Hello, my good Steemit friends! I am happy to have you here reading through my post, in which I talked about "Short Squeeze" which is organized in SteemitCryptoAcademy

What is Short Squeeze? From your own opinion.

In my own opinion, Short Squeeze is a financial term that is used to describe a sharp rise in the price of an asset which forces short seller traders out of the market. Short Squeeze mostly happens in the crypto market, like for example when the price of Steem sharply increases in price due to too many short sellers that are being forced out of the market.

Short sellers are the category of traders that are betting for the price is an asset to fall, which if the price of the asset rises, the short sellers will be forced to close their position which results in losses. The moment a strong buying position is opened by buyers, short sellers will be forced to leave the market, which can happen when stop-less is triggered or when short seller closes their position in the market to avoid further losses.

A short Squeeze can also happen in the crypto market when there's good news that drives the price of the cryptocurrency in the market to sharply increase. In a nutshell, it is when buying pressure starts to overpower selling pressure which short sellers will have no option other than exiting the market.

With a couple of assets (cryptocurrencies) show an example of a Short Squeeze. Screenshots are required.

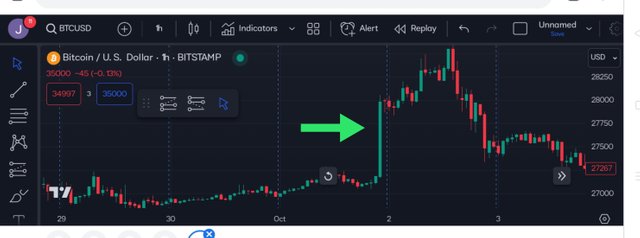

Screenshort gotten from Tradingview

Screenshort gotten from Tradingview

Looking at the BTC/USD chart, from early this month which is 2 October 2023. The price of BTC/USD continued in a Downtrend which is caused by short sellers after a sharp upward move occurred.

Based on the market sentiment that was likely quite low, the short seller would be looking for a way to short their position expecting that the price of BTC would continue falling which it didn't but formed a sharp move.

Screenshort gotten from Tradingview

Screenshort gotten from Tradingview

After the increase of BTC late last month traders might be expecting that the price of BTC would continue moving on a Downtrend which it it didn't, but quickly rise from $27,178 to $27,972.

How is a Short Squeeze formed?

A short Squeeze is formed when there is a sudden sharp increase in price due to buying pressure. If you observe in a crypto chart you will see sharp bullish candles that suddenly push prices up. A short squeeze is highly volatile because it takes short sellers unaware of the market.

Short Squeeze is also formed when demand is higher than supply which causes short sellers to buy back to cover their short position. This is a result of too many investors (buyers) who bet against the short of an asset causing the price to rise. Just as in the example that we have read, showing a sharp increase in the price of the asset as used in the screenshot above is how a short Squeeze is formed.

Advantages and disadvantages of this strategy.

The advantages and disadvantages of a short squeeze are shared below.

Advantages

Leverage is the first advantage of short Squeeze. With the help of margin trade, as a trader, you can short your trade and still put up a portion of your capital in another trade, which gives you a better chance to make a profit.

Short selling increases your chance of making a profit since you have the opportunity to earn both from price increases and price declines.

It helps traders to protect their position.

Disadvantages

One of the disadvantages is that dropping the price of an asset is profitable for shorting. If the price of the asset increases and as a trader you make a mistake, it will be your responsibility to solve it.

A trader or an entity can be forced into bankruptcy for losing their capital especially if it is a borrowed fund.

Short sellers will also pay interest rates despite losses incurred. A short seller who uses a high leverage is liable to suffer high losses.

Show the Short Squeeze strategy on a Steem/Usdt chart and explain.

Screenshort gotten from Tradingview

Screenshort gotten from Tradingview

Looking at the chart of STEEM/USDT on a 1 Day chart. The chart shows that there was a sharp price move in STEEM/USDT around 25th November before the price of Steem then went down.

Screenshort gotten from Tradingview

Screenshort gotten from Tradingview

The sharp price move was based on how Steem was listed for future trade in the MEXC exchange. Before the start move sellers and buyers were struggling with the market, and the buying pressure became higher than the selling pressure before a bearish sharp move was formed which the price of Steem increased from $0.200 to more than $0.3000.

@dave-hanny, @chant, @chiomzy810, and @kuzyboy I am inviting you all

Hello jasminemary.

Short Squeeze is really a good opportunity if a trader identify it correctly. We can make good profit if we can identify it in the market.

You have explained every concept in your own words which made it easy to understand. I am glad to see you back in Crypto Academy and I suggest you to participate regularly in the Crypto Academy tasks.

I wish yoh Good Luck for the contest.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Exactly sir, thank you for supporting me and i will try and be active in the SteemitCryptoAcademy.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes.

Nowadays, there are very less entries coming in Crypto Academy contests and I know you from past that you were good in Crypto Academy tasks.

So, It will be good if you regularly participate in Crypto Academy contests as We are learning every week new new things.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great post, @jasminemary! Your explanation of the Short Squeeze phenomenon provides clear insights into market dynamics. The BTC/USD example is a perfect illustration of how unexpected trends can rattle short sellers. It’s intriguing to see this play out in the volatile crypto space 👍

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you so much for reaching out to my post.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I learned about listing for future trading on the MEXC exchange thanks to your post! Thanks for the info!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I am happy that you have learned something from my post.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That's what steemit is for, to find out, learn and conquer peaks!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you, friend!

I'm @steem.history, who is steem witness.

Thank you for witnessvoting for me.

please click it!

(Go to https://steemit.com/~witnesses and type fbslo at the bottom of the page)

The weight is reduced because of the lack of Voting Power. If you vote for me as a witness, you can get my little vote.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It was an illustrative write-up which helped me to understand the strategy. Have you ever experienced this situation in the real market ever?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you so much for support.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Upvoted. Thank You for sending some of your rewards to @null. It will make Steem stronger.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello

Your post on "Short Squeeze" is both informative and well-explained. Your definition of short squeeze is clear & easy to understand making it accessible to a wide audience. the use of screenshots to illustrate your points such the BTC/USD and STEEM/USDT charts adds a visual dimension to your explanation enhancing the learning experience.

The advantages and disadvantages you have highlighted give comprehensive view of the Strategy helping readers weigh the risks and rewards. It's excellent that you have shared practical examples and explained how short squeeze can form. your mention of the STEEM listing on the MEXC exchange and its impact on the market is a great realworld illustration.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I appreciate your support sir. Thank you for stopping by.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi @jasminemary

Short summary There is no doubt that when the market pumps up or down, it fluctuates. Because of which the market goes up and they withdraw whatever capital they have from it, however, they also get rupees and a lot of profit in it, but apart from that, the small traders are also very good. There is no doubt that the capital that comes in and for us it is very good as we know that the market is doing very well today and every cryptocurrency that has gone up and that is a good omen. Especially this team is pumped up and will continue to improve and your post is excellent and you have prepared it in a very good way. Post number one post.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It's very good to see a practical chart in which you are explaining Bitcoin short squeeze and its more good that you are explaining and giving us a most recent example of year 2023 which is another plus point and its very easy to understand.

I agree that short squeeze is very volatile and its could be very positive and could be very negative depends upon current situation but time challenge could also be a very negative and disadvantage of short squeeze strategy over all you explain everything very well I wish you success in this engagement challenge.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hey friend

That's why there's always a bullish and upward movement in the crypto market at the moment in time because sellers also demanding for the assets causing the rise of the assets at that period of time

Thanks for going through wishing you success, please engage on my entry https://steemit.com/hive-108451/@starrchris/steemit-crypto-academy-contest-s13w4-short-squeeze

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Es una presentación muy buena. Lo que veo dificil de los Short Squeeze es detectarlos oportunamente, casi siempre hay lesionados en los traders en corto sin no toman las medidas que minimizan sus riesgos.

Es una ventaja que los traders en corto puedan jugar este mercado con otra operación que los respalde en caso de una subida sorpresa y pueden sortear mejor su cierre sin ser tan afectados.

Gracias por compartir, saludos y éxitos.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit