1- Define the following Trading terminologies;

Buy stop

Sell stop

Buy limit

Sell limit

Trailing stop loss

Margin call

(I will also expect an illustration for each of the first 4 terminologies listed above in addition to your explanation)

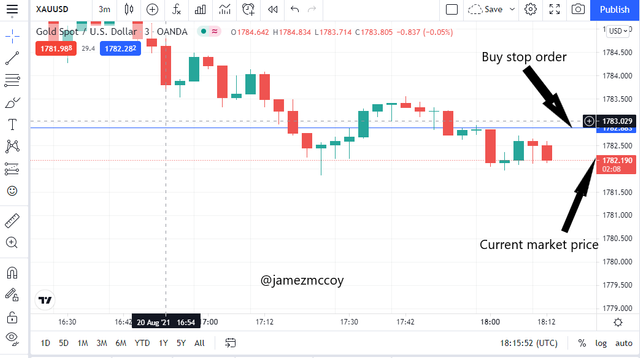

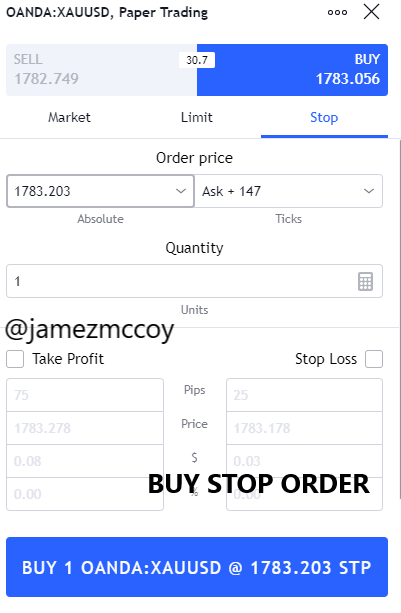

BUY STOP

A buy stop is a limit that is set usually above the current market price, what happens here is an individual set a price, lets say the current market price is 2$ and you want to only enter a market trade at 2.2 dollars, So you set your buy stop order and when eventually the price current market hits 2.2$ you buy stop order will be automatically triggered and your order will be executed

A typical example of a buy stop order is as seen below on Tradingview paper trading

BENEFITS OF THE BUY-STOP ORDER INCLUDES

- More profit

- Automated which reduces the stress of having to monitor the chart yourself and taking profits manually

DISADVANTAGES

- Orders might take a very long while to be fired

- They are chances where your parkrv thu why you go there

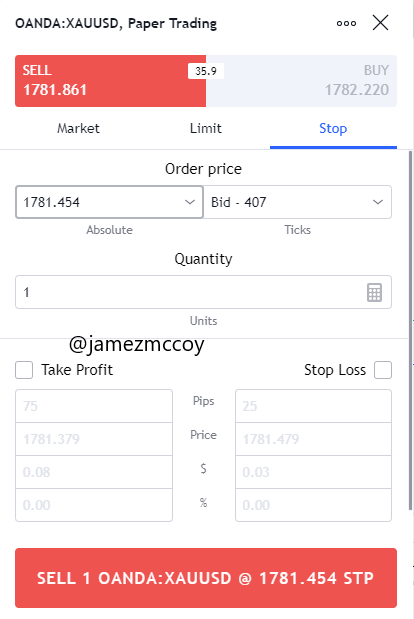

SELL STOP

A sell stop is literally the opposite of a buy stop order. It is usually set below the current market price and is eventually the market price crosses the said input order the order will be triggered and executed. Let's consider his analogy, lets say wants to enter a trade but the current market price is at 2 dollars and he wants to trade only when its at 1.8$ so what he does is he sets a stop limit at 1.8$ when the market price meets up with the order entered the will be automatically triggered

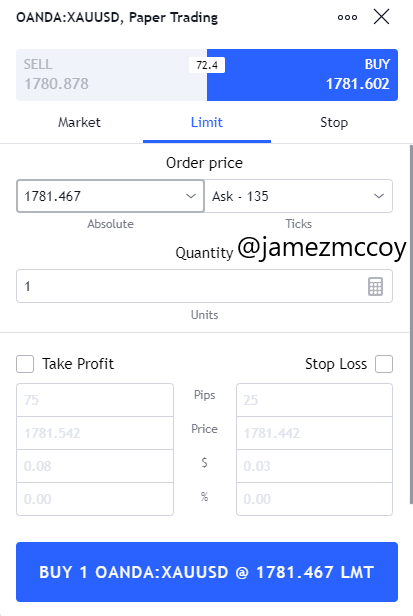

BUY LIMIT

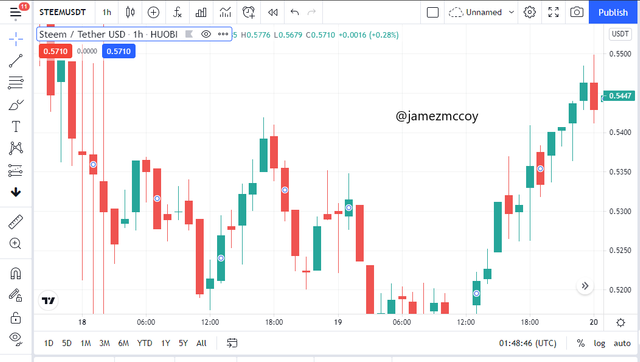

A buy limit is an order created that ensures users pay what they want to for an asset. A buy limit is executed when the price reaches the user's specified limit or below a user-specified limit, allow me to further explain with the help of an analogy. Let's say Mr.A wants to buy Steem Dollar at 6$ a piece but on reaching logging in the crypto market he discovers the coin has inflated to 8$ apiece, The Buy limit is most useful in this context as no one will really have time to sit and monitor the SBD coin until it comes to the specific price he wants then place an order. Mr. A will place a buy limit at 7$ and whenever the coin gets to his specified amount the order will be placed automatically

SELL LIMIT

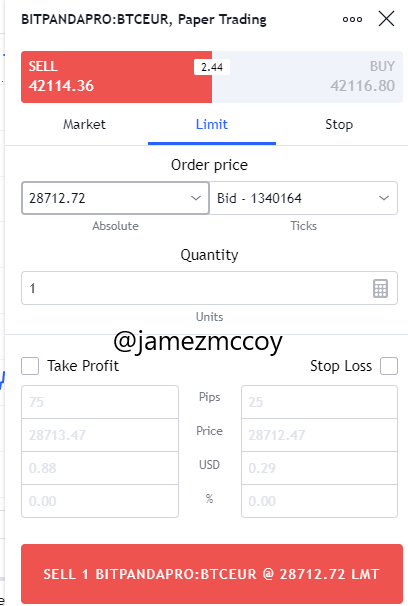

A sell limit is often created by users who are not satisfied with the current market price the individual can set his own price when the market hits there his sell order will be executed. How this works is, lets say for instance a user wants to sell his asset at 15USD per coin but the current market price is at 13USD so a sell limit order is created and once the conditions are met the order will be executed

TRAILING STOP LOSS

The trailing stop loss is an order that can be set either above the current market price or below the current market price it, the trailing stop loss can be set in such a way that it helps minimize loss by a lot and optimizing profits. It is mostly used when an individual finds a favourable position during a trade, the trailing stop loss doesn't limit profits, rather it secures profit while setting limits towards potential loss which enables one to have ride a trend with a flexible stop loss limit following closely behind to ensure one does not loss

Depending on what position one is trading from the trailing stop can be set at a fixed position beneath the market price or at a predefined gap from the current market price lets consider the analogy, the trailing stop is set not too far from the market price in such a way that it cant be triggered and is not set too close so that unexpected sudden movement don't trigger the order. Lets say a user enters a trade at a 100$ and makes a profit of a 100$ that's the current market price. Now to secure the 100$ profit a users sets up a trailing stop loss limitless say 15$ below the current price hence securing the other 75$ profit, as the market goes higher so will the trailing stop limit follow closely behind with a 15$ gap lets say the market makes it to 250$ as the current price, then falls back down as the current price falls below 15$ from the current price the trailing stop loss limit will be triggered and the market will automatically be concluded

MARGIN CALL

A margin call simply refers to situations where a traders trading balance goes below the minimum required amount in a trading platform, the brokers will reach out to the trader with a request to deposit more funds. The process is called margin call. The major factor that brings about a margin call is a loosing trade maybe a trader forgets to set a stop limit and a coin dips to an extent it drains ones account

2 - Practically demonstrate your understanding of Risk management in Trading.

*Briefly talk about Risk management

*Be creative (I will expect some illustrations)

*Use a Moving averages trading strategy on any of the crypto trading charts to demonstrate your understanding of Risk management. (screenshots needed)

RISK MANAGEMENT

As a trader we all venture into the cryptoworld to make profit and not loss, but in most cases due to lack of proper risk management or proper chart analysis or maybe poor interpretation of charts more people end up loosing more than they earn on the crypto world. Risk management is all about inventing strategies, policies and means to reduce or minimize to the fullest losses hence increasing our chances of making profits. they are quite a few ways I can think of that an individual can implement to minimize loss and properly mange risk which include

- PROPER ANALYSIS

This is the basis of all successful risk management., proper interpretation or analysis will reduce one's chances of entering a trade wrongly hence reduces the odds of entering risky situations by a lot. Proper Technical analysis helps a trader know when to properly enter a trade and exit and as we know the more information one assimilate about an asset the less likely he is to trade wrongly. A typical example of proper analysis is seen in charts

- ORDERS

Now they are situation which after all our vast study on an asset the market makes an unexpected trend reversal and we experience price movement in an unexpected direction the stop loss order plays a vital role in assisting us to not loose al our assets over one unexpected price movement. This Oders include the Buy stop, Sell stop, Buy limit, Sell limit, Trailing stop loss and they go a long way in managing risk when trading

- STREATEGIES AND CONDITIONS

In some cases we could come up with strategies that works best in our favour maybe by combining certain chat and indicator or multiple indicators, lets say for instance we come up with strategies using indicator like Bolllinger band and RSI on a Japaneese candle stick and set conditions the chart has to be before a trade can be entered or exited, For instance we could say we only enter sale orders when the SMA breaks beyond the upper band of the bolinger band. sticking with strategies that work helps a lot in cutting losses and improves our chance of profit intake

CONCLUSION

Risk management is essential in the trading world in the sense that every loss is a setbacks and in some cases one gets setbacks up to an extent he gets a margin call, the more knowlegde one has over a cytocurrency the more likely he is to be in full control or at least a step ahead of taking risks in any way. The knowledlegde of the Buy stop, Sell stop, Buy limit, Sell limit, Trailing stop loss, Margin call goes a long way in risk management also as the tend to completely save an individual a fortune with their automated features. I will practice more on this course thank you very much Profesor @yahan2on for this medium to learn about this important features and terminlogies we have in trading

Hi

Thanks for participating in the Steemit Crypto Academy

Feedback

You missed out on one of the very important aspects involved in Risk management and that is setting the Stop Loss and Take Profit. I expected to see that on the final chart under risk management.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit