It is no news that the traditional financial system is a complete wreck, the traditional financial method is totally limited and the existing intermediaries with which it is surrounded makes it difficult for a smooth operation system to become possible, the existence of DEFI has bridged a lot of gaps and has transformed the limitations that exist as a result of the centralized projects to become good opportunities.

Decentralized finance (DEFI), one word that has been in the mouth of so many, is here to disrupt the existing financial system making it obsolete and ready for a change. I was talking to a friend some days back, and he said "if Defi does not kill the banks, then they adopted it early. It is no doubt that everyone wants full control of their funds, you shouldn't queue to get your funds, pay in your funds as well as get c.harged unnecessarily for someone to hold your funds which can be held in a pool thanks to Smart Contract.

Defi is the decentralization of everything central regarding finance, thereby creating transparency and complete ownership and control of assets. Defi apps are decentralized digital applications

Defi Ecosystem [Marketplaces & Liquidity]

Defi has brought about a whole lot of improvements in the crypto space one of which is Decentralized Exchanges (DEX). It is no doubt that Centralized exchanges such as Binance, Huobi, Kraken, and many more have been performing great, but then, it is still centralized with centralized governments and people having large shares to themselves which is where decentralized exchanges (DEX) play an important role by giving everyone the right to their funds, and trading transparently without any middleman or centralized government.

UNISWAP

UNISWAP is a common decentralized exchange that gained massive popularity after its airdrop of over $1000 to users. Ever since the Uniswap exchange and the Uni token have been the talk in the world of AMM and DEX.

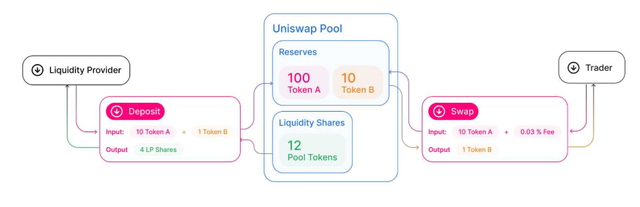

AMM, short form for Automated Market Maker are decentralized exchanges where the users are the providers of liquidity for the goal of generating revenue and the price of the market isn't determined by market makers and takers but by a mathematical formula. With AMM, there is no order book, rather price is determined by the liquidity available and the demand and supply of the coin.

Uniswap is a decentralized exchange that trades over 400 active trading pairs of ERC-20 tokens. The exchange has 6000 liquidity pools for different pairs an impressive milestone for a project that started in 2018, by Hayden Adam.

How Uniswap Works

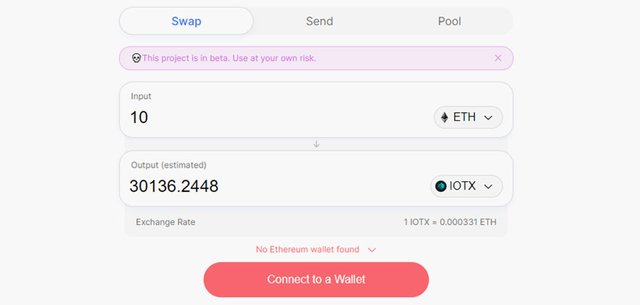

You do not need to register on Uniswap since it is a decentralized exchange, you have the complete right to your funds so in other to access the exchange, all you need is a Web 3 wallet such as MetaMask, Opera Wallet, Trust Wallet, and so on which gives you an exclusive right to your keys and allow you perform whatever task you want to do at your will.

Traders and Liquidity Providers

On Uniswap, there are two types of users, one that trades on the available liquidity, and one that provides liquidity for the exchange. Liquidity providers provide for the pool on both sides of the trading pair after which a liquidity token is granted to the liquidity provider as proof to show that liquidity was granted. Uniswap rewards liquidity providers for providing liquidity and to do that, Unisawap charges 0.25% as fees from all Uniswap tradings.

CONCLUSION.

Defi, gradually changing the finance world has hit into exchanges, and will soon touch other aspects of finances including the stock exchange market. It is no doubt that Uniswap and other DEX have brought a massive change to how we trade our tokens but there is still a long way to go to achieve a fully decentralized financial world.

Thanks for being a part of my class and for participating in this week's assignment. I hope you learned from the class as the aim of the school is to teach and allow people to learn alongside.

Review

You have written a well-organized post with respect to Uniswap. Images properly referenced and the post was written in a way that shows you understand what you are writing.

Would you prefer a Decentralized exchange or a Centralized Exchange currently?

Rating 9

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you very much for the review my dear professor, I will prefer a decentralized exchange definitely.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit