INTRODUCTION

One of the most important aspects of finance is loans. People need to borrow from time to time to meet one need or the other. People also borrow for one reason or the other.

With the advent of decentralized finance, how to go about giving loans in a decentralized manner didn't pose much of a problem for too long thanks to smart contracts. However, the initial costs of operating decentralized loans were quite high and an alternative needed to intervene to ensure that decentralized loans remained accessible.

This post focuses a DeFi protocol that lowers the barrier to operating decentralized loans, JustLend.

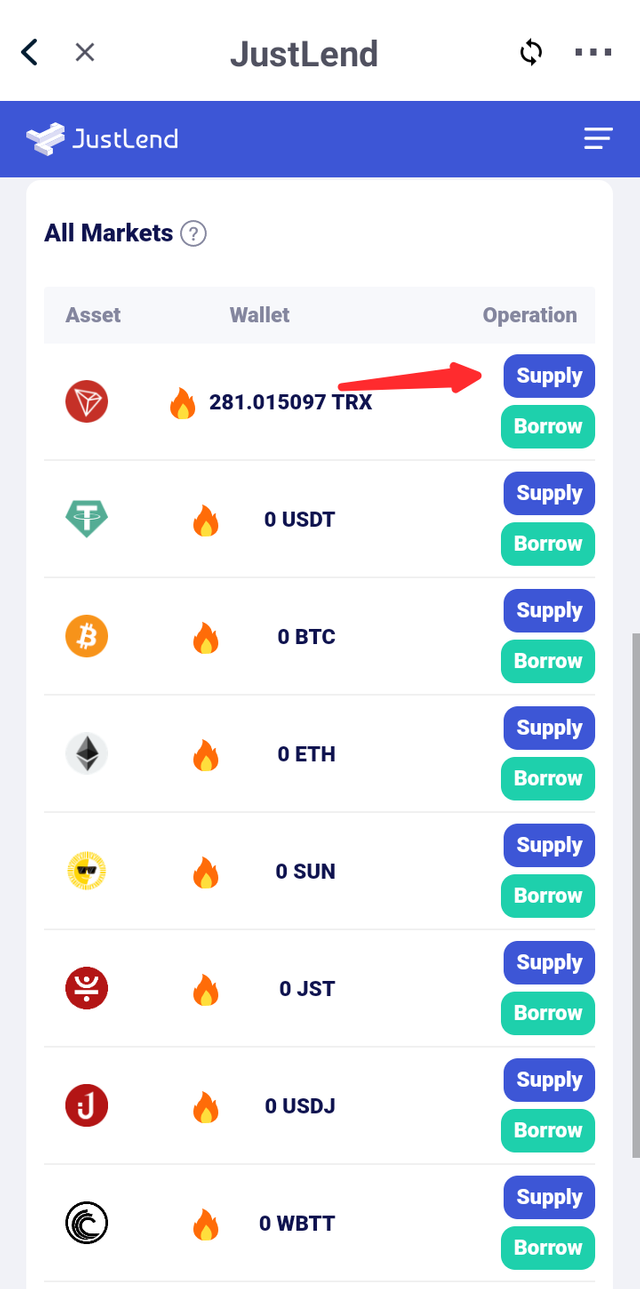

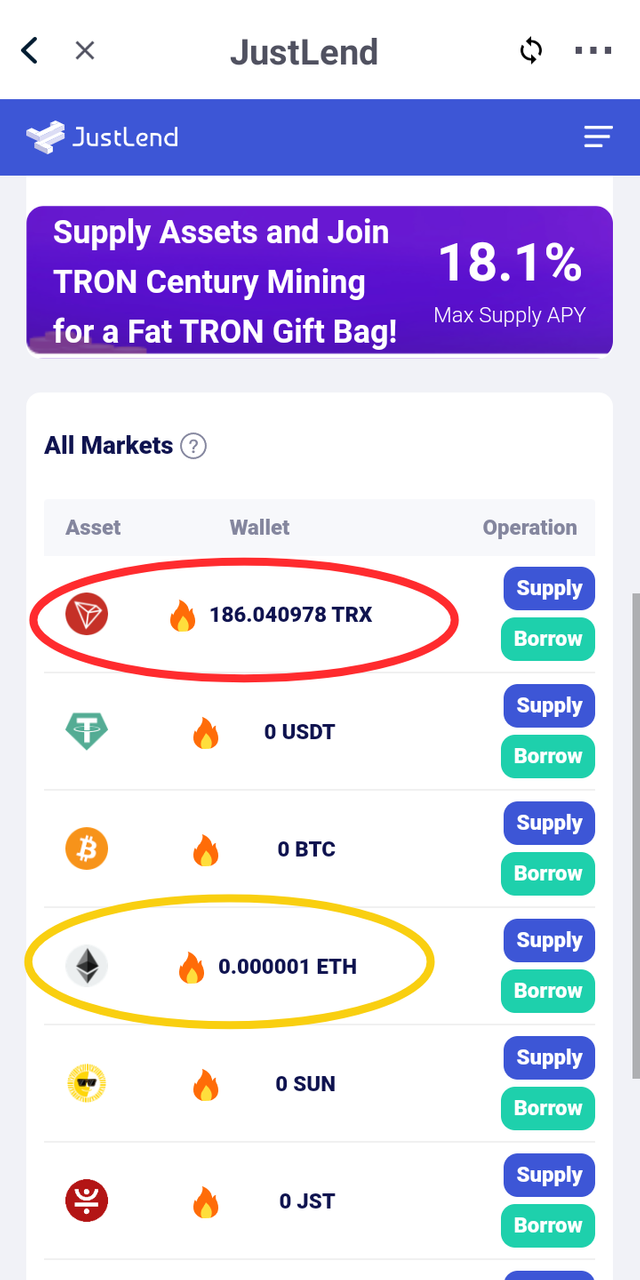

MARKETS AVAILABLE IN JUSTLEND

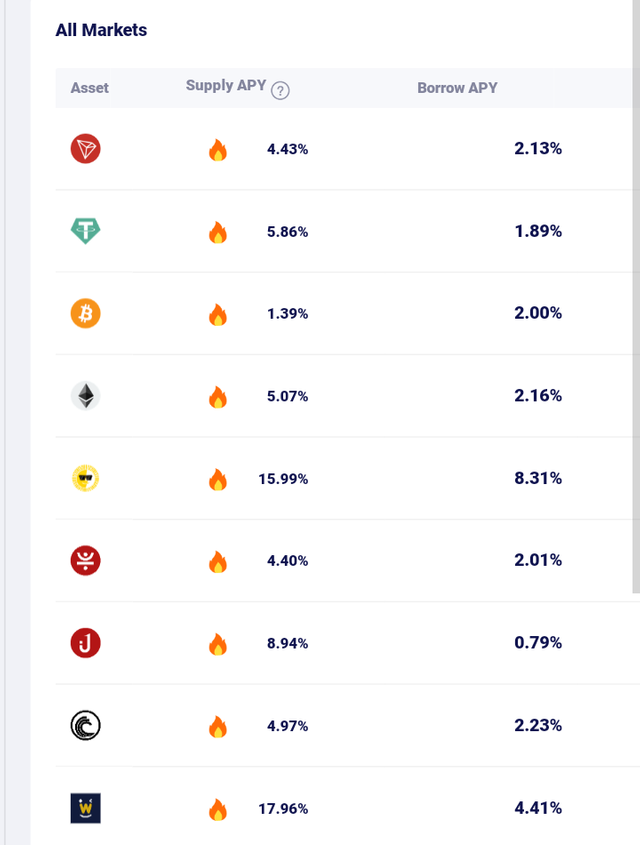

What are the different Markets available in JustLend, which market offers the best Supply APY, and which market offers the lowest borrow APY?

The following markets are available on JustLend

TRX

USDT

SUN

BTC

ETH

USDJ

WBTT

JST

WIN

The market with the best supply APY is the market with the highest supply APY. In this case, it is WIN which has a rate of 17.96%.

On the other hand, the market with the best borrow APY is the market with the lowest APY and in this case, it is USDJ which has a rate of 0.79%

USING JUSTLEND

How do you connect TronLink Wallet to JustLend, and How do you supply a token(e.g. TRX, SUN, JST, etc) to earn Supply APY?

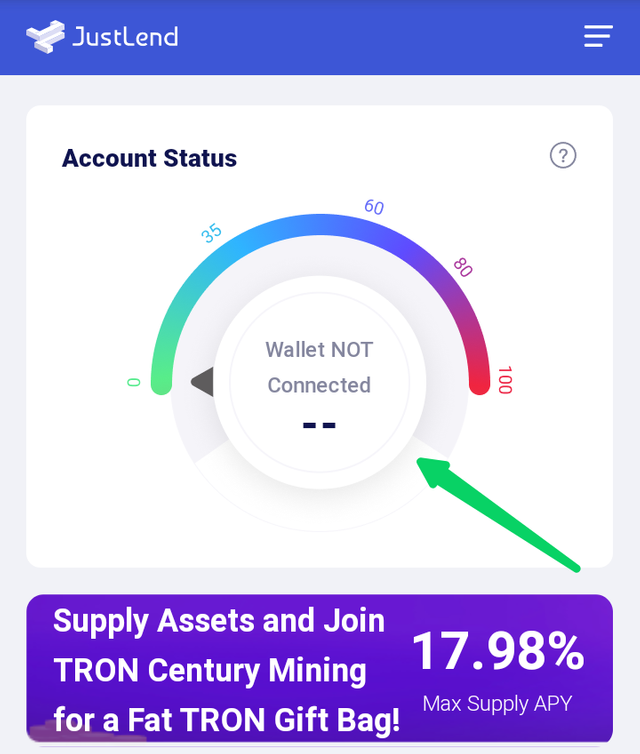

If you don't have your TronLink wallet connected to JustLend and you visit the platform at justlend.org you will be greeted with something like this

Not to worry though, this only means you can't use JustLend except, of course, you connect a wallet.

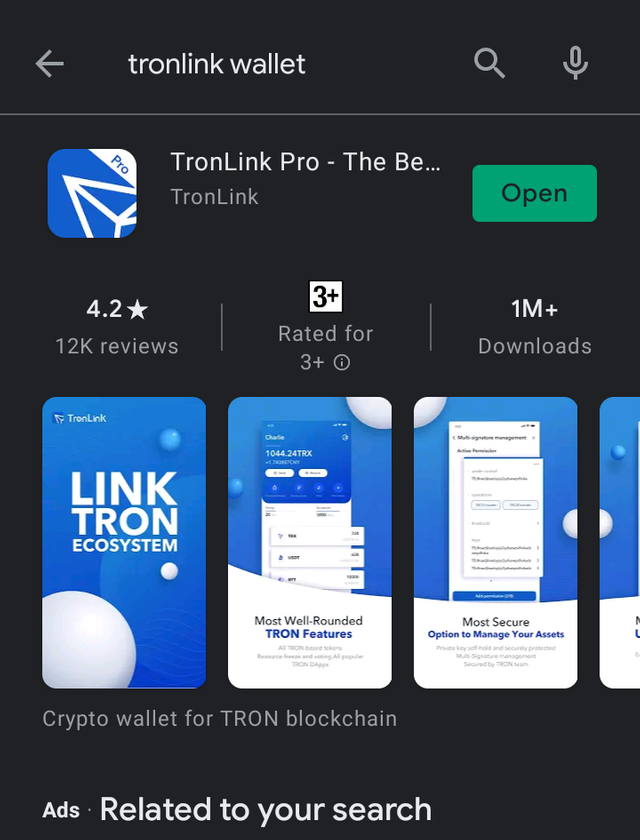

Now this is how to connect your TronLink wallet

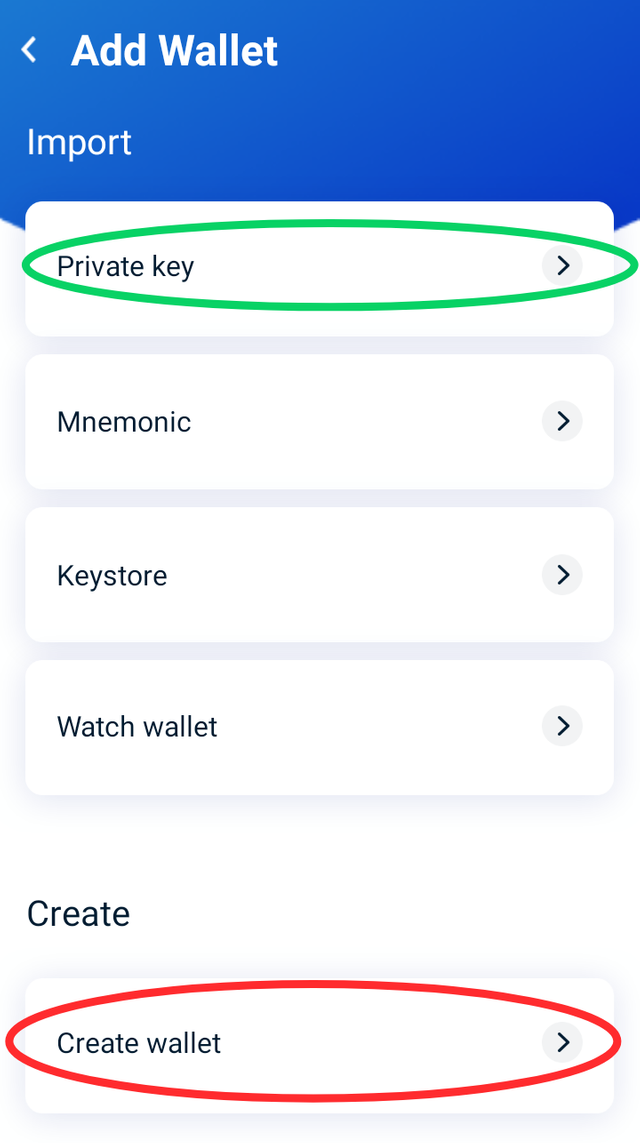

Simply open TronLink pro app on your mobile. If you don't have, you can download it from Google Play Store

After downloading, you'll have to import your account. To do this, I use my tron private key to import my tron account to my wallet. You can also create a new wallet if you don't have one.

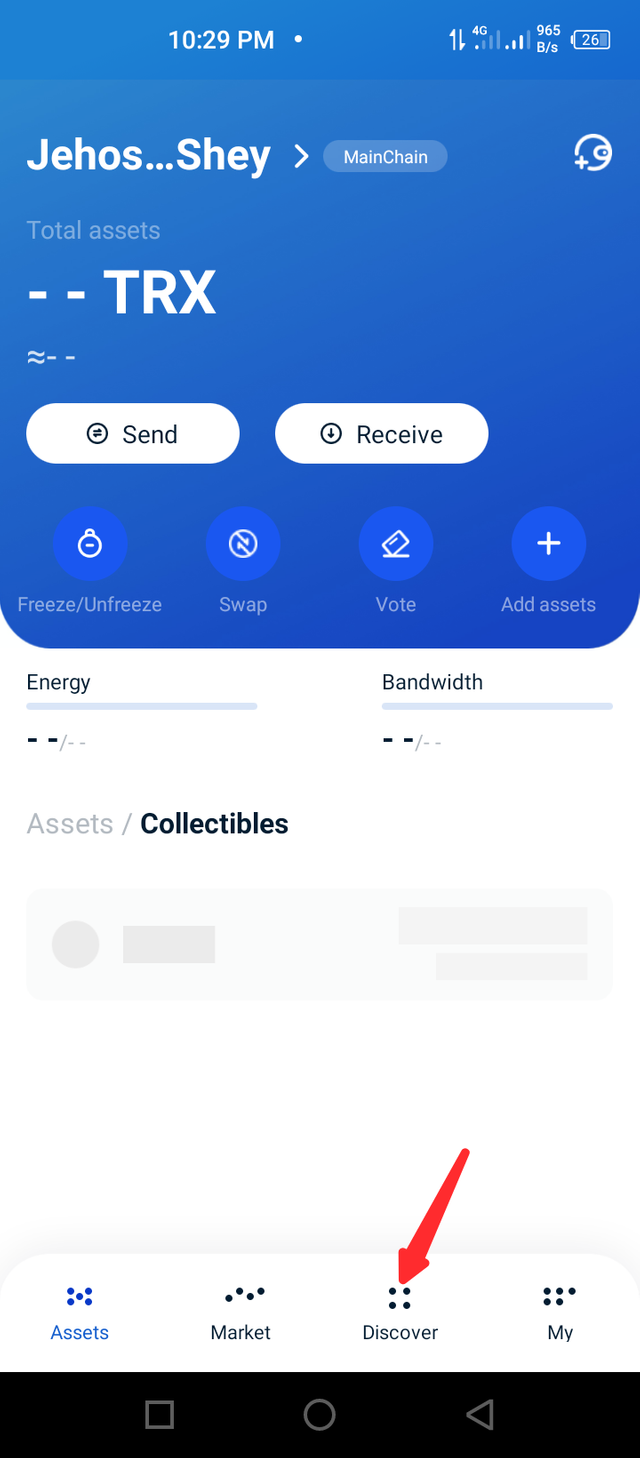

Then open your wallet and click on discover

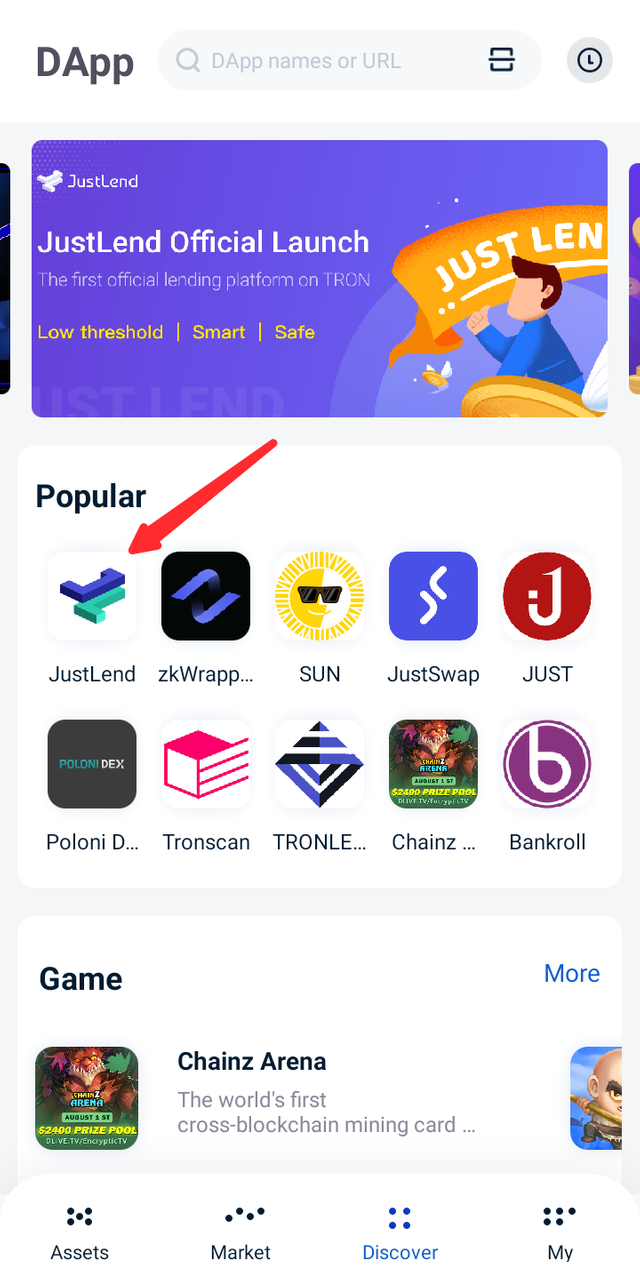

Then select JustLend from the list of options

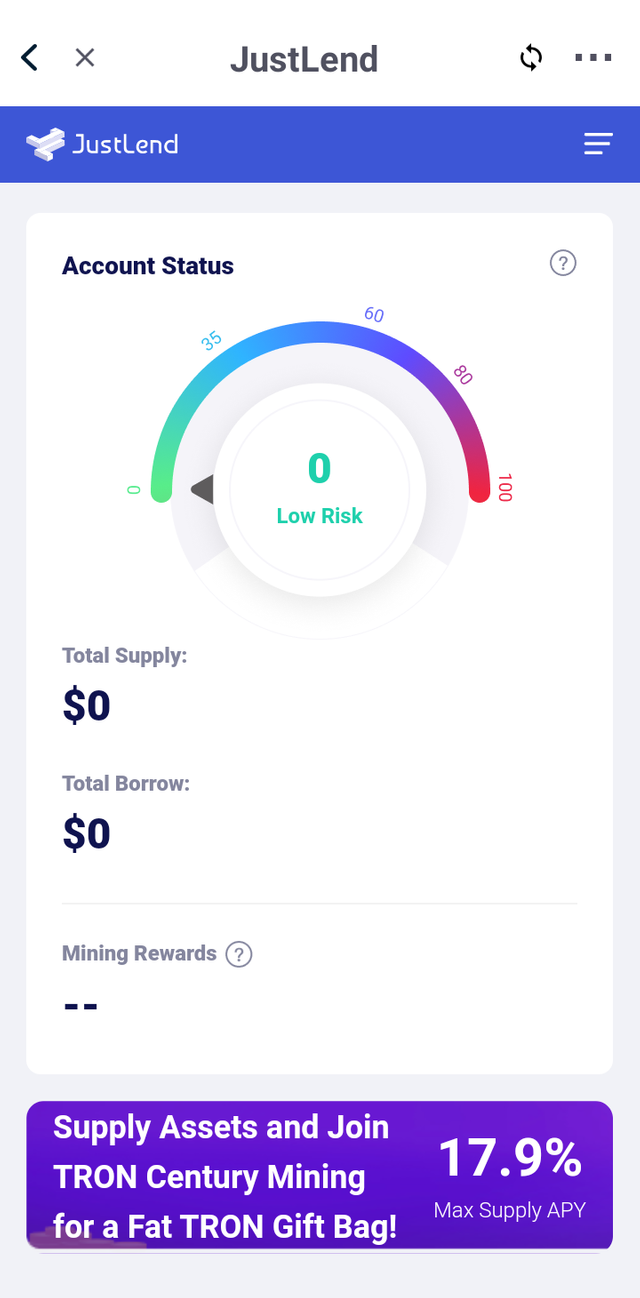

This opens JustLend with your TronLink wallet automatically connected.

Supplying tokens

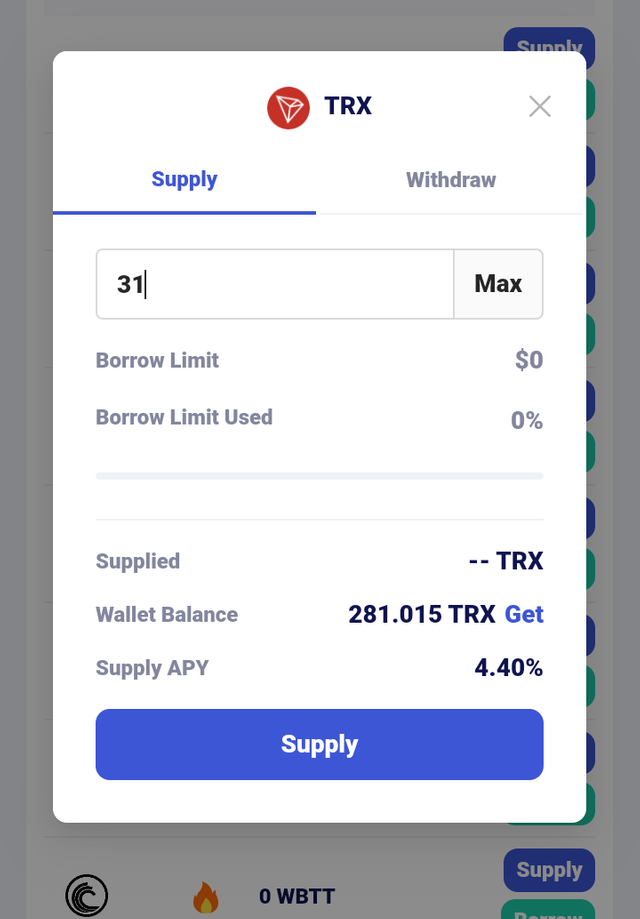

To supply tokens on JustLend, simply scroll to the token of your choice and click on 'supply'.

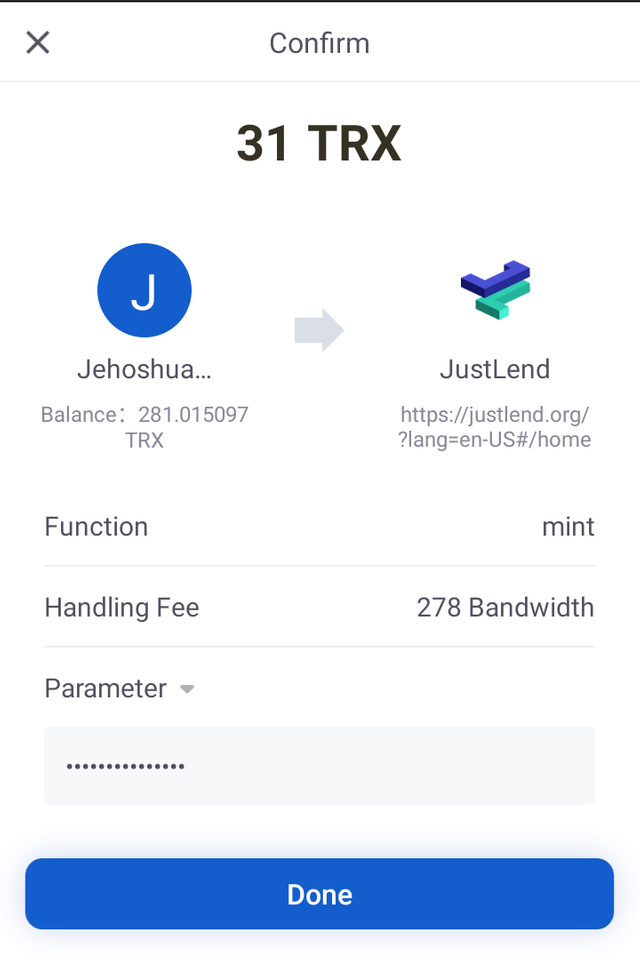

Next, you input the amount you want to supply then click on supply.

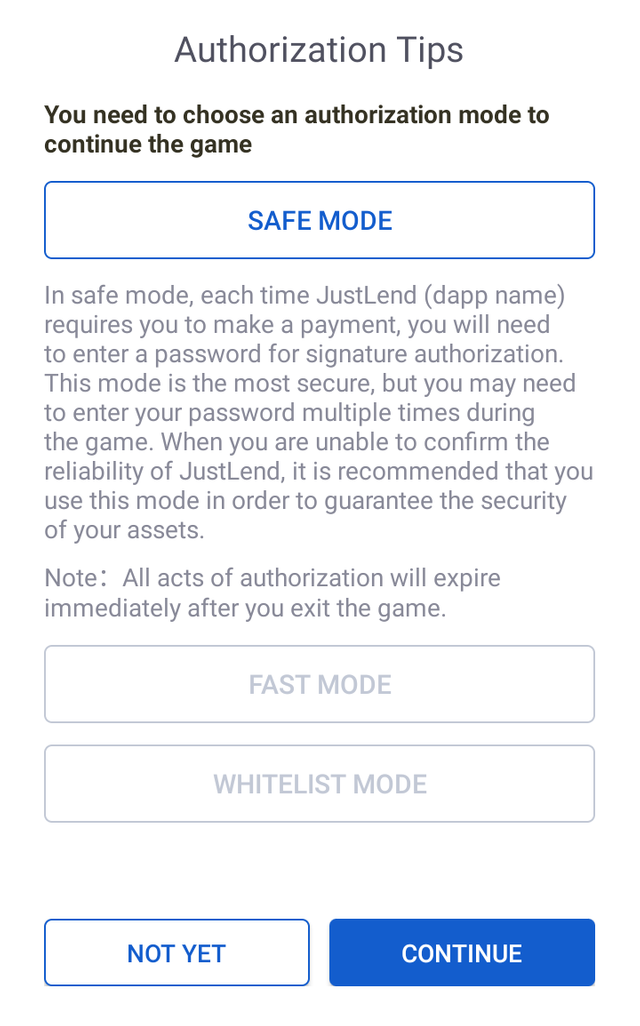

You will be required to do a quick security settings especially if you're supplying for the first time.

Just click on continue an enter your password on the next page.

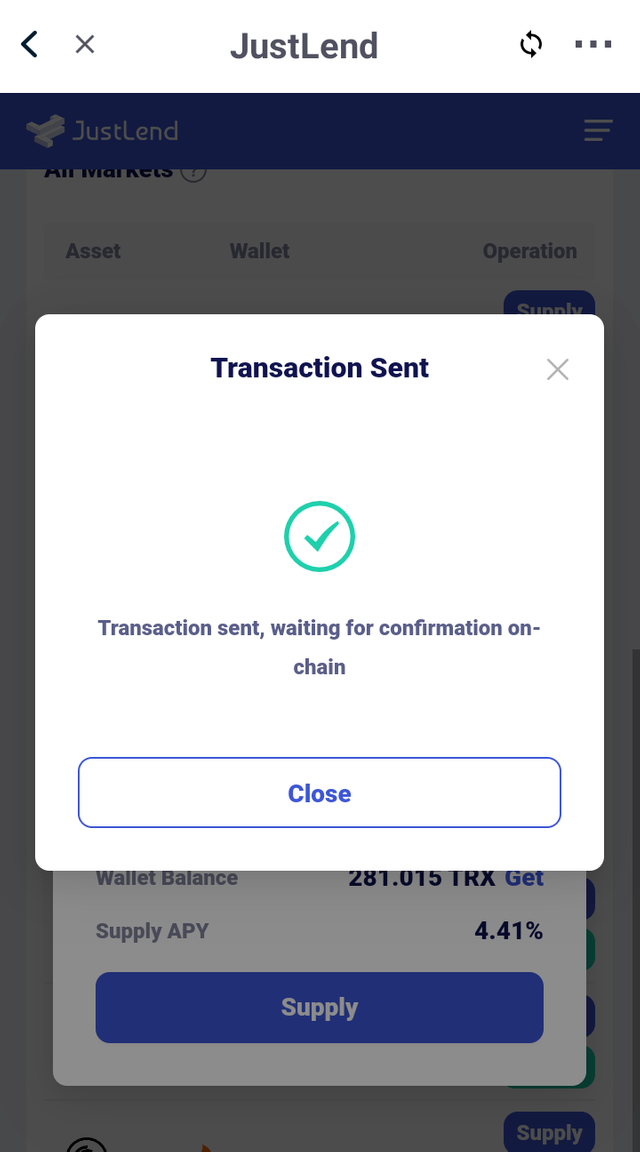

That's it, you've completed your supply.

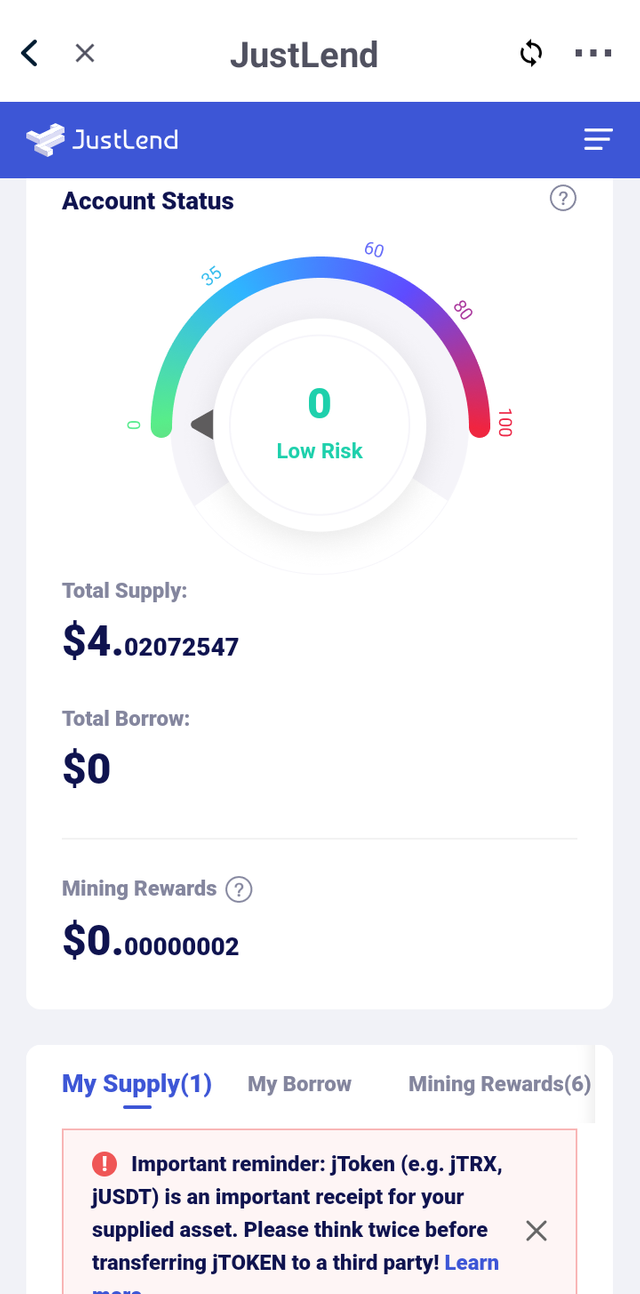

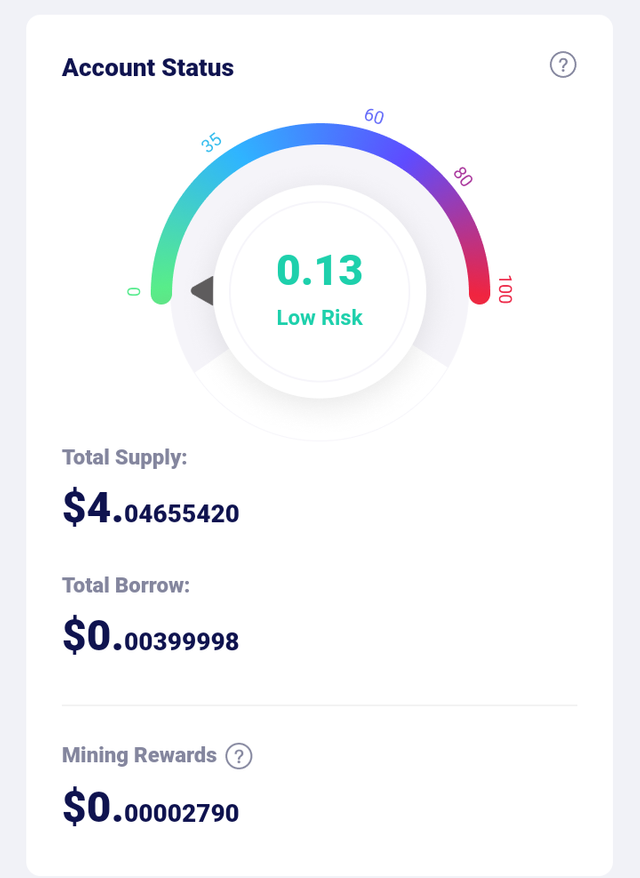

Your account status will also get a face lift

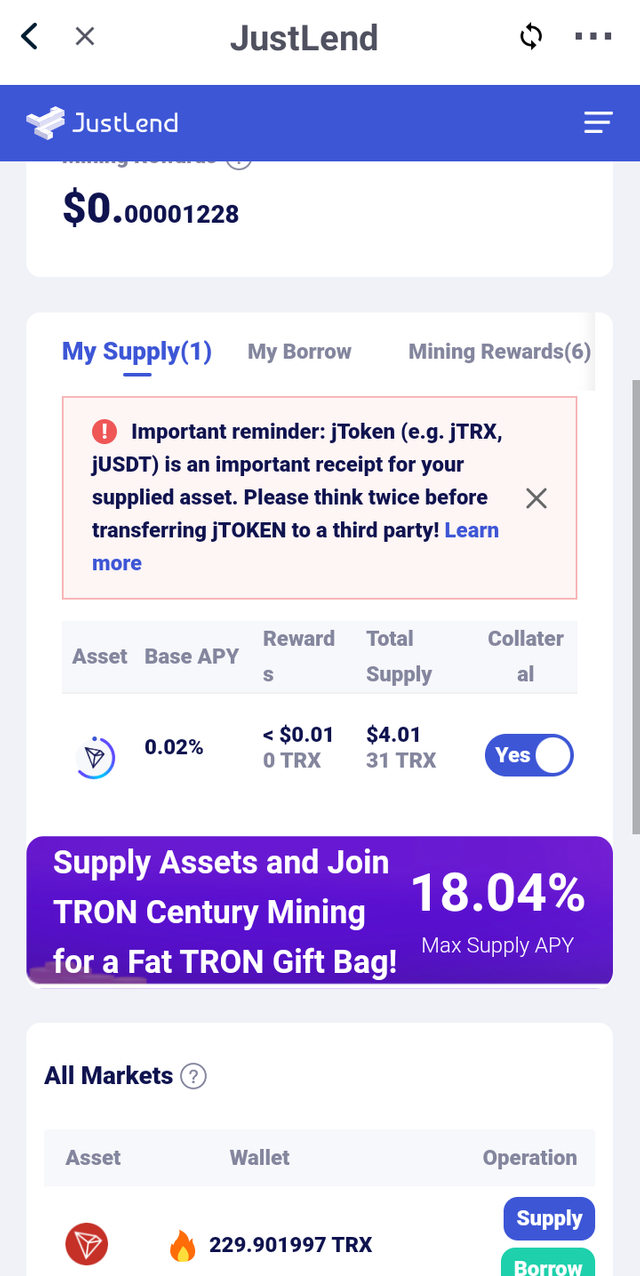

Evidently, with 31 TRX, I have supplied $4.02.

JTOKENS

How do you acquire jTokens, after supplying a particular token, check your TronLink Wallet and indicate how much jTokens you have acquired?

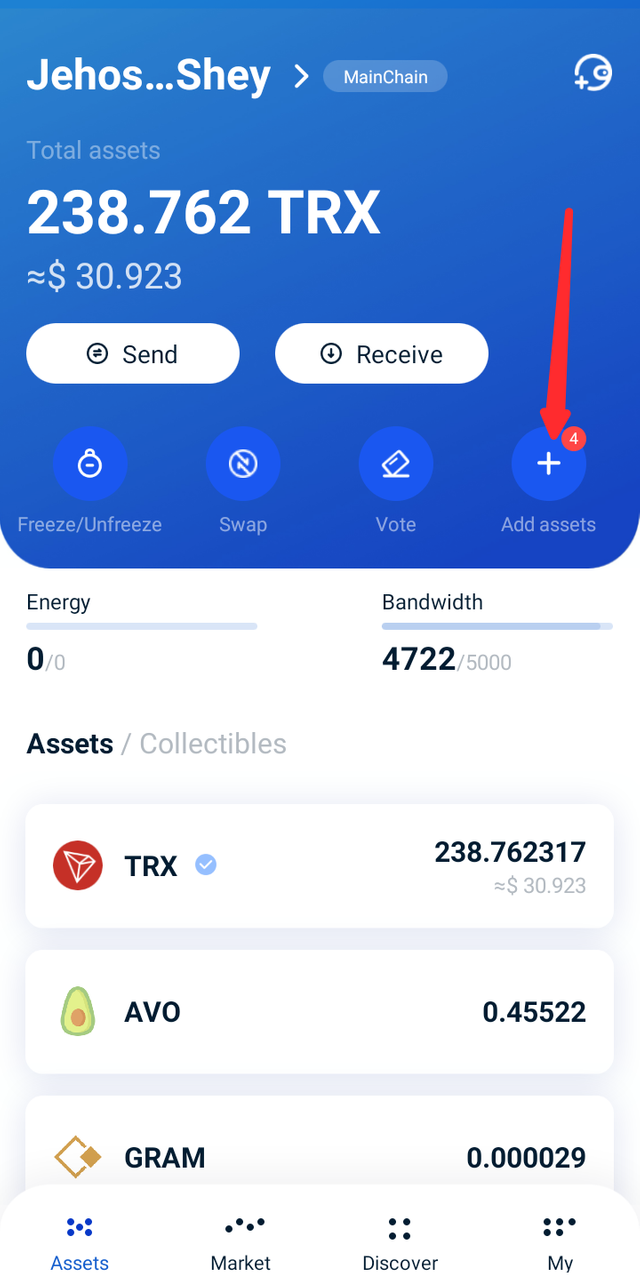

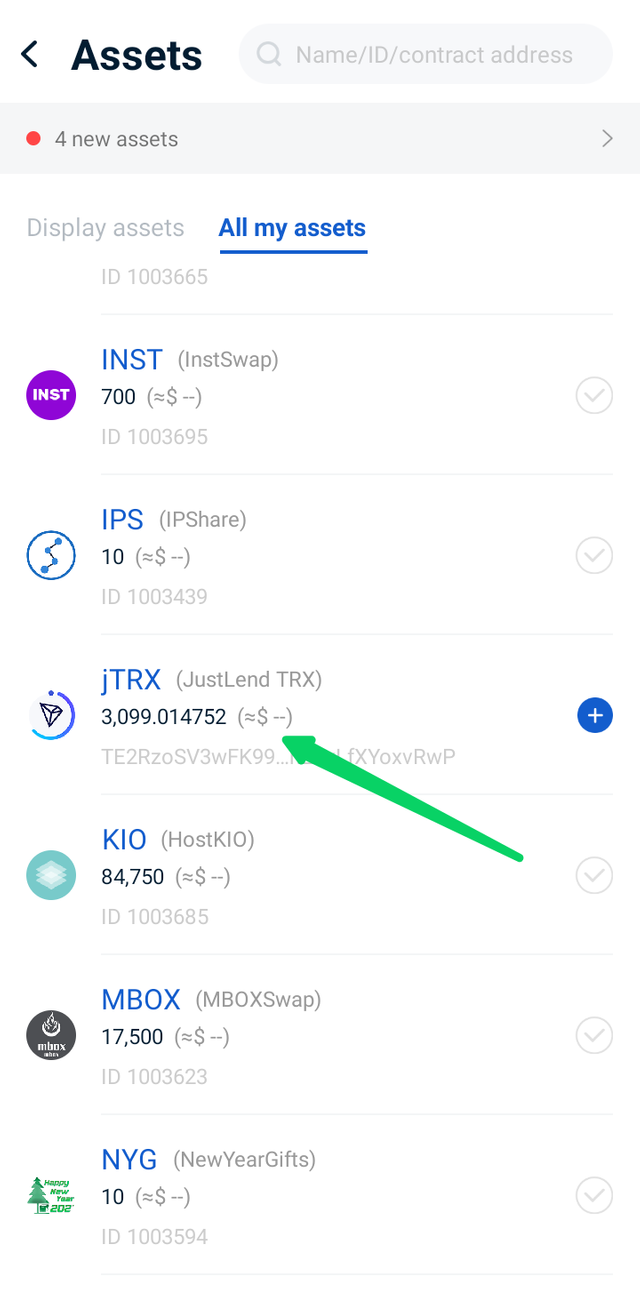

Having supplied TRX to JustLend, I automatically get jTokens. To see how much jTokens I got, from my TronLink wallet homepage, I click on add assets

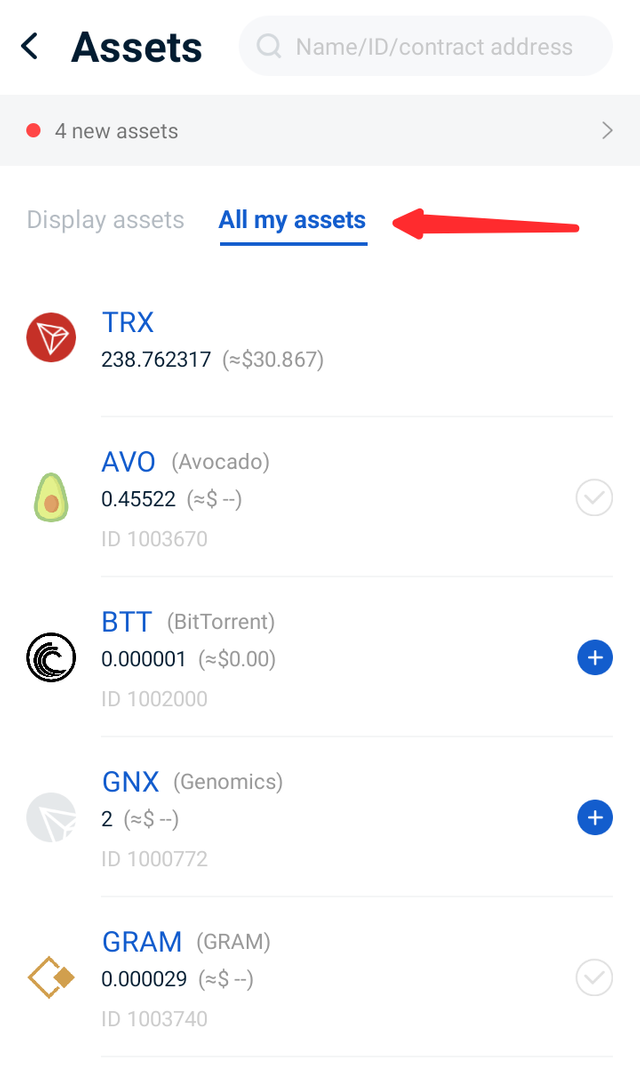

Next, I click on all my assets

Then I scroll down searching for any jToken until I find my jTRX

From my balance, I was issued 3,099 jTRX for supplying 31 TRX.

COLLATERIZATION, BORROWING AND REPAYING

How do you collateralize jTokens to borrow another asset?

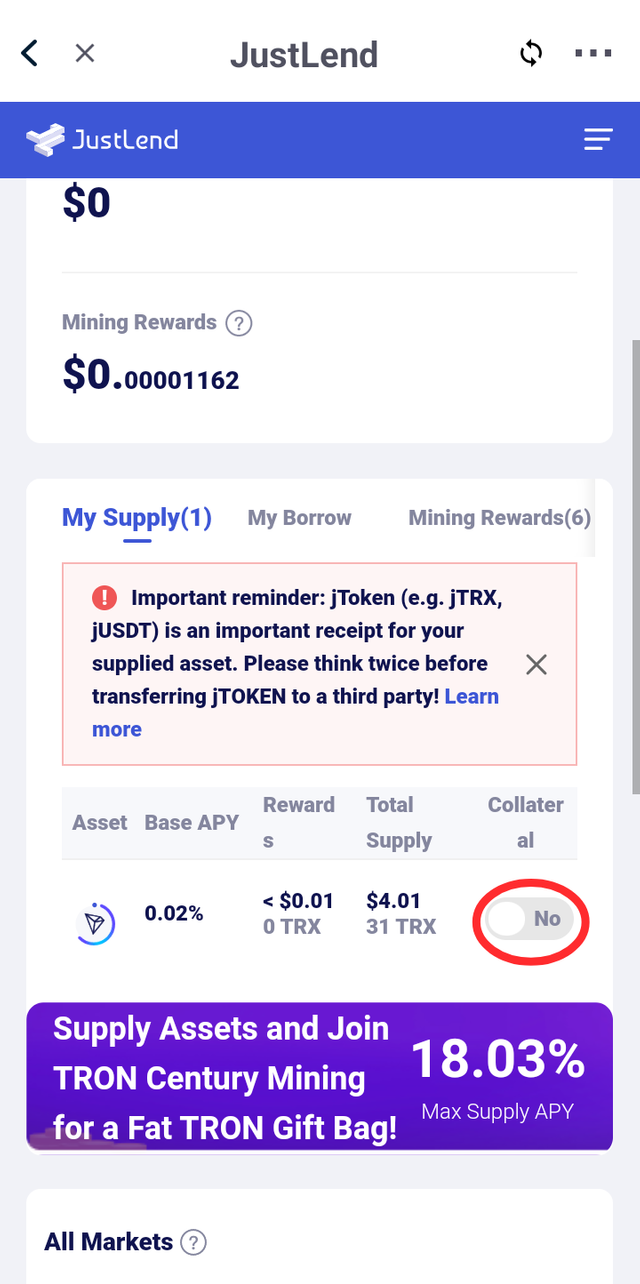

To collaterize my jTokens, I go JustLend on my TronLink wallet and toggle on the collateral

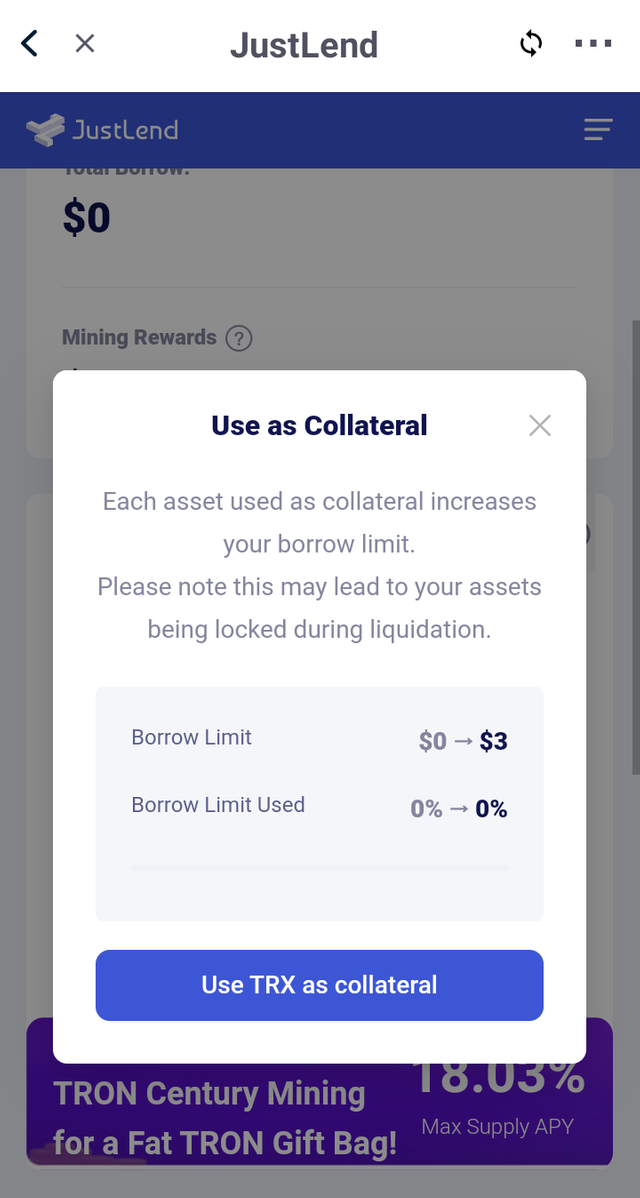

A dialog box pops up, showing me my limits

I click on use TRX as collateral and undergo the security steps to complete the collateralization.

Once that is done, the toggle changes to indicate that collateral is turn on.

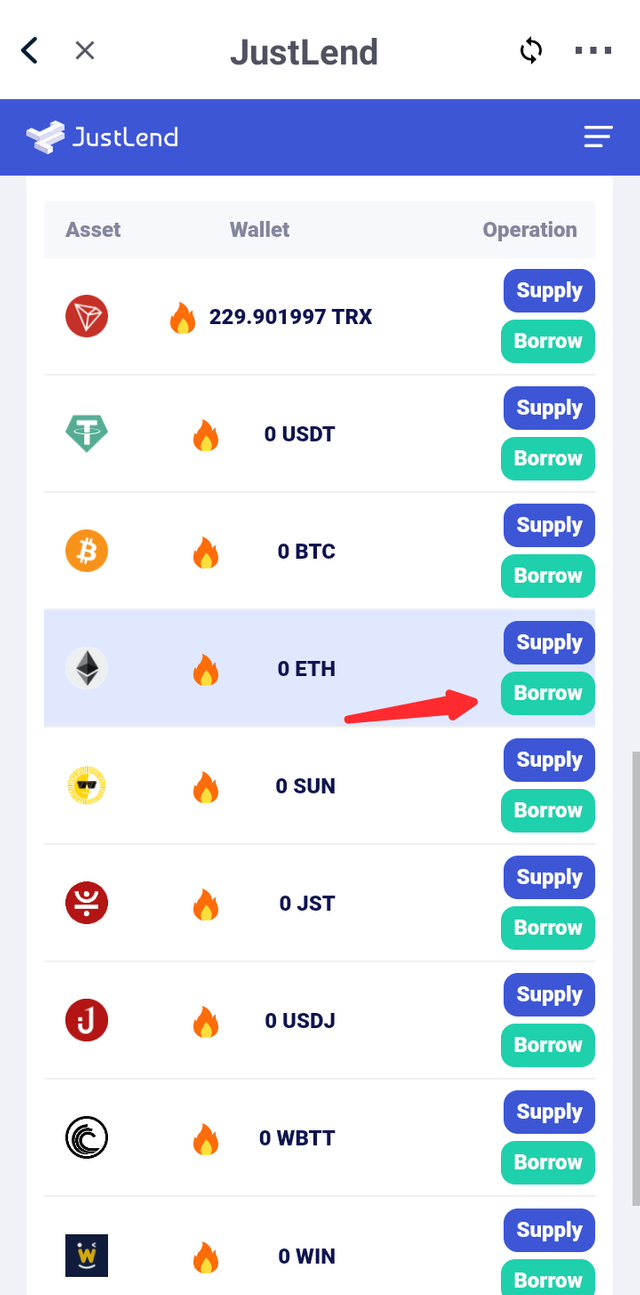

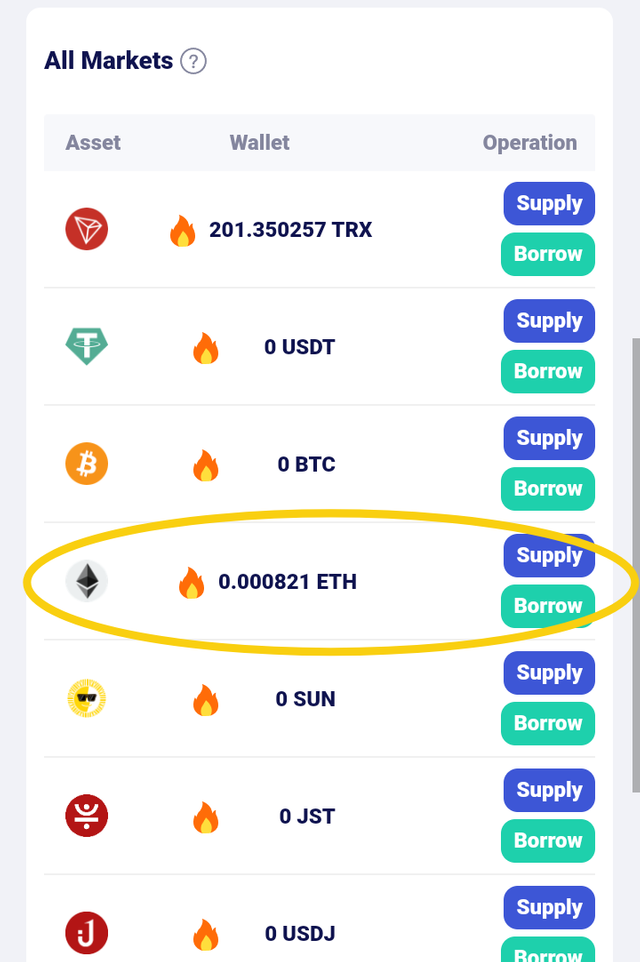

Then, I decide to borrow ETH, so I scroll down to ETH in the market area and click on borrow

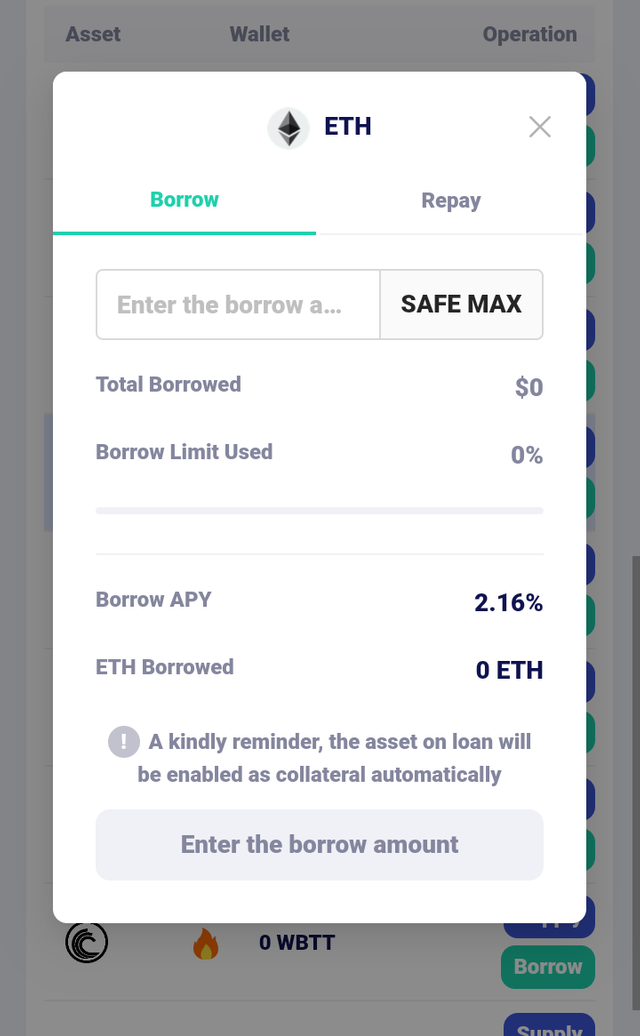

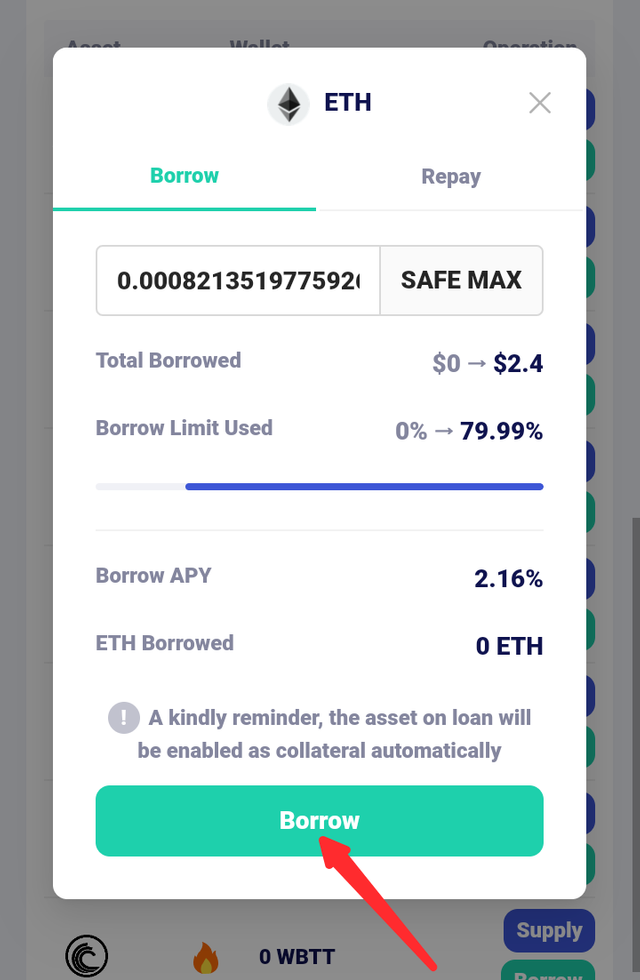

A dialog box pops up.

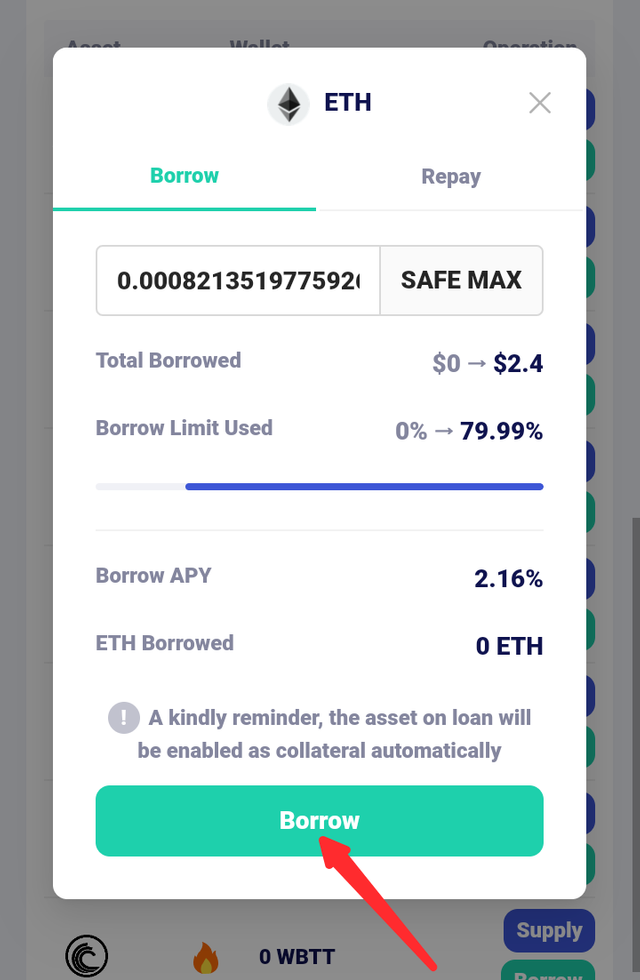

To be on a safe side, I click on safe max to allow the system choose my safe maximum amount to borrow.

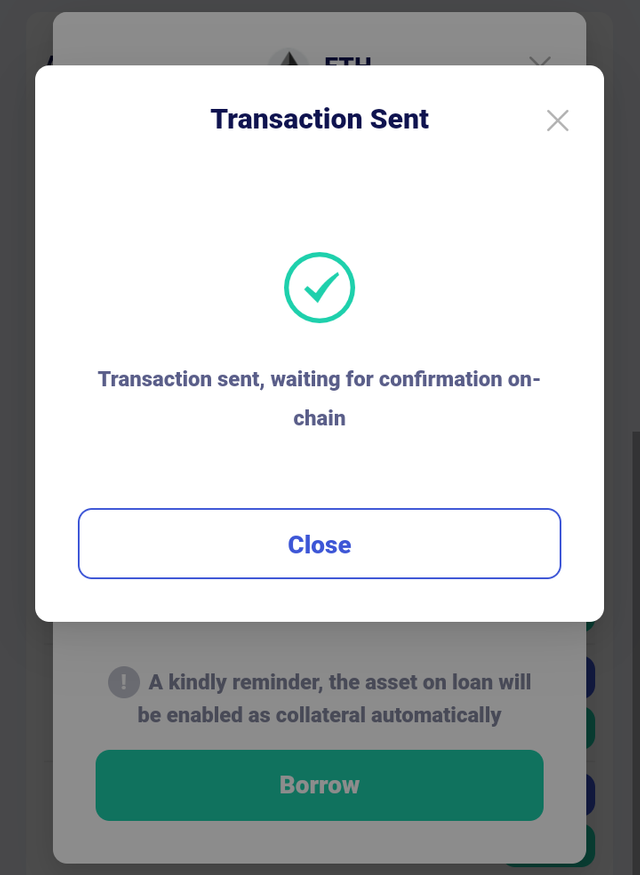

The systems tells me my safe max is 0.00082135 ETH. The borrow APY is 2.16% That's fine, so I click on borrow. After that, I have to undergo the usual security process before my transaction is confirmed.

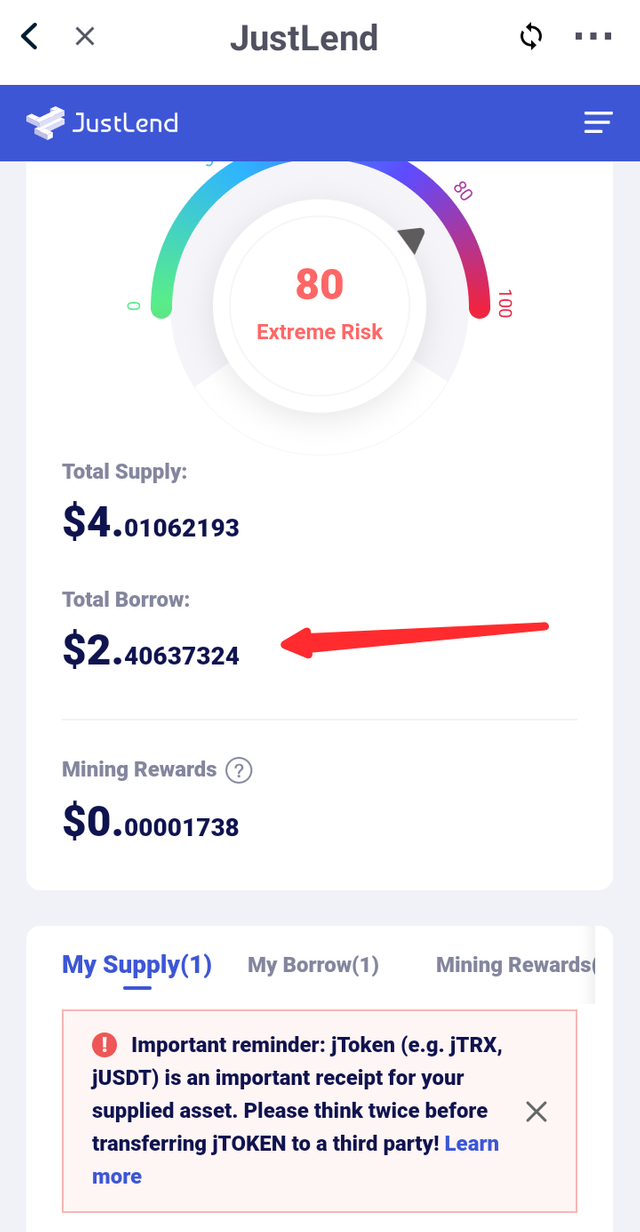

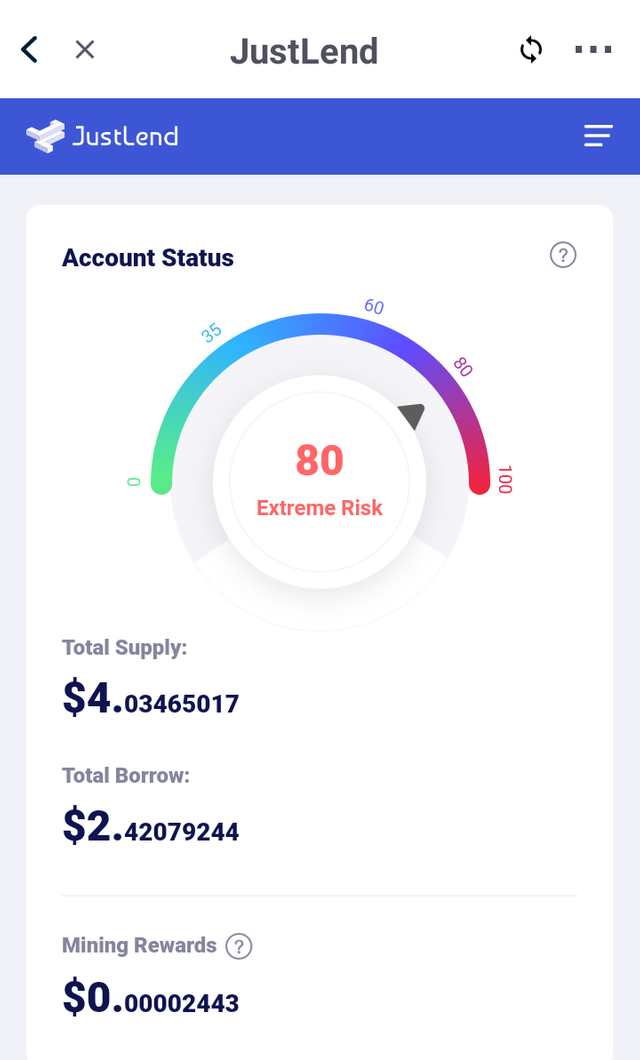

In total, I borrowed $2.4 as against my $4.02

The ETH has also been credited to my balance.

QUICK NOTE: Though I only supplied 31 TRX out of my original ~281 TRX, my TRX balance is currently ~201 TRX. about 50 TRX has been used up in carrying out these transactions.

How much interest did you pay, under what condition it will trigger liquidation? What is the net APY in your case? What is the Account Status(Risk Value) in your case?

Before confirming the borrowing of ETH, I was told the APY or the interest I was to pay.

So for this borrowing transaction, I'm to pay an APY of 2.16%.

Now, once the product of my collateral value and the collateral factor is less than the sum of the accrued interest and the amount borrowed, liquidation will occur.

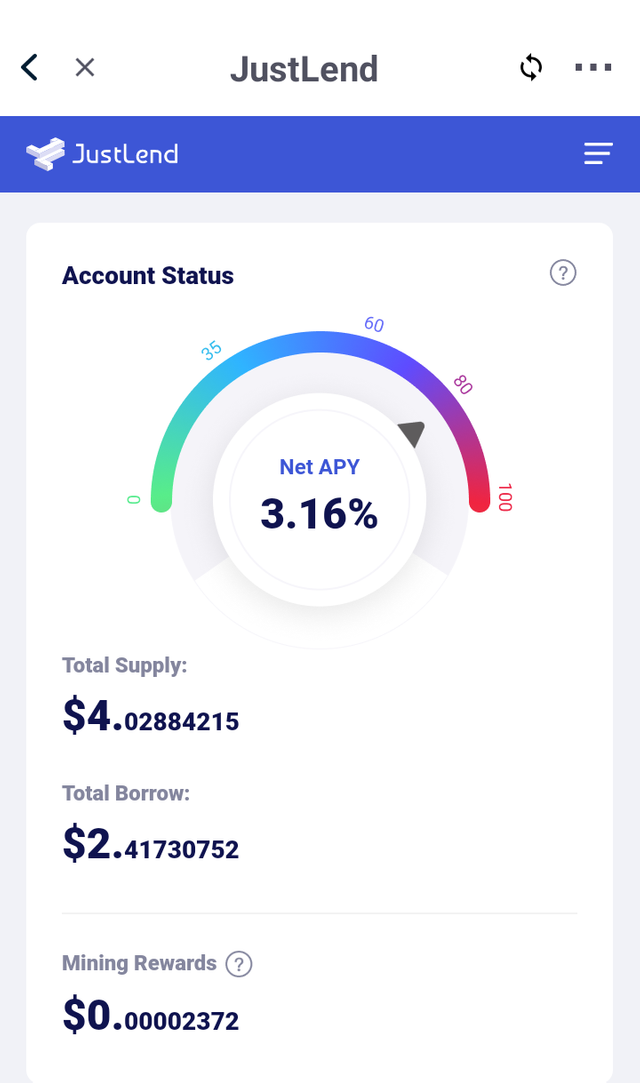

My net APY is 3.16%

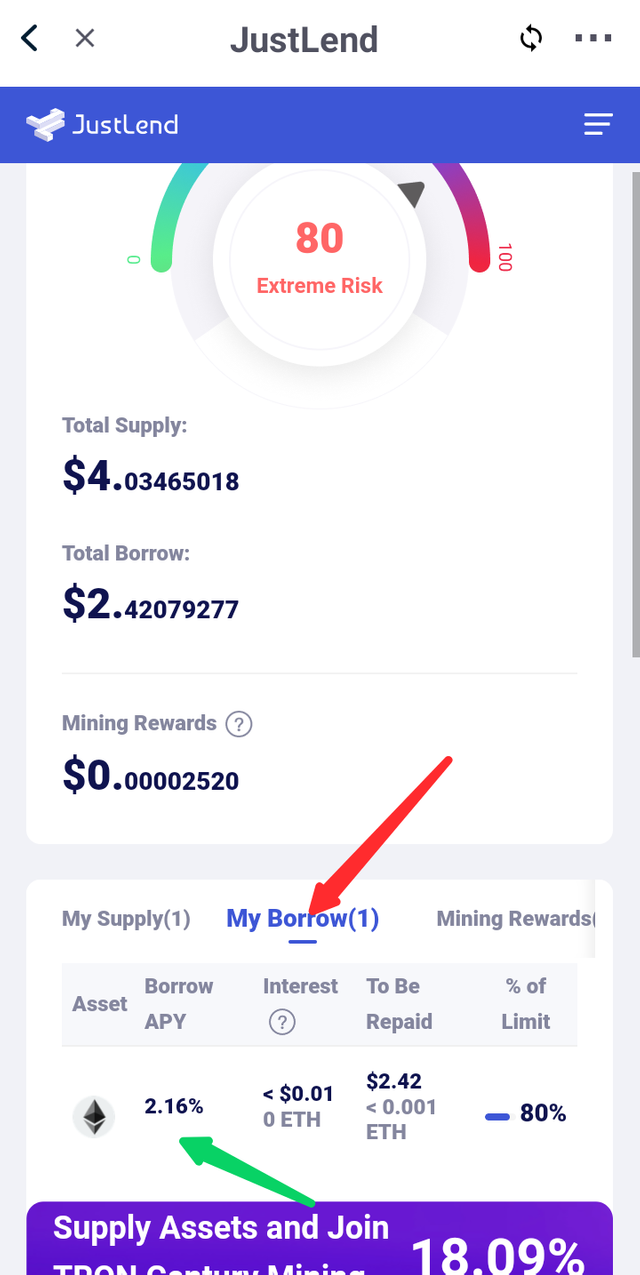

And since I borrowed about 80% of my collateral, the risk is quite high.

How do you repay & unlock your asset in JustLend

To repay a borrowed asset, I click on 'my borrow' and the on the token I want to repay which is ETH.

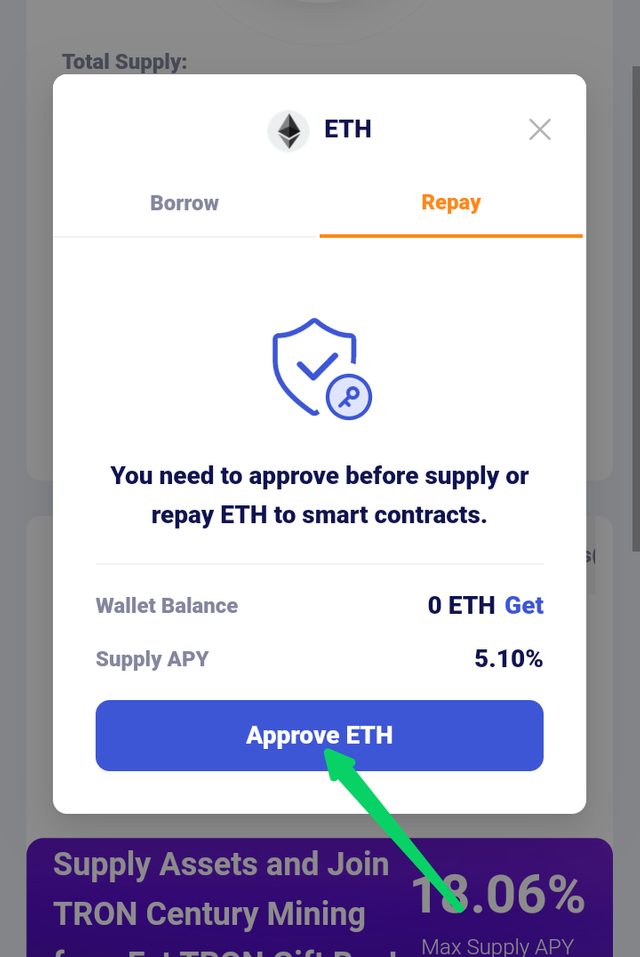

Then I click on approve ETH to approve the repayment.

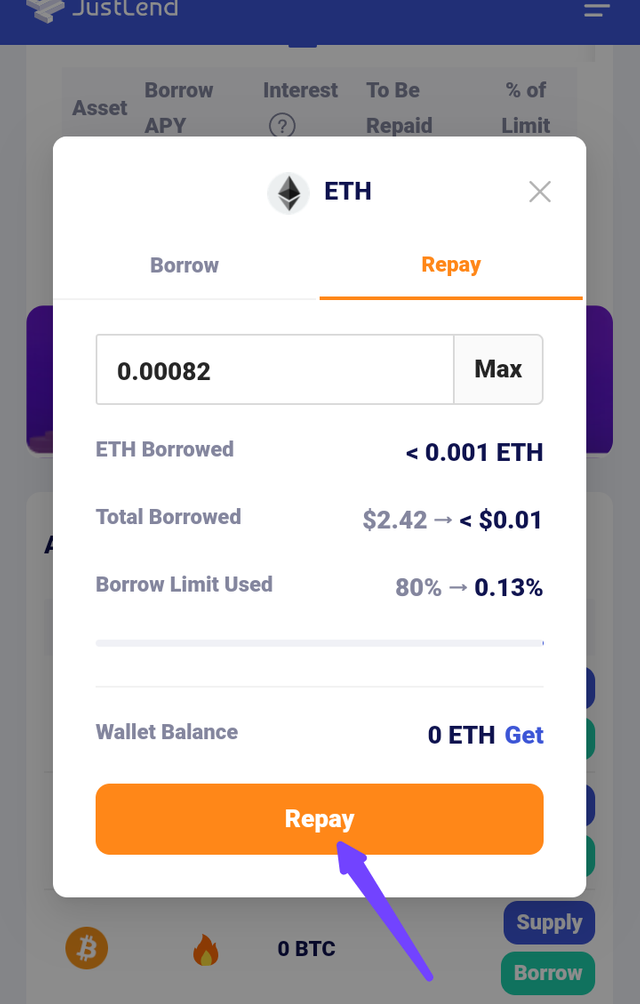

Again, security measures but after that, I'm able to repay. I'll like to offset almost all the debt so I repay 0.0008 ETH.

After clicking on repay, I have to approve the transaction with my password before the repayment is completed.

NOTE that my TRX keeps reducing.

My risk status also has been immensely reduced from extreme risk to low risk.

CONCLUSION

Borrowing in finance comes with lots of charges. This is also observed in the use of JustLend where I had to pay an APY of 2.16% and over 60 TRX in fees. This amount is actually small compared to what one will spend on some other platforms.

In all, the borrower must take into consideration, all the charges involved and use the borrowed funds judiciously to cover up for these charges and avoid losses.

Thanks.