hello steemians we meet again on homework for the 4th week in this 4th season of Steemit Crypto Academy. This time I will make a post for the homework of @reminiscence01. The task this time is to answer several questions that have been given by the professor about Technical Indicators 2.

Homework list:

- a) Explain Leading and Lagging indicators in detail. Also, give examples of each of them.

b) With relevant screenshots from your chart, give a technical explanation of the market reaction on any of the examples given in question 1a. Do this for both leading and lagging indicators. - a) What are the factors to consider when using an indicator?

b) Explain confluence in cryptocurrency trading. Pick a cryptocurrency pair of your choice and analyze the crypto pair using a confluence of any technical indicator and other technical analysis tools. (Screenshot of your chart is required ). - a) Explain how you can filter false signals from an indicator.

b) Explain your understanding of divergences and how they can help in making a good trading decision.

c) Using relevant screenshots and an indicator of your choice, explain bullish and bearish divergences on any cryptocurrency pair.

1. a) Explain Leading and Lagging indicators in detail. Also, give examples of each of them

Leading Indicators

leading indicators are indicators that can help traders determine where the price will move even before the price starts showing its movement, this is a type of indicator that can help traders predict the price direction of an exchange market in the future. As an example, you can see one of the leading indicators that I show in the picture below.

Lagging Indicators

While a lagging indicator is an indicator that is late to show the direction of movement of an exchange market, this type of indicator gives a signal of the direction of a market after the market shows its movement. I will show you an example of one of the lagging indicators.

Then from the explanation I made above, are lagging indicators not more useful than leading indicators? no. it all depends on the trading style of each trader. for a trader who is suitable for a slow, steady, and clear way, the lagging indicator will be more suitable for him.

For traders with a more aggressive trading style and who want to get the overall movement of a trend in the exchange market, leading indicators will be more suitable for him.

1. b) With relevant screenshots from your chart give a technical explanation of the market reaction on any of the examples given in question 1a. Do this for both leading and lagging indicators

Leading Indicators technical explanation

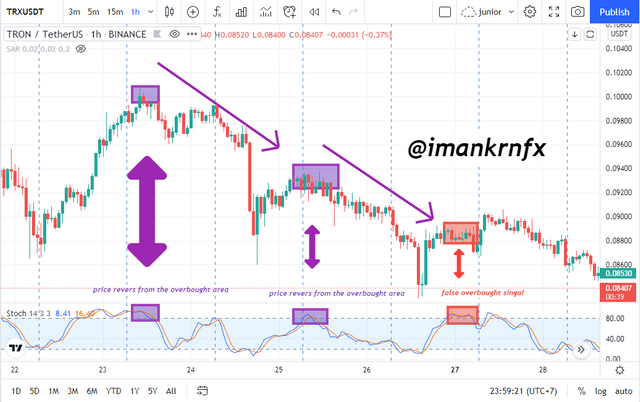

The stochastic indicator uses overbought and oversold levels as signals of the direction of a reversal that will occur in a currency pair, where overbought is a good area to place sell orders and oversold is a good area to place buy orders. It can be seen in the example I gave above, when the price enters the overbought area, traders can get ready to place their sell orders.

The important thing that a trader must remember when using the stochastic indicator is that it can give false signals. So, you have to be smart in choosing the right signal when using this indicator.

Lagging Indicators technical explanation

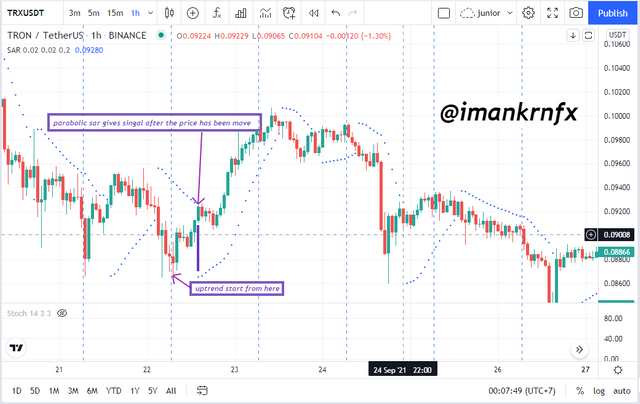

Parabolic sar indicator, this indicator is an indicator that shows a trend with dots like the one shown in the picture above, if the dots are above the candlestick it means that the trend in the market is a downtrend, whereas if the points are below the candlestick it means the market is in an uptrend.

In the picture above, we can see the dots from the parabolic sar move from the top to the bottom of the candlestick, this means that the trend has changed from the previous downtrend to an uptrend, however, this indicator was late to give a signal because the price had shown its uptrend movement earlier than the indicator.

2. a) What are the factors to consider when using an indicator?

When a trader uses indicators to help him trade there are several things he should consider first, so that when he uses signals there is no misinformation.

things to consider when using technical indicators are as follows:

- Understanding trading strategy or trading style

the trader must know what trading style is suitable for himself so that later he can determine what kind of indicator of funds is suitable for him. - Understand the market direction

Understanding the direction of market movement is very important because it can allow traders to filter out false signals from an indicator. - Understand the type of Indicator

When traders determine what indicator to use when trading, the trader must first understand the type of indicator so as not to confuse him when using the indicator he chooses. - Finding Confluences

Confluence when using indicators is very important when using technical indicators, when using 2 or more technical indicators then finding the confluence of some of these indicators will increase the percentage success of the signals given by these indicators.

2. b) Explain confluence in cryptocurrency trading. Pick a cryptocurrency pair of your choice and analyze the crypto pair using a confluence of any technical indicator and other technical analysis tools. (Screenshot of your chart is required )

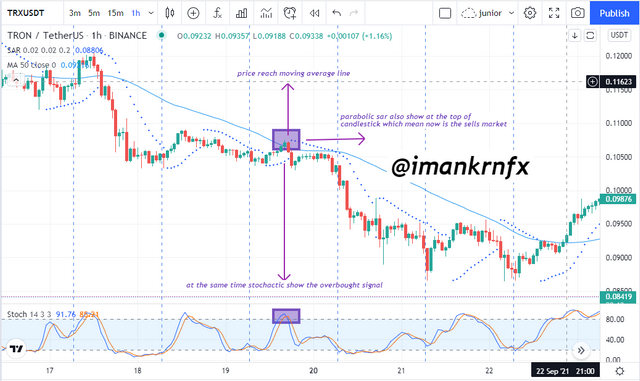

Confluence in using technical indicators is important, therefore in this question I will show an example of confluence that I found from the TRX/USDT crypto currency pair, which can be seen in the image below.

In the picture above, we can see the confluence of the three technical indicators, the signals given by the three indicators in the example above appear simultaneously. This means that the signal given by the indicator is quite strong and as a result as we can see in the picture the price is moving downwards according to the signal given by the three indicators.

3. a) Explain how you can filter false signals from an indicator

Signals from an indicator are often false because the market does not move because of the indicator, because a market moves because of the buying and selling behavior of market participants. now it means the indicator here is only a tool and not a determinant of buying and selling from a trader. From that all traders must be wise in filtering the signals given by the indicator. This can be done by waiting until there is confluence of several indicators and technical analysis, and it would be better if combined with fundamental analysis. If the signal given by the indicator is in accordance with technical and fundamental analysis, then the signal will be more valid to use.

3. b) Explain your understanding of divergences and how they can help in making a good trading decision

Divergence is one of many ways to filter signals from an indicator, divergence can be found in indicators in the form of oscillators, the definition is the difference in movement of candlesticks and oscillator indicators. There are two types of divergence, bearish divergence and bullish divergence. Divergence is also an early sign of the end of a trend, therefore traders can be prepared to place orders in the currency pair market.

3. c) Using relevant screenshots and an indicator of your choice, explain bullish and bearish divergences on any cryptocurrency pair

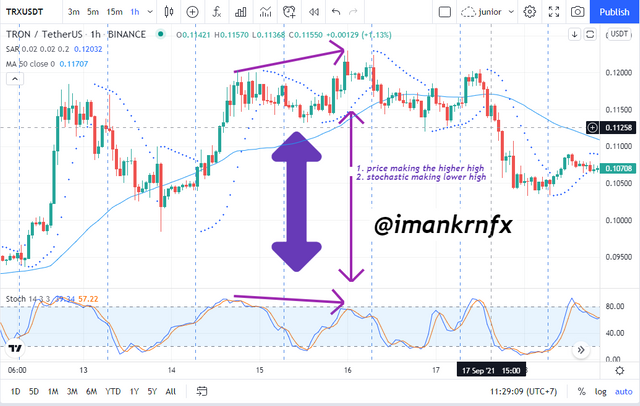

- Bearish Divergence

in the picture it can be seen that the price has made a higher high while the technical oscillator has made a lower high, this indicates that a divergence has occurred between the indicator and the price of the currency pair market. The picture above is an example of a bearish divergence.

- Bullish Divergence

bullish divergence from stochastic on TRX/USDT

In the picture of the bullish divergence example above, it can be seen that the price has continued its movement and made a lower low even though it had previously entered the oversold area, while the stochastic has made a higher low, then the condition is known as bullish divergence.

CONCLUSION

In the homework I did this week I can conclude that confluence is a very important thing to pay attention to when using multiple indicators, and also if a trader only uses one indicator it will be very risky for his success in trading. Divergence is also an important concern, especially for myself because it is very good if applied correctly when trading, be it in the cryptocurrency exchange market, forex or other exchange markets.

CC: @reminiscence01