Hello everyone and greetings to professor @pelon53 for his leadership in this "Investors-Team" which I am here again today to present my Day Trading Competition on the trade that I carried out on ENJ/USDT.

1.- The name of the token and introduction of the project. Technical background of the project, team in charge of the project and important data of the project. In which Exchange or exchange can be negotiated.

Enjin is a software company that allows developers to that want to create and manage virtual properties to have access on Ethereum blockchain. Enjin provides developers with an ecosystem that is interconnected, blockchain for them to manage their in game products across multiple properties. In a nutshell, Enjin is a social gaming platforms, that allows users buy, sell and trade their asset using the value of real world. Is this not nice, for a platform like Enjin to provides such an exclusive services where everyone can create digital assets on Ethereum blockchain and integrates their digital assets into games and applications through the use of Software development kits (SDKs).

ENJ coin is the native coin of Enjin which was formally announced first in July 2017,and in June 2028, it was launched on the Ethereum mainnet. The ENJ Coin is known as a digital store of value that is used on the Enjin platform to back the value of blockchain assets such as (NFTs) Non-fungible tokens. All the asset that are minted using the Enjin platform includes ENJ coin, since it's a minting resource that is locked inside Non-fungible tokens and pulled out from being in circulation.

Maxim Blagov and Witek Radomski are the two founders of the Enjin platform which started as a gaming community in the year 2009. Maxim Blagov, is the CEO of Enjin, whereas Witek Radomski is the technical officer, that is in charge of any technical development of Enjin company.

Enjin initial coin offering (ICO), was first launched in 2027, and about $18.9 million dollars was raised from just the selling of ENJ coins which was later used to build a new blockchain network. 2018 was the year Enjin went live as a new standard for Ethereum issued coins. And finally to this, in 2019, ENJ coin started serving as a token that is used for both minting Non-fungible tokens (NFTs) and Fungible tokens.

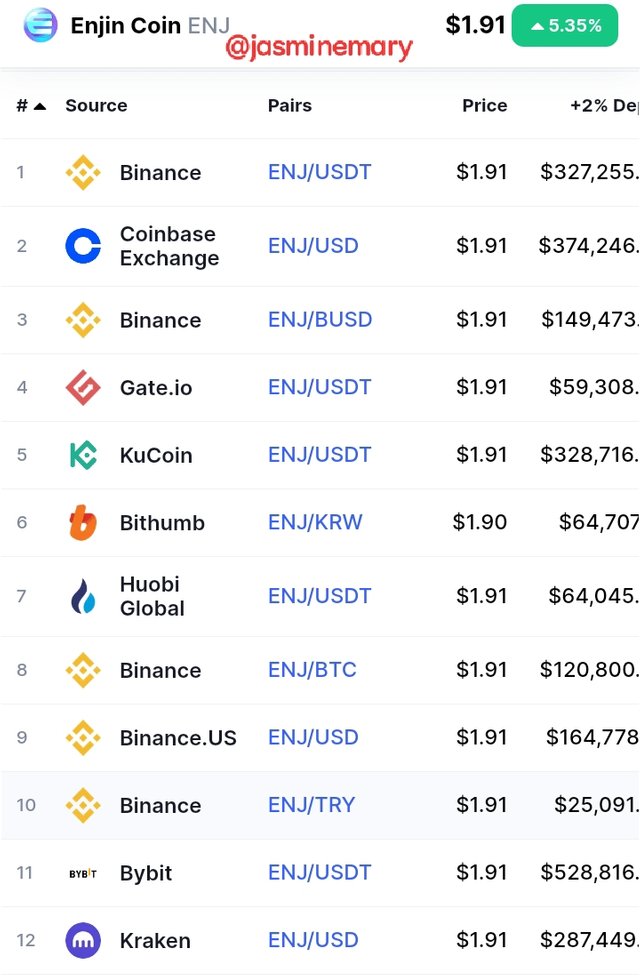

The Enjin (ENJ Coin) can be traded on cryptocurrency exchange as Bithumb, Binance exchange, Balancer and many other crypto exchanges that can be seen on the screenshot below.

Screenshot gotten from Coinmarketcap

In order for you to trade ENJ Coin on Binance exchange, you must first have your your account verify. After your account has been fully verified you can then trade ENJ coin against Bitcoin, Ethereum, USDT, USDC, or fiat currencies like Euro and U.S. dollar. However, on this post I will be trading ENJ on Binance spot trade as against USDT.

2.- Why are you bullish on this token today?

Well, ENJ Coin was one of the crypto that I admired so much in 2021 but couldn't afford to buy it due to some financial issued. ENJ coin 2021 was seriously trading on a bullish trend and became stronger in March immediately Houbi Global announced the listing of ENJ coin on its platform which the as staking was equally organised by Houbi that only lasted for 2days. So many users including my very good very was among those that got rewarded from staking ENJ. From that very moment I began so bullish and interested about ENJ.

Screenshot gotten from Coinmarketcap

Screenshot gotten from Coinmarketcap

Ever since in November 2021 that ENJ coin reached it all time high of about $4.85 which I believe it did because within that same month when I checked its it was around $4.85 and early this year January 2022 it then drop to $2.56 and of which today it's trading at $1.91 which it has not drop below $1.

3.- What is your plan? Do you want to keep it for a long time? Or when to sell it?

Well my plan for this token is based on the token is going to perform after buying it. However, I have the believe ENJ coin will rise this month as it has gain a lot of popularity which more Investors will start finding their ways into the market.

As of 2021 the performance of ENJ was very encourageable for everyone to invest in the coin. Obviously, I was part of those people that was admiring the coin but never have the opportunity to buy it then because of finance, but now that I have the opportunity to do so I will keep it for a long time.

4.- Do you recommend that everyone buy it? The reasons for recommending or not recommending it.

Well, I cannot recommend that everyone should buy ENJ coin because of how crypto is highly volatile of which ENJ is not exempted. However, if am to recommend ENJ to anyone it will depends on how long the person has been in the crypto industry because I believe that such a person might have fully understood how crypto works.

5.- Any other important information of the token/project.

The aim of the ecosystem of Enjin blockchain is offer developers with software that their can used to create develop, monetize and buy and sell properties on blockchain. There are a lot of information concerning Enjin that we can find on it Website, ENJ Coin, and on some of its social media pages like Facebook and Twitter information can be gotten also.

6.- Make an analysis of the token or cryptocurrency that you are going to operate. You must obligatorily use methods and analysis learned in the Crypto Academy.

Here I will be carrying out my analysis on Tradingview using two Indicators which are Exponential Moving Average (EMA) and Relative strength Index (RSI), before executing the trade on Binance exchange.

First, EMA is a very well known Indicator that is used both in crypto and forex trading to know the trend of an asset. The best way of using EMAs strategy is for we to trade on shorter timeframe against a longer-term timeframe which is depends on the position that we want to open.Traders are always bullish when the shorter EMA 10 crosses above the longer EMA 20 or stay above the EMA 20, and it becomes bearish when the shorter EMA 10 falls below the EMA 20. In EMA Indicator one need to pay attention to the crossovers,which is an indication of a potential reversal in the trade.

As for the RSI, is an indicator that I'd used to determine the levels of overbought and oversold. When the RSI is at 70 and above, it means that the asset is overbought, but when it falls below 30 it means that the asset is oversold.

ENJ/USDT Buy

Screenshot gotten from TradingView

Screenshot gotten from TradingView

From the chart above, I noticed that the 10 EMA line has crosses above the 20 EMA line which signify a blush trend. Meaning that a buy order trade can be open. As I look at the RSI, I noticed that the asset has previously hit the level of overbought before it was fall down with one bearish candle. After the falls the RSI began to move above 60 RSI heading to the level overbought 70, which signify that the asset is oversold. After seeing all this I then opened a buy order trade.

Screenshot gotten from TradingView

Screenshot gotten from TradingView

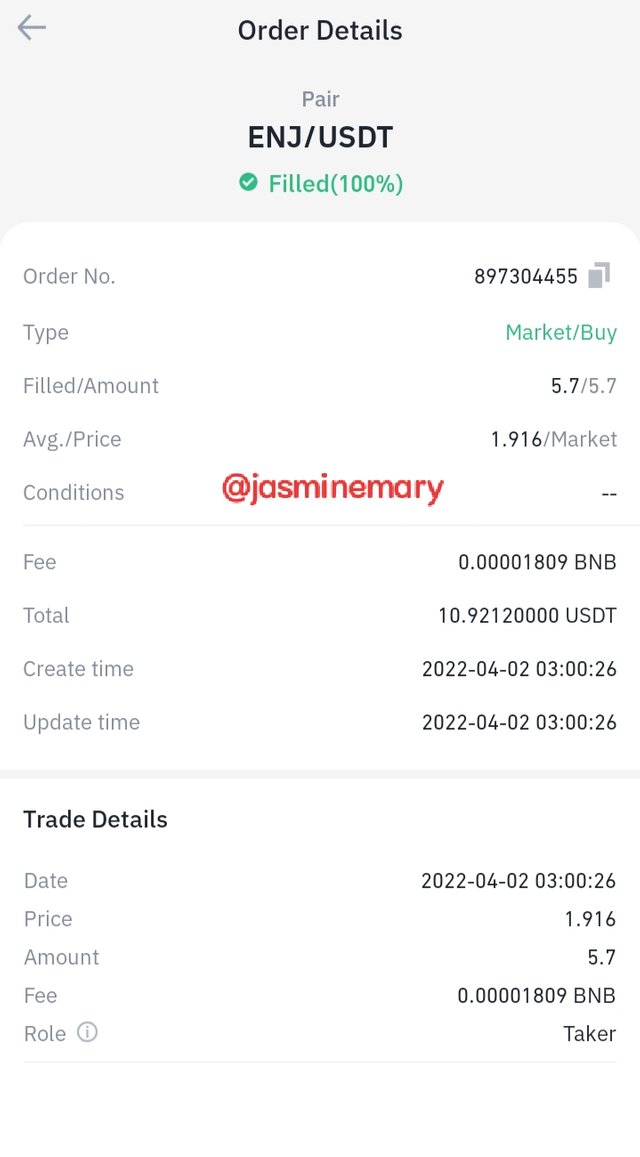

Screenshot gotten from Binance exchange

Screenshot gotten from Binance exchange

Thanks for your precious time here my Dear friend.....

Best Regards;

Cc:-

@pelon53