Hello fellow steemians this is my assignment post for professor @allbert

1- Explain in your own words what the A/D Indicator is and how and why it relates to volume. (Screenshots needed).

2- Through some platforms, show the process of how to place the A/D Indicator (Screenshots needed).

3- Explain through an example the formula of the A/D Indicator. (Originality will be taken into account).

4- How is it possible to detect and confirm a trend through the A/D indicator? (Screenshots needed)

5- Through a DEMO account, perform one trading operation (BUY or SELL) using the A/D Indicator only. (Screenshots needed).

6- What other indicator can be used in conjunction with the A/D Indicator. Justify, explain and test. (Screenshots needed).

1- Explain in your own words what the A/D Indicator is and how and why it relates to volume. (Screenshots needed).

The Accumulation and distribution Indicator is a volume based indicator which basically helps traders identify whether an asset is being accumulated/bought/purchased or Distributed/Sold created by traders. The A/D indicator can also be described as a cumulative indicator which factor volume and price of an asset to determine if an asset is bieng accumulated or distribiuted within a specific period of time.

The Accumulation and Distribiution Indicator was created by CEO of Chaikan Analytics and Stock analyst Marc Chaikan, the objective of the indicator was to show relationship or divergence between price movement and volume through which accumulation phase or distribution phase can be identified hence these phases can be used to predict maket trend or future price direction

Why it relates to volume. (Screenshots needed).

To the best of knowledge i know that the A/D indicator requires VOLUME and price in other to properly display an accurate A/D line so it is safe to say if a wrong volume is presented in the formation of the A/D indicator the indicator will be incacurate.

The higer the rise in volume the higher the demand which in turn indicates an increased rate in traders accumulation of an asset which will also lead to an increase in price rate and vice versa, in some cases the reverse is seen in scenarios like divergence. so we can see from the explanation i gave above that VOLUME is very much relatable to and an essential aspect of A/D indicator.

As is seen in the image above a sharp rise in volume showed an increase in accumulation hence the A/D indicator spiked also

2- Through some platforms, show the process of how to place the A/D Indicator (Screenshots needed).

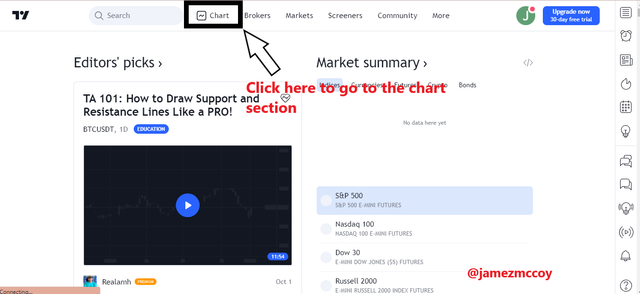

I will be showing you how to add the A/D indicator on your web version google chrome

- STEP ONE

go to (TradingView)[www.tradingview.com]. The homepage looks like this

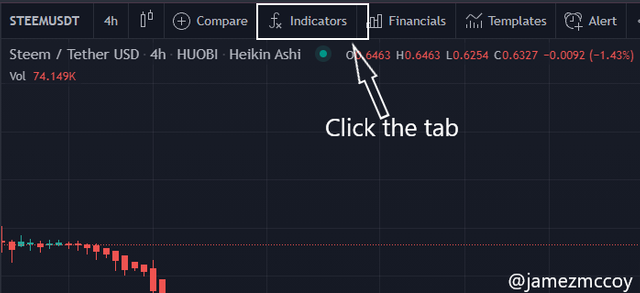

- STEP 2

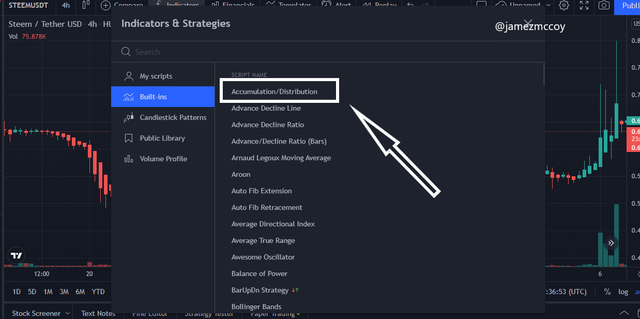

After clicking the chart as shown pictorially above. this should bring you to the chart section select the indicators tab as seen below

- STEP 3

A search bar will appear with a list if all indicators that have been added to the platform. A/D indicator is usually the first indicator on the list so no need to search for anything simply select as shown below

3- Explain through an example the formula of the A/D Indicator. (Originality will be taken into account).

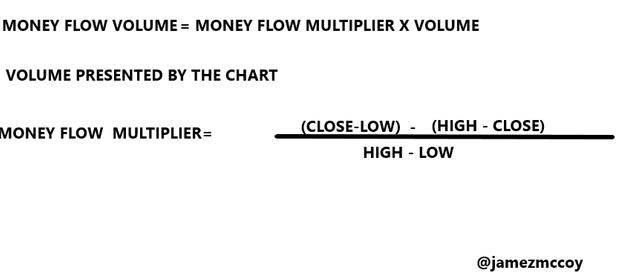

The A/D Indicator is calculated in three steps

- ONE

Identifying where the candlestick closes in relation to Highs and lows

- TWO

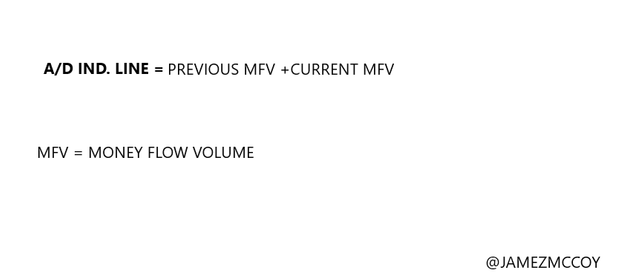

The next step involves the value called the MONEY FLOW VOLUME which can be found by multiplying the value by the volume with the money flow multiplier, the higher the volume the more impact or difference it will make on the MONEY FLOW VOLUME. The detailed formula presented below

- THREE

The last step would be to add the previous money flow volume from which the A/D lie was formed to the current money flow volume on the time frame you are calculating in conjunction to

4- How is it possible to detect and confirm a trend through the A/D indicator? (Screenshots needed)

The A/D indicator does this by showing the liaison between price and volume, when an asset is bieng overbought they is an increase in the volume and also in the A/D indicator which will also lead to a rise in price value hence a bullish trend will follow and vice versa

Now assume a scenario of which one has predicted that a bearish trend in the market and to confirm his prediction one can observe the A/D indicator, which if a reduction in accumulation or an increase in distribution is seen to be more dominant then it can lead to a low volume level and this means the price of value will go down and so will the price hence his prediction for a bearish market is confirmed to be accurate.

In a nutshell one can detect and confirm trends by simply analysing the phase in which the A/D indicator is in, an accumulation trend will mean a bullish trend will occur except in cases of divergence and vice versa, pictorial representation below

DIVERGENCE

DISTRIBUTION PHASE

ACCUMULATION PHASE

5- Through a DEMO account, perform one trading operation (BUY or SELL) using the A/D Indicator only. (Screenshots needed).

I will be performing my trading action on the TradingView platform.

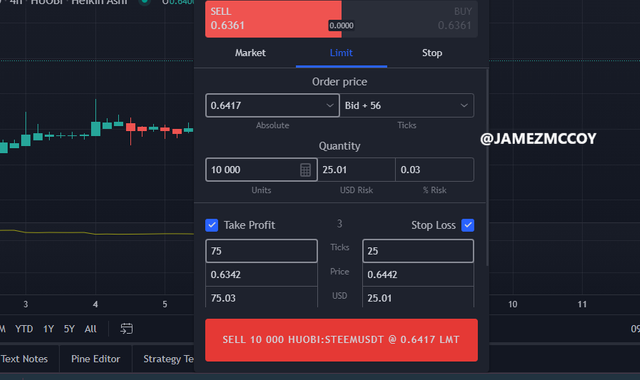

Using a time frame of 4 hours and a closer look at a time frame of 5 mins I entered the trading pair STEEM/USDT at a sell order of 0.6361 with a stop loss and take profit percentage of 75% and 25% which is in ratio 3:1 and exited when I made a total profit of 115.42$ interest after I perceived a trend reversal. Screenshots below

Before entering the trade i noticed a decline in the A/D indicator which implies that the rate of distribution was higher than that of accumulation hence a decline in price value was due to follow since no divergence was spotted hence i entered the sell order

Question 6

What other indicator can be used in conjunction with the A/D Indicator. Justify, explain and test. (Screenshots needed).

Considering the fact that the A/D indicator is a Volume based indicator I believe a very good combination would be with a trend-based indicator. Trend based indicator like half trend with a default setting could give you an idea of where the market is expected to move towards now with a volume-based indicator you can confirm is trend signals sent by your half trend indicator sent is accurate or not. So for indicator conjunction, I would recommend going in with A/D and a half trend indicator so you can analyze the market with one and confirm if your analysis is accurate with the help of the other. The half trend indicate where the trend is expected to go and the A/D indicator can be used to confirm if signal sent by either it or the half trend is accurate as seen pictorially below

Personally, though I love to use more than three indicators and use other indicators to confirm if a trend being sent by one can be verified by the other before market entry or exit are made

CONCLUSION

A/D indicator can be used s a primary or secondary indicator but i strongly recommend it shouldn't be used alone, Personally, though I love to use more than three indicators and use other indicators to confirm if a trend being sent by one can be verified by the other before market entry or exit are made. This way one can minimize loss and maximize profit by confirming signals sent by multiple indicators with other indicators. Thank you very much professor @allbert for this detailed course