planning is the beginning of success. Fundamental analysis is one of the analyzes that must be considered before choosing investment assets. Meanwhile, DCA is a good strategy for buying assets in bearish market conditions, especially for beginners who lack technical analysis. The DCA strategy is very suitable for long-term investment.

Having studied it, we can now trade by combining Fundamental Analysis and DCA strategy. This is a good idea to enter the market and is a good solution to minimize losses. But we should also add Technical Analysis in every trade. In addition, you should also invest your capital in several types of assets because this strategy can also minimize potential losses.

Hello, @ikhsanmanikam Thank you for participating in Steemit Crypto Academy season 3 week 3.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit