Hello steemians we meet again on homework for the third week in this 4th season of Steemit Crypto Academy. This time I will make a post for the homework of @awesononso. The task this time is to answer several questions that have been given by the professor about The Bid-Ask Spread (part II).

Homework list:

- Define the Order Book and explain its components with Screenshots from Binance.

- Who are Market Makers and Market Takers?

- What is a Market Order and a Limit order?

- Explain how Market Makers and Market Takers relate to the two order types and liquidity.

- Place an order of at least 1 SBD for Steem on the Steemit Market place by:

a) accepting the Lowest ask. Was it instant? Why?

b) changing the lowest ask. Explain what happens (Make sure you are logged in to your wallet). - Place a TRX/USDT Buy Limit order on the Binance exchange for at least $15. Explain your steps and explain the impact of your order in the market. (Give Screenshots).

- Place a TRX/USDT Buy Market order on the Binance exchange for at least $15. Explain your steps and explain the impact of your order in the market. (Give Screenshots of the completed order).

- Take a Screenshot of the order book of the ADA/USDT pair from Binance on the day you are performing this task. Take note of the highest bid and lowest ask prices:

a) Calculate the Bid-Ask.

b) Calculate the Mid-Market Price.

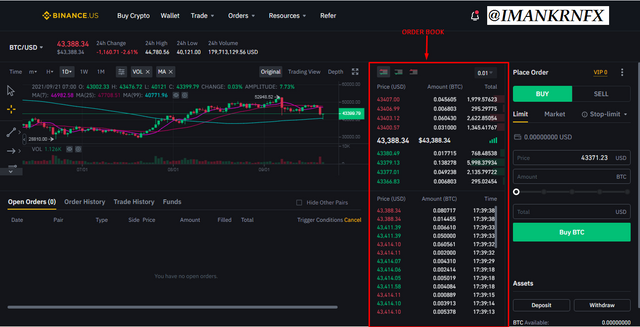

Define the Order Book and explain its components with Screenshots from Binance

Order Book is a list of selling prices and buying prices available in the market within a certain period. You can buy or sell a cryptocurrency using the prices listed there as a reference. So, the Order book is also a record of transactions that occur during a certain time. With a track record of transactions contained in the order book, this tool has 3 functions that can be very useful for traders

1. As a Liquidity indicator

In the first week of homework in this session, we have learned that spreads indicate liquidity in the exchange market, by looking at the order book we can find out the spread and liquidity of a cryptocurrency market.

2. To determine a prevalent market direction

With the order book, we can predict the price direction of a cryptocurrency market, if in the order book there are more buyers than sellers, the possibility of prices moving up will be very high.

3. To determine support and resistance levels

Support and resistance levels are very useful when doing technical analysis, the support level is a level that will be a barrier when the price drops, and the possibility of a reaction to go back up at the support level will be very large, the resistance level is a level that will be a barrier when prices move up and the price may go back down when it reaches the resistance level.

Who are Market Makers and Market Takers?

Who is a market maker? The answer to this question relates to the definition of a limit order, so I will first explain what a limit order is.

Limit orders are orders that are waiting to be filled when the bid price or ask price reaches the price that has been ordered, so the traders who place this order are called market makers.

While market takers are traders who place orders without using limit orders, they make instant execution trades at the price at the time they place the order

What is a Market Order and a Limit order?

Market orders are orders that are filled instantly at the current price, this type of order does not need to wait because the order execution will be filled immediately, traders who use this type of order are called market takers.

Limit orders are types of orders that are not executed immediately at the current price because, limit orders are a type of pending order that will be filled when the bid price or ask price reaches the requested price, traders who use this type of order are called market makers.

Explain how Market Makers and Market Takers relate to the two order types and liquidity.

To answer this question actually, students from the Steemit Crypto Academy can immediately find out what the answer is if they understand very well who fulfills the liquidity in the exchange market and who takes the liquidity. The relationship between the two types of orders in the market made by market makers and market takers is that when many market makers place limit orders they increase liquidity in the market because it means that many orders can be filled, while market takers who place market orders are traders who will fill the order. If the market maker is the trader who creates liquidity in the market then the market taker is the trader who takes the liquidity.

Place an order of at least 1 SBD for Steem on the Steemit Market place by

a) accepting the Lowest ask. Was it instant? Why?

b) changing the lowest ask. Explain what happens (Make sure you are logged in to your wallet).

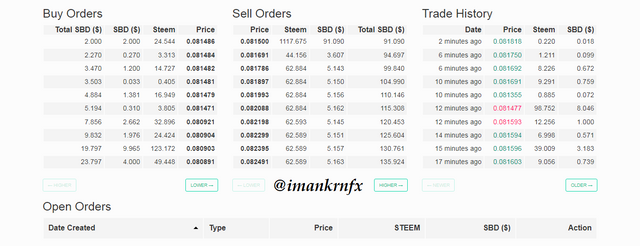

to be able to answer this question, students must go to the steemit marketplace by entering the steemit wallet --> select steem or SBD balance --> click on the market section, then you will see a screen like the one below

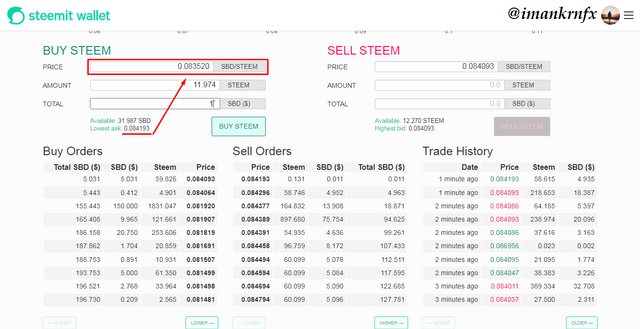

a) Accepting the Lowest ask. Was it instant? Why?

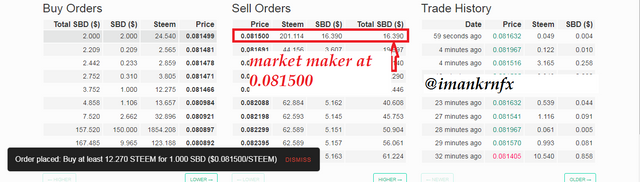

In the picture above I show the transactions that I made in the steemit marketplace by taking the lowest ask, the lowest ask when I made the transaction was 0.081500, my order was executed instantly because I acted as a market taker and there was already a limit order from the market maker at 0.081500.

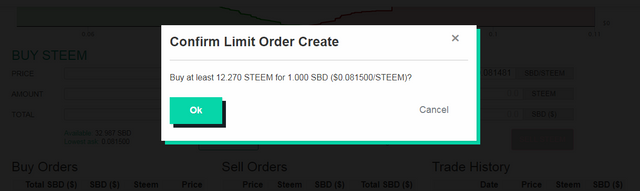

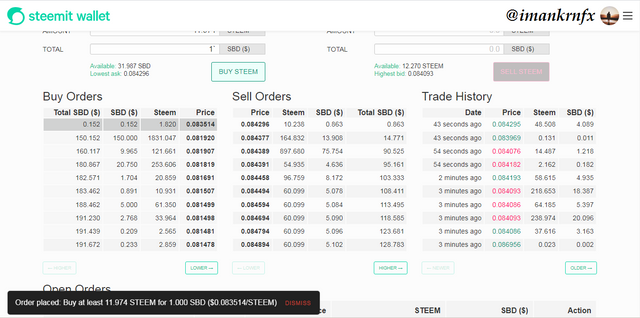

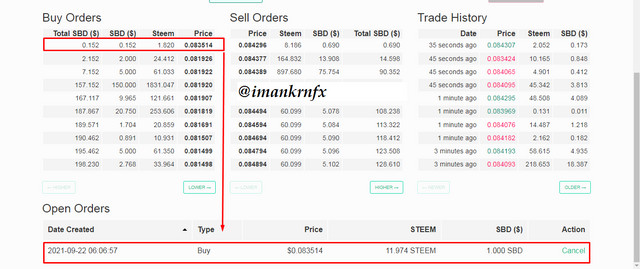

b) Changing the lowest ask. Explain what happens (Make sure you are logged in to your wallet).

Changing the lowest ask on the steemit marketplace means it will make my order a limit order and it means I act as a market maker, how the illustration can be seen in the image below.

As we can see in the last picture, as a market maker my order has been sent to the order book and waiting to be filled by the market taker.

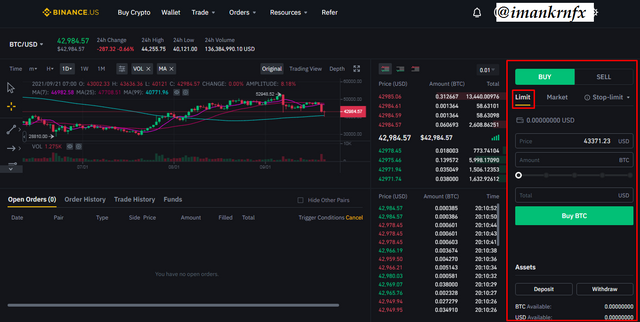

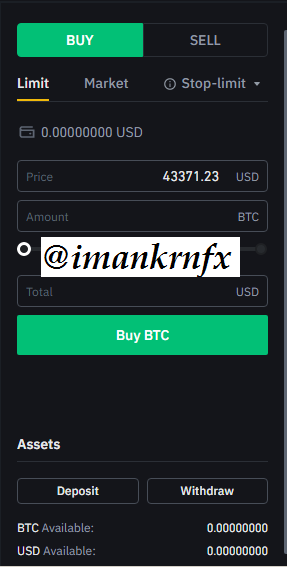

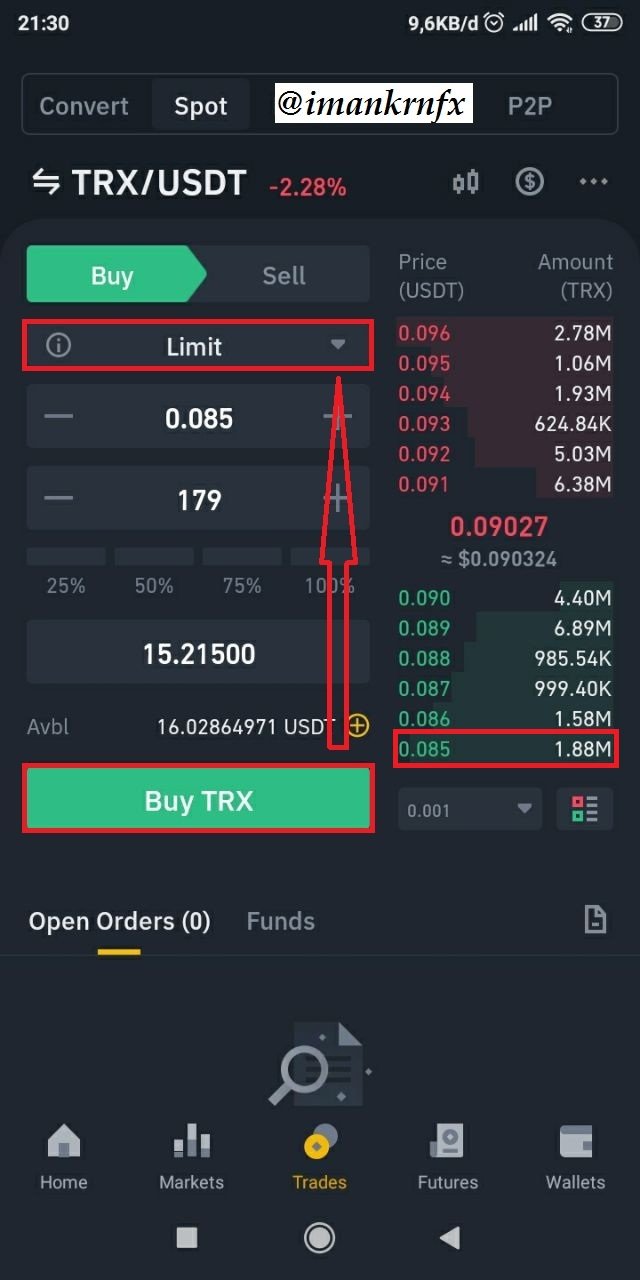

Place a TRX/USDT Buy Limit order on the Binance exchange for at least $15. Explain your steps and explain the impact of your order in the market. (Give Screenshots).

To answer this question I will explain the steps and show a picture when I place a buy limit order for the TRX/USDT cryptocurrency pair.

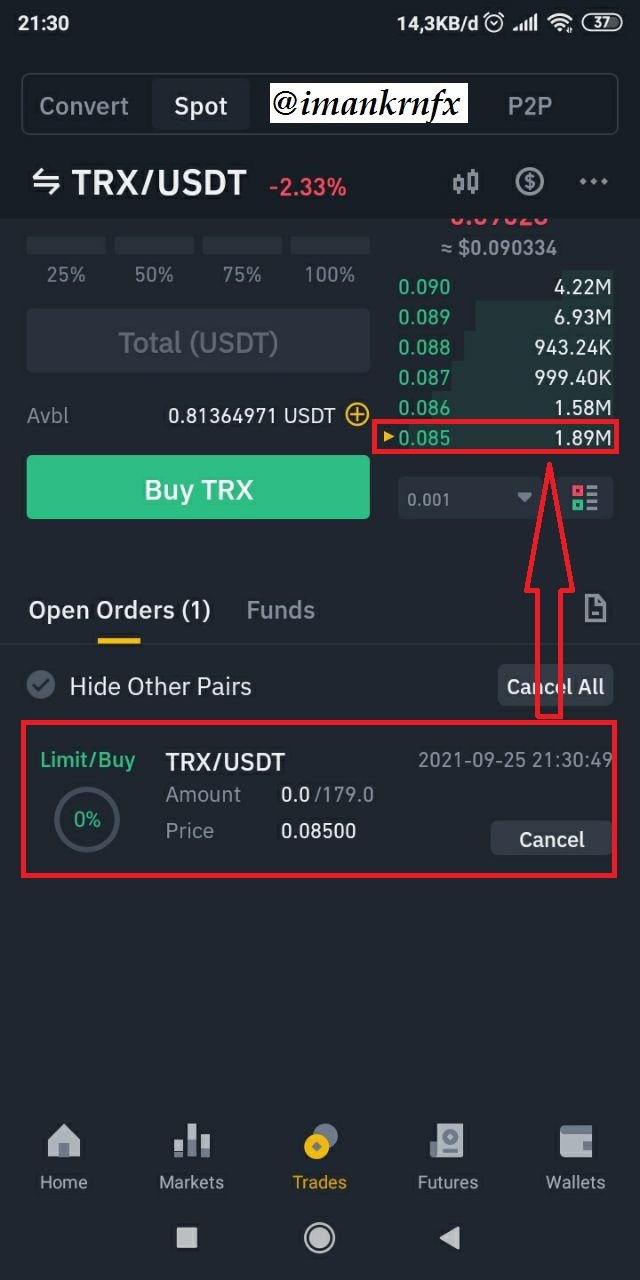

In the picture above I made a buy limit order set up on a TRX/USDT cryptocurrency pair at 0.085, when I placed a limit order it meant I was acting as a market maker. In the image above, we can also see in the order book list that at the price of 0.085 the order that has been placed is 1.88 M before I trigger the buy button.

After I placed a buy limit order at 0.085, it can be seen in the picture that my limit order is waiting to be filled by the market taker.

My limit order also has an impact on the list in the order book, before I placed a limit order at the price of 0.085 there was only 1.88 M the number of orders made by the market maker but after I made a limit order the number of orders that were for 0.085 increased from 1.88 M to 1.89 M.

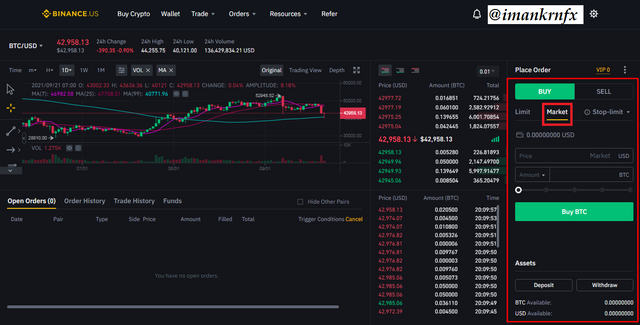

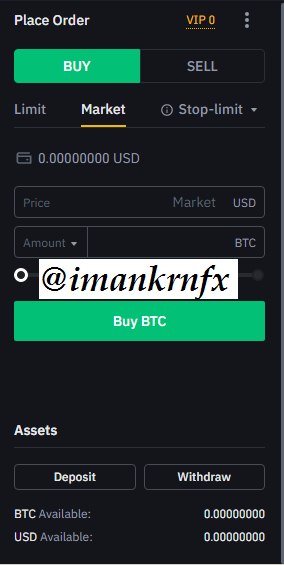

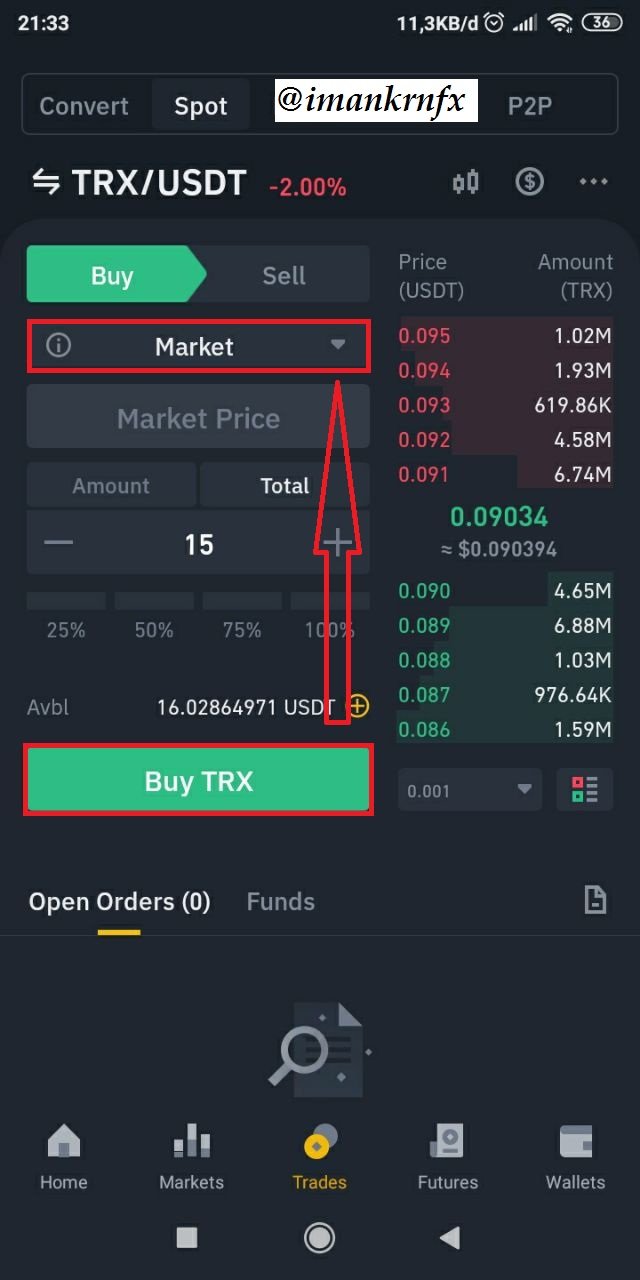

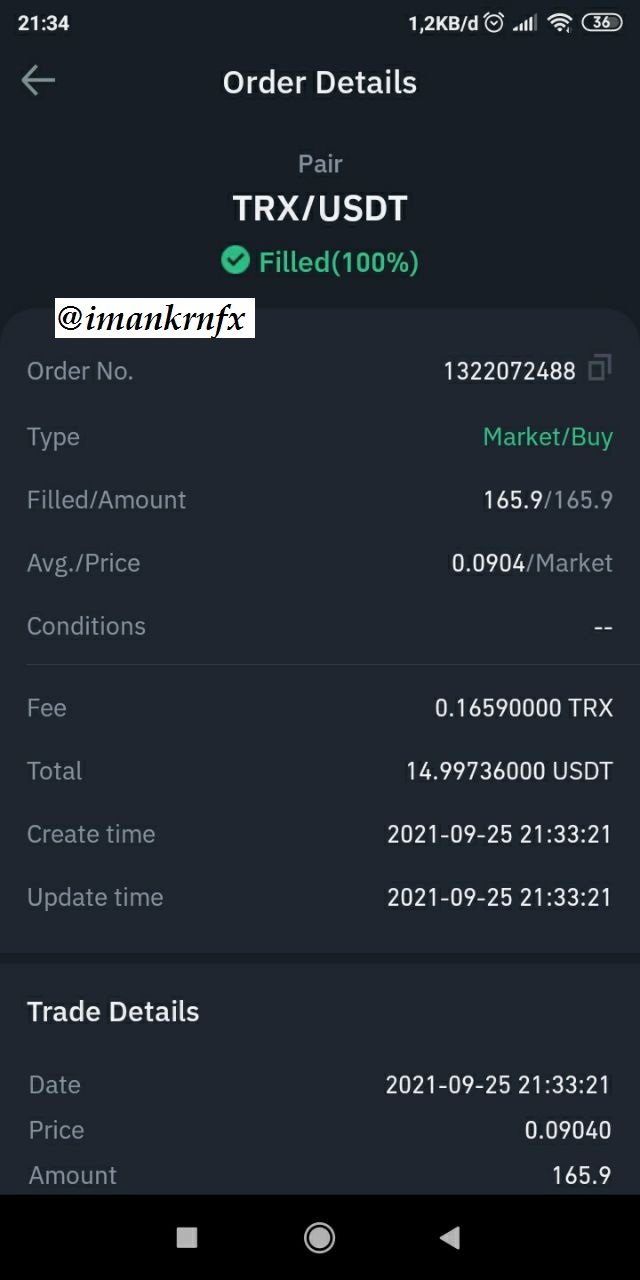

Place a TRX/USDT Buy Market order on the Binance exchange for at least $15. Explain your steps and explain the impact of your order in the market. (Give Screenshots of the completed order).

For this question, I will place a buy order as a market taker for the TRX/USDT cryptocurrency pair and show a screenshot of the completed order.

In the picture above as you can see I will place a buy order for the TRX/USDT cryptocurrency pair at the price of 0.0903 amounting to $15 USDT.

I couldn't get the price of 0.0903 as I wanted, however during the transaction process there has been a price change from 0.0903 to 0.0904 and my order was executed at the price that has changed, this has resulted in negative slippage on my buy order.

In the detailed order picture above, we can also see that even though I placed a buy order for TRX/USDT of $15 USDT, there was a fee taken from the order I had made of 0.16590 TRX, so the final amount of my order was 14,99736 USDT. This will happen to traders if they do not pay close attention to the number of fees to be paid, the amount may differ depending on the broker's regulations.

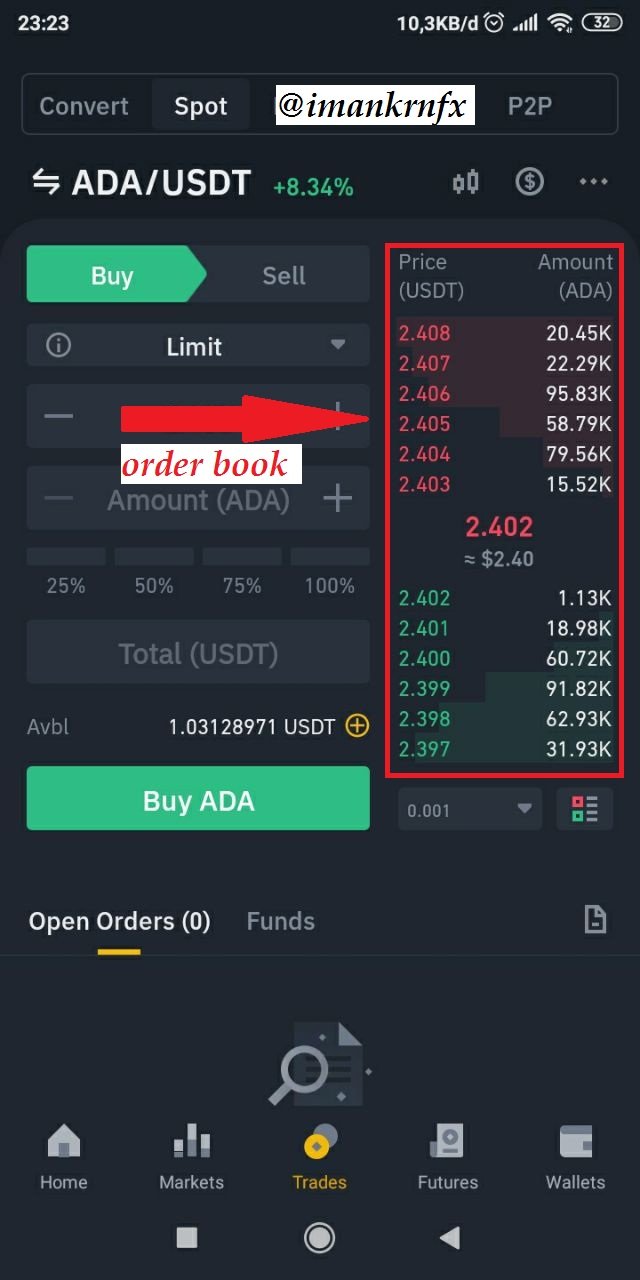

Take a Screenshot of the order book of the ADA/USDT pair from Binance on the day you are performing this task. Take note of the highest bid and lowest ask prices

This is the last question in this week's homework, in this question, there are 2 points I have to answer:

a) Calculate the Bid-Ask

b) Calculate the Mid-Market Price

Before answering the 2 points above I will show you a screenshot of the cryptocurrency pair ADA/USDT on the day I did my homework this week, and I will show you the highest bid price and the lowest ask price from the screenshot.

The screenshot above shows the bid price is on the red side and the highest bid price is at 2.408 USDT, while the Ask price is on the green side and the lowest ask price is at 2.397 USDT.

a) Calculate the Bid-Ask Spread

From the previous homework that has been given by prof @awesononso, we got the formula to calculate the Bid-Ask Spread and the formula is:

Bid-Ask Spread = Ask price - Bid Price

Bid price = 2.408

Ask price = 2.397

Bid-Ask Spread = 2.397 - 2.408

Bid-Ask Spread = 0.011

b) Calculate the Mid-Market Price

To calculate the mid-market price prof @awesononso also had given the formula to be used, and the formula is:

Mid-Market Price = (Bid Price + Ask Price)/2

Bid price = 2.408

Ask price = 2.397

Mid-Market Price = (2.408+2.397)/2

Mid-Market Price = 4.805/2

Mid-Market Price = 2.402

CONCLUSION

The homework that has been given by prof @awesononso this week has made me learn many new things and understand what I have not understood before, in this homework I realize I have been taught about hands-on practice in the exchange market, and also I have learned how to pay attention to very important points before opening an order in a cryptocurrency pair.

CC: @awesononso

Hello @imankrnfx,

Thank you for taking interest in this class. Your grades are as follows:

Feedback and Suggestions

You did not properly explore the order book as requested.

Your answer in question 2 needs some work.

The impact for 6 and 7 also needs some work in explanation.

Thanks again as we anticipate your participation in the next class.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit