HOMEWORK TASK 6

INSTITUTION: STEEMIT CRYPTO ACADEMY

COURSE: Stable coins

CRYPTO PROFESSOR: YOHAN2ON

HOMEWORK TASK: Write about any one of the following stable coins;

- Tether(USDT)

- Steem backed dollar(SBD)

- DAI

INTRODUCTION

The menace of volatility remains a major concern wherever crypto is mentioned. This has hampered the use of crypto as a medium of exchange as no one can rightly predict where the price would go next. Traders and investors have subsequently been reluctant to commit investments as the price would always be uncertain.

So worrisome was this menace that a special kind of cryptocurrency was introduced to address it. These new set of coins are called Stable Coins.

Like was intended, the creators of these stable coins tend to keep the prices of the coins stable. Usually, they achieve this by employing complex algorithms or pegging the price of the coins to a crypto or non-crypto asset including fiats and commodities.

This post places the spotlight on one of such coins, which is - MakerDAO's DAI

THE DAI STABLE COIN

The DAI stable coin is one of those special cryptocurrencies with stable prices. It was created by a decentralized autonomous organization known as MakerDAO. DAI, having been created by a decentralized organization, is a decentralized stable coin, unlike some other stable coins.

MakerDAO keeps the price of DAI stable by backing up the value of DAI with crypto collaterals, lending the DAI and autonomous incentives. To understand how this is possible, a brief mention of why DAI was created will help a lot.

WHY DAI WAS CREATED?

Sometime ago, Maker, a decentralization-driven community of crypto enthusiasts, came up with a workable plan to offer decentralized lending services. To do this, they planned on creating a lending platform which would make decentralized lending a reality. This platform would utilize the ingenious combination of smart contracts and cryptocurrencies.

The smart contracts part was pretty straightforward but the cryptocurrencies part involved an interesting concept.

For lending to be done via crypto, the menace of volatility had to be arrested. A stable coin was needed. Also, the decentralization-driven nature of the community warranted that the value of this stable coin be backed by crypto assets which was the best route to decentralized stable coins. This was why DAI - a decentralized crypto-collateralized stable coin was created.

HOW DOES THE DAI STABLE COIN WORK?

The coin being lent on MakerDAO's lending platform was DAI and to be able to borrow it, users will have to deposit ethereum-based tokens to a smart contract as collateral. The amount of DAI issued to the user is less than the value of collateral they remitted, hence, DAI is over-collateralized. The reason for this, is of course, connected to the stability of DAI.

At first, only ether (ETH) was supported but later, BAT and USDC were also included.

When users deposit these crypto collaterals, the platform's protocol creates DAI of equivalent proportion and issues the borrower. When the borrower pays back the debt (in DAI), the DAI paid is then destroyed.

If the market price(s) of any or all of the crypto collaterals begin(s) to drop, and the DAI-collateral ratio equals the liquidation ratio, the collaterals will be liquidated. Thus when borrowing, users must ensure that the DAI-collateral ratio is significantly higher than the liquidation ratio.

HOW DOES DAI REMAIN STABLE?

The price of DAI is pegged to one dollar. On the MakerDAO lending protocol where DAI is created and issued, this is almost always the case, though in external market, the price of DAI may fluctuate. In the events of these fluctuations, DAI is kept stable by the lending activities on the MakerDAO lending protocol, coupled with autonomous incentives. Let's take case studies.

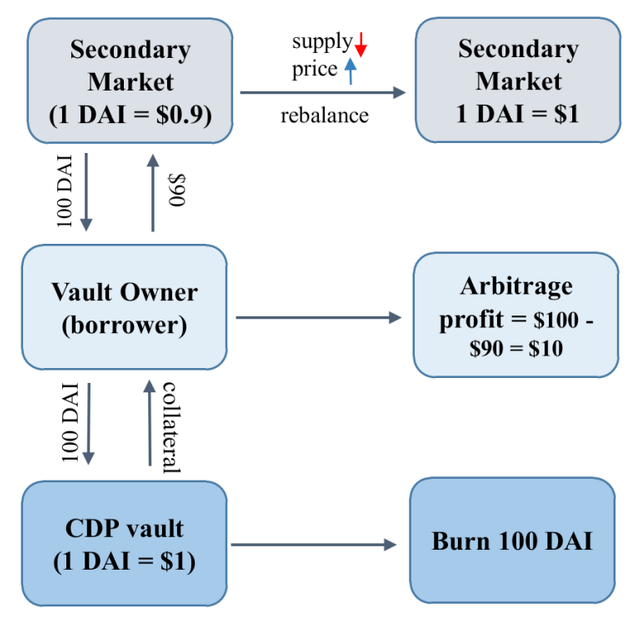

CASE 1: DAI below $1 ($0.9)

If the price of DAI goes below one dollar in external markets, since on the MakerDAO lending protocol DAI is usually $1 (until it is adjusted by the oracle service), before the price fluctuations reflect on the protocol, there is an incentive for arbitrage trading.

A user can borrow 100 DAI @ $100 from MakerDAO's lending platform and buy 100 DAI from the external market @$90 to repay the debt. Then, the user will have re-payed a debt of $100 with $90. That leaves a profit of $10

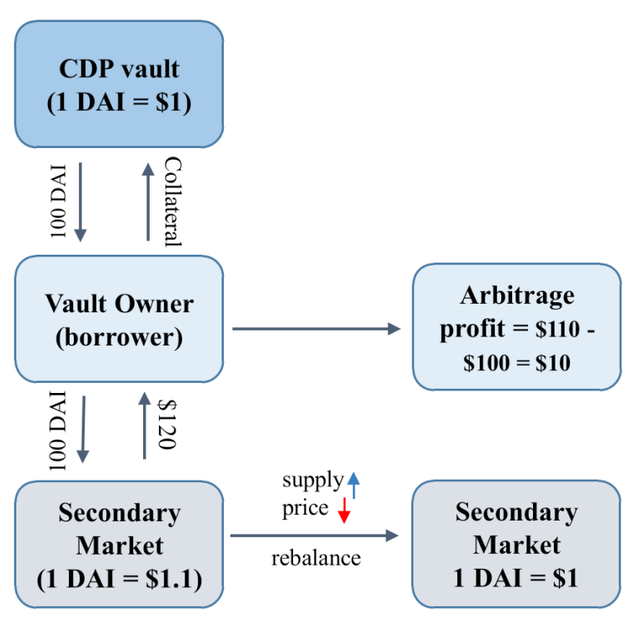

CASE 1: DAI above $1 ($1.1)

If the price of DAI goes above one dollar in external markets, since on the MakerDAO lending protocol DAI it is usually $1 (until it is adjusted by the oracle service), before the price fluctuations reflect on the protocol, there is also an incentive for arbitrage trading.

A user can borrow 100 DAI @ $100 from MakerDAO's lending platform and sell the 100 DAI in the external market @$110 then repay the debt of $100. That leaves a profit of $10

Quick Note: In both cases 1&2, the arbitrage trading done tends to adjust the price of DAI back to $1 in the external market by reducing and increasing its supply respectively.

HOW TO ACQUIRE DAI?

DAI can be gotten from a number of centralized and decentralized exchanges. It can also be gotten by depositing collaterals in MakerDAO's lending platform.

ADVANTAGES OF THE DAI STABLE COIN

Here are some of the advantages that accrue to DAI holders.

INCOME

DAI holders can lock their DAI in some special smart contracts in return for interests. This is void of fees and is globally acceptable.

ARBITRAGE TRADING INCENTIVE

The arbitrage trading incentive talked about earlier is another advantage of the DAI stable coin. Borrowers can leverage the price difference between MakerDAO's lending platform and external markets to make profits from arbitrage.

PRICE STABILITY

The stability of MakerDAO's DAI helps in fund hedging. Investors can hedge their funds using this stable coin.

FINANCIAL OPPORTUNITY

DAI stable coins offers the opportunity of getting loans with just crypto assets unlike traditional finance that will usually request a host collaterals and document.

DECENTRALIZATION

DAI unlike most other stable coins is decentralised. This means it's void of all the problems inherent in centralized system with transparency and single point of failure topping the list.

CONCLUSION

Stable coins have become a necessity in the wake of the negative effect of volatility associated with cryptocurrency. One of such stable coins is DAI. DAI is a special stable coin because its decentralized. It also enables income realizations and borrowing of loans. It's utility cuts across stability and Defi. DAI is a stable coin worth holding.

Thanks for reading.

Cc:

@steemcurator01

@steemcurator02

@steemcurator04

@yohan2on

Special mention:

To the attention of some notable steem promoters who keep inspiring me on my crypto journey which began here on steemit.

@stephenkendal

@trafalgar

@crypto.piotr

@steemchiller

@justyy

Hi @jehoshua-shey

Thanks for attending the 6th -Crypto course and for your effort in doing the given homework task.

Feedback

This is excellent work. Well done with your research on Dai.

Homework task

10

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you so much Prof. I'm happy rhat you found my homework task interesting.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Awesome! I see that you got featured too! Click here. Congrats!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations! Your post has been selected as a daily Steemit truffle! It is listed on rank 25 of all contributions awarded today. You can find the TOP DAILY TRUFFLE PICKS HERE.

I upvoted your contribution because to my mind your post is at least 6 SBD worth and should receive 26 votes. It's now up to the lovely Steemit community to make this come true.

I am

TrufflePig, an Artificial Intelligence Bot that helps minnows and content curators using Machine Learning. If you are curious how I select content, you can find an explanation here!Have a nice day and sincerely yours,

TrufflePigDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit