Greetings to you all my lovely friend. How are you doing today,indeed is a great day of my life because to be a participant of this season 6 cryptoacademy lesson which am here to discuss about my homework task base on the topic : 'Basics of Trading Cryptocurrencies Correctly", that was given by our noble professor @nane15. Without wasting much time let's get straight to the homework task below.

Whatt do you understand by trading? Explain your understanding in your own words.

The words trading is not a new word, it's a very popular words that almost everyone that has passed through an elementary school most have heard about because trading is what most of us have learned backed then in our elementary school days. Even without been taught about trading most of us have traded in one way or the other in our everyday life. Although, base on what I have said some of us might not even remember what we have traded on before, but even if you have forget it's best to know that anything that you buy in a supermarket is part of trading money for goods or services that is render to you.

Literally, as a crypto trader or forex trader we can not be seeing trading just as the way other people that aren't into forex or crypto trading are seeing it. The word Trading simply means the exchange of one item for another item. This means that trading is the exchange of money for an asset that is a seller is willing to sell out to a buyer without influencing the buyer. When we are discussing about trading in crypto market is not different from what I have said, there are the same principle. Let's think about how we do trades our cryptocurrencies. What we normally do is actually buying crypto or a fraction of a crypto. If the value of the crypto that we buy increases, then we have make profit by selling them at a higher price to a buyer which means trading. So with this I can define trading as a means where buy we buy crypto for one price and sell the crypto again for another price that is higher that the price at which the crypto is bought making a profit from it.

What are the strong and weak hands in the market? Be graphic and provide a full explanation.

Crypto and financial market is dominated with big investors who has master the market for a very long time, and with that it's also dominated with players (, investors) that haven't yet have controlled in the market because of the lack of the resources or conviction to carriedout their strategies. Now, if you know a player (investor) who has spent some years in the crypto market of financial market and is still lacking conviction in his/her strategies or he/she is lacking the resources to carry them out, should a player (investor) is often describe as weak hand in the market.

Weak Hands in the market is used to describe a trader or an investor who is driven by fear to immediately exit his position on trade on almost an even that he/she consider to be new or detrimental, which make the trader/ investor to have a losses and poor returns on investment. Weak hand investors tend to focus more on certain rules that makes their trading activities which their have already opened to be easily predictable and be scrap out due to the fear that their used in making their prediction. These category of traders (investors) are those to earn up buying their digital asset at a high price and sell them at a lower price because of fear of losing their capital.

Strong Hands in the market is used to describe describe trader or an investor who is not driven by fear, instead their are refer to big players (investors) in the market. This are category of players (investors) that controlled the market, in the crypto market there are called whales due to the larger stake of Investment that their have. The type of players (investors) that are called whales own majority of the shares of a companies in the crypto market their own the largest funds than the weak hands investor, only their influence alone is okay for a crypto rise and fall. Once those who are strong hands investors start withdrawing their Investment price is been affected. Let's consider looking at the screenshot below.

From the chart above, we can see two phases on the chart which is the distribution and accumulation phases. The distribution phase is the phase that make the demand of asset to be liquidated. When the price of an asset is rising in the market, and strong hand investors started closing their trade in order to take their profits, is what normally cause liquidation in the market. Looking at the screenshot we can see that at the distribution side the price of the traded assets in the market has reverse to a downtrend movement, after weak traders have already bought the asset at a higher price. Equally, we can see that from the chart the market keep on rising and falling.

The accumulation phases, strong hands traders (investors) have already started buying the traded asset bit by bit at the time when the asset was low. The strong do buy their asset at the phases and keep them until the distribution phases so their will sell and collect their profit. Although, since the strong hands investors understand to the market very well their will buy more of the assets before those that are weak hands investors will start buying the same assets which the strong hands have already bought at a lower price. Due to fear of losing out if there is a little downtrend of price, weak hands will hurry and sell their assets.

Which do you think is the better idea: think like the pack or like a pro?

A lot of traders due to what their have watch and read online will make them to start thinking like a pack or like a pro. Although, those who usually think like the pack are those that are refer to as weak hands in the market. This category of thinkers always have that mindset that whatever their have read online or watch on YouTube should be exactly how things should workout for them without them trying to know the strategy that is been put in place for that person to succeed. This category of traders/Investors that always think like the packs are always afraid to take risk instead their just want to do things fast and take their profit immediately, they are more concerned on the information that they got online rather than what their are facing practically.

Most traders/Investors that always think like the pack end up quiting what their have work so hard for because of fear and inpatient in what their ought to believe on which is very bag. Although, those who think like the a pro are those that understand that one day their will come to make it big and equally teach others the way forward.

The pro thinkers are refer to the strong hands traders/Investors their are the people that enter crypto market, forex trade or financial markets with the mindset of taking risks into their achieve their goal, their are eager to take risk in other to become successful, and also their don't have the fear of losing out easily. Their knowledge of expectise come with learning and putting what their have learnt from other strong hands into practice using their own best strategy.

Pro thinking is always far better than pack thinking that is always full of doubt. Thinking like a pack is never a good idea because you have already classified yourself as a failure in the market. Most of the pack thinkers whenever their heard a news like banning of cryptos their will get fear and start withdrawing their Investment even if the news has affected the price of their assets their will still withdraw all out of fear.An example can be seen in the chart below. Let's consider looking at the chart below.

From the above chart, we can see that there was a market manipulation that make those that think like a pack to lose their capital became of fear, although their bought their assets at a higher price and sell them for a lower price. The best think that a trader can do is to totally remove the mindset of thinking like a pack but like a pro which is more better.

Demonstrate your understanding of trend trading. (Use cryptocurrency chart screenshots.)

In order for any trader to get the best out of his/her trader, trend is what is what such a trader need to look at for first before placing either a buy or sell entry trade. Trend trading is what make traders to understand the direction of the market and price movement if it's in an uptrend or downtrend movements, it's with trend that all the aforementioned can be Identified easily.A trend that is moving in it direction is refer to as "counter-trading that seem to be more riskier that any other types of trading.

Although, there are several ways in which trend can easily be determined in the market. Some of the way are the use of price action, chart patterns, technical Indicator, market structure, the use of line chart and many more. Although, the one that I myself thinks is the best is the use of Elliot Waves, which is a read about the movement of market trend.

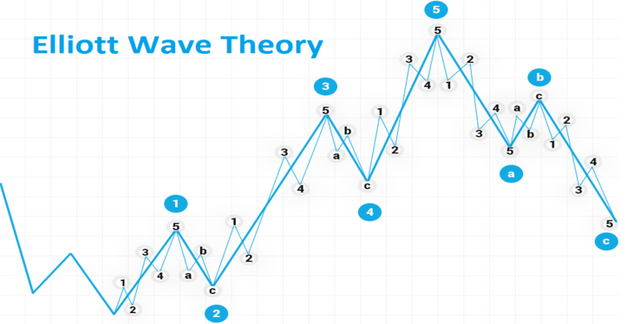

Elliot wave pattern can easily be Identified on a chart as a moving trend which move in a chart making a correction waves or impulse wave. The correction waves is the wave that moves in opposite direction of the impulse and it signal a trend reserval meaning that and Investors can start taking their profit. Impulse wave help traders to identify the market overall trends so that trader can follow how the market is moving.

The impulse wave has 5 waves. Among the 5 waves 1, 2 and 3 of the waves moves in one direction which is that of he trend, whereas the remaining two waves which is 4 and 5 are retracement waves that can pull back at anytime.

In setting of the Elliot wave there three things that one need to put in mind which are;

In setting Elliot wave you need to make sure that the wave 2 must not retrace back to the previous low wave 1. Rather it's the wave 4 that need to retrace back to the previous low wave 2.

Wave 3 should be the longest wave among the 5 waves.

Wave 3 should be higher than that of wave 1 height, but no to be higher than wave 5.

Corrective wave is the wave that occurs after the wave, an if it occurs after wave 5 it's a signal that price can no longer create new signal in the current trend.

Show how to identify the first and last impulse waves in a trend, plus explain the importance of this. (Use cryptocurrency chart screenshots)

As I have earlier explain briefly about Elliot Waves and some of the things that we need to put in mind, of which I believe that we can now Identify the first and last impulse waves in a trend. Although, I will be identifying the first and last impulse waves in a trend here. So now let's take a look at the chart below.

In order for the first impulse to be Identified, there must be a formation of the correction waves. The correction waves are form at the end of wave 5, which bring about trend reserval. At this point,the first impulse can be Identified. Looking at the chart above,we can see how the corrective waves b and corrective wave c has formed a new high peak that is link to waves 5 and wave a. And also we can see that after the traced that was when a new lower peak was created which seem to be higher than that of lower peak of wave c. Looking at the chart we can also see that wave a is lower than wave c and a new trend then became the first impulse waves. The first impulse waves is the wave that tell traders to enter in a new trend untime.

I'm order for the last trend to be Identified, we have to look at for the wave maximum point which is that of the wave 5. Let's now take a good look at the chart below.

From the above chart, we can see that wave 5 formation has make the price of the traded asset to fall lower than that of the previous low peak, which make the formation of the corrective waves a, b, and c to rise up. And after the formation that is when we can then Identify the last point wave which signal and uptrend movement.

Show how to identify a good point to set a buy and sell order. (Use cryptocurrency chart screenshots)

We can identify a good point to set our buy and sell order after the last impulse wave. In doing this you have to make that the high peak wave 5 stand as the resistance level (point) for price. Immediately, after the corrective wave formation, the high peak of the wave is set to be the point of reversal then a good buy order can be place. In doing this let you buy order be placed little above the line that is parallel and with your stop loss be placed below the point of the previous low. Let's consider looking at the chart below.

From the above chart we can see that take profit is placed near the resistance point which is higher then the previous wave 4, and stop loss is placed below the previous low peak.

In order to set a sell order, the same procedure that is used to set a good point for buy order is equally what is used. Here, after the formation of the wave 5 and the corrective waves, has been formed that is when we can set a good sell order. In setting this, price need to fall to break the resistance point before your sell order can be set in a good way. Let's consider looking at the chart below.

From the above chart we can see that stop loss is set above the corrective waves a which is the high peak, and take profit is set at the near the resistance point.

Explain the relationship of Elliott Wave Theory with the explained method. Be graphic when explaining.

Since I have earlier explained what accumulation and distribution phase is all about in question number 2. The relationship of Elliot Waves is what is what is seen in the last wave of question number 5,(i.e wave 5). Let's consider looking at the chart below.

From the chart above, accumulation phases can be Identify using the theory of Elliot wave. The distribution phase displays when strong hands investors are exiting the market which makes price to reverse. It is seen as the correction wave. The accumulation phase help trades to know more about pro investors (traders) to enter the market.

Conclusion:

Trade is not just all about buying and selling of goods or services but it involves the exchange of knowledge business ideas and many more that is attached to trading. Although, before you get into trading it's advisable that you ask yourself if you are going to be a week hands trader or a strong hands trader. All thanks to professor @nane15 for the wounderfu lesson which has sharpen my brain and understanding on trading the more.

Best Regards;

Cc:-

@nane15