Assuming the APY or APR of the coins you chose for staking and the current market value of those coins remains stable, how many coins should you have in 1 year? In US Dollars how much would that amount of coins equal?

You can use an exchange for the procedure but you cannot do staking on a centralized exchange.

Uses platforms such as PancakeSwap, MDEX, Uniswap...

1.) Perform the staking on a platform of your choice.

Step 1

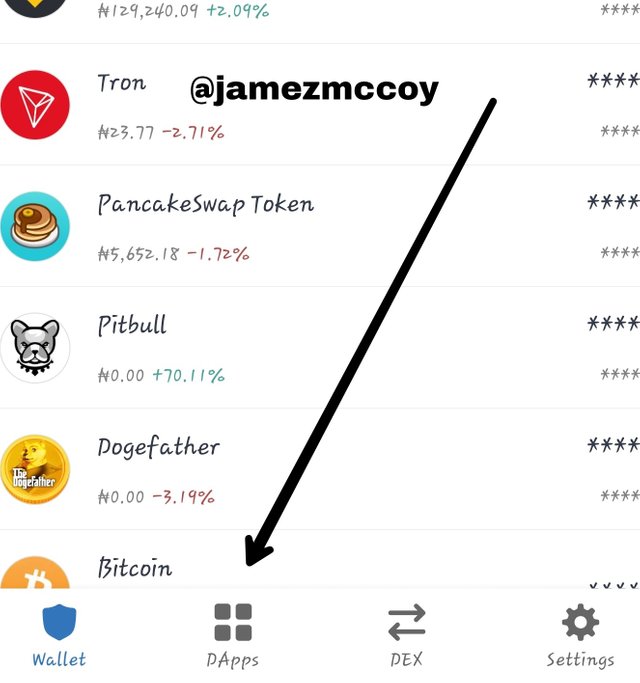

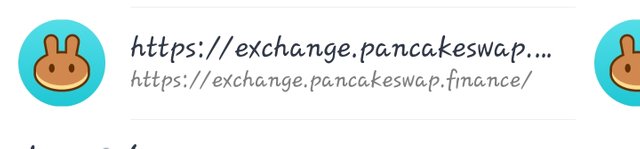

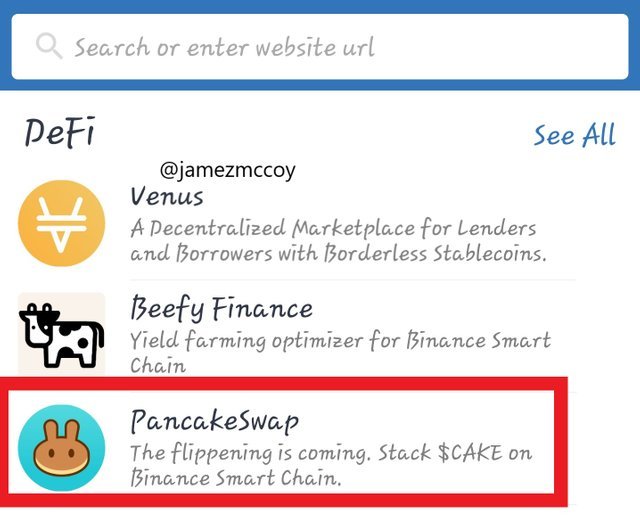

I Will be logging in through my trustwallet, go on your trustwallet homepage, and select DApps and in DApps select pancakeswap in exchanges as indicated in the images below

- Step 2

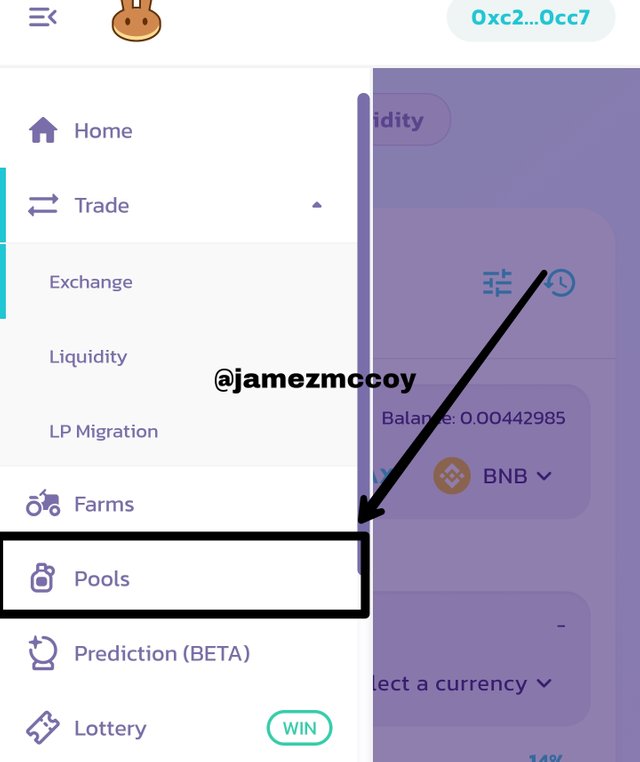

Your pancake homepage will load click on the three dashes on the top left corner which will open up a drop down menu click and select the pools button as indicated in the image below

- Step 3

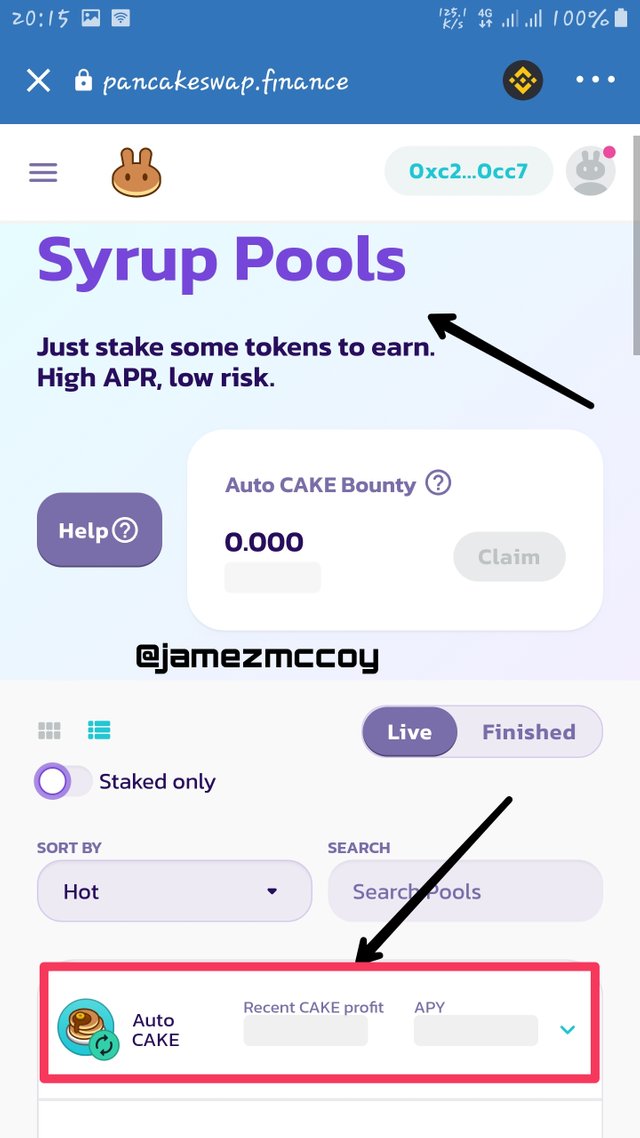

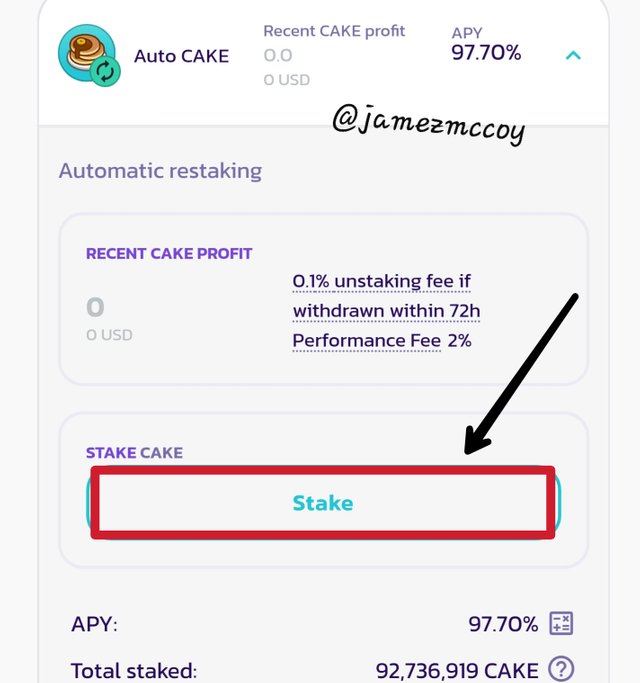

The syrup pool will appear with many pools options in my case I will be choosing the auto cake pools as I believe it to be the most lucrative with an APY of 97.70%

- Step 4

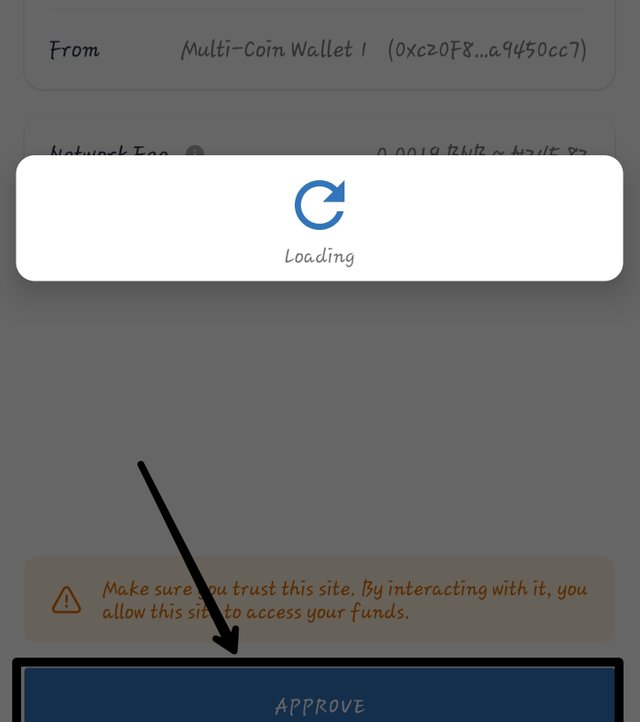

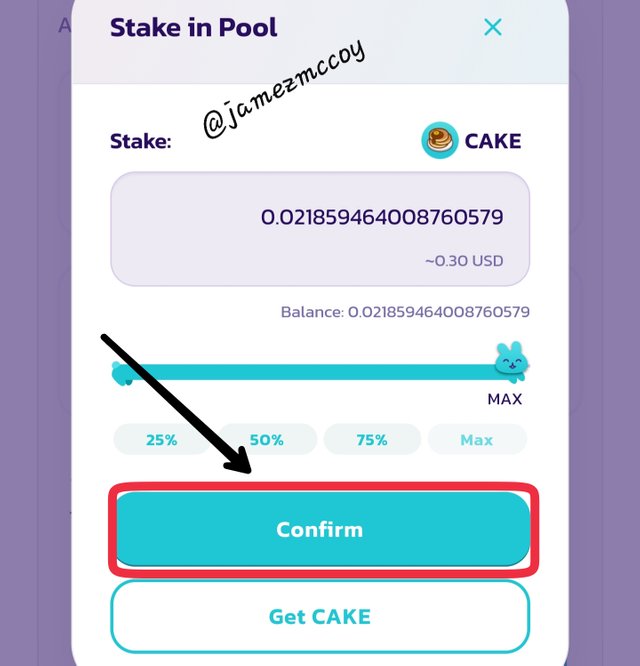

Select the amount of cake you wanna stake and click on confirm it will prompt you next to approve the transaction which may cost you some amount of BNB token

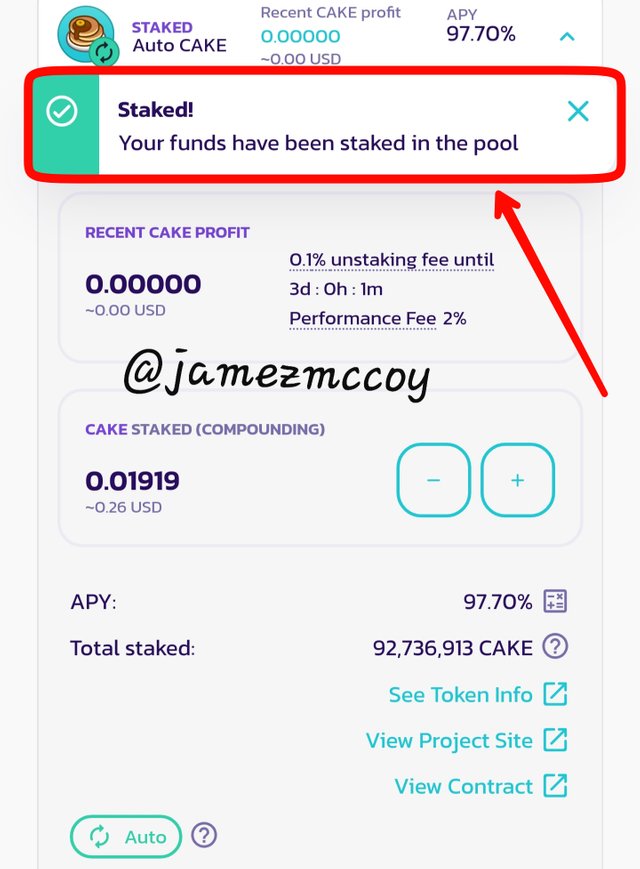

And congratulations your token has been staked

Which platform did you choose and why?

I made use of the Pancakeswap which is currently in the top three #3 among the rank of all Decentralized exchanges...Pancakeswap is my most preferred DEX because it offers way lower transactions or gas fees than other exchanges seem to offer because it runs on binance blockchain, pancakeswap has a 24hr volume of $593,164,398 which means there is high liquidity and buying and selling and other services they offer are going to be fast since they are a lot of people willing to buy and sell in a nutshell it is fast is also another reason why I choose pancake swap.

Which wallet did you use for the procedure? Use screenshots of your own. How can you link your wallet to the platform you chose?

I made use of the multi-universe or multi-coin wallet Trustwallet

and I will be showing you how to link your trust wallet to the pancakeswap DeX

- Step 1

After successfully setting up your trustwallet click on the 2nd button on your trustwallet labeled DApps and search for Exchanges and pancakeswap under it

.jpeg)

- Step 2

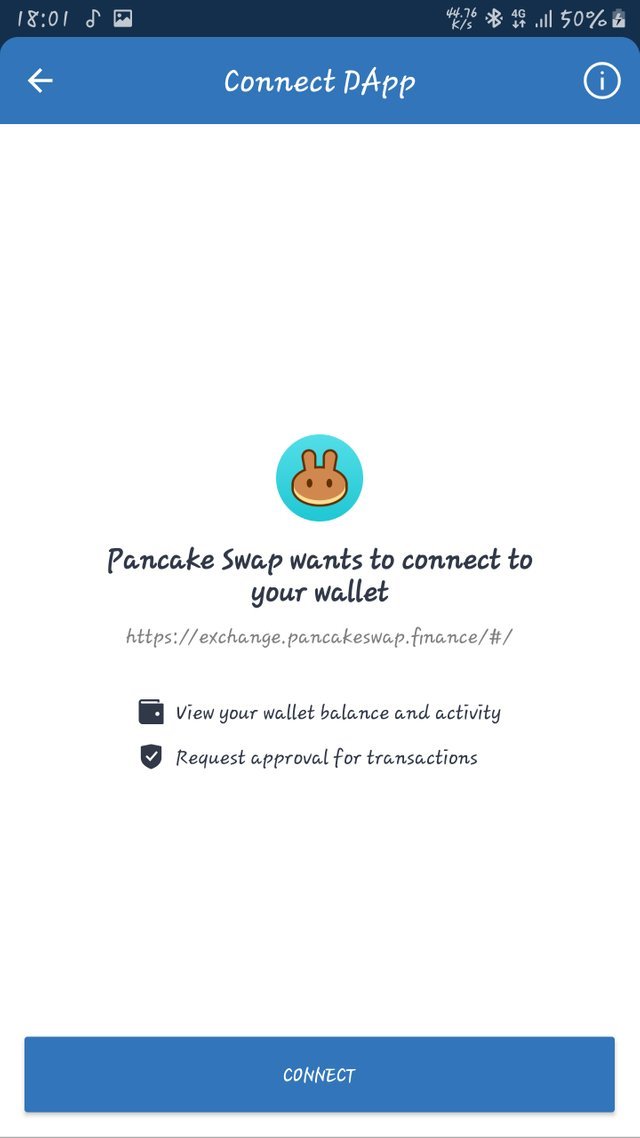

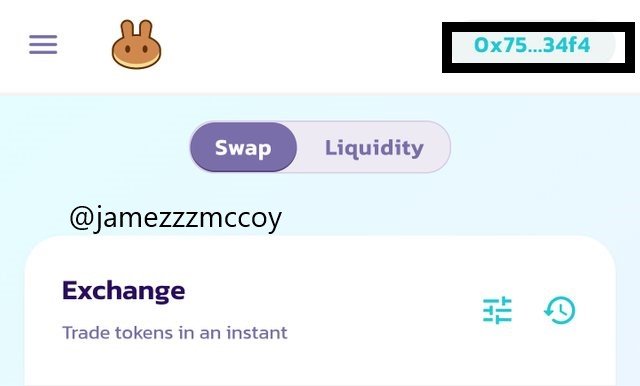

If this is your first time doing this it will prompt you to connect as indicated in the image below after you click connect it will display like this and your ID will be available on the DEX home page as also indicated below

And congratulations your DEX pancakeswap has been linked to your trustwallet and to confirm your unique id will appear on the top right corner

Which coins will you staking with, what is the APY/APR

Pancake swap only supports Liquidity provider tokens to be staked on the pools majorly most people including me use the Cake token which is the prominent LP token that is used on the platform

Assuming the APY or APR of the coins you chose for staking and the current market value of those coins remains stable, how many coins should you have in 1 year? In US Dollars how much would that amount of coins equal?

In my case, I had an Annual Percentage yield of 97.70% with an initial stake of 0.30USD which if calculated properly over a full year i.e 365days will yield exactly 0.59 Cake which when converted into USD dollar in that the Value of Cake remains at 12.79 dollar after a year our coins worth in dollar would be worth exactly 5.12USD

2.) Pick 3 cryptocurrencies and perform a 7-day and 30-day technical analysis. Draw trend lines and describe whether the coins are in a continuation or reversal pattern.

For my weekly or 7 days, technical analysis i will be analyzing the following coins

- Ethereum

- BNB

- XMR

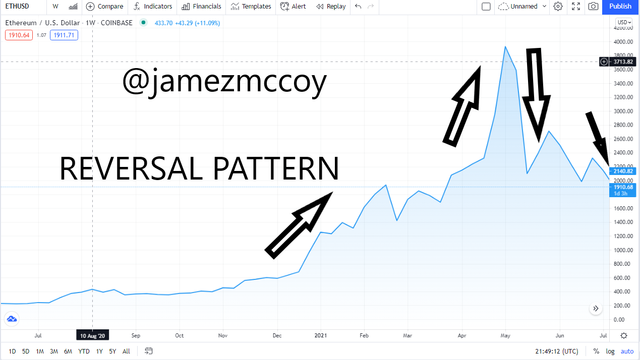

ETHEREUM

For my first technical analysis, i will be making use of the simple line chart which easily and simply displays price movement on the chart, you can grasp the information about these assets from just merely looking at this chart, the Trend as we can see is returning to its average and it is not in a continuous uptrend so it is safe to assume it assumes it is a Reversal Pattern

BNB

For my second token here I will be making use of a more detailed technical analysis tool i.e the Japanese candlestick chart which is very good for spotting market openings and closings from merely gazing at the chart and the Bollinger Band indicator which shows volatility and from the look of the trend we can safely conclude that this is a REVERSAL PATTERN

MONERO

For these assets, I will be combining the Japanese candlestick chart and the Bollinger band as to me this is the best chart set up a technical analyst could combine, it gives a lot more detail although requires some getting used to from the chart here the trend clearly indicates that this market is in a REVERSAL PATTERN

For my monthly technical analysis, I will be analyzing

- Chainlink

- Ethereum

- Tron

Chain link

For this crypto asset, I will be making use of the Japanese Candlestick chart, this chart presenter a lot of detail from just a gaze and from the look of the trend we can see that the market is in a Bullish trend and we know from our this week's lecture that a continuation pattern is seen when a trend takes a brief break and continues on its trend

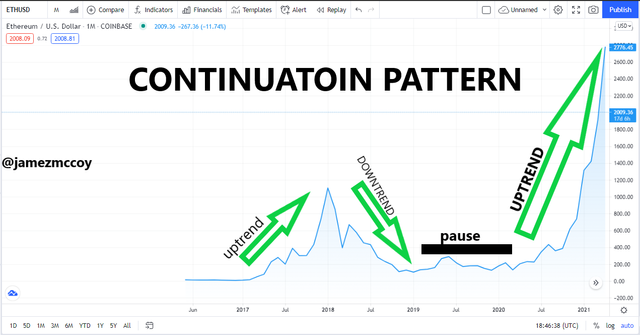

ETHEREUM

In the case of my ethereum analysis, I will be analyzing the Assets with a line chart and from the look at the information presented by the chart we can safely assume that the pattern is a CONTINUOUS PATTERN

TRON

In the case of tron we can see from the Line chart used and date range set over a month that the pattern is clearly REVERSAL in that the trend is not continuing in one direction it goes up and down as the market prices determine

3.) How can we differentiate a bearish season from a bullish season in the market?

- In a bearish season market psychology is low traders are pessimistic not too happy which results In price fall while in a bullish trend market psychology is positive traders are happy everyone is optimistic which will lead to buying more and eventually the value keeps increasing

- Trends are often represented by price movements on charts and if the market price over of asset value increase a bullish trend will follow while if market price decreases it is observed that a bearish trend will follow

- Bearish Trends season often occur when the market is oversold while the bullish trend is often seen when the market is overbought

TABULAR DIFFERENCE BETWEEN BEARISH SEASON AND BULLISH

| BULLISH SEASON | BEARISH TREND |

|---|---|

| In bullish season asset value rises | Asset's value declines |

| In bullish season traders tend to make more money cause the value of assets rises | Trades assets value declines and individuals tend to lose money |

| Market psychology is usually high | Traders psychology is low |

CONCLUSION

Trading knowledge especially being a great technical analyst in the crypto world gives you a huge edge over others and helps you cut loss by a lot if you do your technical analysis properly you would maximize profit intake in the world of cryptocurrency, Knowledge is power in the crypto world and the more knowledge you have the more advantage you have also, A big thank you to our professor @imagen for this detailed lecture and see you all next week

Thank you for participating in the Third Season of the Steemit Crypto Academy.

You made a great effort, however, in Question # 2 the analyzes should be carried out for periods of time of 7 and 30 calendar days respectively and not on historical data with compressed lapses.

Continue to strive, I look forward to continuing to correct your next assignments.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit