src

srcIt's another week of trading and an opportunity to share experiences and learn from those of others with the possibility of winning prizes in the process. I'm happy to be part of this trading contest and hope to make enough trades with minimal losses this period.

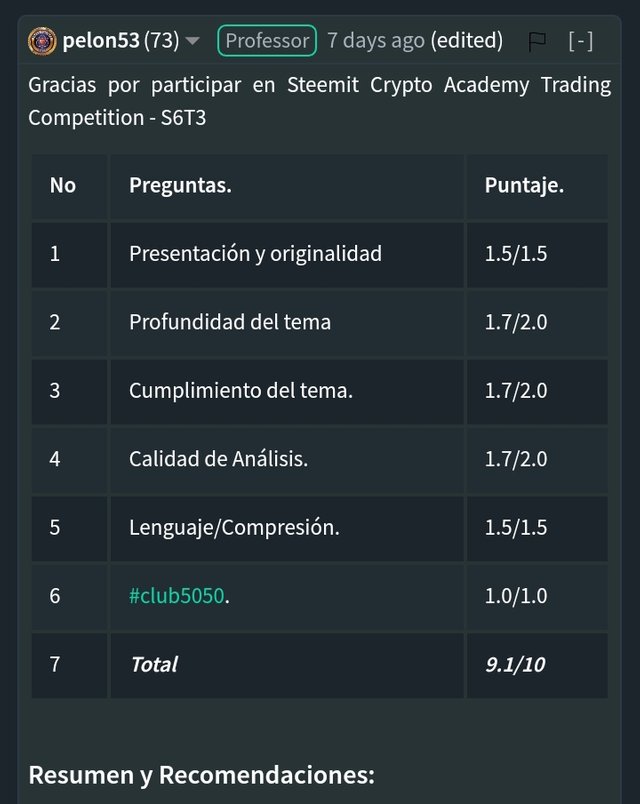

Contained in this post is the details of my first trade for the week rendered according to the guidelines of the contest. It was an isolated margin trade on the LTC/USDT pair with 10x leverage. Using a combination of of some good analysis (in my opinion), close observation and very strict risk management, I was able to avoid a loss in this trade.

Here's how it went...

First, AN OVERVIEW OF LITECOIN

Litecoin was one of the early byproducts of bitcoin. It's also a Peer-to-Peer payment system based on the novel blockchain technology and it offers decentralized, secured, speedy and cheap transactions. This coin stemmed from bitcoin though with a few discrepancies including hard cap, hashing algorithm,and throughput. For instance, bitcoin has a block time of 10 minutes but litecoin is 4x faster with 2.5 minutes.

FOUNDER

Litecoin was founded by a popular computer scientist in the person of Charlie Lee. He forked the Bitcoin core source code, add a few modalities and created what was widely regarded as the next best, at least for some years. Charlie Lee created litecoin to augment bitcoin's economy rather than compete with the digital gold itself.

Lee was widely condemned however when he announced in 2017 that he had gotten rid of all his Litecoin as, according to him, he wanted to 'objectively focus' on developing the coin. The Jury however ruled that getting rid of your coin for whatever reasons passes as 'dumping' and so shortly after the coin nosedived, vacating its ATH for lower territories.

Lee is the current director of the Litecoin foundation, Ex-Director of Engineering at Coinbase, and a one google employee. He can also be found on his verified Twitter handle

Source: Twitter Snapshot

TECHNICAL BACKGROUND OF THE PROJECT

Litecoin was created as a fork of the Bitcoin core source code. It was however stuffed with a few more priviledges including faster transactions and cheaper fees. The hashing algorithm was also different too. Compared to bitcoin which has an average block completion time of 10 minutes, litecoin boasts of 2.5 minutes per block.

It's modifications makes it preferred to bitcoin for small scale transactions and those that require near instant processing. Litecoin seems to still be feeding off bitcoin as it implements upgrades meant to enhance bitcoin on it's own network.

Litecoin has implemented SegWit and also has a Layer 2 solution - Lightning network,for enhancing scalability. Another Layer 2 solution - Omnilite is responsible for the deployment of smart contracts on the litecoin network.

Litecoin also integrates the MimbleWimble protocol in its network making it more usable and increasing the value of the Litecoin coin. An upgrade of this protocol was launched in 2022 through the MimbleWimble Extension Block (MWEB).

WHERE TO BUY LITECOIN?

LITECOIN can be bought on almost all exchanges selling major currencies. It's currently the 20th most valuable cryptocurrency by market cap and as such can be found almost on every centralized exchange.

To name but a few, Litecoin can be bought on Binance, Coinbase exchange, Huobi Global, Kraken, FTX, ByBit, Kucoin, BitFinex, Gate.io, Poloniex, Gemini, BitStamp, Bithumb, Bittrex, Coinone, etc.

WHY I'M BULLISH ON THIS COIN

I'm bullish on this coin because of its significance in the crypto space as a by product of bitcoin and because of the recent developments with the network which was the upgrade of the MimbleWimble protocol. Also, the technical analysis outlined below strengthened my resolve on the likelihood of an uptrend in this coin.

TECHNICAL ANALYSIS

First, I analysed the entire price history of the coin available on Tradingview with the Week TF. I observed that price formed a one year low few days ago on March 16. This suggested that price was upward bound.

Screenshot taken from Tradingview

Then on the day timeframe I observed the formation of a 3 month diagonal resistance and how that this resistance was recently broken.

Screenshot taken from Tradingview

There was another horizontal resistance broken strengthening my suspicion of an upward move.

Screenshot taken from Tradingview

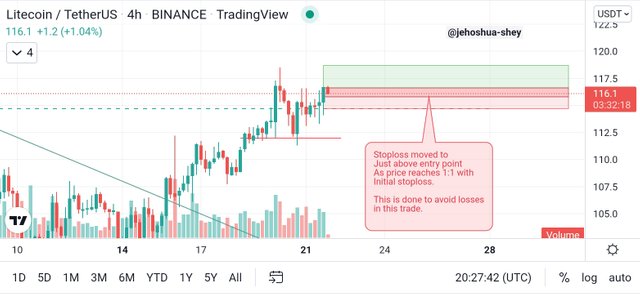

To enter my trade and make my setup, I consulted with the 4H timeframe. Since I was using Isolated margin with 10x leverage, it was wise for me to use a tight stoploss. I set my stoploss to the lower part of the current candle and my take profit in a 3:1 ratio.

My entry point was at $115.7, my initial stoploss was set to $114.7 and my take profit was at 3:1 with my stoploss at $118.7

Screenshot taken from Tradingview

HOW THE TRADE PROCEEDED

With time, the price appreciated and got to a point which was 1:1 with my stoploss (i.e. half of my take profit) because of my leverage and because I wanted to avoid loss, I adjusted my stoploss to my entry level ($115.8)

Screenshot taken from Tradingview

After sometime, the price came back down to my entry level and hit my new stoploss.

Screenshot taken from Tradingview

So, I basically exit the trade at the point I entered courtesy of trailing stoploss and this was to protect my funds which was leveraged 10x.

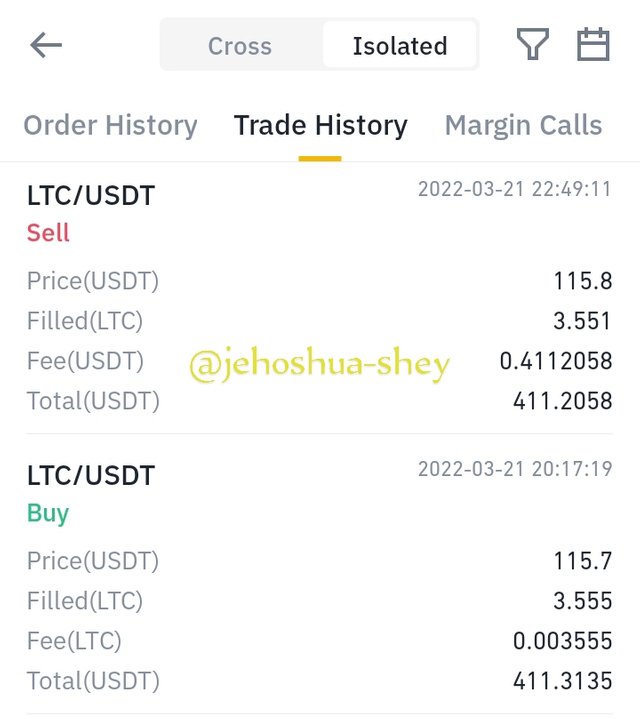

PROOF OF TRADE

Screenshot taken from Binance

Above you see the orders being made and cancelled to reflect new stoploss. The green arrow points to the take profit orders (unchanged) while the red arrow points to the stoploss order (changed once)

Screenshot taken from Binance

Basically, I only incurred the tiny fractions paid as fees, else, the trade was pretty much a stalemate. Bought at $115.7 and sold at $115.8.

MY ADVICE ON BUYING THIS COIN

I always advice to DYOR because one needs to be convinced and ascertain the best time to enter a trade in order to minimize loss and maximize profit. Litecoin however boasts an ATH of $400+ and so at current price of $122, it's a bargain for hodlers. Buying this coin for the long run is not a bad idea at all.

Thanks for reading

Cc:

@pelon53

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit