Hello, my good Steemit friends! I am happy to have you here reading through my post, in which I talked about "Leverage in cryptocurrencies" which is organized in SteemitCryptoAcademy community.

Download and design with flyer maker

Download and design with flyer maker

In your own words, what do you understand by leverage?

The words "Leverage" when it has to do with crypto trading means borrowing capital to run a trade is simply what I understand. However, as someone who has been in the crypto space for a long, I think my understanding of leverage should be more elaborated.

Having said that before I take you deeper into what leverage is, let's consider looking at how you want to amplify your trade for it to be easier for you to buy and sell any crypto of your choice with small capital, but a big target. Leverage is what amplifies your trade since it offers you the opportunity to borrow capital for your trade.

Leverage from what we have discussed means using borrowed capital (money) to trade the crypto market or financial market. Leverage is been offered by crypto exchanges to make traders trade the crypto market with more capital than the available trading capital.

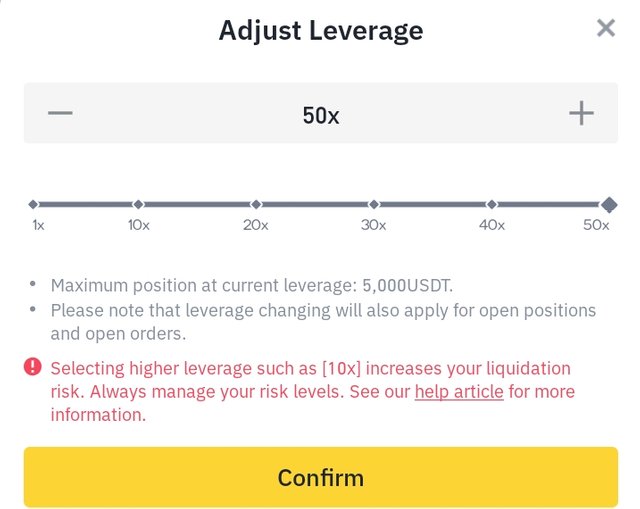

screenshot from Binance

screenshot from Binance

Some crypto exchanges offer traders the opportunity to borrow up to 50 times your available balance which is usually described in a ratio such as 1:5, 1:10, 1:20 which stands for 1:5 means 5x, 1:10 means (10x), and so on. What this means is that if you have $50 in your Binance futures and you want to open a trade that is worth $500 in STEEM coin, it means you will use (1:10) 10x leverage which is the purchasing power of $500.

For another example let's assume you have $200 as your trading capital and you decide to a open BTC position with 20x leverage, it means your $200 will turn into $4,000 as your trading capital since it will be multiplied in this way ($200 × 20) = $4,000.

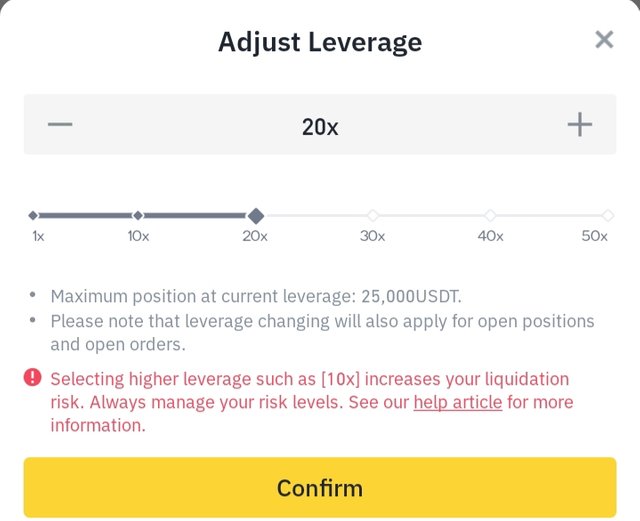

screenshot from Binance

screenshot from Binance

One thing about leverage that I would like you to know is that it provides you the opportunity to make huge profits if the market is going in your favor, but if it is going against you then you will also get to lose a huge amount of money.

Explain how leverage works.

How leverage works has already been introduced earlier as we have used STEEM and BTC as an example which we will still elaborate more for you to understand here again.

Now, leverage works only when you have deposited funds into your trading account which is the money that will serve as collateral for the amount of funds that you want to borrow to amplify your trade. The collateral that is provided is based on the leverage that a trader wants to use and the position that the trader wants to open is the margin.

Practically saying this is how leverage works. As a trader, I want to invest $1,000 in STEEM with 10x leverage. The margin that I will use would be 1:10 of $1,000, which means I must have $100 in my Binance futures as the collateral for the $1000 that I want to borrow.

Now besides me having the required margin deposited in my account, I must also maintain a margin threshold for my trade. To this if my trade move against my prediction, I will be required to add more funds into my trading account to stop it from liquidating.

Based on my prediction if I should open a long position, it means I have the confidence that the market will go bullish, but if I open a short position which is sold, it means I am confident that the market will go bearish.

The ability for me to open long or short positions is done by leverage based on my available balance which serves as my collateral. If as said earlier if my prediction goes in my favor then my profit will be 10 times my capital, and if it goes against me, my losses will be 10 times my capital. To this, I will advise you to take your risk management seriously (SL/TP).

Why is leverage used in cryptocurrencies?

The main reason why leverage is used in cryptocurrencies is to increase the trading position that is opened by traders so they can make profits from trading with small capital. However, based on what we have so far talked about, the higher the capital is the higher the profits and risk that is associated with trading.

Enhancement of liquidity is another reason why leverage is used in cryptocurrencies. For instance, as a trader, I can choose to increase my liquidity up to 10x and above in a single trade.

Another reason why leverage is used in cryptocurrencies is to allow people to trade with less capital since they can use whatever amount they have as an available balance to borrow funds. With this as a trader, you can channel your money into other things.

If you want to open a long position and you have 12,000 USDT in Steem and a leverage of 10x. Explain if the price of Steem rises by 45% and then explain if the price drops by 15%. Give your own opinion.

screenshot from Binance

screenshot from Binance

Going by the above question which says if I have 12,000 USDT in STEEM and an overage of 10x the price rises by 45% and drops by 15%.

| Answer: If the price of steem rises by 45% |

|---|

If I have 12,000 USDT in STEEM and I want to open a long position as a trader using leverage of 10x, it means I will have to deposit 1,200 USDT as collateral first. With my collateral, it means if the price of STEEM rises by 45% I will earn a profit that amounts to $5,400 minus trading fees, $540 I would have made if had traded my 1,200 USDT in STEEM without me using leverage.

| Answer: If the price of Steem drops by 15% |

|---|

If the price of STEEM drops down by 15%, my position would go down by $1,800. Now, since my initial collateral is 1,200 USDT, a drop of 15% would liquidate my account balance to $180.

| My Opinion |

|---|

Well, my opinion here is to add more funds to your trading account so your collateral will be increased and avoid using high leverage when opening a position. Have a risk tolerance and know how to apply it to your trading.

Mention the advantages and disadvantages of leverage.

Whatever has an advantage also has disadvantages which I will be showing you as leverage.

Advantages

Leverage increases potential returns

With leverage which is borrowed fund, we can use it and increase potential return when our trade favor us.Diversification of portfolio

The risk is distributed across different assets.It is a way to grow:

Leverage can be used to expand our growth and expand our business and investment strategy.It is resource efficiency

It helps traders to achieve more with less capital (money).

Disadvantages

It Amplified losses:

With leverage, losses can exceed initial capital most especially when the market is against your prediction.Obligation and Interest costs

You will have to pay interest for the fund you borrowed whether you made profits or losses.Market volatility is sensitive

Due to sudden market fluctuations which can happen, you can lose your funds.High risk Using a high leverage can blow up your account to zero if the market is against you.

Conclusion

Leverage is what we have learned here, and this post has exposed us to how leverage works. I will advise you to always trade with small leverage so you won't be kicked out of the market fast. Stay safe, enjoy your day, and trade well, for @jasminemary love you.

@dave-hanny, @yakspeace, and @ruthjoe I am inviting you all

Upvoted. Thank You for sending some of your rewards to @null. It will make Steem stronger.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes, you said it right

Leverage is a double edge sword. Without any experience and understanding of the market, it may backfire and wipe out all capital in a short period of time.

I think there is some mistake

Please check.

Thanks for sharing, keep writing!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for stopping by, but i still can not identify the mistake you are talking about. Thanks for coming around.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hola, un gusto saludarte.

Buena participación. Te deseo muchos éxitos.

Este método de inversión es algo que hay que pensar bien antes de llevar a cabo pues sus riesgos son tan grandes como sus beneficios, creo que es más recomendado para personas expertas en trading, pues nuestro capital se puede perder en solo un abrir y cerrar de ojos.

Feliz y bendecida noche amiga.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello friend.

You have really put great efforts in your post and Your explanation about every concept is simple. You have discussed some good advantages and Disadvantages of leverage in trading which makes this post a quality content.

Good Luck for the contest.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for your words of encouragement.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@jasminemary Your breakdown of leverage in cryptocurrencies is Super insightful. The way you simplify complex concepts makes it breeze for both seasoned traders and newbies to grasp. Kudos On emphasizing the importance of risk management its a critical aspect often overlooked. the practical examples with STEEM and BTC really drive the point home. I appreciate your balanced view on leverages pros & cons . Best of luck in the contest !

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Has dejado claro que el apalancamiento es un préstamo e

esencia similar al que conocemos comúnmente, sólo que en el mundo criptográfico tiene sus propias reglas, grandes ganancias y grandes pérdidas, como es de esperarse en esta dinamica de alta volatilidad. Es un asunto que los mas expertos pueden manejar bien.

Gracias por participar y te deseo mucha suerte y éxitos.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Basically the leverage is same like that we are taking loan from anyone in order to increase our investment and profits respectively. But we should apply leverage very carefully especially in crypto currencies because the crypto market is highly fluctuating and all our assets may lose. By the way thanks for sharing a very well written and impressive article with us.

Have a great day 😌

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for supporting me.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You are always welcome dear ❤️

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit