Q.1. Discuss Dark Pools in Cryptocurrency in your own words. How does dark pool works?

Dark pools are private platforms that facilitate the exchange of cryptocurrency in a private manner. The transactions carried out on dark pools are kept away from the eye of the public. This is why it is best described in my own words as behind the scenes trading.

The price here is already set so there's hardly any slippage. Unlike the public trading of crypto assets where there is a deluge of volatility which causes slippages.

If you've traded with a dex like PancakeSwap before, you might have come across a coin transaction that was unable to calculate the gas fees. Such transactions usually requires increasing the slippage to about 12% for the transaction to go through.

Slippages usually occur because of volatility which is simply a high frequency of price fluctuations. Since the price may deviate from a value very quickly, trades might execute at a different price than was set.

With dark pools, this does not happen. Price is fixed and is not deviating so there's no slippage. Also, large transactions are carried out on these dark pool platforms. Obviously because of privacy, predetermined prices, and no slippages and maybe more.

There's no order book in dark pools and this should at least help keep the predetermined price in force. Traders just have to buy asset based on what they like or feel like buying but the price is already set and you don't get to know how much another person is buying.

Trading is in large volumes in dark pools and because of this, transactions in dark pools are sometimes referred to as block trading. The large size of transactions carried out are private and do not impact the general market - one advantage of dak pools.

HOW DOES DARK POOLS WORK

Dark pools work through the concept of limit orders. When making a trade, a trader usually sets orders either for a buy or for a sell. The way this order is set determines if it's a limit order or not.

When the order is set to be executed at current market price, this is called market order. Market order involves a lot of slippages because withing the second the trade executes, the price can shift, causing the trade to execute at a different price.

Dark pools however uses limit order. A trader sets the pric at which they want their trade to proceed and the trade does not get executed until another order meets that price. This removes the problem of slippages.

Q.2. Discuss any crypto exchange that offers a dark pool. How does its dark pool work?

I'd like to discuss dark pool on Kraken. Kraken exchange made a move to support the non-impact transaction of large crypto volumes by providing dark pools for crypto trading. They preferred the idea of large amounts of crypto transaction having no effect on the general market.

HOW DOES KRAKEN DARK POOL WORK

Kraken provides dark pools to traders through limit orders. The exchange has a special section for dark pools. When a trader places a limit order, the order is not visible to the public. Same goes for when a trader places an order that makes chest an existing order, all happen in secrecy such that both traders don't know if they're making or taking in the market.

So in the dark pool on Kraken, a trader comes along and places a limit order which is hidden from public view. Another trader comes along and also places their limit order which is also hidden from public view. If these orders match, they are executed at the predetermined price, no slippages.

Q.3. What are the supported assets on the dark pool mentioned in (2) above? What are the requirements for getting involved in dark pool trading on the platform? Is there any fee attracted? Explain.

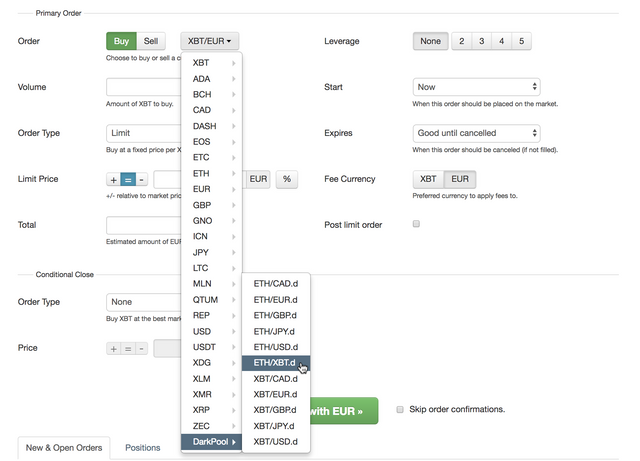

As at press time, the only assets supported on the kraken dark pool are BTC and ETH. The pairs available include but not limited to ETH/BTC, ETH/USD, ETH/EUR, BTC/GPB, BTC/USD, and BTC/EUR.

REQUIREMENTS FOR DARK POOL TRADING

Given that this type of trading is a reserved one, not all traders can participate. They'll have to fulfill some requirements. This type of trading requires the trader to meet the following:

Limit order: Only limit orders are allowed. So market orders have no part here. To use the dark pool, the trader must use limit orders.

Verification: Kraken is KYC complaint and they're are very much concerned with who's dealing. So to participate in Kraken's dark pool, the user has to have completed pro level verification.

Entry level: The dark pools involve large volumes of transactions. This, when using a dark pool on Kraken, there's a floor price below which the transaction will not go through. This is 100,000 USD worth for BTC pairs and 50,000 USD for ETH pairs.

Q.4. For the chosen dark pool, give a brief illustration of how to perform block trading on the platform. (Screenshots required).

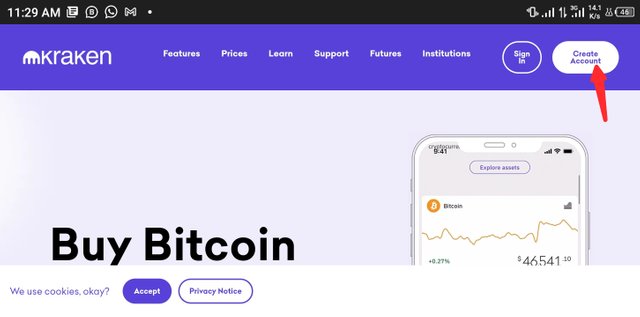

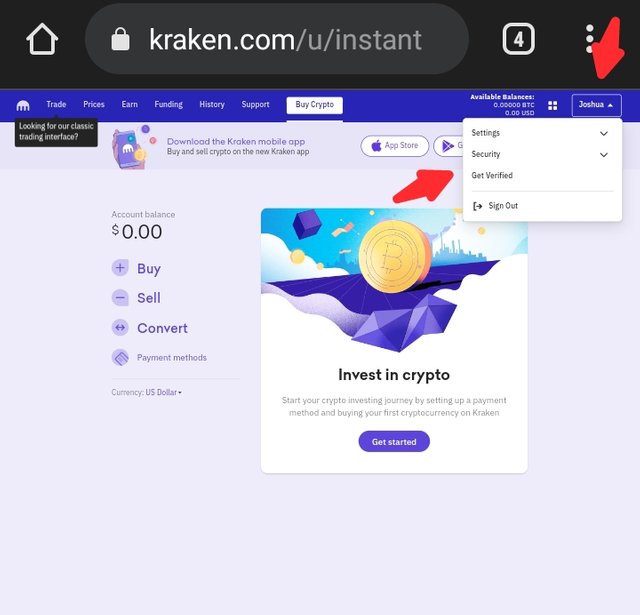

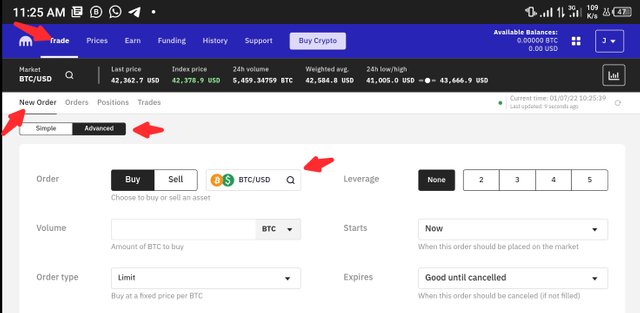

To use dark pool on Kraken, you can follow the steps below.

- Open an account on Kraken.com and sign up. You'll have to verify your email.

- Next click on your profile and then click on get verified.

- Next click on trade and select advanced from the order type. You can then select the dark pool option at the pairs list to use the dark pool.

src

NB: Currently, as at the time of writing this post, dark pool is not available on Kraken for some reasons. But when it comes up, the above steps are valid except if the platforms designs otherwise.

Q.5. What's your understanding of the Decentralized dark pool? What do you understand by Zero-Knowledge Proofs?(Screenshots required).

We'll established that dark pools are private platforms where large volumes orders are fulfilled with zero slippages and at a predetermined price, in secrecy and without an impact on the general market

Well, with decentralization comes even better secrecy. Of course no matter how secret it is, you'll have to go through kyc on a decentralized exchange. This means that you're know down to your social security number or whatever means of identification you used for the kyc. All though, the trade still remains impactless on the general market.

On decentralized dark pools, you have the real anonymity. There's no such thing as kyc and your identify to concealed perfectly. In addition to this, there is also no impact on the general market.

The bulk order is even broken down into different smaller orders which are then shared among different nodes to be fulfilled at the next matching order.

Transactions on decentralized dark pools have the integrity of their transactions verified by zero knowledge proof.

WHAT IS ZERO KNOWLEDGE PROOF

Zero knowledge proof or protocols are very imperative in cryptography. It enables a prover to prove to a verifier the truth of a fact without exposing the details of the fact to the verifier.

These can be interactive in the form of challenge-response interaction where a verifier proofs that a prover's statement is true or not without accessing the facts of the statement.

src

src

Q.6. State one decentralized dark pool in cryptocurrency and discuss it. How does it work?

One of the decentralized dark pools in existence today is the Republic Protocol's RenEx dark pool exchange. It is also the first decentralized dark pool.

RENEX

The Republic Protocol's RenEx dark pool exchange as was said earlier is the earliest decentralized dark pool on crypto history. It is verifiably fair and suited for bulk or block trading. It enables institutional trading of crypto asset in a decentralized manner. The order book on this exchange is hidden from the protocol itself as well as the public.

HOW DOES RENEX WORK?

On the RenEx platform, trades are placed on a hidden order book hard coded into the protocol. The protocol also features an engine built on a multi-party computation protocol. This engine is responsible for matching orders placed on the hidden order book.

The orders placed on the hidden order book are hidden from the protocol itself. However, these orders are visible when they have been completed. At completion, the details of the trade are made public.

The platform also supports institution grade KYC (i.e. Know Your Customer) and AML (Anti Money Laundering) compliance integration.src

Q.7. Compare a crypto centralized exchange dark pool with a decentralized dark pool. What are the distinctive differences?

Let's make a comparison of the two dark pools we've mentioned this far.

We talked of the Kraken dark pool which is a dark pool belonging to a centralized exchange and involves the user going through a mandatory KYC. We also saw that this is done via limit orders.

Then we talked of the Republic Protocol. This is a decentralized dark pool exchange that offers a decentralized platform for private and truly anonymous exchanging.

The differences between these two exchanges are listed below

| Kraken Dark Pool | RenEx Dark Pool |

|---|---|

| Platform in control of a central authority | Platform morning control of central authority |

| KYC required | No KYC required |

| Dark pool order book visible to the exchange | RenEx order book hidden from the protocol itself |

| Kraken knows the traders | Fully anonymous |

Q.8. Research any recent huge sale in any market in the crypto ecosystem and how it has affected the market. What difference would it have made if the dark pool was utilized for such sales?

Recently, the wallet with the third largest number of bitcoins purchased more bitcoins and this made the rounds especially on finance.yahoo. Given that there is an extreme fear in the market, this may have helped if it were done via general trading. However, there seem to be little or no impact on the price of bitcoin as this was probably done in bits or in a dark pool.

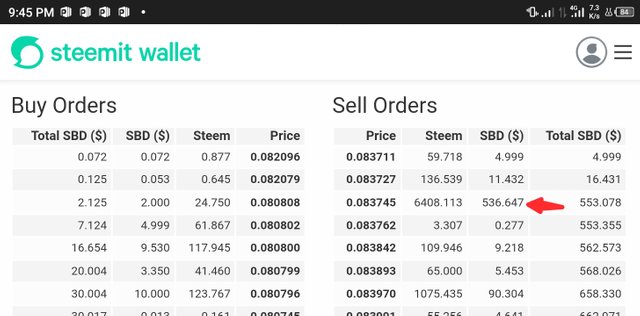

A good instance to visualize the effect of orders in an open order book is to consider the steem internal market. Consider the image below

This whale in the image above is bringing 6.408 steem to buy 536 SBD at the rate of 0.083745 SBD/STEEM. As long as that order is still open, any other seller who wants to sell steem will have to make a lower sell offer or a higher buy offer else they'll queue behind the whale and their order will only be fulfilled after the whales.

This is why once a whale comes around, the sell price appreciates or the buy price drops. This is because many of the other traders wouldn't want to queue behind the whale so as to get their orders fulfilled. If the whale adjusts, the traders will follow suit and the market sell price will go up or buy price come down.

On the contrary, if a dark pool is used, there will be non-impact because no one will ever know that a trade is going on. No one will then want to set the price higher or lower because they don't know and can't see what is going on.

Q.9. In your own opinion, qualitatively discuss the impacts of trades carried out in the dark pool on the market price of an asset. (At least 150 words).

Trades carried out in private and away from the public view will have no impact on the market. This is not unusual as during the trade period, no one will have wind of what is happening.

Normally, what affects the price is the order book that people see. Arbitrageurs for instance are on the lookout for price variance to exploit. When they find this the exploit it an in a matter of time, their actions tend to balance price. Now, if they couldn't find the price variance to exploit, the market would most definitely remain as it is.

When a order for a large volumes is placed, there is usually a lot of smaller volume orders with better prices placed. On order books, large volume orders don't stay on top for long as other traders in a haste to trade will come with higher or lower prices.

But if these large volume orders are done in a dark pool, everybody is completely oblivious of the transaction and so there will be no effect.

Q.10. What are the advantages and disadvantages of Dark pool in Cryptocurrency?

The advantages of dark pools are stated below

Block trading: Dark pool facilities block trading of assets in a private platform and with secrecy. The price is not shown to anyone which removes competition and favours traders dealing on large volumes.

No price impact: Large volumes usually impact price as have been stated earlier. With dark pools however, this is not the case. High volume trades are carried out under the radar and price is not affected.

No Slippages: Earlier it was mentioned that dark pools have no Slippages and this is an advantage to the concept. With dark pools, the orders are placed at a given price and are fulfilled when a matching orders come.

The disadvantage of dark pool is majorly the case of transparency especially on centralized exchange dark pools. As the transaction details are hidden during the transactions, a lot could go on behind the scenes and it may proceed at a price distant from the set price due to manipulations from the centralized authority.

Thanks for reading.

Cc: @fredquantum

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit