Unsplash

Hello everyone this is my Assignment task post

"Decentralized finance (commonly referred to as DeFi) is a blockchain-based form of finance that does not rely on central financial intermediaries such as brokerages, exchanges, or banks to offer traditional financial instruments, and instead utilizes smart contracts on blockchains, the most common being Ethereum."wiki

Q1. What Is the Importance Of the DeFi System?

ABSOLUTE CONTROL

The Centralized finance system we have had in place all this time has to obey policy set by the government like the bank could choose to freeze your account because the court ordered them to or one can even get licked out of his account for certain reasons, the decentralized finance system eliminated all that any asset of cryptocurrency you have in your possession is completely and permanently yours and you alone can approve transactions on your assets or cryptocurrency

NO INTERMEDIARIES

In most cases often 8n the centralized fincance system when one wants to send money from one end of the world to another he has to go through some processes and filling out forms after doing all the stress still has to pay some certain amount as charges to the middleman sending to money or charges to the bank, the decentralized finance has no intermediary your transaction from any part of the world to any part of the world is strictly between you the sender and the reciever and the sending to anyone can be done from the convenience of our home without having someone look over our transactions and decide if it should be approved or not

EARN MORE

The decentralized assets enables an individual to earn more than he initially invested in specific cases like yield farming where and individual gets to attain more assets by simply buying and holding a particular cryptocurrency over a particular period of time, and the rate at which you earn interest in defi is way more efficient than the return rate our centralized banks offer us

TRANSPERANCY

This is a feature blockchain entirely is well known for the decentralized finance is open ledger anyone anywhere can go over transactions and check if really it occured, no more excuses of fake transaction details or any excuse at all if any transactions occurs it can be reviewed or seen by amyone and everyone from around the world

Q2.Flaws in Centralized Finance.

SUBJECT TO AUTHORITIES

This flaw i find the most disturbing, the federal government can just decide overnight and render all your earnings useless with formation of new policy, the governing bodies can decide to freeze your asset for as long as they see fit. An individual is subjected finicially to the mercy of those in power

LITTLE OR NO PRIVACY

In the decentralized finance one big flex it has is the ability to keep the sender or the recipient completely ananymous if the recipient or the sender chooses to be, all you need for a transactions in defi is recipient address and and thats all you need but in the centralized finance to send or recieve both parties full names and banks and other details are required, for someone looking to not reveal his identity on the Centralized finance it wont work as your name and dedicated bank account number is required before a transaction can be completed

LOW INTEREST RETURN RATE

In defi finance platforms like the pancake swap offer up to 97% annual interest which is almost 10x what the centralized finance offers its clients in annual returns even though they get more than they give for interest to thier clients

Q3.DeFi Products. (Explain any 2 Products in detail).

DECENTRALIZED EXCHANGES

.jpeg)

Source

These are platforms that offers it users numerous opportunities and services like staking, buying and selling of cryptocurrencies and exchanging of of assets either to fiats or to other forms of cryptocurrencies. We can simply explain Decentralized exchange to be Exchanges that gives its users anonymity and total control over thier assets and cryptocurrency while providing the individual with direct access to market in order to trade,buy,sell or exchange assets as the user sees fit Dex are often seen to be faster and cheaper cause of the elimination of the middleman factor, example of the major DEX platforms available are

- PANCAKESWAP

- UNISWAP

- MDEX

- SUSHISWAP

- HONEYSWAP

WALLETS

A wallet can be explained on a simple term as a store house for crypto currency and assets,we can say a wallet is anything that stores your public keys which one can use to share out or give in order to be able to receive cryptocurrencies and private keys with which one can use to access his cryptocurrencies, a wallet is also a medium individual use to interact with a blockchain by recording transactions that occur on a blockchain hence can keep track of our assets when we receive or send on the blockchain.

We have 3 types of wallets

- PAPER WALLETS

- HOT WALLETS

- COLD WALLETS

some typical examples of wallets we have are

- Trustwallet

- Metamask

- Tronlink pro

- Wombat

- Exodus wallet

Q4.Risk involved in DeFi.

VOLATILITY OF ASSETS

Its no news to anyone in the cryptocurrency world that assets that was worth 500$ a piece last nigth is worth 250$ the following morning, assets prices is very volatile and individuals having a hige portion of thier assets in defi stand a chance of having thier assets/cryptocurrency loose value hence leading them to loose capital

VULNERABILITY TO HACK

In some cases some developers are careless as to leave loopholes when creating smart contracts and if hackers find this loopholes they can use it to extort or shut users off thier assets amd steal it all leaving the users with less than their capital or nothing at all

TRANSACTIONS COSTS

In blockchains like ethereum ridiculous amount of gas fees are seen for instance ine wants to send ethereum worth just 5$ the gas fees can go up as high as 42$ and that is why it is mostly used by whales and those with high quantity of ethereum to send

ILLEGAL ACTIVITIES

Since the defi is completely decentralized and individuals carrying out transactions on the open blockchains are completely anonymous some individuals migth use as a medium to store stolen and untraceable money, it can also be perfectly used to do money laundering as in defi you have no one to answer to all transactions are free of 3rd parties no one can track or monitor you there

Q5. What is Yield Farming?

Yield farming in a simple term can be explained as a process in which individuals lock thier asset on a platform for a specific period of time to earn more assets. Yield farming is a process that allows liquidity providers i.e individual to provide liquidity to pools with sole aim to earn or attain more assets over a perid of time .

Q6. How does Yield Farming Work?

They yield farming process runs bery similar to the centralized banking system we have in place currently where the banks provide help in form of assets or cash in exchange for something of equal value but with a slight increase in value aspa interest. In the case of the yield farming the roles are reversed the liquidity providers i.e the individuals serves as the the banks who lock assets (liquidity provider tokens) in in pools( the recipient in this case) over a certain period of time to get paid back after a certian period of time with something of equal value but with certain increase in value depending on how long the assets are locked out for in the pools

Q7.What Are the best Yield Farming Platforms and why they are best. (Explain any 2 in detail)

PANCAKESWAP

.jpeg)

Source

The decentralized exchange platform has an APY of 97.70% and an APR of up to 200% although i have not used a lot of yield farming platforms but i believe pancakeswap is an outstanding exchange and stands out for many features. Pancakeswap is one of the best because it has a lot of yeild farming featuresbut most importantly it is the best cause of the little transaction fees it charges on the platform

UNISWAP

.jpeg)

Source

The uniswap exchange platform is a built on the ethereum blockchain which has a lot of varieties when it comes to tokens with a good amount of APR up to 60%

Q6. The Calculation method in Yield Farming Returns.

They are two ways in which the yield farming returns can be calculated: the APY which is Anual Percentage Yield and APR Anual Percentage Rate

- APY

In this method of calculation of Yield farming

returns we are calculating compunding interest over time, which means if your interest rate is 10% for a capital of 100$, day 1 you get 110$ day two you get 121$ day 3 you get 133.1$ and the interest keeps getting added as so on as so forth the formula used for APY is

APY=P(1 + r/n)^nt

WHERE

P= Principal

R=Rate

T=Time(in days ,months or years)

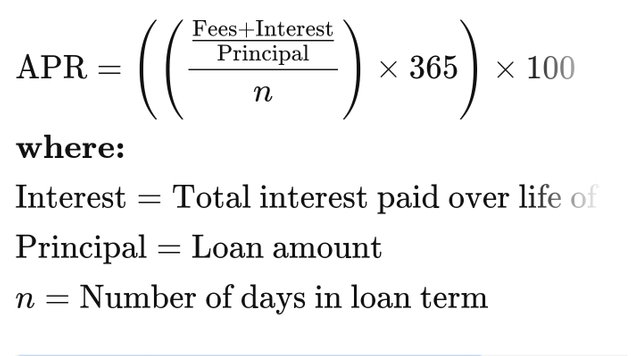

- APR

In the APR method of calculating the yield farming returns the individual does not calculate compunding interest and the formular we can follow to calculate the APR is given below

Q8.How Is APR Calculated?

The rate is calculated by multiplying the periodic interest rate by the number of periods in a year in which the periodic rate is applied. It does not indicate how many times the rate is applied to the balance.

Investopedia Source

> Q9.Advantages & Disadvantages Of Yield Farming.

ADVANTAGES

- LUCRATIVE

You get to earn more assets for literally doing absolutely nothing but waiting, this is one hufmge aspect of the yield farming you end up with more assets than you began with initially, the interest rates are very good so if a large amount of liquidity token is locked a very considerable amount will be earned regularly

- PRIVILEDGE

When you have a certain token locked away in the yield farming platforms you are given some certian rigth to vote or make contributions aspa decision wise in the platform

- VOLATILITY GAINS

In some cases while your assets is locked away for a long time apart from the usual Percentage you are earning you can wake up and meet your locked away asset value has inflated by alot hemce leaving you with a lot of profit

DISADVANTAGES

- HIGH INVESTMENT CAPITAL IS REQUIRED

If an individual starts yield farming with a small amount of asset the interest he accumulates 9ver a long period of time is often nothing to write home about, to earn significantly you have to lock a very significant amount of asset

- DEFLATION

While your asset is locked away over a long period of time you might unlock it oneday only to find out it jas list more than half its value and its only worth half of what it was when you locked it

- CHANGES IN RETURN RATES

Say for instance you locked your asset at 2020 wjen the return rate of the yield farming platform was 100% and in 2021 the RR was slashed in half, you will start to earn half of what you were earning initially

Q10.Conclusion on DeFi & Yield Farming

The defi has eliminated lots of challenges we have had with the centralized finance system currently in place like the privacy and intermediary factor as this are some of the most prominent challenges we currently face with the Centralized finance today,the yield farming is an amazing way to earn more just for locking your assets up quite similar with what we have with our usual bank account but instead of just leaving the mo ey in our account we lock them somewhere it will ne generating more money for us. The Decentralized financial system is an answer to a lot of problems we have currently the only challenge we have rigth now is having it accepted as generally as the centralized finance is presntly...

Thanks to professor @stream4u for this amazing lecture and class

Hi @jamezmccoy

Thank you for joining The Steemit Crypto Academy Courses and participated in the Homework Task.

Your Homework Task verification has been done by @Stream4u, hope you have enjoyed and learned something new.

Thank You.

@stream4u

Crypto Professors : Steemit Crypto Academy

#affable

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit