Hello Friend, You Are Highly Welcome To My Homework Task That Was Given By Professor @reminiscence01 On The Topic: Technical Indicators 2. It Is MY Pleasure To Have You Here Remain Bless As You Read Through.

1.a) Explain Leading and Lagging indicators in detail. Also, give examples of each of them.

As the names implies leading and lagging indicators,are two different words that are used in crypto trading or Forex trading. Leading, simply means looking at the future movement of price of assets, whereas lagging is what helps traders to understand the trend of asset that is looking at how the assets will fall down.

Now when using the both indicators in trading, it will help us to understand that condition and trends of the assets that is been traded. At this point, let's look in details to what Leading and Lagging indicators means one after the other.

Leading Indicator

Leading Indicator is simply a technical indicator that makes uses of past historical information concerning price to give out future information concerning price movements to traders so their can be at the upper edge when trading. It is the type of indicator that allow traders to know the future price of an asset before their can enter into trader. An examples of leading indicator are; Candlestick Patterns, Volume Oscillators and (RSI) Relative Strength Index. The volume indicator is what consentrat on price momentum, whereas the (RSI) is easily cited, and it shows the volume of trend that change before price .

Lagging Indicator

Lagging Indicator as I have earlier said, lagging is looking at how the price of an asset will fall down. In an nutshell, lagging Indicator is simply a technical indicator that focus on looking back in order to know if trend was achieve. Lagging is what inform traders on what has already happened in the market trend. Traders prefer using lagging indicator for trading activities because helps them to trade without fear due to the way it validate trading. An examples of lagging indicator are Exponential Moving Average, Bollinger Bands, Parabolic SAR and the rest of them.

b) With relevant screenshots from your chart, give a technical explanation of the market reaction on any of the examples given in question

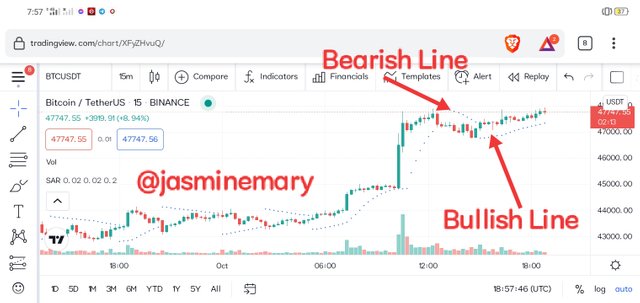

Graph of Leading Indicator

The screenshot above is a 15 minutes chart of BTC/USDT pair, showing Relative Strength Index (RSI) where the trend reversal in the chart and the price pick up immediately.

Graph of Lagging indicator

The above graph is a chart of BTC/USDT showing parabolic SAR. In the chart the trend has moves above the indicator. Looking at the chart their are 9 lagging point with a bullish and bearish trend.

2.a) What are the factors to consider when using an indicator?

Some of the factors that traders need to consider when using an indicator are details below.

Know the Market Trend

This is a very important factor that need to be consider and look into when using indicator. When you know the market trend of an indicator, you will probably know which is the updated of downtrend nor when the market is at bullish or bearish.

Indicators like Relative Strength Index, and stochastic indicator are good indicator for traders to understand very well as their shows when market price is high and also at a low point. Now understanding,this indicators will helps traders buy crypto or asset at a low price and sell that same crypto/asset at a high price.

Understand the type of Indicator

Choosing indicator is very easy but the issue is knowing what the indicators is meant for. Like the ADX that is use measures the strength of a market trend. Also indicator like RSI are very simple indicator that can be understanding easily but without probably consideration traders and would be mislead. This implies that traders need to know the types of indicators their are using and their function.

Consider your Trading Style

Always follow the trading strategy that is good for you. If ADX is what you understand best make use of it, if it is RSI then consider it, as well know the time frame that you're good are, time frames like 1minute, 15minutes, 2hr etc all this are part of trading style that traders need to consider. Doing this will avoid you from losing funds.

b) Explain confluence in cryptocurrency trading. Pick a cryptocurrency pair of your choice and analyze the crypto pair using a confluence of any technical indicator and other technical analysis tools. (Screenshot of your chart is required ).

Confluence is simply a word that is used to portray a geographical point where two more more things meet together to form one. But in terms of cryptocurrency trading the confluence is totally different in meaning and understanding. Confluence in cryptocurrency trading confluence is define as the strategy that is put in place when using different method in trading or different technical indicators. In a nutshell, it is describe as the additional used of several trading signals as a means to check the authenticity of a potential sell signal or buy signal.

Let's say that, for example, you spotted reversal price that is potential for support level and resistance level. Now before you accept an enter the trade, you need to check the moving average position to see if all the trade are in the same reversal price zone. In a situation where you need to confirm the validity of the trade the used of ADX indicator would be the best option. Let's take a look at the chart below for a better understanding.

We can see from the above chart of BTC/USDT the ADX indicator line and RSI indicator line are in the same point with the graph.

3.a) Explain how you can filter false signals from an indicator.

False Signals is the desire of trend without actual focus that do not react to the market signal or price. It goes in opposite direction from what the real market price is moving. Although, one of the easiest way to filter false signals is to study the chart very well in order to know if truly the market strength is raising or falling below the signal line before making decisions.

Another ways to filter false signals is to use the indicator that you are familiar with in the trade, as it will helps you to know the support and resistance levels. This is because using indicator that you're not familiar with will always lead you to false signals but using the one you're familiar with you will definitely know when the trend has move in opposite direction.

b) Explain your understanding of divergences and how they can help in making a good trading decision.

Divergences is simply when the price of an asset is moving opposite the indicator. In a simple understanding, divergences is the disagreement that occurs between the price and the indicator, that can lead to lost of fund or implications of trading.

Although, divergences is a good trading decision, as it helps trader to react very fast once their have notice that price action has change from how it was. The divergences tells traders that trade is changing and once the trader has recognize the change, the trader quickly make a decision on his stop loss and take profit. Although, we can see that divergence is of advantages to traders as it inform trader on the suddenly change in market which their follow to protect their profits,by increasing profitability.

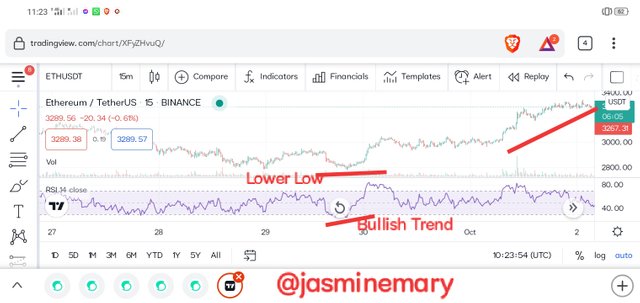

Bullish Divergence

Bullish divergence happens when the market price of the asset that is traded has makes a higher high without the indicator following suit. The above screenshot is a chart of ETH/USDT chart that is showing bullish divergence.

Bearish Divergence

The Bearish Divergence,occurs when the market price of the assets that is traded makes a lower, and the indicator does not follow suit. The above screenshot is a chart of BTC/USDT chart that show and example of the bearish divergence.

Conclusion:

The understanding of indicators will helps us to avoid lost of funds when trading and also using the right indicator can helps us avoid false signals. I sincerely thank professor @reminiscence01 for his wonderful lesson which has been the backbone of this homework task.

Best Regards;

Cc:-

@reminiscence01