Very few incentives better contests when it comes to encouraging the habit of trading crypto. So then, in participation of the ongoing steemit trading contest, I'm glad to share a report of one of my completed trades on the BTC/USDT pair on Binance (@deepcrypto8).

This was a margin trade that ended in profit thanks to proper signals from the indicators applied. I was sure it was worth the risk so I made it an isolated margin and applied maximum leverage - 10x.

AN OVERVIEW OF BITCOIN

To any group of crypto enthusiasts, Bitcoin needs no introduction. It's for all practical purposes, the symbol of cryptocurrencies. For proper understanding, the word Bitcoin represents any of, the Bitcoin network, Bitcoin the coin (BTC), the Bitcoin blockchain, and or the Bitcoin software. Altogether, they are referred to as the Bitcoin project in this post.

THE BITCOIN PROJECT

Bitcoin the project, started off as a peer-to-peer electronic digital cash payment system manned by a community of dogged bitcoiners who despite the rave of programmability have stayed true to the original doctrines of the Bitcoin project.

Thus, we see Bitcoin the coin today mainly as a substitute for fiat. Bitcoin the project however has some inherent deficiencies including programmability, energy costs and throughput owing to its design which can be summarized as follows:

The Bitcoin network was designed to function according to a consensus mechanism known as Proof of Work.

The blocks in the Bitcoin blockchain was designed to only contain 4MB of data.

The Bitcoin blockchain was only designed to process payments (i.e. the transfer of bitcoins).

The Bitcoin project was designed to be completely and truly decentralized and this was underlined by the anonymity of the inventor/creator/founder.

The tokenomy of Bitcoin the coin, follows a deflationary path and with its decentralized nature, the deflation of the coin is enforced by a fixed reduction pattern after a fixed time. This is hard coded in the Bitcoin software run by every member of the Bitcoin network.

The fixed time for the reduction also goes with a fixed number of blocks which would be produced within the time.

The fixed time is 4 years and the fixed number of blocks to be produced within that time is 210,000 blocks. Do the maths, that's 1 block every 10 minutes.

Proof of Work also has a significant impact on energy consumption as it is a competition-type consensus mechanism.

THE BITCOIN TEAM

Bitcoin was invented or founded by the pseudonymous Satoshi Nakamoto who remains unknown till date. However, Bitcoin is maintained by the Bitcoin community which can include anyone who wants to join the network. Decisions can be implemented by anyone who has 51% of the computing power of the network.

The community of bitcoiners (people actively participating in the Bitcoin network) is open to anyone who wishes to join though the cost implications mean that not everyone can.

MY PRICE EXPECTATION ON BITCOIN

I'm of the school of thought that bitcoin will rise to $100,000 in the near future. This is because, the project has been massively successful since its inception. Despite its deficiencies, it has been able to address major concerns including the recent mining ban imposed by China. The hash rate has risen to an all time high these past few days showing that even a country with an economy as big as China can't shut down this beast.

Its weaknesses are also its strengths and this has made Bitcoin invulnerable since it began. Yes it will require more energy than some countries to run, but that makes it nearly impossible to hack. Low throughput means more time is taken to verify transactions which also improves security and validation on the blockchain.

Then there's the inherent strength of scarcity that makes it even more valuable. Look at it this way, Bitcoin serves as a digital decentralized secured payment system based on a digital currency. There can be only 21 million units of this currency for 7.9 billion people, that's not upto 0.003 per person.

Consider that the total value of fiat currencies (broad money) in circulation is about $80,000,000,000,000 src. This is about $10,126 per person.

Compare that to 0.003 BTC per person and you have an idea of the potential of Bitcoin at full adoption. I'm bullish on bitcoin in the long term though I was bearish for this short term trade 😂. I felt it would fall for at least some few hours.

WHERE TO BUY BITCOIN

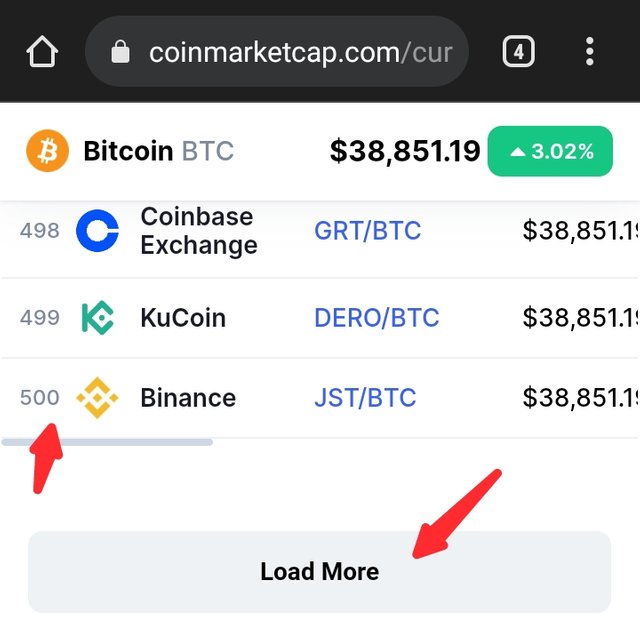

Literally Bitcoin (BTC) can be bought on all centralized exchanges and almost all decentralized exchanges. I can't possibly list all of them. Just check with any legitimate exchange and you'll get bitcoin. On CMC, there are over 500 markets for Bitcoin

MY BTC/USDT TRADE

FUNDAMENTALS/TECHNICALS

The deficiencies of Bitcoin mentioned earlier, including its energy impact has led to the rise of a host of other coins generally known as Altcoins. These deficiencies sometimes become a tool in the hands of investors who want to down the price of Bitcoin.

Other times, the incidents in the world affect where people put their money and this could also impact the price of Bitcoin which stands among the most valuable assets in the world today.

Recently, the news of Russia's certain invasion of Ukraine sent the market crumbling with Bitcoin part of the plunge. Over the last couple of days, it has been bearish for the entire crypto market and this was subtly impressed by Ethereum founder - Vitalik Buterin when he appeared in a bear-like attire at the EthDenver 2022 conference.

Src

A look at the TEMA 200 indicator on the chart does not oppose this fact. Rather, from February 16, 2022 to February 23, 2022, we see a downward slope.

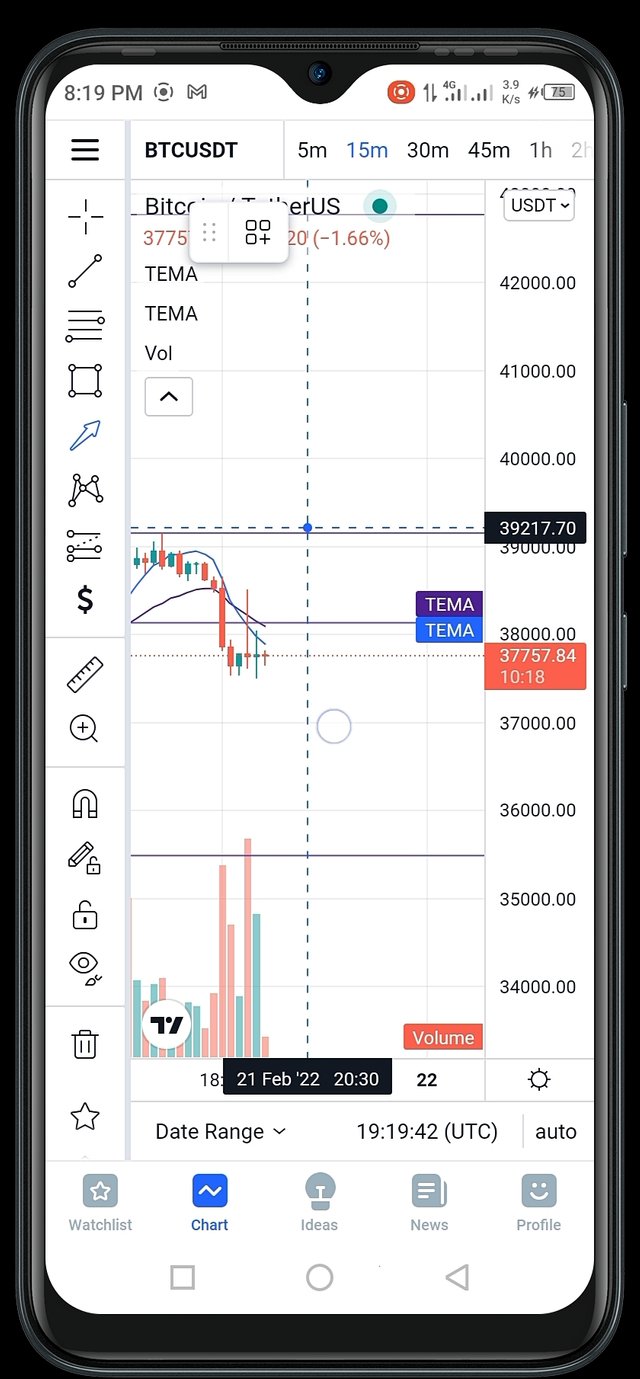

It was during this period that I made my trade and it ended in profit, precisely on February 21, 2022. As at that time, the chart looked something like this:

Screenshot taken from a video of my trading session

For my entry, I considered the following:

The downward direction of the price as evident by the chart.

The growing concerns of the Russia-Ukraine crisis leading to the price plunge.

The bearish crossover of the 21 TEMA below the 50 TEMA.

The high volumes on red candles (longer volume indicator red bars) and the low volumes on green candles (shorter volume indicator green bars).

The fact that price just went below one of my major supports (the purple line in the screenshot)

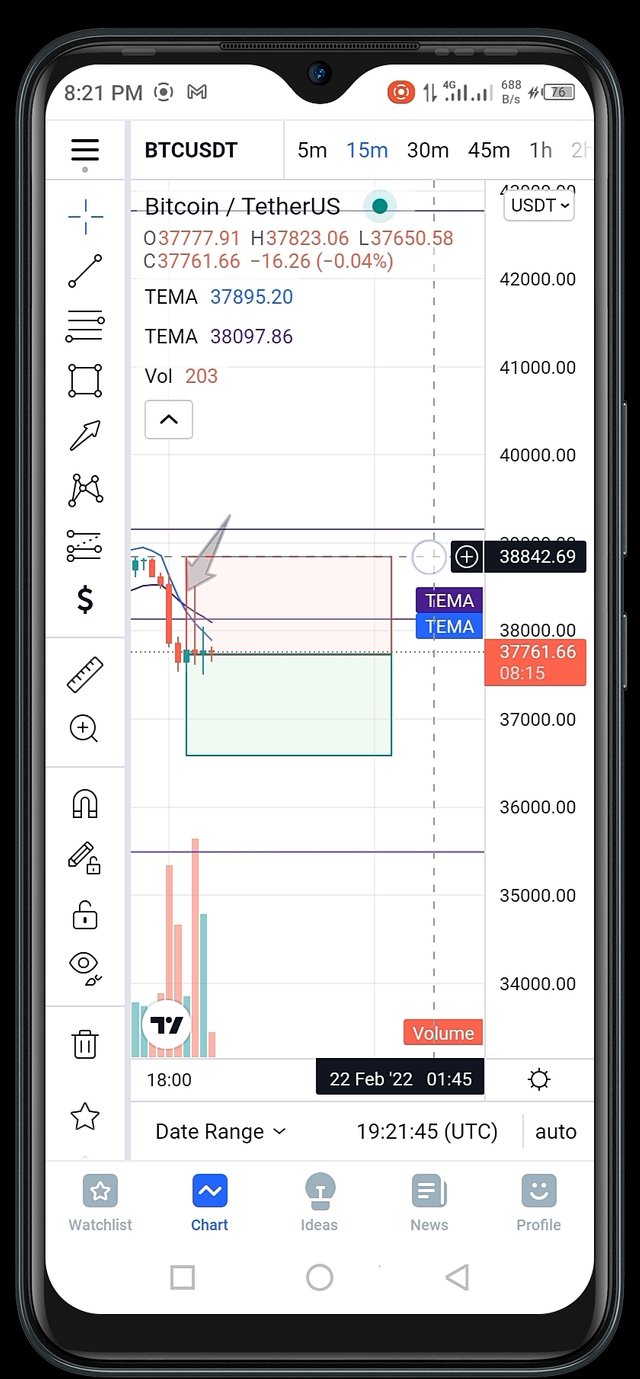

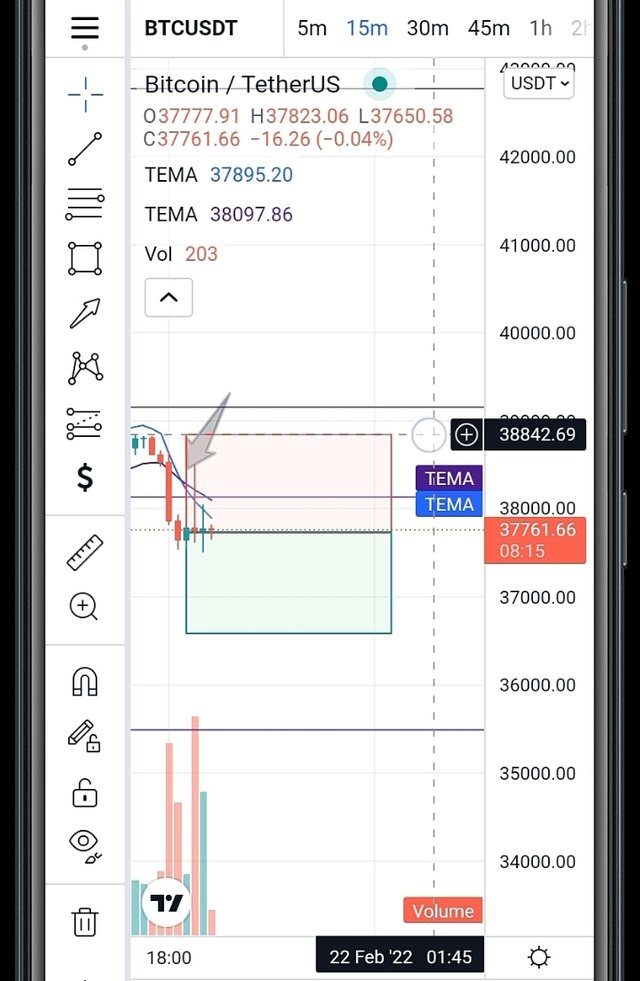

Below is an image of my trade setup.

Screenshot taken from a video of my trading session

MY TRADING STRATEGY

Let me further explained my strategy for this trade. First, here's more explanation on my considerations:

Price Direction:

On the chart, the price can clearly be seen to be sloping downwards on higher time-frames. For my BTCUSDT chart, I have previous taken time to draw support and resistance lines on the weekly timeframe to mark major support and resistance areas.

Taking a look at the screenshot of the price chart above, it can be seen that the price had gone below one of the major support lines confirming a downward trend.

Bearish Tema Crossover And Volume Indication

This is one of the reasons I entered when I entered. There was a bearish crossover of the 21 TEMA below the 50 TEMA and this just occurred a few minutes before my entry. After the bearish crossover, we see neutral candles, two red and one green.

The volume indicator all but confirmed the entry point. Of those three neutral candles, the two red had more volume while the one green had less volume, showing selling pressure.

The Russia-Ukraine Growing Concern

After US president stated that he was sure Russia's president would invade Ukraine, it was clear that it was only a matter of time before it happened. This made the market very sceptical and unable to hold up or rise. As Russia began to amass its forces along the Ukrainian border, it became even more worrying.

It was difficult to see the market bullish under these circumstances as the outbreak of any war pitting Russia against the West is sure to have a drastic impact on the world's economy. The aftermath of such a war will leave a long lasting impact as for one, there'll be worldwide refugee crisis depending on how the war escalates, not to mention the sectors of the economy that might have to shut down.

Security tensions and economic sanctions will surely grind some sectors of some economies to a halt and if there's any take away from the pandemic striken 2020, it's that markets crumble when the world's economy shrinks.

I was sure under the heighten tensions due to the Russia-Ukraine crisis that markets would slope down at least for the next few hours and this happened after Putin ordered his troops into Ukraine on Monday night src.

MY TRADING STRATEGY EXPLAINED

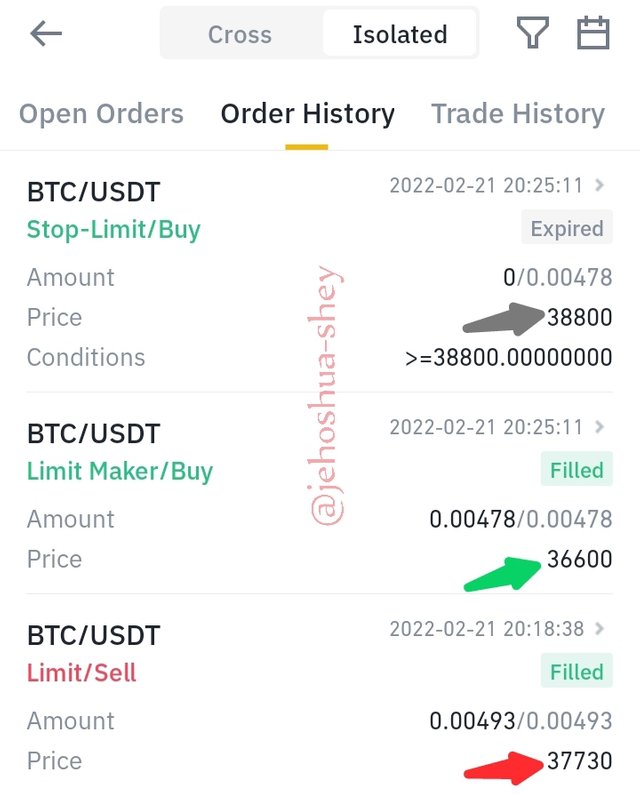

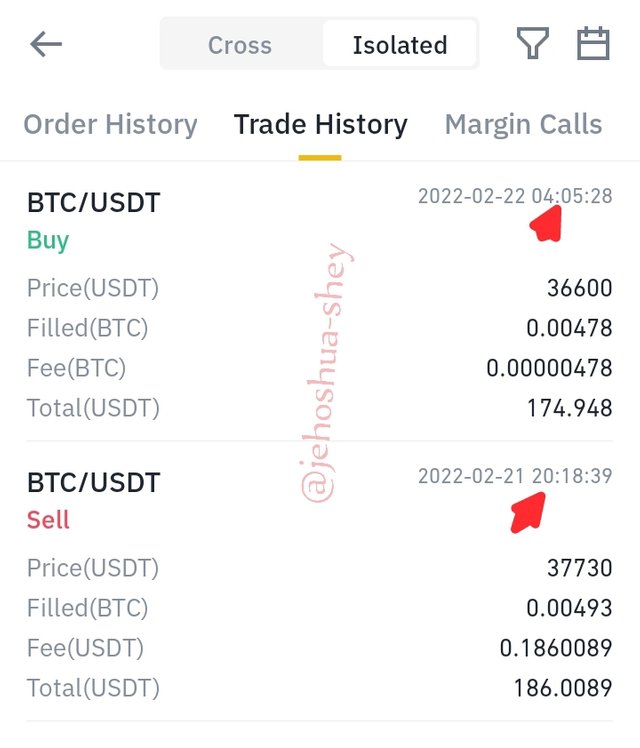

I used the TEMA bearish crossover trading strategy. I placed my entry at the third red candle after bearish crossover at $37730 and put my stoploss at the last resistance level on the trading timeframe at $38800. My take profit was set in a 1:1 ratio with my stoploss at $36600.

It was an isolated margin trade on Binance with 10x leverage.

As can be seen in the screenshot above, my trade hit my take profit and this happened after 8 hours. Below is a screenshot of the how the price progressed on the chart after my entry.

CALCULATIONS

Entry price was $37730 and exit price was $36600.

Profit was (($37730 - $36600)/$37730) x 100%

= ($1130/$37730) x 100%

= 0.02994 x 100% = 2.99%

But since I used a 10x leverage, profit was 2.99% x 10 = 29.9% 😌

PROOF OF PROFIT

MY RECOMMENDATIONS

I recommend extensive research and strict adherence to technical indicators and strategies and of course proper risk management when making any trade entry. The last thing anyone should use to trade is instinct. I mean, with all due respect to your intelligence, your instinct is of no use in trading cryptos without proper analysis, strategies and risk management.

I recently made a setup on OGN according to instinct and watched it developed. It hit my stoploss. Thank goodness I know not to put my money where only my instinct is.

For Bitcoin, buying on spot at the current price of $38.7k is a good bargain because of the potential in bitcoin hinted earlier. I would recommend anyone to get in on BTC now.

Thanks for reading.

Hello @jehoshua-shey,

Thank you for choosing our team to participate in the 1st week of Season 6 of this trading competition, hoping that you will make gains during this period, you deserve a Total|8.5/ 10 rating, according to the following scale:

My opinion on your choice of pair:

Despite some low periods when Bitcoin prices can sink into the abyss, investing in these assets has so far proven to be good long-term business. But beware: investing in cryptocurrencies is not without risk. First remark when arriving in this universe: Bitcoin has no official course. This is explained because each exchange platform offers its own according to the supply and demand it observes between its users. There are significant variations between platforms, sometimes several thousand dollars. Be careful, therefore, before buying.

My opinion on your trading style:

You have analyzed the bitcoin market well based on the indicators (TEMA and volume) and also the war in Ukraine, I congratulate you on the gain of 5$ using the margin style for trading with 10x leverage.

We thank you again for your effort and we look forward to reading your next article.

Sincerely, @kouba01

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit