HOMEWORK TASK 6

INSTITUTION: STEEMIT CRYPTO ACADEMY

COURSE: How To Invest in Cryptocurrencies - A beginners Guide

CRYPTO PROFESSOR: BESTICOFINDER

HOMEWORK TASK

You need to do your own fundamental analysis and select the cryptocurrency to invest in in 2021. (coinmarketcap.com : Token Rank Should be between 100 - 400 range | ( Excluding Steemit) )

Prepare an article explaining the factors you considered for your selection considering following

1. Read the project whitepaper and explain the project concept

2. Discuss the social reach, project purpose, team, response from the market for the particular project.

Discuss the factors supporting your decision and explain why the particular project will be a good investment.

INTRODUCTION

When I read through this week 3 course by @besticofinder, I thought the course content deserved an award. Not only does the course content cover a very important part of crypto - what crypto to invest in, it will also through its homework task, leave a lot of suggestions as to which crypto one can invest in.

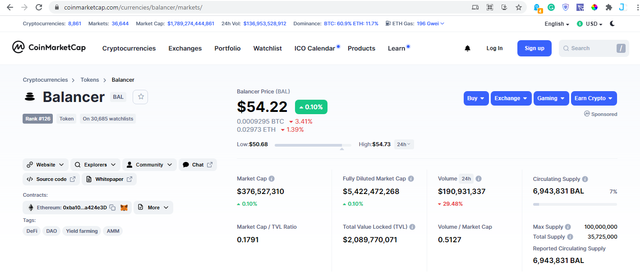

In accomplishing my homework task for this course, I'll be analyzing a cryptocurrency project I think is a good investment for the year 2021. It wasn't easy picking a project ranked between 100 & 400 as most of the coins I hold or have profited from, are ranked higher. There is, however, one cryptocurrency project I'm so optimistic about, which is - BAL (BALANCER). It is ranked 126th on coinmarketcap

Read the project whitepaper and explain the project concept

WHAT IS BALANCER

Balancer is a Defi protocol similar to Uniswap, that facilitates decentralized exchanging of assets. To understand what balancer does, a brief mention of how assets exchanging works will help a lot.

On centralized exchanges, an asset exchange transaction is completed when a seller sets a price for their asset and a buyer accepts that price. In this case, that price that was set by the seller and accepted by the buyer becomes the price of the asset for that point in time.

These transactions happen very quickly on large centralized exchanges, hence a constant fluctuation in the prices of assets. The records of the buyers and the sellers' orders are kept in an order book

It's quite different for decentralized exchanges. There are no order books, instead, decentralized exchanges use a protocol called Automated Market Maker (AMM). In this protocol, buyers and sellers don't meet, instead, each meets a smart contract. This smart contract, found in the AMM, involves a pool where assets to be exchanged are kept in a constant ratio.

The Automated Market Maker keeps the ratio constant by using that constant ratio to alter the weights of both assets according to a fixed correlation.

Eg. Ratioconstant = Priceasset 1 x Priceasset 2

Balancer uses a more sophisticated method to facilitate their decentralized exchanging. This method, however, still uses an Automated Market Maker to determine the price of the assets rather than an order book as is found in centralized exchanges.

HOW DOES BALANCER WORK?

I've just explained that balancer is a protocol that facilitates decentralized exchanging, removing the centralized order book model and replacing it with a market maker. I also mentioned that it involves buyers interacting with a smart contract rather than sellers and vice versa. Now, how does Balancer work?

First, the balancer protocol uses Liquidity Pools (LP) in its decentralized exchanging activities.

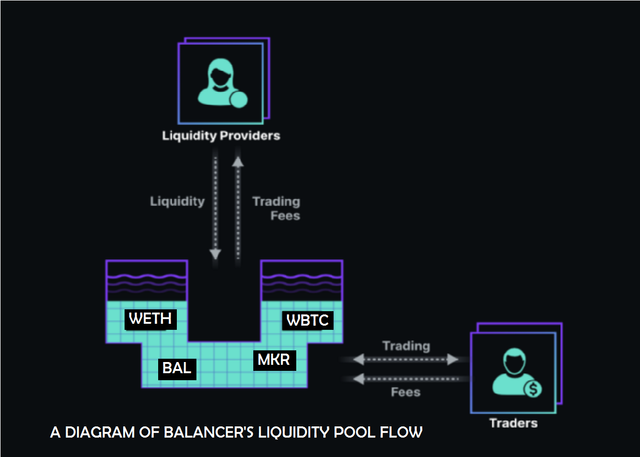

Next, there are two sets of people balancer caters for - liquidity providers and traders. Liquidity providers put into the pool while traders take away from the pool, remitting an asset of corresponding equivalence as well as trading fees.

A simple illustration of how balancer works is given below -

The liquidity providers provide liquidity to the liquidity pool in return for trading fees. This liquidity pool can up to 8 different assets. The traders come along and take this liquidity provided, paying the trading fees and the corresponding value of what they're taking. Eg. the trader may pay wrapped bitcoin (WBTC) for BAL.

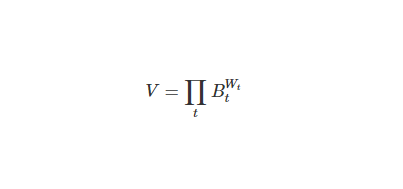

Earlier, I mentioned that balancer uses a sophisticated method of market-making. This method is the reason why balancer, unlike other DEX protocols, can allow up to 8 different assets in a pool. This is possible as this method keeps the value function of the balances and weights of the different assets constant using the correlation

source - balancer's whitepaper

Where:-

V = the constant (the value function)

B = asset balance

W = asset weight

t = depicts the asset in the pool.

More information about the maths involved in balancer's liquidity pool can be gotten from balancer's whitepaper here - link

BAL

The governance token of the balancer protocol is BAL. It's distribution is capped at 100M although BAL token holders have the power to keep the total supply of BAL below this amount. Investing in balancer could either mean providing liquidity and earning trading fees and BAL or acquiring BAL token to either hold or sell. So then, let's take a look at the token - BAL.

Discuss the social reach, project purpose, team, response from the market for the particular project.

To elaborate on BAL, the governance token of balancer, there is a need to mention the purpose of the balancer project and its governance.

THE PURPOSE OF BALANCER

With the advent of smart contracts and Defi, decentralized exchanging became a possibility. This is because smart contract platforms were able to replace the centralized 'order book' model with Automated Market Makers. This gave rise to decentralized exchange protocols like Uniswap and later, Balancer.

Balancer, unlike some other decentralized exchange protocols, was designed to support multiple assets in its pools or automated market maker. These assets are added to the pools in a pre-arranged proportion determined by the pool owner. Also, different assets can be added in different weights, unlike some other protocols.

Balancer was also designed to be a self-balancing weighted portfolio that would make it possible for crypto-assets owners to collect fees from traders rather than pay fees to portfolio managers for the re-balancing of their crypto assets portfolio. Balancer allows traders to swap assets quickly for a fee which is paid to the liquidity providers.

In summary, the purpose of the project is to provide a flexible and trustless platform for programmable liquidity source.

BALANCER'S GOVERNANCE

Being a Defi protocol, balancer was designed to be governed via decentralized governance, with holders of a certain token having the power to vote on proposals and have a say in the running of the protocol. This token that vests this power is the balancer governance token, known as BAL.

BAL was first given to liquidity providers through a process called liquidity mining. Liquidity providers are considered the most important stakeholders on the protocol. This is because, the liquidity they provide is what attracts traders who trade and pay fees and as the pool becomes profitable, it will lead to the provision of more liquidity.

BAL was first given to compensate for the risk involved in liquidity providing. Liquidity providers on the balancer protocol are paid 145,000 BAL every week.

Later on, the traders on the protocol were also recognized as their inputs were also a very important part of the protocol. The balancer community decided that BAL would be earned by traders for each swap made on the balancer exchange dApp

SOCIAL REACH OF BALANCER

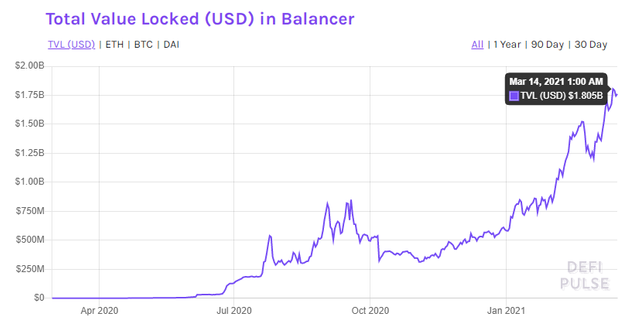

Balancer has seen massive adoption since its launch in March 2020, though it wasn't until one month after its launch that liquidity began to pour in. However, liquidity has continued to pour in ever since with the best daily record of over $15 million.

Just 3 months after its launch, balancer had about $130 million locked in liquidity, and though that didn't translate into massive usage, it was an indicator then that the protocol would thrive in liquidity providing. Then, the protocol boasted more liquidity than Uniswap V1 and V2 combined source.

Currently, the total value of liquidity locked in the protocol is above $2 billion, according to coinmarketcap.com. This confirms the wide adoption the protocol has received in just a little over a year of its launch.

MARKET RESPONSE TO THE PROJECT

From the amount of liquidity locked in the protocol, we can see how receptive the market has been to this Defi protocol. This has been aided, by no small measure, by the rise to prominence of Defi in the last few months. Crypto investors who have idle crypto assets have suddenly found a lucrative way of storing them in balancers liquidity pools.

The protocol's governance token BAL, has also seen huge valuations with the unit price rising to $54 within the last 24 hours from the time of putting up this post. BAL is currently listed on many popular exchanges including binance, huobi, kraken, FTX, bitfinex, gemini, poloniex, bittrex, okex, etc.

THE TEAM BEHIND THE PROJECT

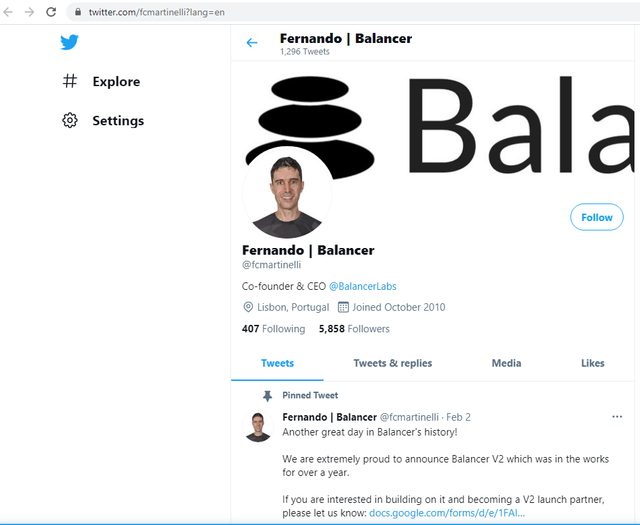

According to cryptobriefing.com, only three members of the balance team are documented and they are, founders Fernando Martinelli (CEO) and Mike Ray McDonald (CTO); and frontend engineer Timur Badretdinov.

I've been able to trace one of the above-mentioned team members - Fernando Martinelli to some of his social media accounts including medium, twitter, and linkedin. He is an alumnus of Pantheon Sorbonne University and a serial entrepreneur who has founded three companies source.

McDonald is a crypto enthusiast who is best known for creating the popular MakerDAO tracking tool - MKR.tools source.

He also has a twitter account @mikeraymcdonald

WHY I'M OPTIMISTIC ABOUT BALANCER

It will be nice to end this homework task with some reasons why I'm optimistic about balancer and the factors that influenced my optimism.

Discuss the factors supporting your decision and explain why the particular project will be a good investment.

My optimism about balancer stems from the success it has achieved in just its first year. The traction gained daily by Defi as a whole means that more and more people will join protocols like balancer. Defi is proving to be one very interesting way of earning and having transactions done in a secured and trustless manner. The importance for liquidity is also another reason while I think balancer with the much it has already will continue to flourish.

So, in summary, the factors supporting my decision to acknowledge and invest in balancer as a viable investment for 2021 is based on

The success it has achieved in just its first year (over $2 billion locked in liquidity)

The traction gained on a daily basis by the Defi space

The importance of liquidity in the crypto market

Furthermore, I think balancer will be a good investment because it's gaining lots of recognition and the graph keeps rising to new heights as the days go by. There are also two ways of earning from balancer - providing liquidity and trading BAL.

Providing liquidity gives you rights to the 145,000 BAL being donned out every week. Holding BAL, gives you right to governance on the balancer protocol, or if you're not interested, a profit on resale as the value of BAL is currently on the upside.

CONCLUSION

The rise to prominence of Defi has seen the birth of numerous Defi protocols. Some of these protocols have gendered mass adoption as a result of their applications. One of these protocols is the balancer. This is a Defi protocol that aims to provide a decentralized platform for programmable liquidity. It has seen mass adoption having just launched in March 2020, with an estimated $2 billion locked up in liquidity on the protocol.

Balancer and BAL are excepted to be viable crypto investments this 2021 based on the success of the balancer project after barely one year of its existence and also, the traction gained by Defi these days.

REFERENCES:-

Thanks for reading.

Cc:

@steemcurator01

@steemcurator02

@steemcurator04

@steemitblog

Hello @jehoshua-shey ,

Thank you for submitting homework task 6 ! You have done a really good fundamental analysis on BALANCER project. very informative and well organized article. [9]

Thank you

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you so much professor, this week's topic was so important.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit