hello steemians we meet again on homework for the 6th week in this 4th season of Steemit Crypto Academy. This time I will make a post for the homework of @reminiscence01. The task this time is to answer several questions that have been given by the professor about Trading Cryptocurrency.

Homework list:

- Explain the following stating its advantages and disadvantages:

a)Spot trading

b) Margin trading

c) Futures trading - a) Explain the different types of orders in trading.

b) How can a trader manage risk using an OCO order? (technical example needed). - a) Open a limit order on any crypto asset with a minimum of 5USDT and explain the steps followed. (Screenshots needed from any cryptocurrency exchange).

- Using a demo account of any trading platform, carry out a technical analysis using any indicator and open a buy/sell position on any crypto asset. The following are expected.

a) Why you chose the crypto asset

b) Why you chose the indicator and how it suits your trading style.

c) Indicate the exit orders. (Screenshots required).

Explain the following stating its advantages and disadvantages

Spot Trading

| No | ||

|---|---|---|

| 1. | don't rely on liquidity for-profit | can only make a profit when the price goes up |

| 2. | there is no minimum amount to trade | can't make profit with hedging trade technique |

| 3. | there is no time limit to hold assets until you get a profit | need an exchange wallet in order to trade |

Margin Trading

Margin trading allows traders to buy stocks, forex, or crypto in more quantities than the amount of capital the trader has, at the time of the transaction the orders placed will be in the form of lots, the number of lots that can be traded by traders depends on how much leverage is used. It should be noted that if the leverage is greater, the risk of loss if it is wrong to analyze the price movement of a cryptocurrency pair, will be greater than the loss obtained from smaller leverage.

| No | ||

|---|---|---|

| 1. | margin trading provides very good profits for traders with small capital | Traders rely heavily on liquidity in the market |

| 2. | traders can borrow more to open position with less capital | Requires good price analysis and risk management to minimize losses |

| 3. | More flexible in opening orders and even hedging techniques | |

| 4. | still recommended for beginner traders |

Futures Trading

| No | ||

|---|---|---|

| 1. | Traders can trade more than the amount of capital they have | Traders rely heavily on liquidity in the market |

| 2. | With large leverage, traders can make a huge profit with less capital | Requires good price analysis and risk management to minimize losses |

| 3. | More flexible in opening orders and even hedging techniques | Not recommended for the beginner trader |

| 4. | Huge profit can be made in a single order | Requires high win-rate trading strategy |

Explain the different types of orders in trading

1. Market Order

2. Pending Order

- Limit Order

- Stop-Limit Order

- OCO Order

3. Exit Order

1. Market Order

2. Pending Order

- Limit Order

- Stop-Limit Order

- OCO Order

3. Exit Order

How can a trader manage risk using an OCO order

Open a limit order on any crypto asset with a minimum of 5USDT and explain the steps followed. (Screenshots needed from any cryptocurrency exchange)

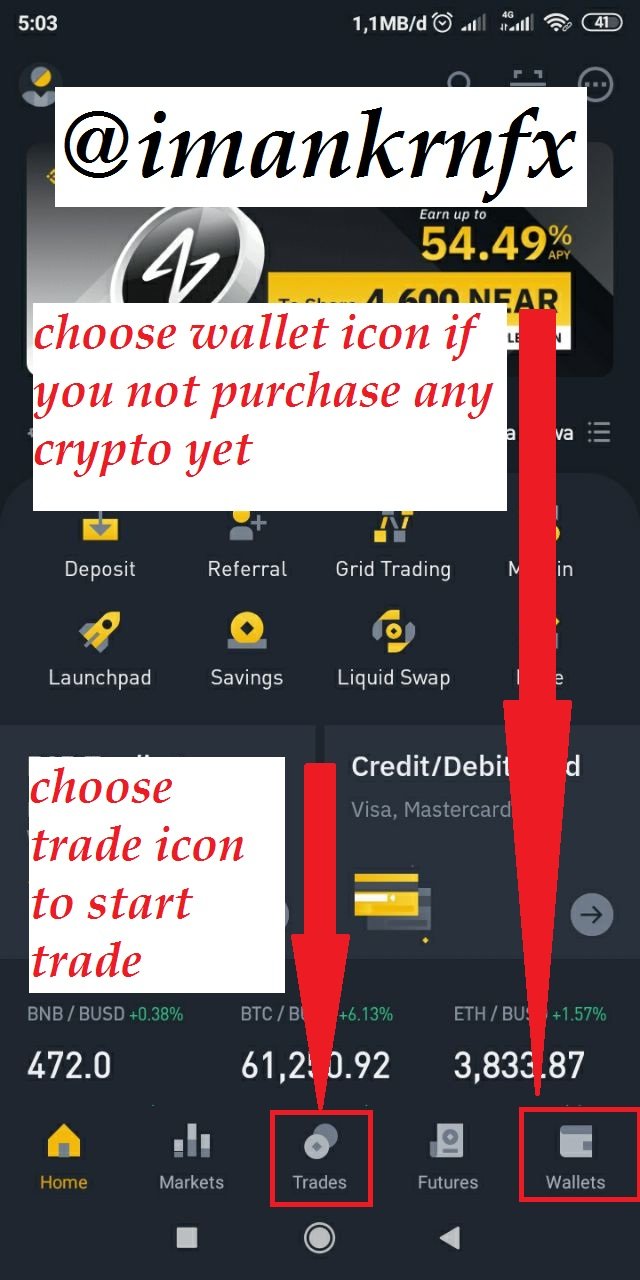

- Open the Binance app on your mobile and log in to your Binance account.

- After logging in you will see a screen as shown in the first screenshot, I immediately chose the trade icon because I already have USDT in my Binance Wallet.

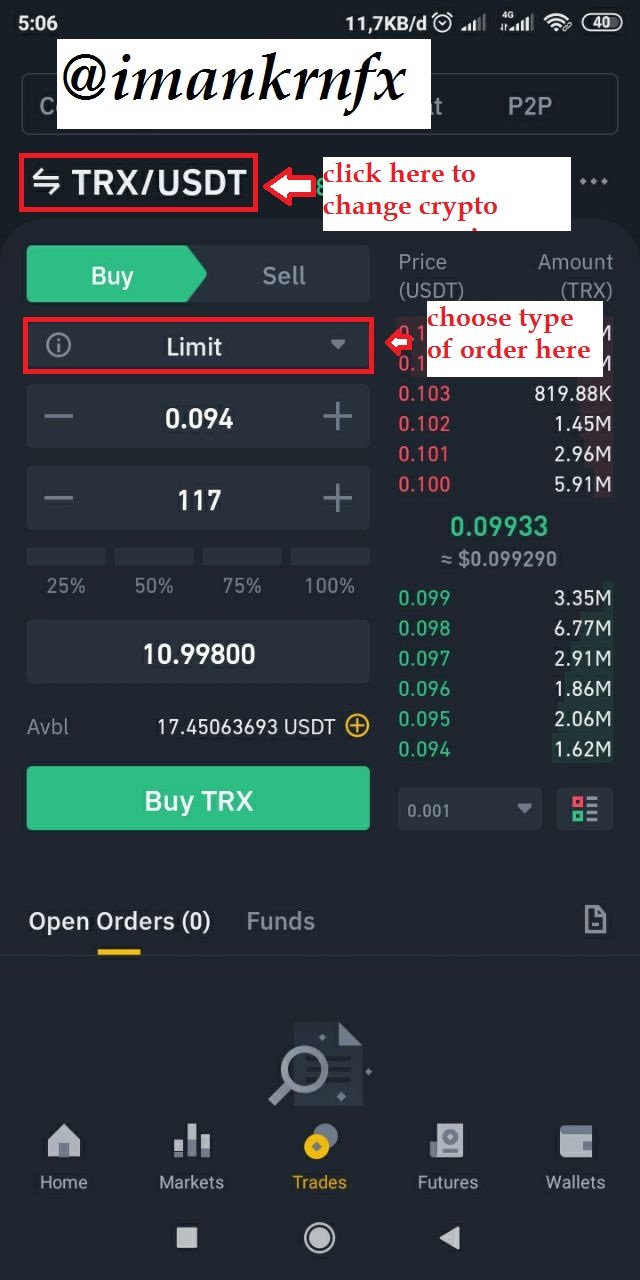

- In the second screenshot you can see the features that have been marked in the image.

- I selected a limit order and placed my buy limit order for the cryptocurrency pair TRX/USDT at the price of 0.094 for 10.99 USDT.

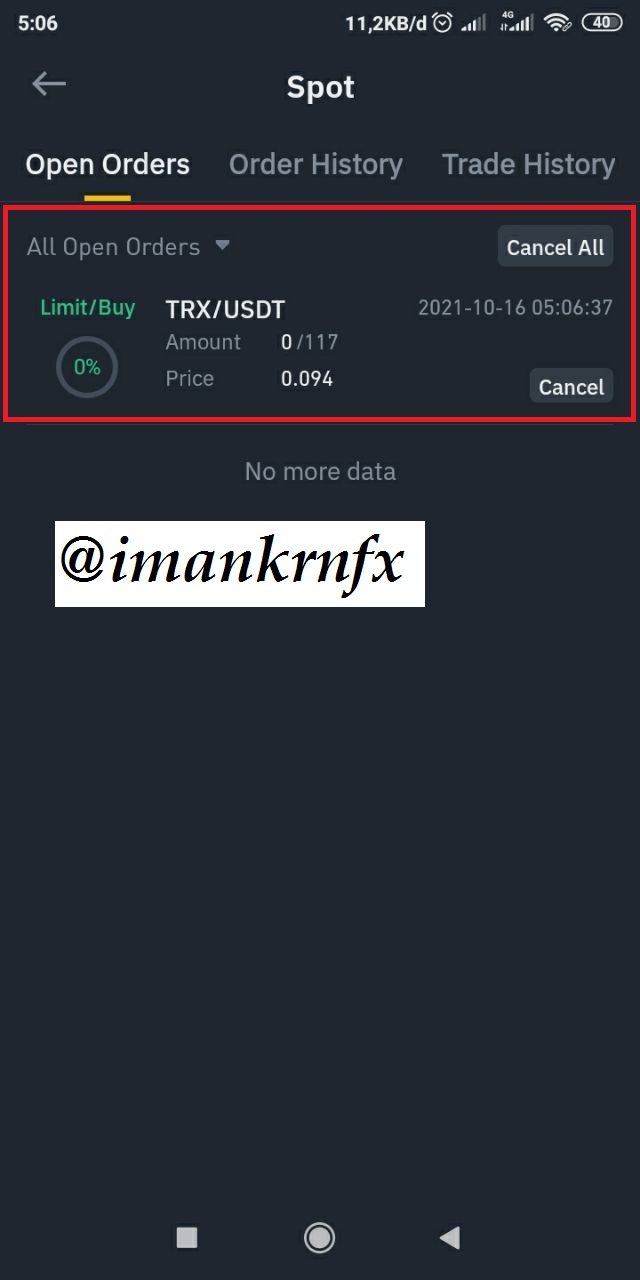

- After I finished placing the buy limit order, then I just have to wait until the price hit and executes the limit order that I have made.

- Orders that are open or waiting to be picked up by market takers can be seen as in the screenshot I have shown on the side.

Using a demo account of any trading platform, carry out a technical analysis using any indicator and open a buy/sell position on any crypto asset

To answer this question I went straight to the Tradingview platform because I already have an account on that platform and also I am familiar with the features that have been provided.

I chose Ethereum because it is one of the cryptocurrencies that has lasted a very long time in the exchange market and is proven by Ethereum as one of the cryptocurrencies with high enough liquidity.

There are two technical indicators that I use, the stochastic and the alligator. I chose these two indicators because they fit my trading style very well, pullback traders will usually use two indicators like this, one indicator as a compass that shows the direction of the trend and the other as an alarm if the momentum at the time of the pullback has weakened which indicates the possibility to resume the trend in accordance with the indicator that served as a trend compass. take a look at the screenshot below.

As we can see in the screenshot above, the alligator indicator shows that the market is in an uptrend, so because I trade using multi timeframes to read pullback movements, I go down from the 30-minute timeframe to the 5-minute timeframe.

in the 5 minute timeframe, I see a divergence between the price and the stochastic indicator which indicates that the pullback will end soon and the price may continue the uptrend from the 30-minute timeframe. so I opened a buy order at the price of 3863.24. The exit order method I use is a take profit target of 1:1.5 Risk/reward at 3899.66, my stop loss is at the closest support price at 3839.71.

CONCLUSION

Learning the science to analyze market movements in the world of cryptocurrencies is very important and this week there was a lot of useful knowledge from the homework I did, even before I didn't understand what OCO orders were now so I know how to use them and when to use these types of order.

CC: @reminiscence01

Hello @imankrnfx , I’m glad you participated in the 6th week Season 4 of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Observation:

This is not a disadvantage of spot trading.

Recommendation / Feedback:

Thank you for participating in this homework task.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for the review prof

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit