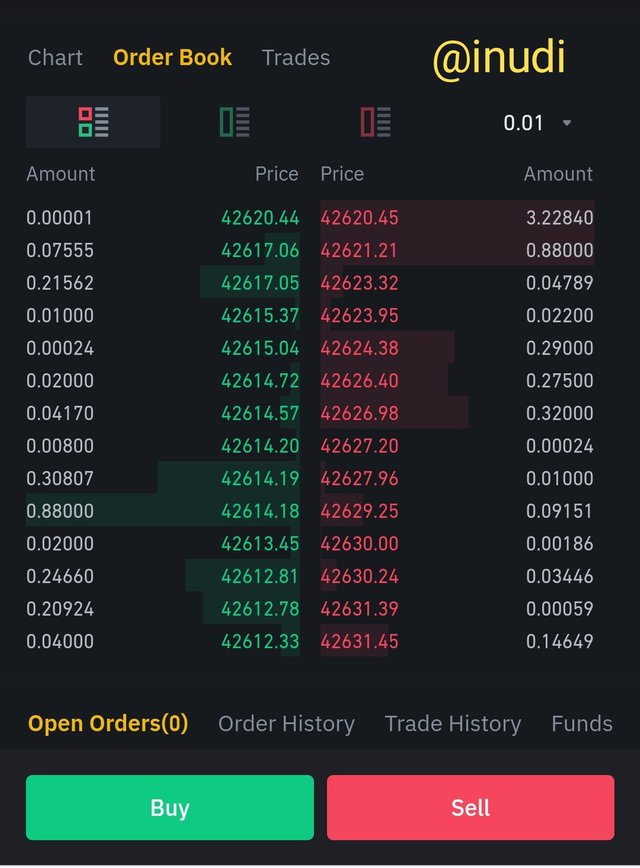

01.)Define the Order Book and explain its components with Screenshots from Binance.

An order book is a digital book that lists the buying and selling orders opened for an item.

Here, when we look at the open order list that we see in any pair of assets, we can see how they are arranged in order from top to bottom prices in an exchange platform.

This digital order book consists of two parts: Buy Order and Sell Order.

In other words, the order book has both the bid side and the ask side, respectively.

The columns in the order book indicate the price (BUSD), quantity (ETH) and total, and everyone can see the trade and prices.

By using this we can determine the transparency of crypto transactions, the liquidity of the market and whether the market has a rising or falling trend.

When you look at the screenshot above, the green indicates the bid side of the market and here is the overall activation of the buy order for the trading pair at the moment.

Here you will find the highest bid order at the top of the order book.

The red on the indicates that it is the ask side of the market. The overall functionality of the current sale order for trading pairs is recorded here and arranged in the order of price increase. That is, the highest demand price can be seen at the top.

02.) Who are Market Makers and Market Takers?

Those who trade without a limit are called market takers and buy or sell using the current exchange rate. For this reason, transactions take place quickly.

At that time, the market bid price and the market demand without any argument, they accept the price without bargaining for the product they buy.

Market makers are people who create an order to buy and sell a product at a certain price.

They set a market price at which they want to buy or sell their assets, buy at their own bid and sell at their own ask price.

03.)What is a Market Order and a Limit order?

market order

is an order that is open to the current price of the asset to be traded and does not delay the execution of this order. Therefore, we may want to link this order with market buyers.

Limit order

is an order that is open to the current price of the asset to be traded and does not delay the execution of this order. Therefore, we may want to link this order with market buyers.

It is also a form of order that will be implemented as soon as possible following the current market. Further, these orders will be executed immediately.

When referring to a limit order, a limit order is the creation of a buy and sell order for a product at a certain price.

This order sets the maximum or minimum price at which an asset can be purchased or sold, and the maximum or minimum price at which the seller is willing to buy or sell the asset at that time is the limit. If not, the order will not be processed.

4.)Explain how Market Makers and Market Takers relate with the two order types and liquidity in a market.

The market maker is the one that quots the selling price and the buying price of a commodity in the market in order to make a profit from the bid-demand spread.

Here the liquidity of an asset increases when limited orders are placed and if the limit orders are high, there are many orders opened at different prices.

The limit order seeks to maintain the financial liquidity of the market when the requirement meets the price.

And as soon as they receive a purchase order, they sell their shares immediately to enable the order to be processed and help flow into the market. It makes it easy for sellers to buy sell.

market trakers trade at the prevailing prices in the market and have nothing to do with the best price activation in the market

Also market trakers are similar to market order and are always responsible for obtaining liquidity.

5.Place an order of at lease 1 SBD for Steem on the Steemit Market place by

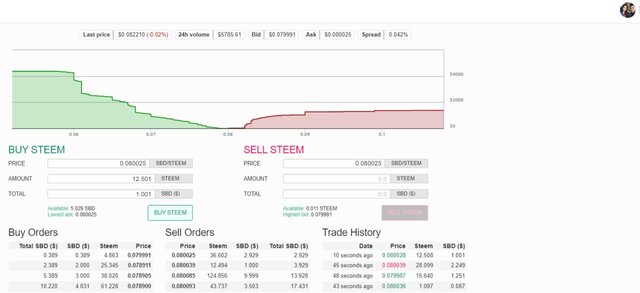

a) accepting the Lowest ask. Was it instant? Why?

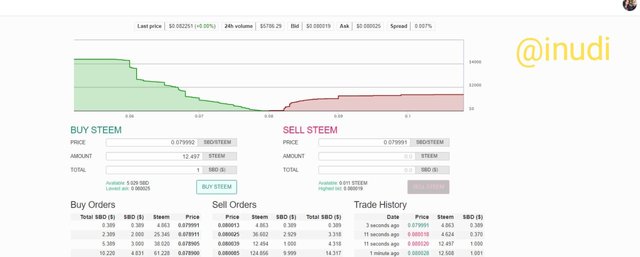

b) changing the lowest ask. Explain what happens.

(Make sure you are logged in to your wallet.)

a.) At the time of preparing this assignment, the lowest demand value was 0.079999. Therefore, I entered the lowest request for SBD1 as 0.079998

** Yes order initiated fast , screenshot below **

reason - accepting the lowers asked price

b.) Took some time as a buyer must agree on my request price.screenshot below .

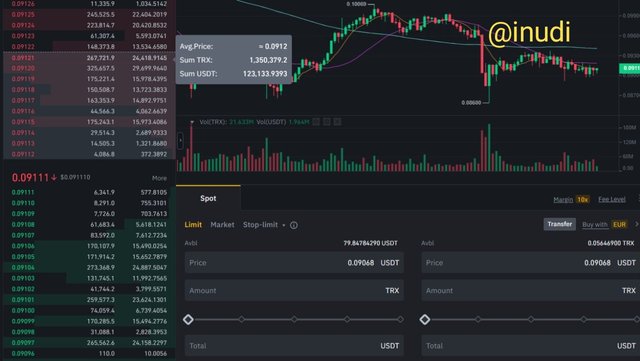

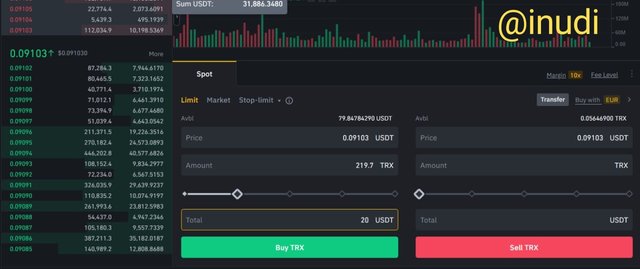

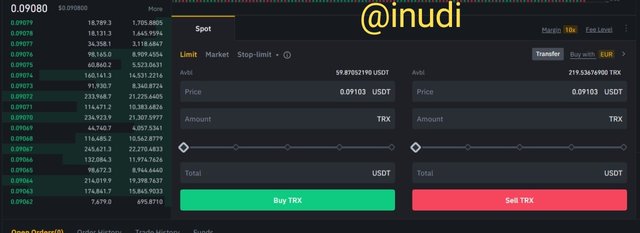

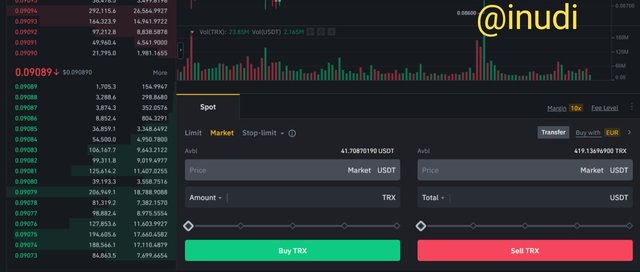

6)-Place a TRX / USDT Buy Limit order on the Binance exchange for $ 15. Explain your steps and explain the impact of your order in the market. (Give Screenshots).

Placing a limit order - selecting limit order

placing a limit order to buy 20$ worth TRX

After purchasing TRX completing the limit order

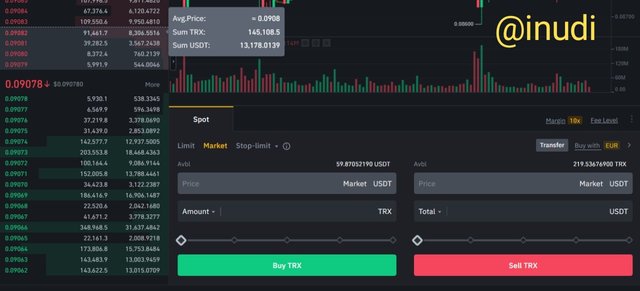

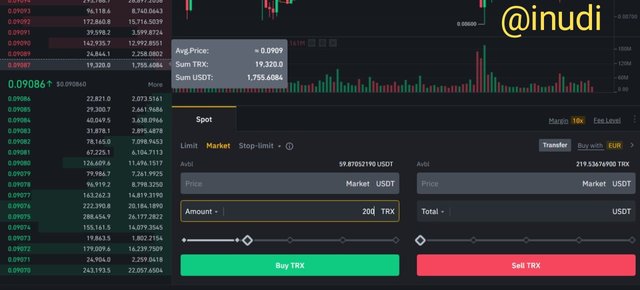

7.)Place a TRX/USDT Buy Market order on the Binance exchange for at least $15. Explain your steps and explain the impact of your order in the market. (Give Screenshots of the completed order).

Selecting the market order page

Placing a market order to buy 200 TRX ( greater than 15$ )

after purchasing 200 TRX through completing the market order

8.)Take a Screenshot of the order book of ADA/USDT pair from Binance on the day you are performing this task. Take note of the highest bid and lowest ask prices:

a) Calculate the Bid-Ask.

b) Calculate the Mid-Market Price.

ADA/USDT order book

Highest bid - 2.393 USDT/ADA

Lowest asked - 2.392 USDT/ADA

a.) the formula for The Bid-Ask Spread

Bid - Ask spread = 2.393 - 2.392 = 0.001

b.) The formula for Mid-Market Price

Mid-Market Price = (Bid Price + Ask Price)/2

= ( 2.393 + 2.392 ) / 2 = 2.3925 USDT

Thank you..

Cc:- @awesononso