HOMEWORK TASK 7

INSTITUTION: STEEMIT CRYPTO ACADEMY

COURSE: Money Management & Portfolio Management

CRYPTO PROFESSOR: STREAM4U

INTRODUCTION

Investing has always been the right decision to take whenever money comes around. This is because it secures money for the future if done right. Sometimes, an investor can get as many times more than what they invested, while at other times, it might be a loss.

The act of investing in crypto is not without caution and safe practices. Every investor should know, understand and practice necessary management techniques to avoid severe losses. Some aspects of investment requiring management include money and portfolio.

This post examines these aspects, providing real life examples where available.

MONEY MANAGEMENT

In the money aspect of investment, a meticulous managerial approach is required. Here, it is important to understand that investment decisions are not to be taken based on feelings.

A crypto investor, for example, should not invest in a coin because they like it, rather, they should carefully understudy the coin and check it feasibility within the period the investment would last.

Next, it will be foolhardy to put all ones eggs in one basket. This is bad money management and bad investment practice. It's risky and unwise. Preferably, the investor should have a number of investments, not just one.

Money management requires the investor to divide their overall capital into several parts (the more the merrier). Each of these parts should be engaged in separate investments such that the investor, with that overall capital, has a number of investment.

This number should be ideally, at least 3. Personally, I advocate odd numbers, so I'll suggest the capital be divided into 3, 5, 7, or thereabout.

The idea here is that, if these investments are made at the right time, hardly will there be a total loss. Some investments may not pay off but so far as the investments were done carefully and cautiously, advised by sound technical indications, some of the investments will definitely pay off.

I'll give a personal experience later in the post to back this point.

FUTURE PLANS ON MONEY MANAGEMENT

Having benefitted from money management, I plan to continue employing it in the future. In my case, all my investments paid off, however, with proper money management, it would have been difficult for me to make huge losses.

I plan to continue money management in tge future. This simply means, I'll continue to divide my overall capital into 3 or 5 parts or more, and understudy any coin I develop interest in and wait for the right technical indicator to take the right action, whether buy or sell.

PORTFOLIO MANAGEMENT

If you have ever heard of the word portfolio and you know what it means, you won't be needing anyone to tell you that you will have to manage it correctly if you have one.

First of all, portfolio simply means the assets held by an investor.

As an investor, you need to manage the assets in your possession. If an asset in your portfolio is exhibiting a 'sell' indication in the market, it shouldn't still be on your portfolio because you might incur losses if you hold it for a longer time.

Also, if an asset is showing signs of a price surge but is not on your portfolio, and you have an asset on your portfolio that is trading within a very small range, you can exit your position on that asset and acquire the other one that seems bullish, only that you have to confirm the indications first.

Now, let me give you a personal example.

I once had a number of coins in my portfolio, including steem, SBD,and TRX. Steem wasn't bullish at a point, so I decided to exchange it with another coin that was bullish at that time. This coin was Huobi Token.

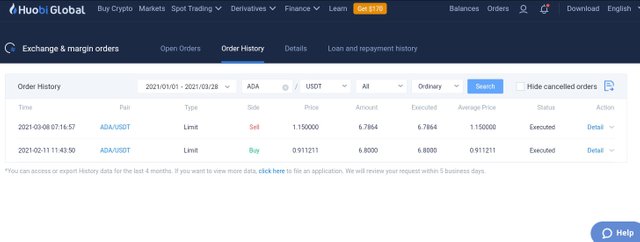

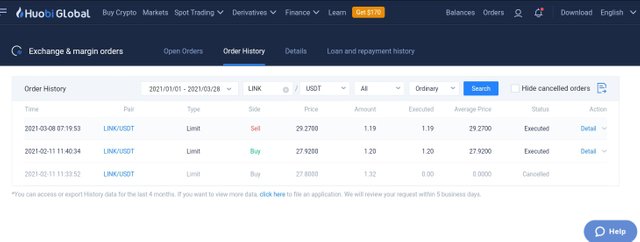

I also got other coins as I wanted to insure against losses and practice good money management. These coins were ADA and LINK.

At a favorable time, I closed my position in these three coins and made profit on all of them.

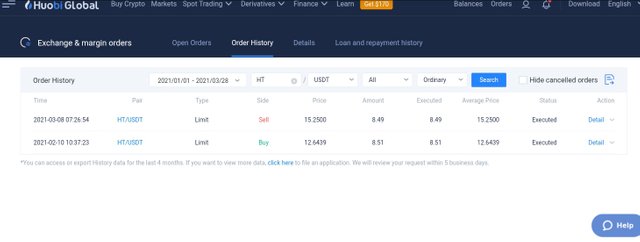

I opened my position on Huobi Token on February 10, 2021 and closed on March 8, 2021

I opened my position on ADA (Cardano) on February 11, 2021 and closed the position on March 8, 2021

I opened my position on LINK (Chainlink) on February 11, 2021 and closed the position on March 8, 2021

From my proofs above, you can see that I held these coins for almost a month and I made a profit on all my investments. I learnt a lot during the period I held these coins. I learnt the importance of technical indicators over having personal price targets.

Though I made profits on Houbi Tokens (HT) I could have sold at $26 rather than $15, but I missed that profit because I chose to wait for the price to rise to a price target I had in mind ($50), rather than to follow technical indicators. So, you can also learn from my mistakes.

FUTURE PLANS ON PORTFOLIO MANAGEMENT

I plan to practice better portfolio management in future. I'll do this by monitoring the assets in my portfolio and other assets in the market. I'll also attach priority to technical indicators to know when to enter and exit market.

I won't fail to square of on any asset when technical indicators tell me to do so. I'll also make sure that I enter any market at the right time so as not to have losses on my portfolio.

Currently, I only hold BTC, TRX, USDT, STEEM and SBD. I'm not so engrossed in observing the market now cause I'm having my attention a bit divided on other matters, else, I would have held more. My major action in the crypto market now is arbitraging.

CONCLUSION

A good crypto investor should understand how to properly manage their money and their portfolio. It's disastrous to ignore the importance of portfolio and money management. These two, if done right, with technical indicators being strictly followed, will minimize losses and all but guarantee profit.

Never invest all your capital in one asset, don't be too greedy in the market, and always prioritize following technical indicators over personal price target.

Let this be my contribution for now. Thanks for reading.

Cc:

@steemcurator01

@steemcurator02

@steemcurator04

@stream4u

Special mention:

To the attention of some notable steem promoters who keep inspiring me on my crypto journey which began here on steemit.

@stephenkendal

@trafalgar

@crypto.piotr

@steemchiller

@justyy

Except otherwise stated, ALL images used in this post are screenshots taken by me, from my accounts on Huobi Global

.jpeg)

Hi @jehoshua-shey

Thank you for joining Steemit Crypto Academy and participated in the Homework Task 7.

Your Homework task 7 verification has been done by @Stream4u, hope you have enjoyed and learned something new in the 7th course.

Thank You.

@stream4u

Crypto Professors : Steemit Crypto Academy

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Sure. Thank you so much for your tutelage of this course.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit